After all my years investing in cryptocurrencies and watching this space evolve, I still have a bunch of unanswered questions about what the future holds for the crypto industry. I’m sharing my top three today in an effort to remind us all of how much we still don’t know about this very new and exciting asset class.

Key Takeaways

- Layer-one (L1) blockchains are critical to the future of this space. They must scale if this asset class is to grow exponentially.

- Layer-two (L2) blockchains add scalability and speed, but are reliant on L1 for security.

- The battle between newer L1s and L2s is ongoing and may drive further specialisation.

- Layer-three (L3) blockchains will further enhance specialisation, but it could lead to products that resemble traditional finance.

- For some projects, having a token makes absolute sense. For others, it is questionable at best.

Is Layer 2 Better Than Layer 1?

If you spend enough time in the Ethereum community, you’ll hear layer-two (L2) blockchains be touted as the path towards mass adoption of blockchain technology. That’s because of their faster transaction speeds and cheaper fees, especially compared to older layer-one (L1) blockchains like Ethereum.

However, the blockchain landscape is rapidly evolving. Newer blockchains like Solana, boasting thousands of transactions per second, and others, such as Cosmos, promise to facilitate effective interoperability and scalability through innovative network architectures. Even Ethereum will continue getting performance upgrades in the coming years.

L2s optimise for transaction processing speed by relieving themselves of certain security and operational concerns that L1 blockchains face. This makes them ideal for use cases that require fast transactions and the exchanging of relatively low amounts of economic value (e.g. trading card games (TCGs)).

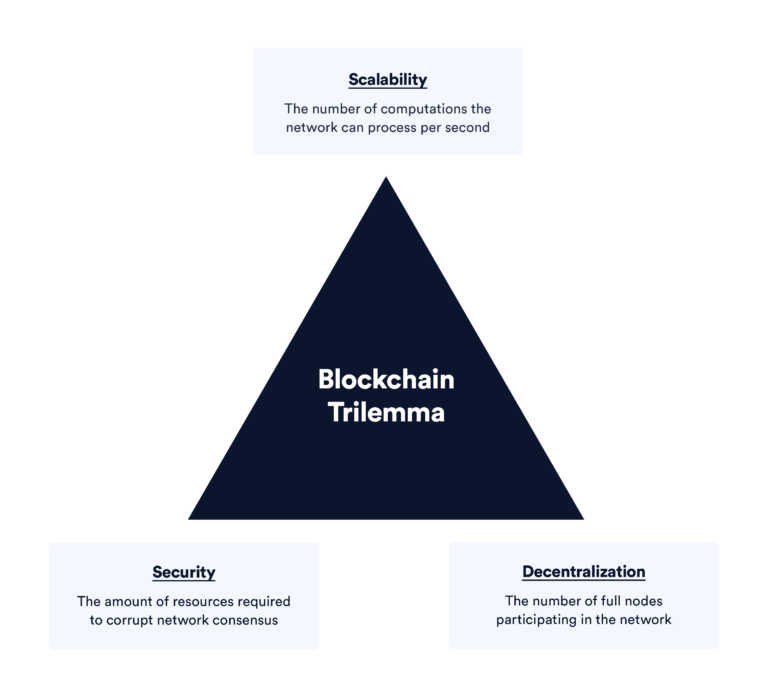

Today’s blockchains cannot have all three of these conditions simultaneously (Source: Chainlink)

However, L2s have drawbacks, such as heightened security and centralisation risks. Also, because they are relatively new, L2s tend to be less battle-tested than the more established L1s. (More on this in Nick’s recent post, ‘Why Ethereum L2s Aren’t As Safe As You May Think’.)

Using Solana as the L1 and Arbitrum as Ethereum’s L2, there are arguments for and against which one outperforms in the long term. As an L2, Arbitrum has the advantage of being able to tap into Ethereum’s security and strong developer community.

Conversely, Solana is designed to handle high throughput without even needing L2s. The network’s performance and reliability are set to be bolstered next year with the ’Firedancer’ release.

Compared to L2s, certain L1 blockchains have superior security and decentralisation. However, they often encounter scaling problems. The opposite is generally true for L2s. It’s unclear which will win in the long term. It may ultimately be determined by what exactly the chain is optimising for.

Will Layer 3 Become More Like Traditional Finance?

L1s (e.g. Bitcoin, Ethereum) are the foundation of the blockchain ecosystem. L2s are designed to help the connected L1 scale.

Some ecosystems are now taking it a step further by introducing layer-three (L3) blockchains. The purported benefits of L3s mostly have to do with greater customisability, allowing developers more freedom to design their blockchain in a way that better suits their needs. Of course, there are many unknowns with L3s, given they are largely untried in public.

