There’s no denying cryptocurrency has been littered with speculative use cases. This could all change as we enter the “utility value” phase, which perhaps doesn’t get the attention it deserves. I cover two tangible use cases personifying this transition from speculative to utility value.

Key Takeaways

- As cryptocurrency matures, we’re entering the “utility” value phase.

- Two tangible use cases demonstrating the transition from speculative value to utility value phase include:

- Stablecoin usage via opening access, payments and transfers.

- NFTs power to monetise and engage

Movement From Speculative to Utility

One of cryptocurrency’s biggest challenges is the perceived lack of utility.

This isn’t necessarily wrong. For too long, cryptocurrency markets have been fuelled by nothing more than speculation with limited utility value.

There is a motto championed by Circle CEO Jeremy Allaire, outlining that “we’re entering the utility phase of cryptocurrency.”

Why this matters?

If these actual use cases become more widely understood and appreciated, it will help to bring legitimacy to the space.

Use Cases Applied

I could include many examples here, but I’ve narrowed it down to two topic areas.

- Stablecoin Power

- NFTs Ability to Monetise & Engage

Stablecoin Usage

Stablecoins are the #1 killer use case of cryptocurrency. Its importance in the ecosystem is undeniable, with stablecoin market cap growing from $400M in 2019 to $130B in 2023.

The power of stablecoins showcases three tangible use cases outside of speculation:

- Payment and transfers

- Cross-border exchange

- Improving worldwide access to alternative currencies

Stablecoins in payments and transfers

The use of stablecoins to move dollars around the world is incredibly underestimated.

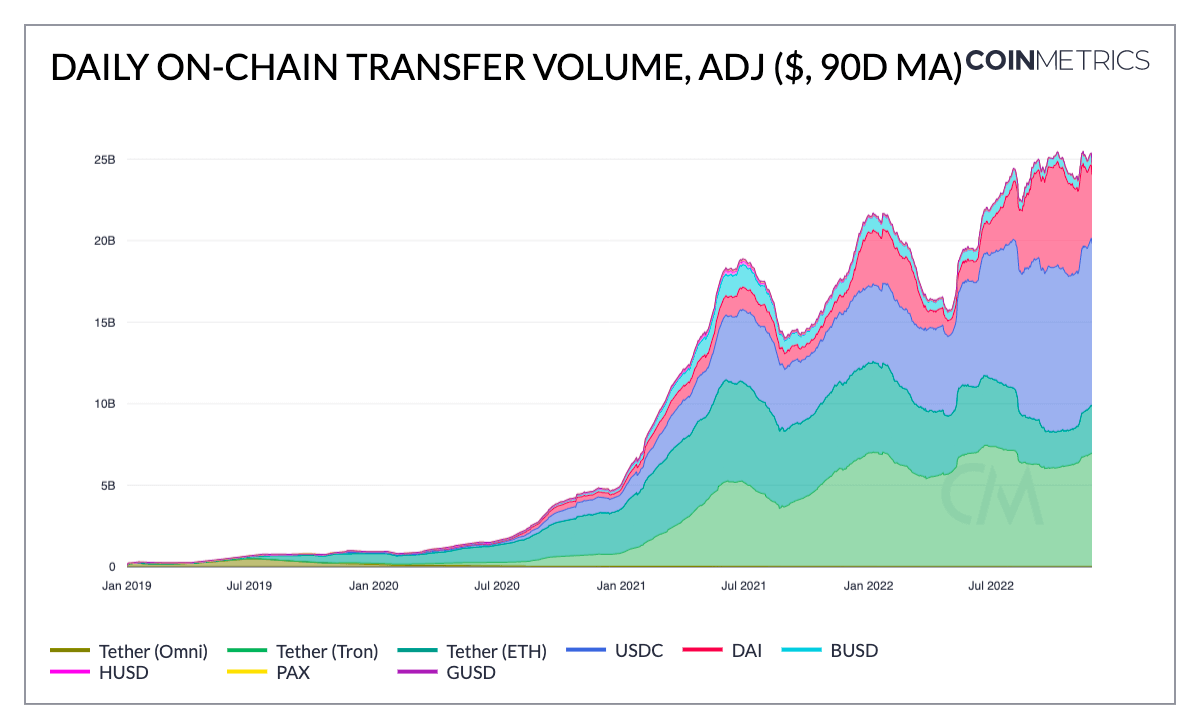

Onchain stablecoin transaction volume (not accounting for off-chain trading on centralised exchanges) ended 2022 with ~$9tn in annualized transfer volumes.

