Key Takeaways

- Real-world assets (RWAs) are assets that are represented on blockchains through a process called ‘tokenisation’.

- The RWA sector has one of the strongest narratives of this bull market, largely due to the nature of the early adopters (e.g. major banks) and its far-reaching potential.

- Virtually any asset—whether it is physical, financial or intangible—can become an RWA through this tokenisation process.

- Today, the vast majority of RWAs are tokenised versions of cash and cash equivalents (e.g. stablecoins).

- Ondo Finance (ONDO), Chainlink (LINK), Pendle (PENDLE) and Maker (MKR) are among the leading RWA projects.

Understanding RWAs

Real-world assets (RWAs) are assets that are represented on blockchains. This is achieved through a process called ‘tokenisation’, where blockchain-based smart contracts are leveraged to create digital tokens that represent ownership or rights associated with the underlying asset.

Virtually any asset can become an RWA through this tokenisation process.

The nature of these assets can be physical (e.g. real estate, fine art, precious metals), financial (e.g. equities, corporate bonds, fiat currencies) or intangible (e.g. intellectual property, insurance).

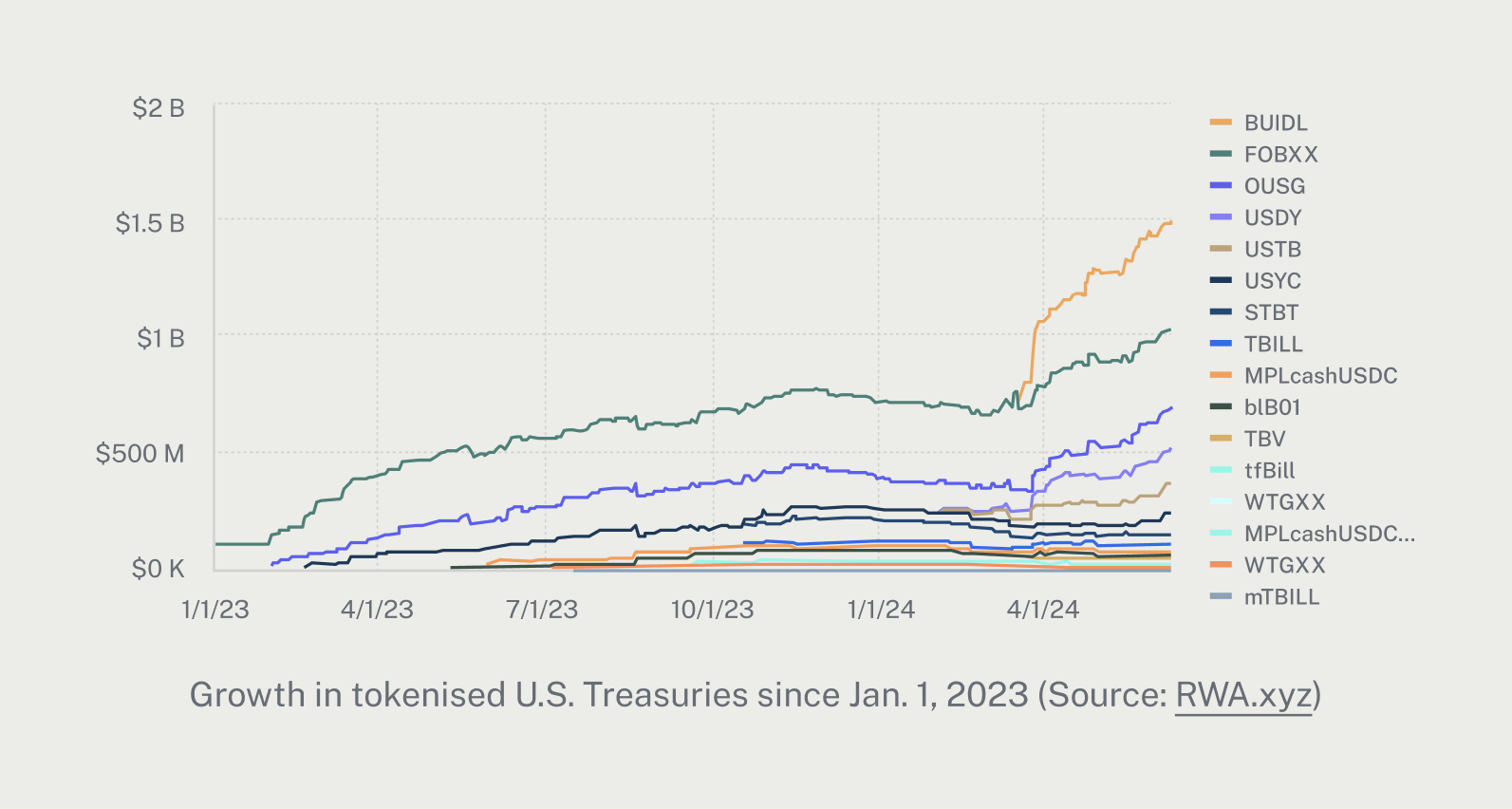

To date, the vast majority of RWA activity has centered around financial assets, with the largest ones being USD-backed stablecoins (e.g. USDC, USDT), commodity-backed stablecoins (Tether Gold), well as tokenised U.S. Treasuries and other cash equivalents (e.g. BlackRock’s BUIDL fund).

