Key Takeaways

- Fear and greed index drops to new yearly lows as Bitcoin trades under US$90k

- Stablecoin market continues to see growth

- Impactful inflation metric releasing this week out of the US

The market has fallen to levels of fear not seen since mid-2024. This comes while Bitcoin has fallen under US$90,000 (approx. AU$139,000). Bitcoin is currently down -17% since the start of February.

Overnight we have seen the cinders from the global trade wars re-ignite, with the US targeting the EU. Donald Trump has threatened to slap 25% tariffs on imports from Europe, quoted to be making an official announcement very soon.

While volatility has certainly picked up in the last few days, we are still awaiting potentially impactful economic data announcements later this week. More on this below.

Stablecoin sector growth

Retail sentiment might be the worst I’ve seen. Buuut, on-chain data doesn’t necessarily reflect the doom and gloom weaving its way through social media.

We have continued to see liquidity in the stablecoin market deepen with the sector’s capitalisation rising US$8.3b in the last 30 days.

Data available from Circle shows an additional US$5.3B in USDC has been added to circulation in the last 30 days. For perspective, this represents 18% of the total amount they’ve added (net) into circulation in the last year.

Yet, this rise in stablecoins means investors are likely pulling cash out of altcoins to weather the volatility. But, it also shows money waiting on the sidelines, ready to enter if conditions turn favourable.

Headline inflation data to land

A lot of the negativity is stemming from macroeconomic uncertainty, particularly around inflation. But we have some big data dropping soon that could change the tune.

US Personal Consumption Expenditures (PCE) data will come out on Friday at 11:30 pm AEST. This metric is used by the Federal Reserve to guide monetary policy in the US.

Importantly, the Federal Reserve is closely monitoring both inflation and jobs data. Lower-than-expected inflation results on Friday may pave the way for easing in economic conditions in the near future. This could blow positive tailwinds for crypto markets and steadily shift sentiment away from extreme fear. If the macro picture starts to improve, all those stablecoins sitting on the sidelines could come back into play.

Bitcoin analysis

But with confidence plummeting in the short-term, even the market stalwart, Bitcoin couldn’t handle the heat. After the Bollinger Bands tightened in mid-February, volatility has returned to the market, resulting in a sharp drop in Bitcoin’s price. With these bands expanding, we wait to see how the market responds. Below are two potential scenarios.

Bullish scenario

Should price push higher back inside the lower Bollinger band, this could then result in Bitcoin reclaiming its January low (US$89.2k), and the yearly open (US$93.5k). A better-than-expected PCE reading on Friday might be the catalyst here.

Bearish scenario

Prices continuing to trend lower and remaining outside the lower band could see further downside.