According to Blockworks and the Brevan Howard Digital team, this is significantly higher than volumes processed by Mastercard (~$2.2tn in 2021), AmEx (<$900bn in 2021), and Discover (<$200bn in 2021), with expectations that onchain stablecoin volumes could surpass $15T to outpace Visa’s $12T annualised volume.

Figure 1: Daily onchain transfer volume (Source: Coin Metrics Network Data)

Cross-border exchange

We’re also seeing SAP, one of the largest payment companies behind many Fortune 500 companies, testing USDC stablecoin cross-border payments.

Cross-border payments are a hassle for many small and mid-sized enterprises with international business partners, expensive – up to $50 per transaction, slow – up to seven days to transmit the money, and non-transparent – you never know the status of the transaction…These major challenges can get solved with digital money as a means of settlement and blockchain as the underlying technology.

SAP product expert Sissi Ruthe

Remittances are littered with opportunities for improvement. Blockchain and stablecoins provide significant cost and time savings. After all, sending money worldwide costs an average of ~6% and equates to billions in lost value.

Improving worldwide access to alternative currencies

People can opt out of their local currency into USD via stablecoins—never before has it been so easy to trade into dollars.

This matters because emerging countries experiencing significant inflation have more positive outlooks on cryptocurrency and usage of stablecoins.

We can also see tangible examples of stablecoins effectively delivering financial aid via USDC.

