Key Takeaways

- The proposed Bitcoin Act by Senator Cynthia Lummis, which suggests the U.S. government acquire over 1 million BTC, could significantly impact demand and long-term price prospects if passed.

- Expected fiscal spending from the U.S. and China could drive an increase in the M2 money supply, which has historically been positively correlated with rising asset prices, including Bitcoin.

- The potential end of quantitative tightening (QT) and a shift towards lower interest rates could boost liquidity and investor appetite for assets like Bitcoin.

Bitcoin Act

One of the most significant potential developments for Bitcoin in 2025 is the proposed Bitcoin Act, championed by U.S. Senator Cynthia Lummis. The bill suggests that the U.S. government should consider holding over 1 million BTC as part of its financial reserves. If passed, this legislation could mark a monumental shift in Bitcoin’s role as an accepted and strategic financial asset.

Such a move would not only cement Bitcoin’s status as a legitimate store of value but also introduce substantial new demand into the market. Given Bitcoin’s fixed supply, the acquisition of such a large volume would likely have a long-term positive effect on price dynamics, tightening available supply and driving price momentum.

Beyond market impact, the Bitcoin Act could set a precedent for other nations considering similar strategies, accelerating global institutional adoption. Although the outcome of this bill is uncertain, its progression through U.S. legislative channels will be a key event to watch in 2025.

Global Money Supply Increase

Fiscal spending from major economies, particularly the U.S. and China, is anticipated to rise in 2025 as both nations look to sustain growth and stabilise their economic outlooks. In the U.S., increased government spending could be directed towards infrastructure and technological development to support domestic economic strength. Meanwhile, China is likely to boost stimulus measures aimed at countering challenges in its property sector and encouraging consumer demand.

Such fiscal measures would likely be financed through borrowing, increasing the M2 money supply. M2 tends to rise when governments introduce stimulus and expand liquidity. Historically, growth in the M2 supply has corresponded with rising asset prices as excess capital seeks returns in markets like stocks and cryptocurrencies.

Increased liquidity could drive stronger demand for Bitcoin, which is often seen as a hedge against monetary debasement. If global liquidity expands as expected, Bitcoin may benefit significantly from the increased capital flowing into alternative assets in 2025.

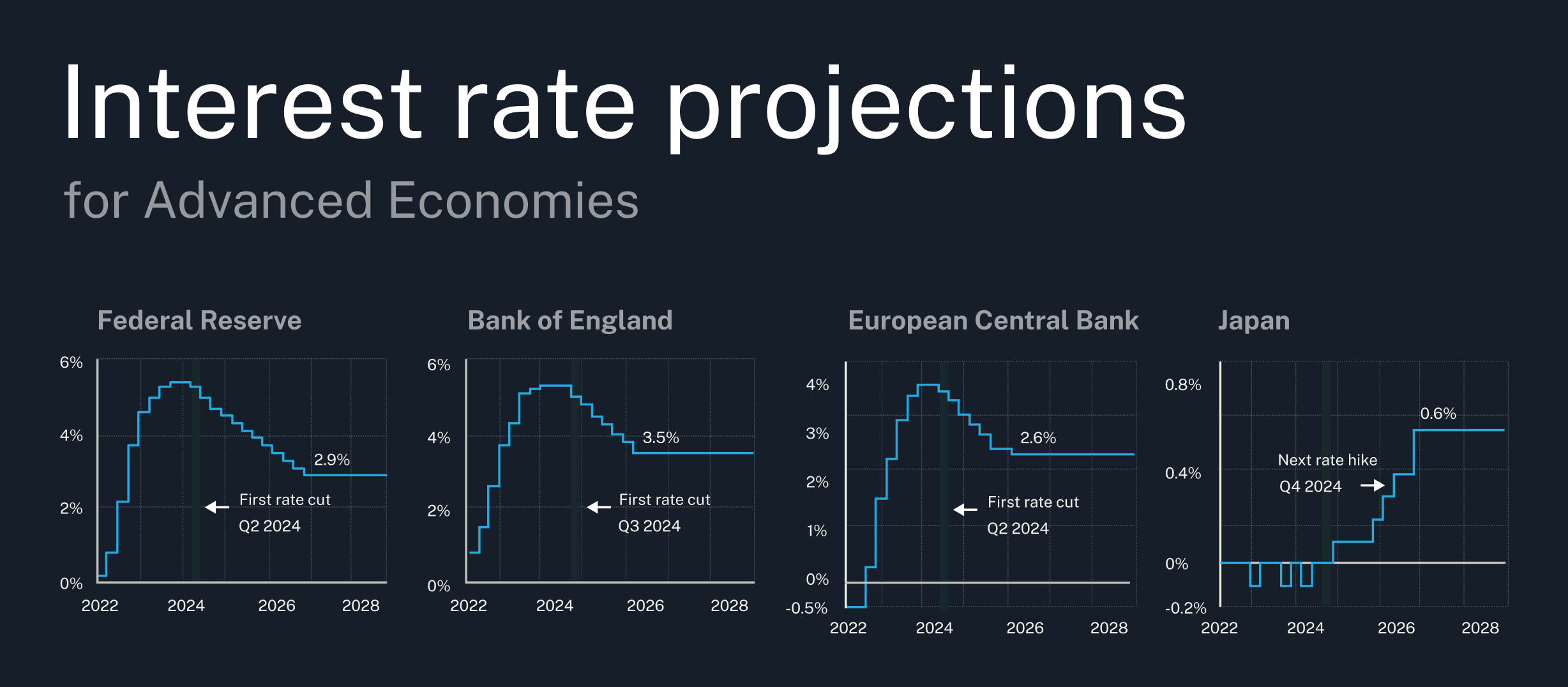

Federal Reserve Easing

The U.S. Federal Reserve’s current policy of quantitative tightening (QT) — where the bank deliberately lowers the amount of assets it holds on its balance sheet — has put pressure on liquidity and asset prices in recent years.

Many expect the Fed to end its QT policy in 2025. While it may be some time before quantitative easing (QE) returns, ending QT alone should improve liquidity conditions.

The removal of QT would halt the reduction of liquidity from financial markets, while lower interest rates would reduce borrowing costs and encourage greater investment activity. Historically, Bitcoin has performed strongly during periods of increased liquidity and low-interest rates, as investors search for alternative assets that offer higher returns.

If the Fed follows through with policy easing, it could inject significant optimism into the Bitcoin market, reducing selling pressure and attracting new buyers. Combined with increased global liquidity and policy shifts like the Bitcoin Act, Federal Reserve easing could be a key catalyst for Bitcoin’s growth in 2025.

Conclusion

2025 is shaping up to be a pivotal year for Bitcoin, with multiple macroeconomic and policy-driven catalysts on the horizon. The potential approval of the Bitcoin Act, increased fiscal spending, an expanding monetary supply and a shift towards Federal Reserve easing are all developments that could drive substantial movements.

While Bitcoin has faced significant headwinds in recent years, these evolving trends suggest a more favourable landscape ahead. If these catalysts align, Bitcoin could see renewed demand and stronger price appreciation, positioning it for a potential breakout year.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.