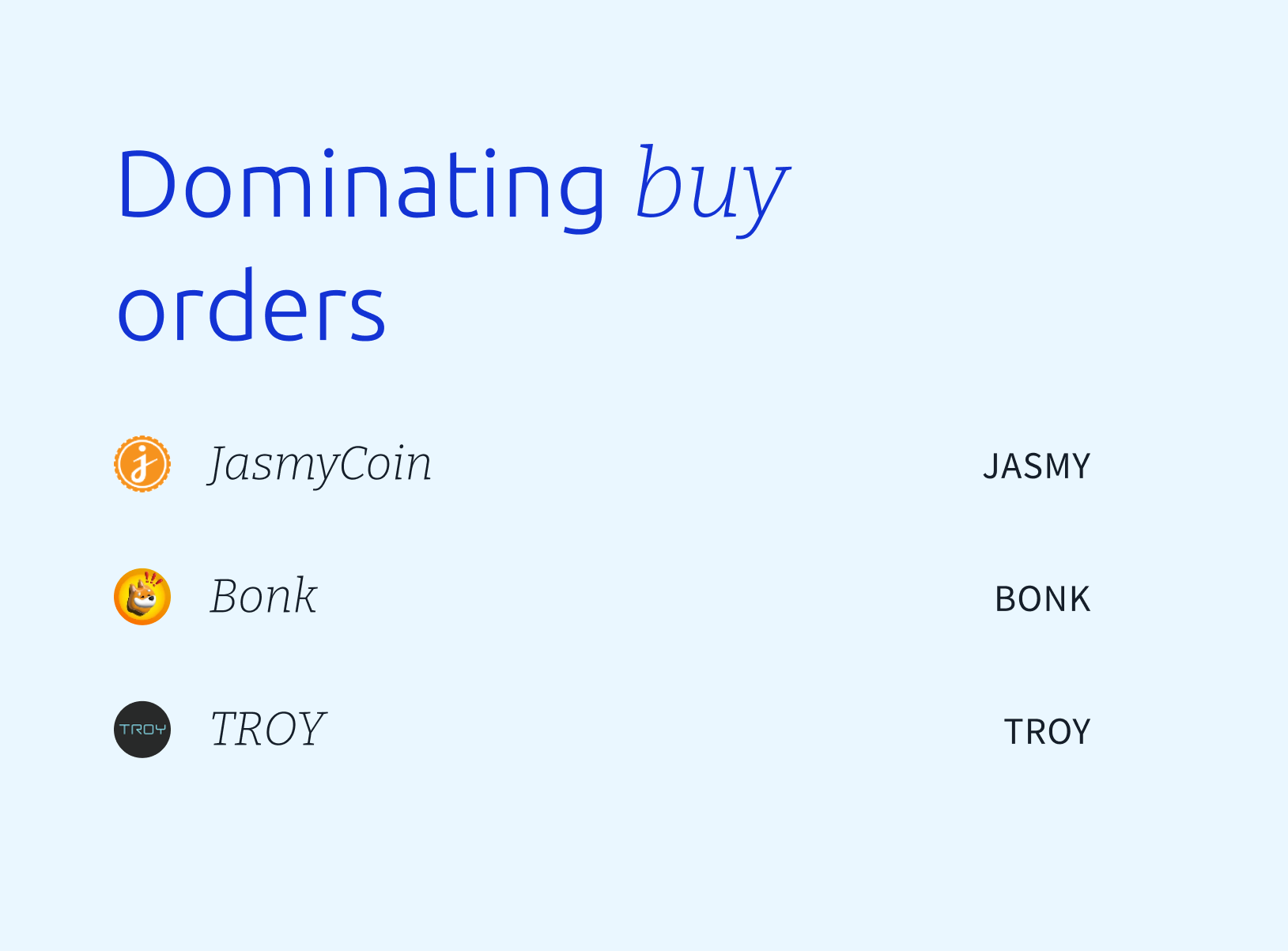

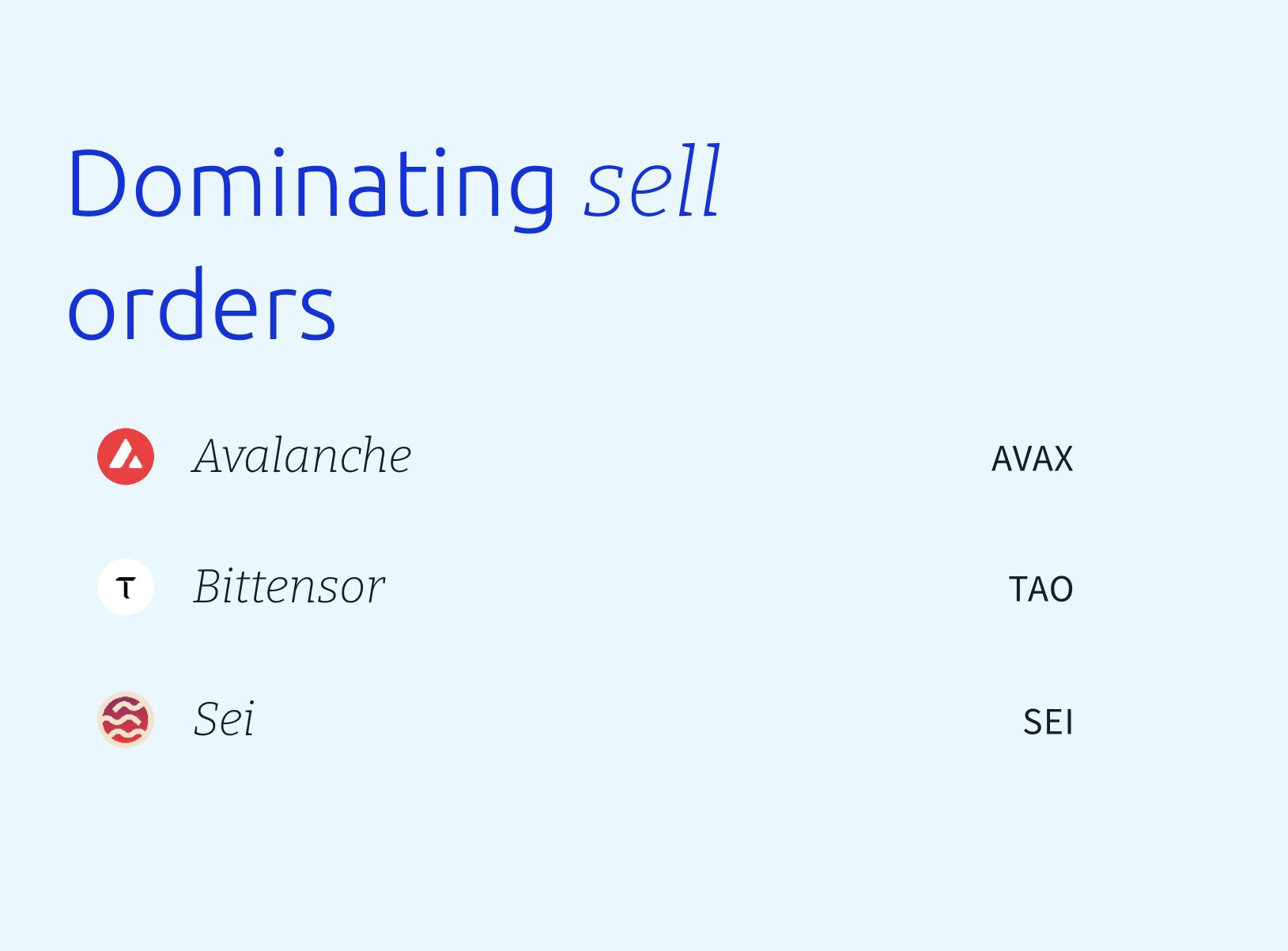

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.