Key Takeaways

- Hyperliquid operates as a decentralised exchange (DEX) and Layer 1 blockchain, built for speed, low fees, and seamless on-chain perpetual trading.

- Unlike traditional Layer 1 blockchains, Hyperliquid focuses on an order book model, eliminating reliance on automated market makers (AMMs).

- The HYPE token launch avoided VC funding and private allocations, focusing instead on broad community participation.

Understanding Hyperliquid

Hyperliquid is a purpose-built blockchain designed to support high-performance decentralised trading. Unlike general-purpose Layer 1 blockchains that cater to a wide range of decentralised applications, Hyperliquid is optimised specifically for derivatives trading, making it a unique contender in the crypto space.

The protocol provides a fully on-chain order book, which enables transparent, efficient, and low-latency transactions. Traders can execute perpetual contracts without worrying about slippage and gas fees — an advantage that removes unnecessary costs for users.

The high performance of Hyperliquid could also unlock other smart contract applications, expanding its use case beyond just derivatives trading.

How Hyperliquid Stands Out from the Competition

Hyperliquid sets itself apart from conventional Layer 1 blockchains and other perpetual trading platforms through several defining features.

Order Book Model for On-Chain Trading

Instead of using automated market makers (AMMs) like Uniswap or SushiSwap, Hyperliquid adopts a fully on-chain order book, giving traders better control over execution prices, reducing slippage and enabling more sophisticated trading strategies.

No Gas Fees for Trading

One of the biggest pain points in DeFi is gas fees, which can eat away at profits, particularly for active traders working on small margins. Hyperliquid has solved this by eliminating trading fees on its network. Unlike Ethereum, where users must pay for every transaction, Hyperliquid absorbs these costs, making the platform more accessible and cost-effective.

Seamless Cross-Chain Integration

Hyperliquid is designed with interoperability in mind, allowing users to deposit assets directly from a variety of blockchains. This feature increases liquidity and enhances accessibility for users across different ecosystems.

HYPE Token: A Well-Received Launch Model

Layer 1 projects often allocate a large portion of their token supply to venture capitalists who buy-in early. Though necessary for some cryptocurrencies, relying on VCs can raise concerns around centralisation and funding priorities. To address this, Hyperliquid took a community-first approach to its token launch.

The HYPE token was distributed with no pre-mine or private sales, ensuring that early adopters and active participants in the ecosystem received a share relative to their contributions. Instead of favouring institutional investors, Hyperliquid rewarded its users, reinforcing a decentralised and community-driven network.

Price action has also turned favourably following the launch, with HYPE experiencing a significant jump in value. Unlike many projects that see large declines in price after launch due to early investor sell-offs, HYPE has shown strong market demand and sustained momentum, reinforcing confidence in its community-driven distribution model.

Hyperliquid’s Future Roadmap and Growth Strategy

Expanding Beyond Perpetual Trading

Although Hyperliquid is primarily known for its on-chain perpetual trading platform, the team has indicated ambitions to expand beyond this niche. The blockchain’s high performance metrics could support additional DeFi applications, such as lending, options trading, or structured financial products. This shift would position Hyperliquid as a broader financial hub within DeFi, rather than just a derivatives platform.

Becoming a Multi-Purpose Layer 1 Blockchain

Currently, Hyperliquid operates as a specialised Layer 1 built for trading, but there are clear indications that it wants to compete with general-purpose blockchains like Ethereum and Solana. Expanding beyond trading would allow developers to build decentralised applications (dApps) on the network, potentially attracting NFT projects, gaming applications, and other DeFi protocols. However, this transition presents a challenge — Hyperliquid must balance expansion with maintaining its unique edge in trading.

