Key Takeaways

- XRP is experiencing a significant rally, but opinions are divided on whether it is sustainable or hype-driven.

- Recent developments, including regulatory shifts and innovative on-chain initiatives, are sparking renewed interest.

- Bullish outlooks focus on potential adoption and institutional products like ETFs.

- Bearish concerns highlight overvaluation, Ripple Labs’ holdings, and competition.

What Is XRP?

XRP is the native cryptocurrency of the XRP Ledger, a blockchain built to enable fast and low-cost cross-border payments. Initially, its primary use case was to act as a bridge currency for international money transfers, making it easier and cheaper for financial institutions to convert between fiat currencies.

While cross-border payments remain a key focus, XRP’s ecosystem is evolving. Recent developments, such as a Ripple-issued stablecoin and the introduction of tokenised assets, suggest that XRP is positioning itself as more than just a payments facilitator. These innovations could expand XRP’s role within decentralized finance (DeFi) and institutional financial systems, broadening its utility beyond its original purpose.

What’s Driving the Rally?

XRP has risen by almost 400% in just a few weeks, though still falling short of its all-time high (ATH) from 2017. This significant rally can be attributed to a mix of fundamental developments and speculative enthusiasm:

- Regulatory Optimism: Ripple Labs’ legal battle with the U.S. Securities and Exchange Commission (SEC) has recently taken a favourable turn, bolstering investor confidence. Many speculate the SEC might drop or significantly reduce charges against Ripple.

- Institutional Products: Four separate applications for an XRP ETF have been filed, which, if approved, could bring substantial institutional capital and increase XRP’s accessibility.

- On-Chain Developments: Recent innovations, like the first tokenised money market fund on the XRP Ledger and the confirmed launch of a Ripple-issued stablecoin, add a layer of utility to XRP’s ecosystem.

- Retail Euphoria: The resurgence of older “dino coins,” including XRP, has attracted retail investors re-entering the market, driven by nostalgia and speculative sentiment.

Ripple’s price has rapidly increased, surpassing 2021 highs. Source

The Bullish Outlook

Regulatory Clarity

A resolution to Ripple’s legal challenges could provide XRP with a regulatory framework, potentially positioning it as a leader in the remittance and payment space.

ETF Momentum

The prospect of an XRP ETF could significantly increase adoption and drive liquidity into the market. This could look similar to the increase in positive sentiment that both BTC and ETH received with their ETF approvals.

Expanding Use Cases

XRP’s growing ecosystem, including tokenised assets and stablecoins, enhances its appeal to developers and institutional users.

The Bearish Outlook

Overvaluation

At its peak, XRP’s fully diluted market cap (FDMC) exceeded AU $280 billion, surpassing financial giants like PayPal. This raises concerns about whether such valuations are supported by real adoption and utility.

Ripple Labs’ Holdings

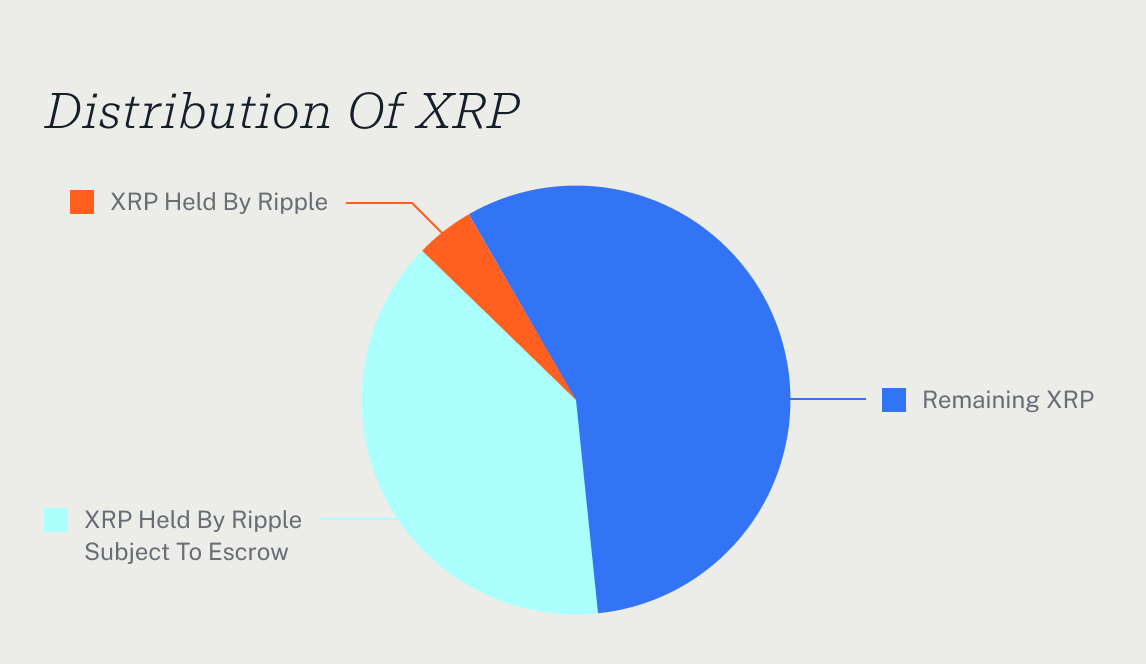

Ripple Labs controls approximately 44.18% of the total XRP supply (around 44.18 billion tokens). This centralized holding raises concerns about supply pressure and the potential for market manipulation.

Competition

XRP faces fierce competition from faster, cheaper and more versatile blockchains like Solana and Ethereum L2s, which are attracting significant adoption.

Market Sentiment

Much of the recent rally appears to be driven by hype and speculative trading rather than substantive on-chain activity.

Unclear Adoption Metrics

Despite its age, XRP has struggled to demonstrate consistent growth in network activity or developer adoption.

Pie chart showing XRP tokens held by Ripple Labs (as of 30th Sept. 2024). Source

Conclusion

The XRP rally reflects a combination of hope, market speculation and real progress. While developments like regulatory clarity and new institutional products provide reasons for optimism, concerns about overvaluation and competition cannot be ignored.

Investors should approach XRP with caution, balancing the bullish potential of its ecosystem with the bearish risks of overhyped sentiment, Ripple Labs’ concentrated holdings (44.18% of supply) and uncertain adoption.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.