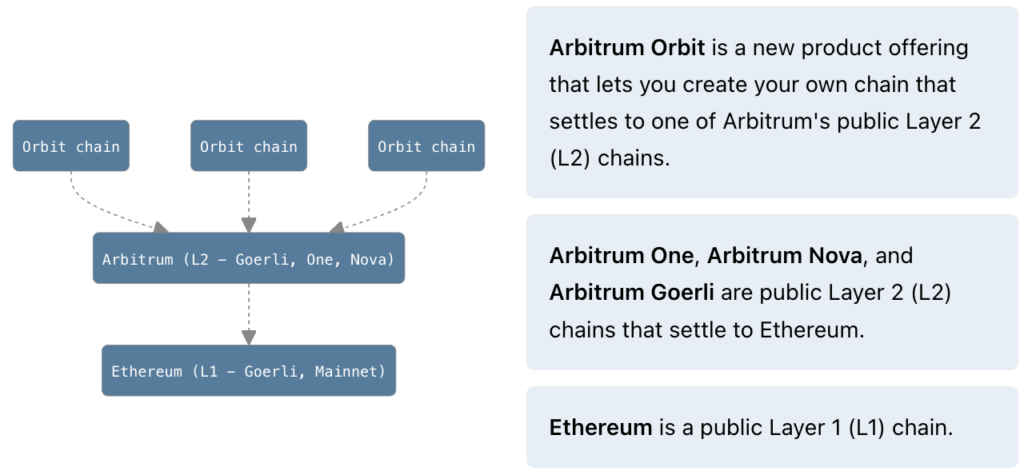

An example of an ecosystem with L3s is Arbitrum. So-called ‘Orbit chains’ (i.e. chains that are built with the Arbitrum Orbit framework) must settle to either Arbitrum One or Arbitrum Nova, both of which are L2s that settle to Ethereum.

Orbit chains are among the first examples of L3s (Source: Arbitrum Docs)

Whether L3 ends up mimicking traditional finance is one of the biggest unanswered questions I have about crypto. I can see certain scenarios where this is a net positive. For instance, operating a low-cost privacy L3 for microtransactions may give rise to societal improvements in third-world countries that were previously unimaginable.

How Many of These Projects Really Need Tokens?

The market is littered with cryptocurrencies that have questionable utility.

Many of these cryptocurrencies launched through initial coin offerings (ICOs) and initial exchange offerings (IEOs), where teams’ primary objective was to raise capital to spend years building a blockchain, protocol or app. In many cases, the underlying cryptocurrency was not essential to the design of what they were building.

The speculative mania of past bull cycles resulted in more of these questionable cryptocurrencies going live, as opportunistic teams saw how much easier it was to raise capital than traditional methods (e.g. venture funding).

And that’s just covering the teams that weren’t malicious from the get-go. Of course, another key reason why the market is flooded with useless tokens is the fact that the nature of the crypto space (i.e. public and permissionless blockchains, ethos of open-source development, heavy retail participation, slow regulatory progress) is ideal for scammers and grifters.

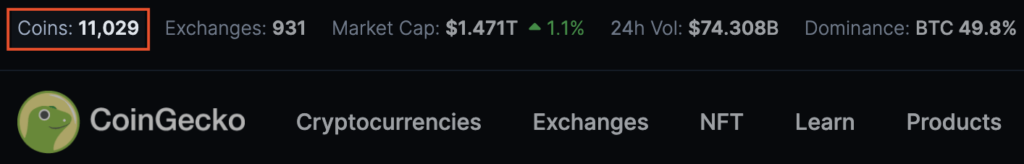

How many of these projects truly need their own cryptocurrency? That is another big unanswered question I have about this space. I suspect that it’s a very high percentage of the 11,029 cryptocurrencies that CoinGecko has listed. Time will tell whether that percentage is closer to 50% or 95%.

How many of these 11,029 coins and tokens have no to little utility? (Source: CoinGecko)

This is why it’s critical to have a thorough research process when analysing cryptocurrencies for potential investment. This entails evaluating a token’s purpose, technology, whitepaper, website, GitHub activity, team backgrounds, competition, price history, and community sentiment. Remaining vigilant against misinformation and scams, diligently researching, and leveraging credible sources are essential steps in developing an informed opinion on a given token.

Recap

Given crypto is such a new market, it’s highly important to come up with your own unanswered questions about crypto. Also, with how fast things can change, it’s just as important to routinely check in on any progress made in relation to these unanswered questions. Doing so can shape your long-term outlook and, potentially, even your investment performance.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.