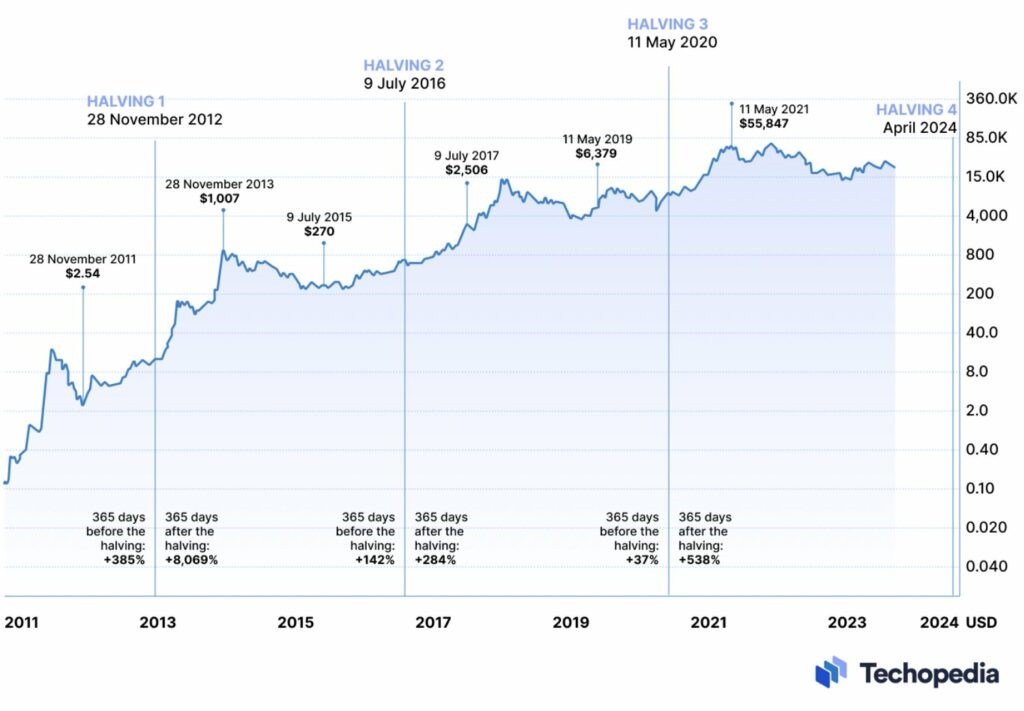

So far in Bitcoin’s short history, it has moved in distinct 4-year ‘Halving’ cycles. If history is anything to go by, we are about to come out of the depression or disbelief phase. Due to global tensions and macroeconomic challenges, there is a question mark on the timing. But if you are a long-term investor, volatility is to be expected.

Key Takeaways

- The Bitcoin Halving historically plays a vital role in price appreciation.

- The 4-year cycle typically has 4 stages.

- Current Bitcoin sentiment is eerily similar to the Wall Street Cheat Sheet’s Psychology of a Market Cycle.

The Bitcoin Halving

Please refer to the previous post on Bitcoin Halving.

The Bitcoin halving event is a crucial and highly anticipated occurrence in cryptocurrency. It occurs approximately every four years and marks a significant point in Bitcoin’s monetary policy. This event is ingrained in the protocol and is designed to reduce the rate at which new Bitcoins are created, thus making them more scarce and valuable over time.

The halving event occurs after every 210,000 blocks have been mined, roughly every four years, due to how the Bitcoin network operates.

To understand its importance, let’s take a look at what happened during previous halving events in 2012, 2016, and 2020:

- 2012 Halving: This was the first-ever Bitcoin halving event, taking place approximately four years after Bitcoin’s creation.

- 2016 Halving: Bitcoin had gained more recognition by this time, and the media covered the event more broadly. Like the 2012 halving, Bitcoin’s price started to rise after this event, and it became apparent that it was entering a new phase in its market cycle.

- 2020 Halving: The most recent Halving took place in 2020. Bitcoin’s price experienced significant growth, attracting even more mainstream attention. The event coincided with a global liquidity injection caused by Covid.

The key takeaway from these previous halving events is that they often signal the beginning of a bullish phase for Bitcoin. The reduction in the rate of new Bitcoin issuance highlights its scarcity, making it more appealing to investors as a store of value. This scarcity narrative, combined with increased adoption and recognition, tends to drive up demand and, subsequently, the price of Bitcoin.

While past performance does not guarantee future results, these historical patterns have led many in the crypto community to believe that Bitcoin’s halving events are crucial in shaping its market cycles. As such, each halving event is met with keen interest and speculation about its potential impact on Bitcoin’s price and the broader cryptocurrency market.

In contrast, some believe the 4-year cycle is aligned with the global liquidity cycle, which is the more significant determinant of Bitcoin’s price performance.

Typical Stages of the 4-Year Cycle

Another way of looking at the 4-year cycle is through the lens of the 4 stages:

#1 Rapid Price Appreciation: In each Bitcoin market cycle, there is a period of rapid price appreciation, often called a bull run. During this phase, the price of Bitcoin surges to new all-time highs, attracting significant attention from investors and media.