Growth in tokenised U.S. Treasuries since Jan. 1, 2023. Source: RWA.xyz

Relative to legacy systems, the key benefits of RWAs are as follows:

- Cost savings: Smart contracts can reduce the extent to which financial intermediaries are involved in the asset-management process, lowering operational costs for issuers and fees for users.

- Greater transparency: Public blockchains are exceptional at maintaining a secure, immutable record of ownership and transactions. This is beneficial because it could result in more streamlined audit and compliance processes, reduced fraud, and improved trust between parties.

- Enhanced market efficiency: Certain RWAs can be traded 24/7 from anywhere in the world. Also, because RWAs can be fractionalised (i.e. ownership of the underlying asset is represented by multiple tokens instead of one), more investors can gain access to assets they otherwise could not afford, such as real estate. (Worth noting, in practice, access to many RWAs remains limited due to regulatory uncertainty.)

Strong Narrative Appeal

RWAs are one of the leading themes of this bull market. This is largely because most major banks and financial institutions are experimenting with RWAs in some capacity. For example, BlackRock, the world’s largest asset manager, has been particularly optimistic about RWAs, with its CEO Larry Fink predicting them to be “the next generation for markets.”

“I believe the next generation for markets, the next generation for securities, will be tokenisation of securities.” – Larry Fink

