The “metaverse” received significant attention in the last 18 months, with a massive push for crypto-native metaverses and experiences. Part 1 of this two-part series explores why it matters and the current state of play before Part 2 dives into ways to gain exposure.

Key takeaways

- The metaverse = a massively scaled and dynamic network of real-time 3D worlds and environments. Experienced by all simultaneously and by an unlimited number of users.

- It matters because of the growing market opportunity.

- Despite the metaverse fading from popularity, many businesses and governments are still paying attention, with 2 big metaverse alliances created in 2022.

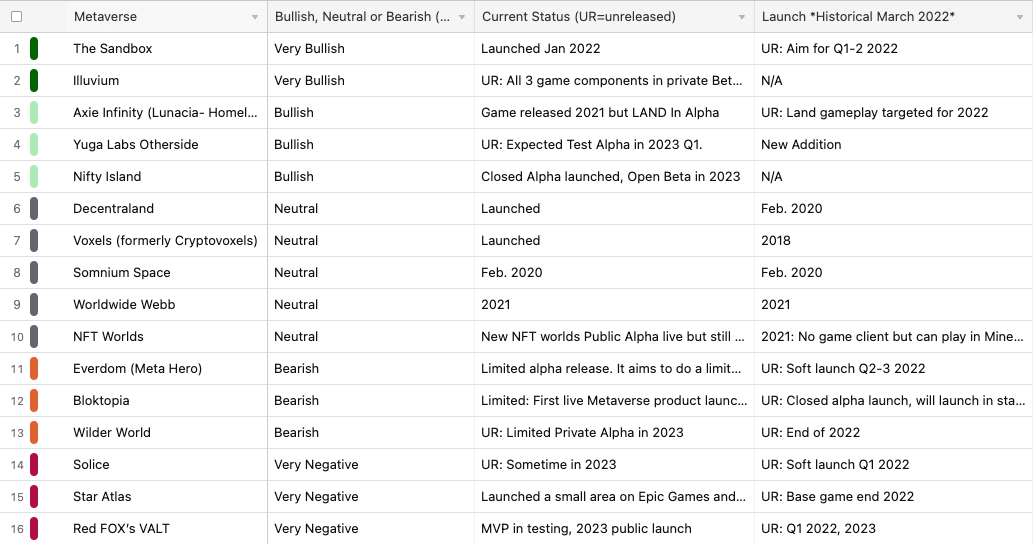

- The top crypto metaverses by rank and unique value are featured in an air table. But now they struggle to gain adoption, with web2 competitors where the majority of activity lies.

- The metaverse remains a while off due to significant challenges: Technology struggles include bandwidth, computing, common standards, graphics and infrastructure.

- If your time horizon is months to years, this might not be for you, as the timeline for this narrative is years to decades.

Defining the Metaverse

Before getting into the metaverse, let’s quickly recap precisely what we mean by the “metaverse”.

The “metaverse” evolved into a buzzword following Facebook’s rebranding to ‘Meta’ in 2021 as they fully committed to becoming a “metaverse” first company.

But what does it mean?

It refers to a hypothetical iteration of the internet where users interact in a shared virtual space. But it is much more than this, as we currently have virtual worlds such as Roblox or Minecraft. The metaverse goes beyond these virtual worlds to provide:

- Real-time 3D worlds.

- A shared, simultaneous experience by all users.

- Integration and interconnectivity of a wide range of virtual goods, avatars and objects.

- An effective unlimited amount of users.

- Persistent—it’s always active.

No games or virtual worlds meet this definition today.

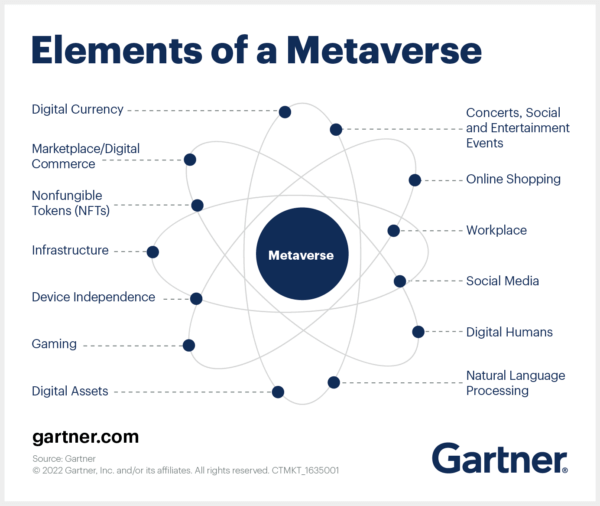

The “metaverse” combines entertainment, digital currencies, gaming, NFTs, e-commerce, social and entertainment.