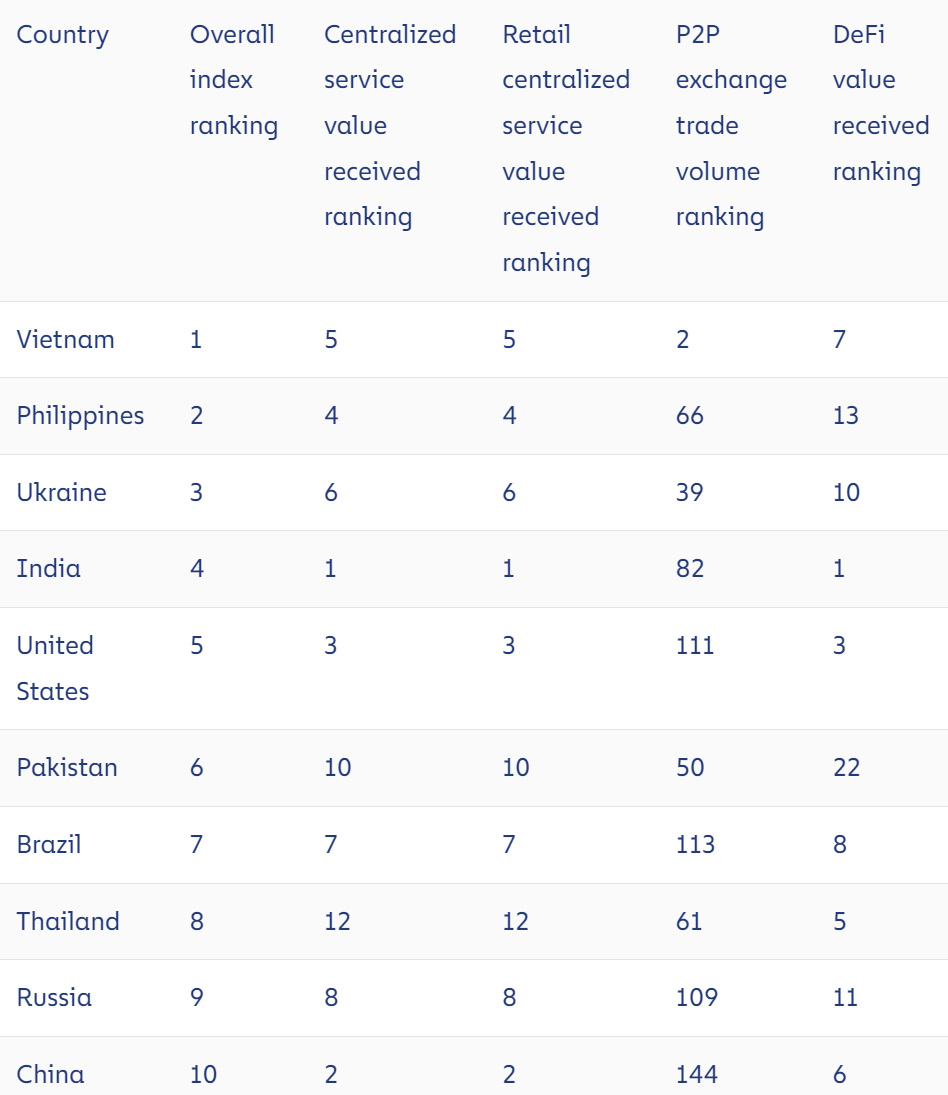

Looking at the 2022 Global Crypto Adoption Index by Chainalysis, 8 of the top 10 countries using cryptocurrency were all “non-Western” or “emerging” countries.

Figure 2: The 2022 Global Crypto Adoption Index (Source: Chainalysis)

NFTs For Creators & Brands to Monetise Audiences

Of all NFT use cases, this one has arguably generated the most traction to date. They use underlying crypto infrastructure such as layer-1 networks (e.g. Ethereum, Solana) to house these NFTs. We can break it up into two key use cases:

- Creators to monetise

- Brands to engage fans

NFTs provide better monetisation for creators

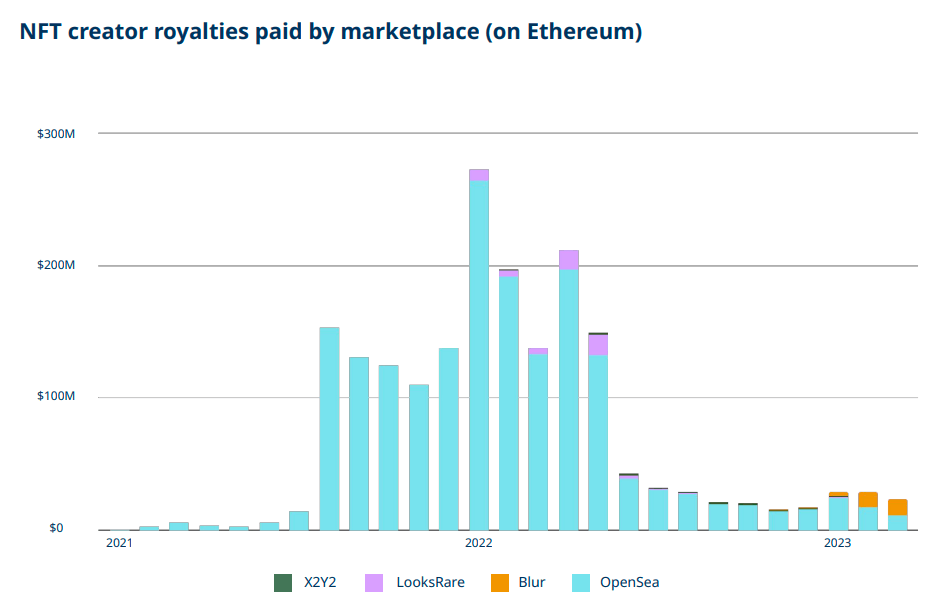

According to a16z, NFT creators have earned >$1.9B in royalty revenues. Although there have been issues with enforcing royalties, new token standards with inbuilt royalty enforcement are being developed.

Figure 3: NFT creator royalties paid by the marketplace on Ethereum (Source: a16Z State of Crypto 2023)