#2 Peak and Correction: At some point during the bull run, Bitcoin reaches its peak price for that cycle. This peak is typically followed by a significant correction, where the price of Bitcoin retraces from its all-time high. This correction phase can be triggered by profit-taking, regulatory news, or other factors.

#3 New Support Level: A new support level is established during each cycle’s correction phase. When Bitcoin experiences a correction, the price does not drop as low as in the previous cycle’s low.

#4 Sustained Growth: After a prolonged period of sideways movement, the price begins to trend higher. This trend is sustainable at this stage of the cycle.

Bitcoin Cycle Based on Psychology

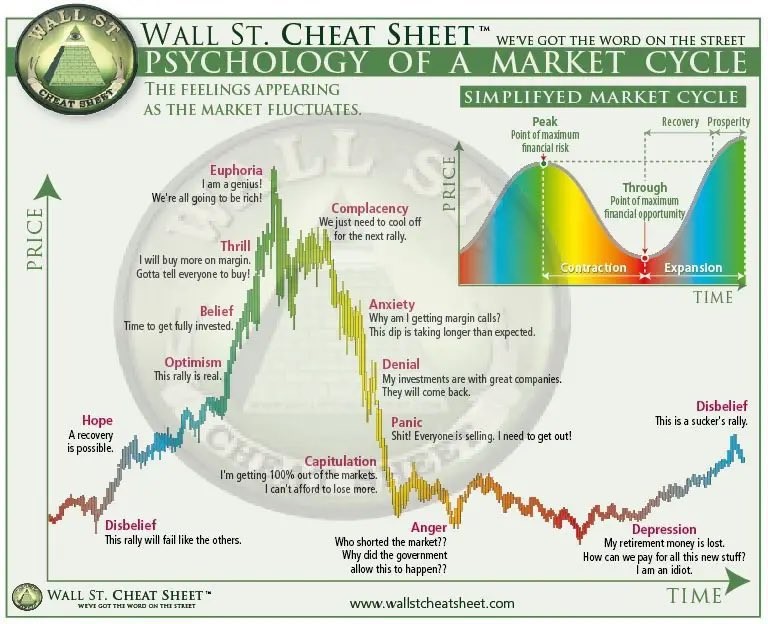

The 10 sentiment or psychological stages are recurring patterns that shape a market cycle. It is important to note that not every market cycle will precisely adhere to this chart, and the timing can vary.

Nevertheless, these stages offer valuable insights into the psychological aspects of market cycles. These phases are typical in all markets, including the crypto market. However, their duration and intensity can be influenced by factors such as risk (notably high in the cryptocurrency market). It is crucial to acknowledge that accurately predicting market cycles is a challenging endeavour.

We can glean from this that markets exhibit cyclicality; they do not experience perpetual upward momentum or plummet to complete worthlessness (assuming they maintain long-term legitimacy). Historically, they tend to “revert to the mean” over time.

Where Are We in Sentiment

It’s best to separate out Bitcoin and altcoins, as they have significantly different sentiment.

Bitcoin: The best estimate is that Bitcoin is in the mid to late stages of the disbelief phase.

The price has risen significantly from the $15k lows, and its performance shows similar trends leading to the Halving. There is still a lot of negative sentiment in the crypto market and traditional finance. Arguments have been made that this time is different because U.S. liquidity is being drained, war or the threat of war is occurring in multiple localities, the global economy is underperforming, and China’s deflation may cause it to repeat the mistakes of Japan.

Despite all these risks and the recent appreciation of the DXY (US Dollar Index), Bitcoin has held up incredibly well.

Altcoins: In contrast, altcoins are still in the depression phase. While some coins have performed quite well during the bear market, as a whole, it can be argued that non-Bitcoin is yet to properly bounce off the lows.

Ethereum is an anomaly that can be argued to be in either disbelief or depression phases. It has underperformed against Bitcoin but outperformed most Alts.

What Does it All Mean?

The amount of Bitcoin Hodlers is staggering versus previous cycles. More and more people are understanding the value proposition of the orange coin. Other established blockchain projects are also starting to show their capabilities. This dramatically differs from the previous cycle, where the hype was based on hopes and dreams.

With the macroeconomic picture being the most different since Bitcoin’s inception and the black swan risks associated with war, this time’s cycle will differ from previous cycles. However, the extent of the difference will not be as significant as some commentators claim. The deflationary asset mixed with technological advancements will continue to push forward the importance of blockchain.

Yes, there is a risk of a black swan event.

Yes, brilliant people are telling us that things must fall apart.

And yes, the threat of war can cause inflationary pressures. However, it is essential to zoom out. If you have conviction, you are better off being in the game than on the sidelines. Don’t get caught waiting for lower lows that may never come.

Recap

Bitcoin and crypto go through cycles. Whether it follows global liquidity or the 4-year Bitcoin Halving cycle, its value proposition continues to increase as adoption and awareness improves.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.