Figure 1: Elements of a Metaverse. Source Gartner.com

Why The Metaverse Matters

It matters for 2 key reasons:

The significant market opportunity. There’s an expectation the metaverse could attract considerable development, investment and rewards for those companies building out the core infrastructure to make it possible:

It isn’t easy to calculate precisely how large this market opportunity is, but many different investment firms and researchers have placed it in the range of trillions:

- Global X estimates the global metaverse market to surpass $1.5T by 2029

- Bloomberg Intelligence estimates ~$800B by 2024.

- JPMorgan places the revenue market opportunity at $1T.

- Morgan Stanley forecasted an $8T market size in China alone.

- Deloitte estimates $13T in the next 7 years.

- McKinsey growth $5T by 2030.

A new way to connect to people

The metaverse presents a new digital native way to connect with audiences and citizens. It could give agile early adopters utilising the metaverse to communicate to consumers and build businesses like never before.

Current State: Are People Still Interested?

The metaverse went from relative unknown to the town’s talk within a few months. As seen by Google Trends, interest in the metaverse has reduced while a new narrative, artificial intelligence (AI), has taken centre stage.

It would be a mistake to think the metaverse narrative is dead as businesses and governments continue to create strategies for this upcoming trend.

Governments are still paying attention:

- Japan’s Prime Miniter called out NFTs and the metaverse in the country’s digital transformation investment plans.

- The U.A.E released its Dubai Metaverse Strategy to turn Dubai into one of the world’s top 10 metaverse economies.

- South Korea is building a virtual replica of the capital city of Seoul, Metaverse Seoul, to be completed by 2026.

- Saudi Arabia’s Digital Government Authority (DGA) signed an MOU with the Sandbox for “future metaverse development”.

- Singapore created a digital twin of the country, with the goal of a metaverse version next.

Major financial institutions and businesses continue to be interested:

- Fidelity trademarks hinted at metaverse services.

- Qualcomm announced a $100M metaverse fund to invest in its “Snapdragon” processor, which powers many VR devices.

- Epic Games raised $1B in 2021 for long-term metaverse plans.

- Roblox spends $800M yearly on R&D for its virtual world.

- Lego partnered with Epic to build a kid-friendly metaverse.

- Sony‘s preparing to become a “metaverse-ready entertainment juggernaut”.

- Meta has spent ~$36B building the metaverse with no signs of slowing down.

- Chinese companies Tencent, Alibaba and ByteDance all continue allocating to this narrative.

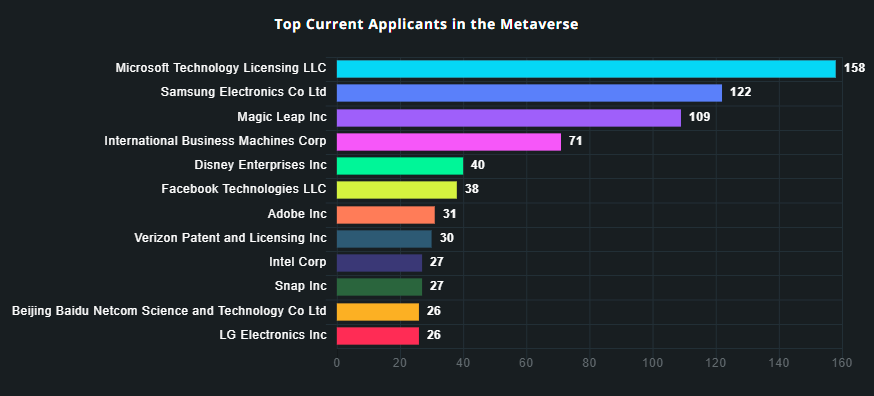

- Microsoft purchased gaming giant Activision Blizzard for ~$70B in 2022, citing the purchase as the “building blocks for the metaverse”. Microsoft leads all companies for most current applicants for metaverse-related patents.

- Blockchain company Animoca Brands started a $1–2B metaverse fund in Nov. 2022.

For more, I suggest checking out the article by [vc] cafe, ‘THE TOP 10 COMPANIES INVESTING BILLIONS IN THE METAVERSE‘.

Companies coming together

The metaverse is not going anywhere, with 2 major metaverse alliances formed in 2022.