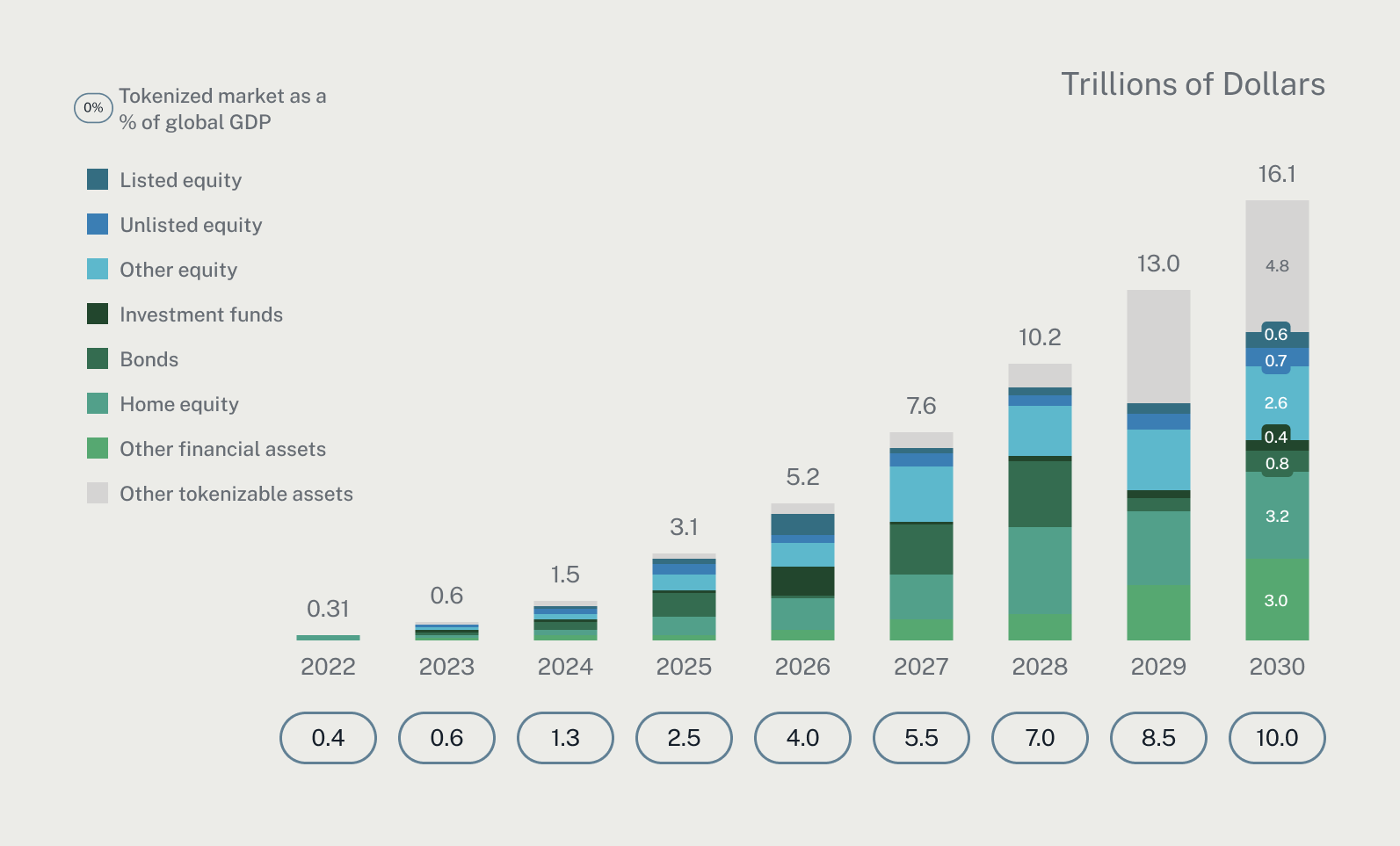

Another key reason why RWAs have drummed up so much excitement is their far-reaching potential. In other words, given that just about any asset can technically become an RWA, it’s difficult to place a ceiling on the RWA sector’s potential size. This is how you end up with broad forecasts such as the one shown below by Boston Consulting Group, which estimated that the market for tokenisation of global financial assets would be worth $16T by 2030.

Tokenised market as percentage of GDP. Source On Chain Asset Tokenisation.

Despite there being a long list of unanswered questions regarding how value accrues to RWA tokens, news headlines can be enough to drive prices higher. For example, BlackRock’s launch of BUIDL in March caused many RWA tokens to rally by more than 100%, even though they had no connection to the product.

The table below shows average performance of crypto categories/narratives in Q1 2024, according to CoinGecko. It shows RWA’s being the second-best performing category behind memecoins.

5 RWA Projects to Watch

1. Ondo Finance (ONDO)

Ondo is a platform that offers RWAs associated with financial assets, starting with cash equivalents (e.g. government bonds). It currently offers two yield-bearing products, Ondo Short-Term U.S. Government Treasuries (OUSG) and U.S. Dollar Yield Token (USDY), both of which are available across multiple blockchains, including Ethereum and Solana. In June 2024, the total value deposited into these two products surpassed $500M for the first time.