Final Thoughts

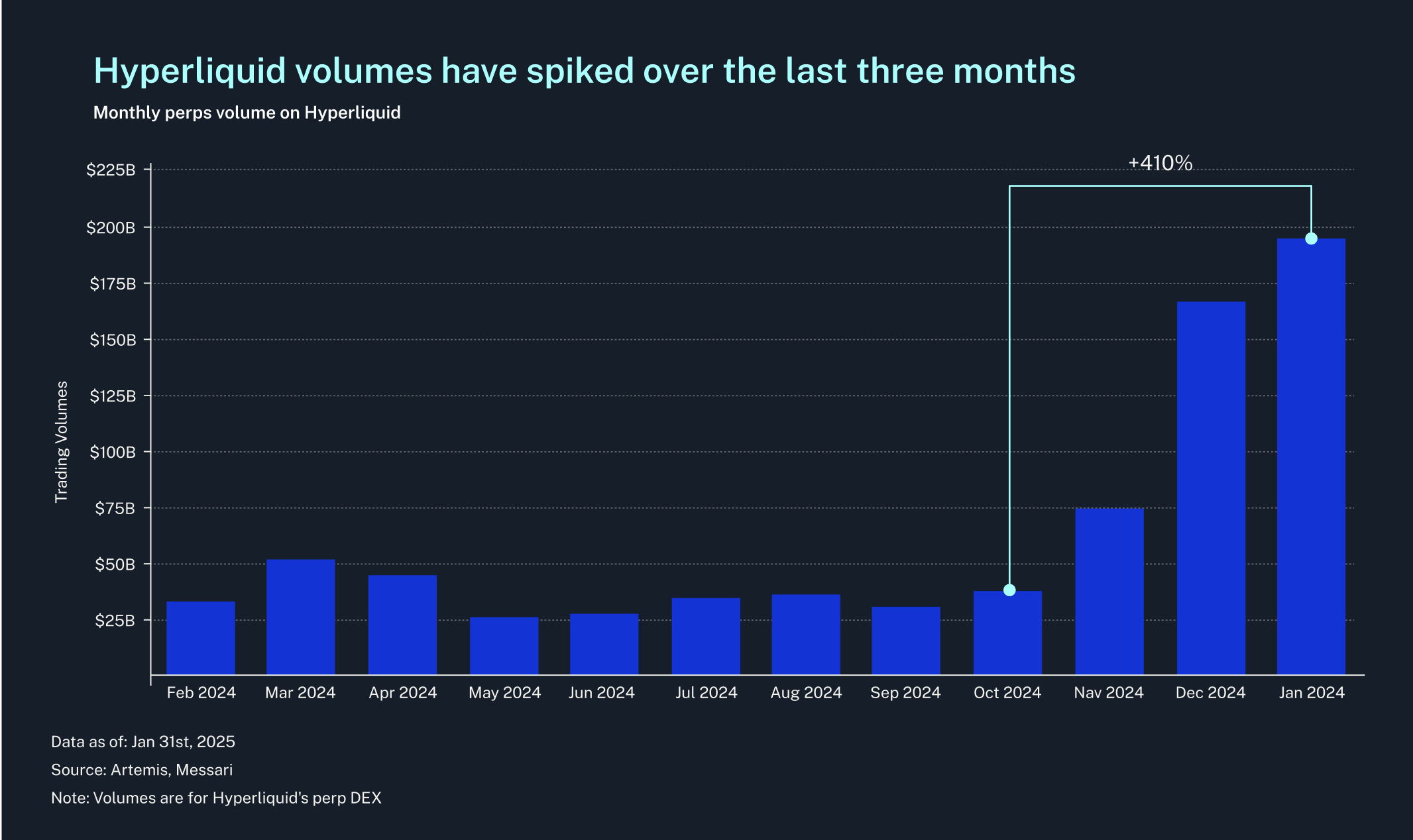

Hyperliquid is making a bold move in redefining decentralised perpetual trading, offering a high-speed, gas-free, and fully on-chain order book experience. With a community-driven token launch and growth throughout 2025, it has quickly positioned itself as a viable alternative to other decentralised derivatives platforms.

Its decision to evolve beyond a trading-centric blockchain into a multi-purpose Layer 1 raises questions about its long-term direction. If Hyperliquid’s network can scale effectively while maintaining its core strengths, it has the potential to become one of the most impactful decentralised financial networks in the crypto space.

Whether Hyperliquid sticks to its niche or expands into new territories, its innovative approach to on-chain perpetual trading makes it a project worth watching.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.