The Open Metaverse Alliance (OMA3) launched in Nov. 2022 as a DAO to realise an open metaverse focusing on crypto-native voices. One of its key priorities is establishing open-source standards to ensure NFTs work across metaverses, comprising blockchain companies such as:

- Animoca Brands

- Cryptovoxels

- Alien Worlds

- Dapper Labs

- Decentraland

- The Sandbox

- Decentral Games

- Upland

The Metaverse Standards Forum formed in Jun. 2022 to focus on “pragmatic, action-based projects” like hackathons and prototyping tools for supporting common standards for the open metaverse. It features 33 of the largest tech companies, such as:

- Meta

- Microsoft

- Epic Games

- World Wide Web Consortium (W3C)

- Nvidia

- Qualcomm

- Sony Interactive Entertainment

- Unity

There’s still some pain

It’s not all roses for the metaverse industry. Due to the overhyped nature of the metaverse, a tough economic outlook and a downturn in the technology sector, some companies have reduced their metaverse spend:

Different Metaverses

When thinking about the “metaverse”, there are 2 main ways to break them up—centralised vs decentralised.

Centralised or Web2 metaverses: Controlled by a central company.

- Roblox

- Minecraft

Decentralised or web3 metaverses: Mostly using blockchain to house these metaverses

- Decentraland

- The Sandbox

The definition here is not perfect, and many sit somewhere in between. For the simplicity of this post, I have grouped them into these two areas.

The below Airtable is a database of the most common crypto native metaverses’, ranked as compared with each other. (I’ll cover this more in Part 2):

- Bullish (Green)

- Neutral (Grey)

- Bearish (Red)

Table 1: Crypto Meterverse Round Up. More info

Centralised vs decentralised

The critical difference = true ownership

- For example, if company A wants to kick you off your land, they could ease you or lock you out.

With crypto or decentralised worlds, ownership or censorship is fixed. No one person or company can kick you out or take your in-world land or items. Users remain in control, not big tech.

Why blockchain?

For some using blockchain and NFTs are critical to making the metaverse a reality:

- NFT provide enforceable property rights in the metaverse.

- Blockchains provide easy payment rails & storage for important primitives such as the social or NFT layer.

Which metaverse is winning?

A few notable metaverse platforms in terms of monthly active users (MAU) include:

Centralised

- Fortnite: 230M MAU

- Roblox: 215M MAU

- Minecraft: 178M MAU

- League of Legends: 148M MAU

- Grand Theft Auto 5: 19M MAU

- World of Warcraft: 9M MAU

- Meta’s Horizon Worlds: 200K MAU

- VR chat: 21K MAU

Decentralised

- Axie Infinity: 400K MAU

- The Sandbox: 200K MAU

- Animoca Brands: ~100K MAU via dozens of virtual worlds and games.

- Illuvium – ~10-35K players testing out the private beta.

- Decentraland – 6K MAU

- Otherside – Yet to be released but has a chance to compete with the top 3 once launched.

For now, centralised metaverse platforms significantly outperform any decentralised alternative.

- Outside of Axie Infinity and the Sandbox, no crypto-native “metaverses” are receiving meaningful adoption.

Challenges building the Metaverse

It’s important to understand the “metaverse” remains a far way off, with significant challenges, including:

Technology struggles: Bandwidth, computing, graphics and infrastructure must greatly improve. Senior vice president of Intel said the metaverse will require a 1000x increase in computational efficiency. Other technology, such as wearables, must also be created to provide a more immersive experience.

Monopolisation and legal challenges: Big tech like Apple have strict rules on what users or businesses can and can’t do. Apple’s 30% fee on all app store purchases places great pressure on developers and creators. For many, government action must stop anti-competitive behaviour and open up these platforms for the metaverse to become a reality.

Governance—separation of kids from adults: One of the most underrated challenges comes from legal, security and well-being risks (i.e. who is governing the metaverse?).

For example, will Roblox face legal issues for so many of its user base is under 12? This is an active issue in the metaverse and virtual worlds, which will only become more of a problem.

Scaling blockchains: Decentralised alternatives cannot happen until these chains have greater transaction throughput.

Common standards: Interconnectivity is a big defining part of the “metaverse”—it requires establishing common standards to make these virtual worlds interoperable.

Poor experience & does it even make sense? Not everyone agrees the metaverse is the next great computing platform due to the limited nature of the current technology. Elon Musk believes the metaverse isn’t “compelling” due to a lack of real use cases and a disappointing experience for consumers.

“Sure you can put a TV on your nose. I’m not sure that makes you “in the metaverse”…I don’t see someone strapping a frigging screen to their face all day and not wanting to ever leave. That seems — no way…I currently am unable to see a compelling metaverse situation.” – Elon Musk on the metaverse in 2021

All about your time horizon

Is this for you? It depends. It’s important to consider your time horizon.

The metaverse remains 5–10+ years away with many challenges; if you’re not ready for a longer-term trend to become a reality, then the metaverse is not for you. The timeline for this narrative is years to decades, not months to years.

Thanks for making it to the end; I’d love to hear your opinions in the comments! If you’re still interested in this narrative, look for part 2 next week, which discusses the many ways to gain exposure.

Published by Collective Shift on 18th of February 2023

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.