OUSG is considered the world’s first tokenised U.S. Treasuries product. It launched in January 2023 and is available only to accredited investors and qualified purchasers. The significant majority of assets held in OUSG are currently deposited into BlackRock’s BUIDL.

USDY is a tokenised yield-bearing note secured by short-term U.S. Treasuries and bank demand deposits. While this product is far more accessible than OUSG, it is not offered to individual and institutional investors from various countries, including the U.S., Canada and the UK.

Looking ahead, Ondo aims to tokenise the various other types of financial assets that exist beyond cash equivalents. It is doing so by building Ondo Global Markets to address the ongoing lack of secondary-market liquidity that has hindered the adoption of RWAs tied to many financial assets (e.g. public securities). Ondo Global Markets was announced in late February, and the team has yet to share an estimated release date.

2. Pendle (PENDLE)

Pendle (PENDLE) is a yield-management protocol that maximises your returns from yield-bearing assets. It does this by partitioning these assets into distinct components, enabling you to speculate on changes in the underlying yield.

Yield-bearing tokens are digital assets that generate returns by participating in various DeFi protocols. The Pendle platform empowers users to enhance their yields through two key features: yield tokenisation and yield trading.

In essence, Pendle is an asset-management protocol that gives you greater control over your yield by employing various strategies (e.g. longing, shorting), while also enabling speculation on yield fluctuations. (It’s similar to interest-rate derivative markets in traditional finance.

3. Chainlink (LINK)

Too often, Chainlink is narrowly defined as the ‘leading price oracle’. While this is true, it fails to capture the extent to which Chainlink has expanded in recent years. One of these areas of expansion has been RWAs.

For example, in May, the Depository Trust and Clearing Corporation (DTCC), the world’s largest securities settlement system, reported on a pilot project it conducted with Chainlink and several major U.S. financial institutions (e.g. BNY Mellon, JP Morgan).

This pilot attempted to standardise the provision of net asset value (NAV) data of funds across blockchains, using Chainlink’s Cross-Chain Interoperability Protocol (CCIP). As per the DTCC’s report, “CCIP is the only cross-chain protocol that offers defense-in-depth security.” (For more on how financial institutions (e.g. Swift, ANZ) are using CCIP, go to page 7 of the report.)

“Major market infrastructures and institutional banks such as Swift, ANZ, and many others have successfully used Chainlink to demonstrate that financial institutions can use existing infrastructure and messaging standards to interact with tokenized assets across blockchains through CCIP’s blockchain abstraction layer.” – DTCC

The full mainnet release of CCIP is expected very soon. The protocol soft-launched in mid-2023 after years of development, marking a continued expansion for Chainlink far beyond its origins as a price oracle for the DeFi sector.

4. Maker (MKR)

Maker is a protocol on Ethereum that essentially functions as a decentralised bank. It issues a stablecoin known as Dai (DAI) to borrowers who must deposit supported cryptocurrencies at varying collateral ratios exceeding 1:1 (i.e. over collateralised loans).

Over the years, MakerDAO (i.e. the governance community consisting exclusively of MKR holders) has voted to allocate increasing amounts of Maker’s reserves into RWAs. These allocations have significantly increased and diversified Maker’s revenue.

As for what’s ahead for Maker, the big thing to watch is ‘Endgame’, a multi-phase growth plan that will take years to complete. The first phase of Endgame, dubbed ‘Launch Season’, is set to start very soon. One of several features of Endgame is subDAOs, which are essentially dedicated units that will sit under MakerDAO. Expect multiple subDAOs to deploy capital into RWAs.

5. Goldfinch (GFI)

Goldfinch (GFI) generates yields through real-world lending, distinguishing it from the notably volatile DeFi lending methods you might be accustomed to.

Goldfinch’s objective is to enhance access to capital by establishing a unified global credit marketplace. This entails enabling borrowing from the same capital markets for entities ranging from startups in Lagos to institutions in New York while also granting direct access to these opportunities for all investors.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.