What is dollar cost averaging?

Dollar cost averaging (DCA) is an investment strategy that can be utilised by inexperienced and advanced crypto traders alike. It is an incredibly simple technique used to manage price risk and has existed in traditional finance long before crypto existed. It is designed to remove emotion from making trades, a common pitfall for newcomers to buying and selling crypto.

The dollar cost averaging process is very easy to replicate. Investors can do this by buying a fixed amount over regular intervals (e.g. every week or month). The idea is to place these orders regardless of the asset’s current price and the broader market conditions. This might look like buying $100 worth of BTC every month.

Dollar cost averaging can also be performed when selling over set intervals. This is to avoid selling at an untimely time, and potentially missing a big spike in price.

Given the nature of dollar cost averaging, it is only effective if the price increases over time, which will not occur for every asset or investment.

Please note, Swyftx does not endorse any investment strategy, including dollar cost averaging.

Important to Remember

DCAing is a long-term strategy that aims to capitalise on growth over time, rather than the fast price fluctuations common in cryptocurrency.

How to put dollar cost averaging into practice?

The popularity of dollar cost averaging in the crypto industry has developed over the years. Now, many reputable centralised exchanges offer support of the strategy by using a “recurring order”.

Let’s say an investor named Lucy has $1,200 to invest in Bitcoin. Lucy has two options – to buy $1,200 worth of BTC in one go or to spread it out over a longer timeframe. If she chooses the lump sum route, she might get lucky and purchase Bitcoin at its 12-month low (currently $24k). However, she might also mistime her investment and buy Bitcoin at its 12-month peak ($45k).

Alternatively, Lucy could employ a dollar cost averaging strategy by investing $100 into Bitcoin every month. If she did this between the 1st of June 2022 and the 1st of June 2023, she would see an annual return of 14%, which is an excellent result.

The exact performance of DCAing will fluctuate along with the market, but the outcome is consistent – dollar cost averaging is typically less risky than lump sum investing. Another strategy Lucy might use is to combine both investment styles and double the recurring purchase during periods she believes are the market bottom.

Using Swyftx recurring orders as part of your DCA strategy

The Swyftx recurring order feature can be an effective tool to Dollar Cost Average into crypto assets.

