Long-Term Holder supply is punching to new all-time-highs, which is both expected, and great to see playing out. This comes alongside Gold testing new ATHs, bank stocks in the US in freefall, and Bitcoin prices remaining remarkably strong.

The world is getting pretty tense. Both the Fed and the RBA hiked rates this week, although I am sure they left the press conferences and went to have a cold shower. I sure wouldn’t want their job right now, as they are dealing with an impossibly difficult situation.

Regional bank stocks in the USA have seen massive stock price declines in recent weeks, as a seemingly endless bank-walk of deposits leave, and head to higher yielding pastures in US treasuries, and money markets. This relentless digital decline in deposits, coupled with the US regulators handing First Republic at a great discount to JPMorgan gives little incentive for the big banks, to save the small banks.

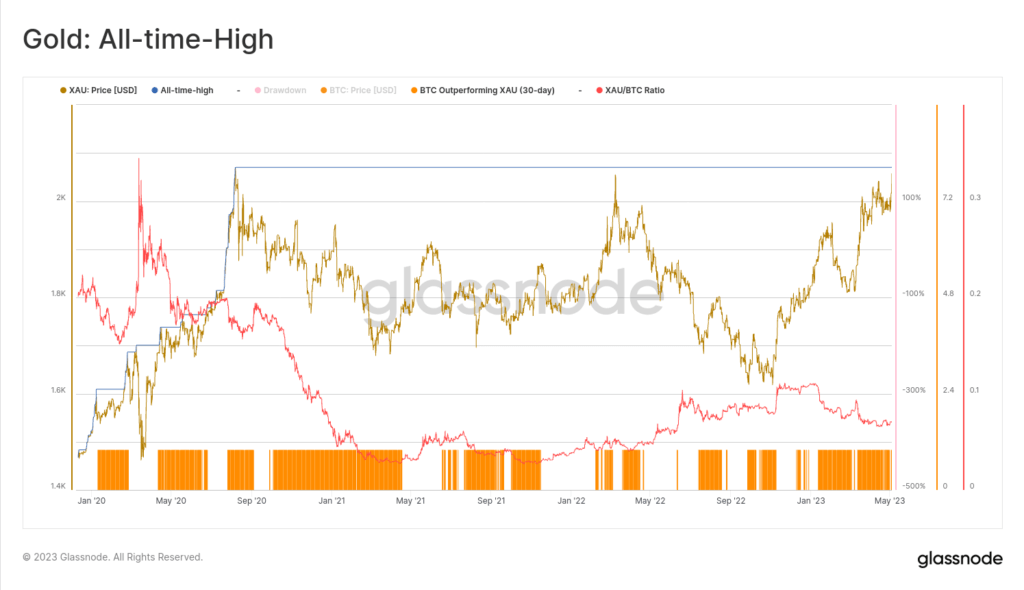

Gold is in the process of rallying and retesting all-time highs vs the USD, and set a convincing one against the AUD today. However, our beloved Bitcoin continues to outperform, as the chart below shows. Orange bars indicate 30-day periods where BTC outperforms gold, and the red trace is the XAU/BTC ratio.

The demand for hard money remains well and truly intact

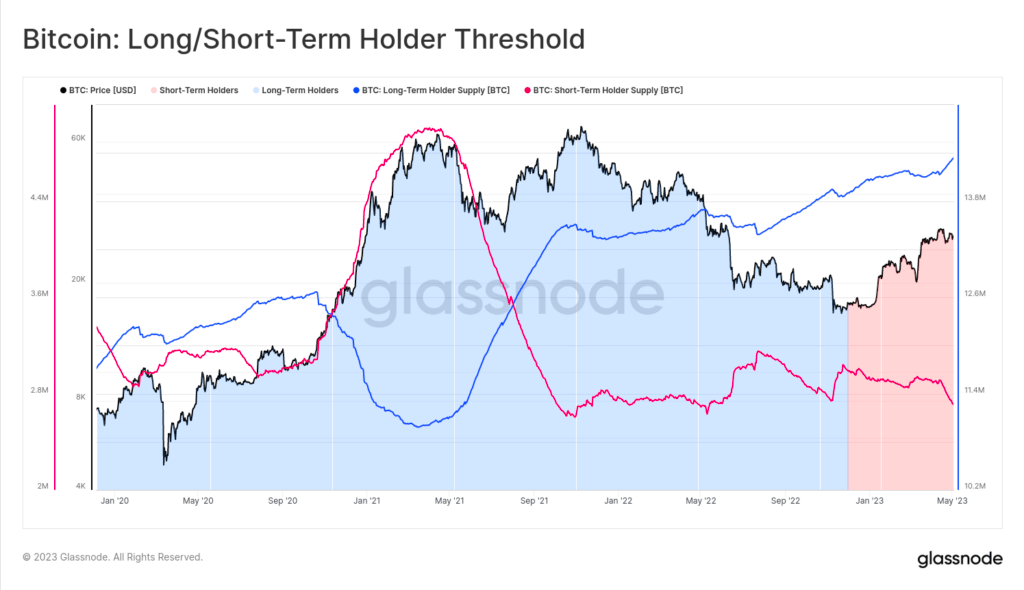

Meanwhile, BTC Long-Term Holder Supply is ripping to new ATHs also, getting up to 14.34M BTC (74% of supply). These are coins held off exchanges, but dormant for at least 155-days and statistically the least likely to spend. The chart below shows that the threshold age is just after the FTX doom candle, and we know for sure that LOTS of coins changed hands down here.

So my expectation is that this chart will continue to rock and roll north. Whilst this is technically looking at past demand, it is also demonstrating a strong willingness to HODL on. Folks simply are not parting ways with their coins just yet.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.