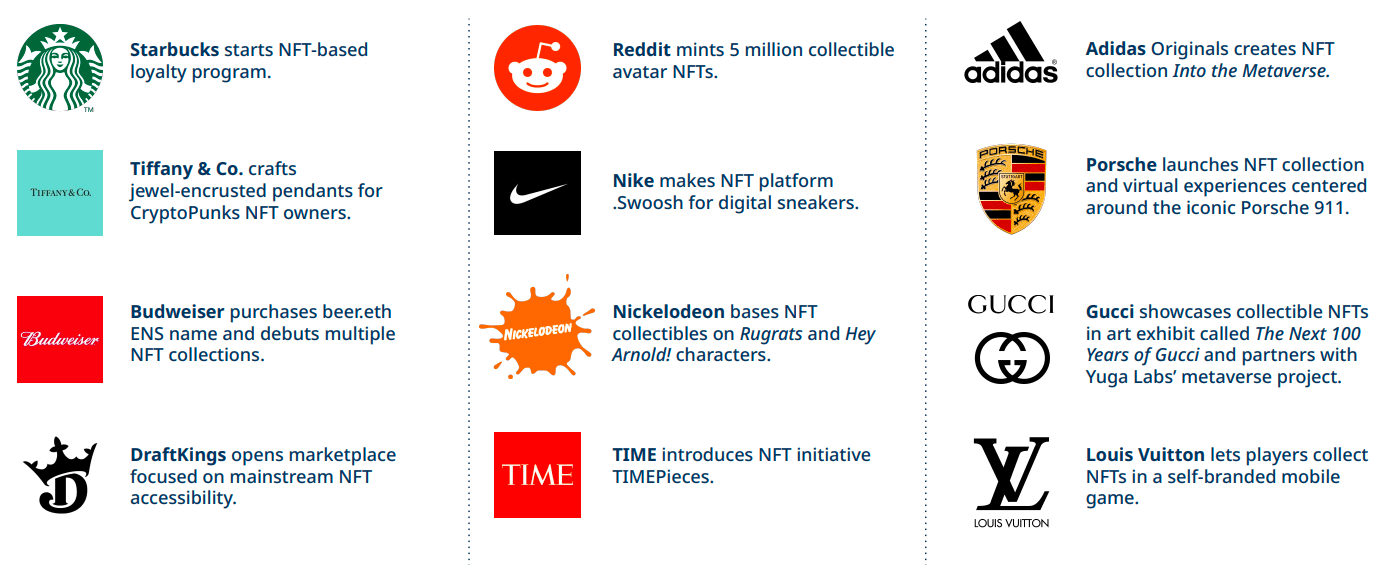

Brands using NFTs to engage and monetise audiences

Brands have become some of the biggest adopters of crypto-native tools and explore web3 via NFTs. Big names such as Reddit, Adidas, Nike and Starbucks have all tested and rolled out NFT initiatives to monetise their audiences, create loyalty and directly engage with their audiences or customers.

Figure 1: Brands exploring web3 (Source: a16Z State of Crypto 2023)

A prime example is Shopify, one of the world’s largest e-commerce platforms, embracing NFT-enabled token-gated access. This week, its CEO shared details of its blockchain team’s products in preparation “for the next crypto rebound.”

Honourable Mentions

There were many other examples I didn’t have the space to mention; these include:

| Use Case | Why Crypto? |

| Bitcoin as a Store of Value (SoV) | It offers unique properties making it useful for an SoV—it’s easy to move, liquid to sell, and supply cannot be easily manipulated. BTC can be seen as protection against the current financial system and currency devaluation, as it promotes a fairer system where the “rules of the game” cannot be changed. |

| Gaming | Traditionally gaming developers are looking closely into NFT and crypto-gated games. There are benefits from unique rarity, the ability for players to recoup costs and true asset ownership. |

| Tokenising carbon credits | Using token incentives and blockchains, it provides a transparent, liquid, and accessible market. |

| Crowdfunding | Although used negatively to raise many dubious “ICOs”, the ability to crowdfund social causes or common enterprises is powerful. Crypto crowdfunding was on display with crypto onchain sleuth ZachXBT raising $1M in a week to fight a defamation lawsuit. |

| Instant settlement | 24/7 transactional settlement with cryptocurrency instead of multiple-day settlement. Instant settlement could also be applied to stock trade settlement, eliminating hefty clearing fees. |

| Digital Identity | Provides individuals greater sovereignty over their data. |

| DeFi | An ability to borrow, swap, and lend without using a middleman—with smart contracts making markets and settling trades. One of the most widely used utility aspects in the crypto ecosystem. |

| Reduce merchant fees | Retailers are now passing on payment processing fees to the end consumer. For example, Aldi announced a 0.5% surcharge would apply to all credit card purchases. Visa isn’t alone, with payment processing fees typically ranging from 1–2%. This presents an opportunity for newer financial technology to lower the costs of transacting and paying for goods and services. |

Table 1: Further cryptocurrency use cases

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.