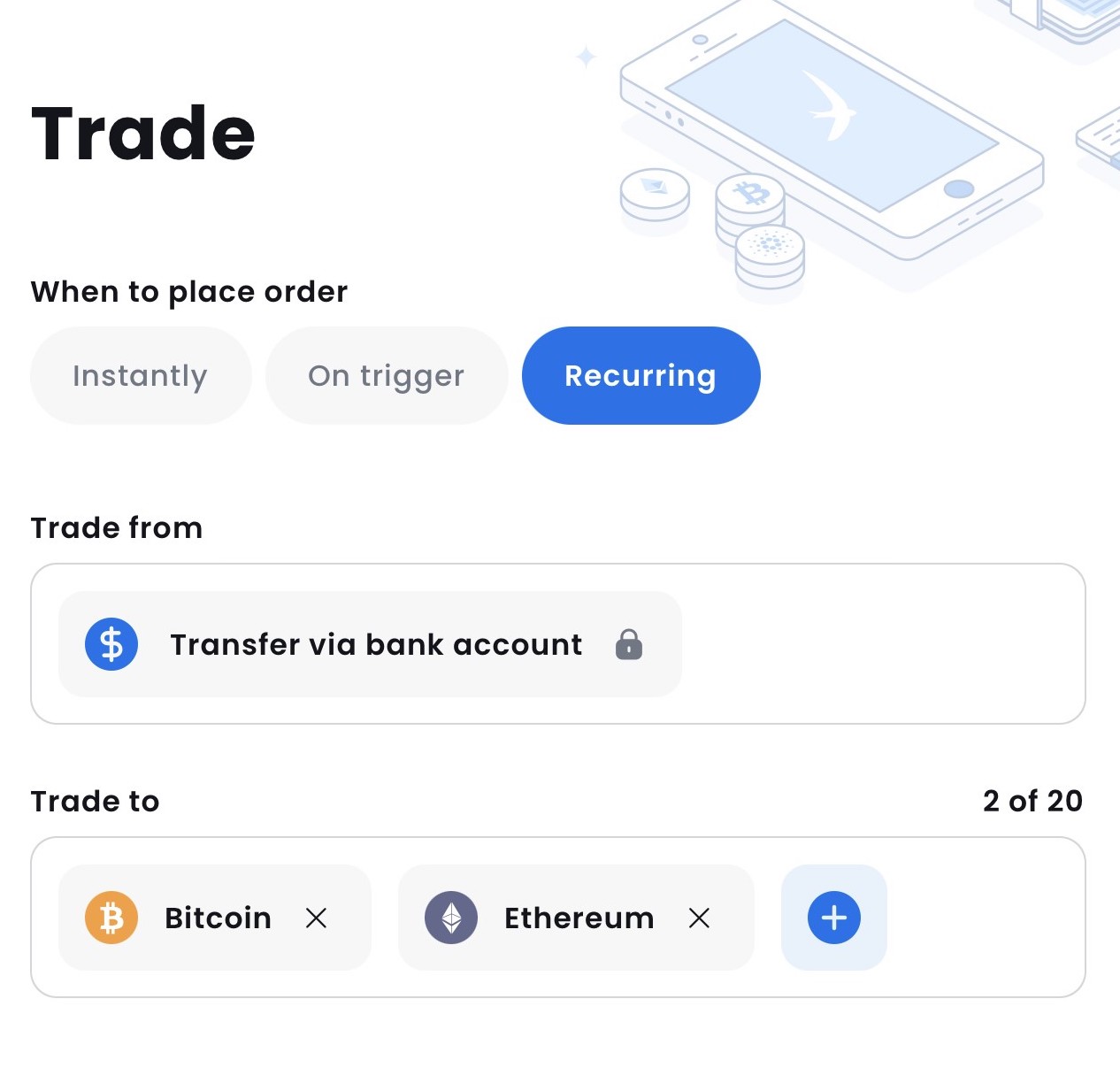

To create a recurring order, you need to follow 3 key steps:

- Set up recurring orders in Swyftx: Select recurring order, choose the asset you want to DCA into and then copy the deposit information (needed for step 2).

- Create a recurring transfer with your bank: Create a new recurring transfer and enter the Swyftx deposit information.

- Confirm the recurring order with Swyftx: Go back to your Swyftx account Select I Understand to confirm your recurring order.

Screenshot of Swyftx recurring orders page on app.

Pros and cons of DCA

Like any investment strategy, dollar cost averaging has positives and negatives. We have broken down some of these below, but you should consider through your own research the best investment strategy for you.

Please note, Swyftx does not endorse any investment strategy, including dollar cost averaging.

Benefits of dollar cost averaging

Mitigation of risk: The key advantage of investing in consistent intervals is the potential mitigation of risk. Cryptocurrency is notoriously volatile, which means it can shoot up or down by significant margins within a day or two. This makes it extremely difficult to identify a good time to buy (or sell) digital currencies, especially as a novice. DCA strategies remove this stumbling block and aim to protect investors from major short-term losses.

Removes emotion: Additionally, dollar cost averaging goes hand-in-hand with a long-term investment timeframe (usually one year or longer). Because everything is automated, investors don’t have to worry about the day-to-day market movements. They can go about their lives without negative emotions (like fear or greed) influencing their investment decisions.

Risks of dollar cost averaging

Although dollar-cost averaging is designed to mitigate investment risks, it does have potential disadvantages.

Opportunity cost: A risky but well-timed lump sum investment will almost always outperform a steadier dollar-cost averaging strategy.

For instance, Ethereum may be undergoing a major upgrade in the coming days, significantly increasing its functionality and potentially its value. A hands-off dollar-cost averaging strategy would not account for this development and could leave investors missing out on improved returns or unaware of drops as a result of priced in initiatives.

Missing important news and events: DCAing can negate the need for fundamental and technical analysis. This is beneficial in one sense, as it takes away potentially rash, emotion-driven decision-making. However, analysing the market using multiple metrics is a key skill that crypto investors shouldn’t ignore.

Some investors may use fundamental analysis to find good projects with strong foundations and then choose to DCA into it. However, it’s important to understand that the crypto market evolves at a rapid pace, so a strong project today may not be considered so strong in 6 months’ time due to reasons like:

- Regulatory changes

- Changes in competitive landscape

- Hacks or exploits

Key Takeaway

A lot of people choose to DCA into stronger projects, rather than the latest altcoin as they can be less risky than smaller altcoins.

For more info on Fundamental analysis, try out our Learn and Earn course and get $5 AUD in the process.

Quiz

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read