Key Takeaway

- The traditional four-year crypto cycle is breaking down, with institutional demand and macroeconomic factors playing a larger role in market movements.

- Major crypto-specific catalysts, including ETFs, have largely materialised.

- Macro factors like interest rates, fiscal policy and political cycles are now the dominant forces for Q4.

- With monetary easing likely ahead, history suggests conditions could favour crypto and other risk assets.

Where Are We In The Cycle?

The cryptocurrency market has long been guided by the four-year cycle, centred around Bitcoin’s halving events. Historically, this cycle followed a predictable path: a supply shock due to halving, a bull run, a peak, then a bear market and accumulation phase.

But that pattern is breaking down. The four-year cycle is becoming less relevant as macroeconomic conditions, institutional flows and regulatory changes increasingly shape market dynamics.

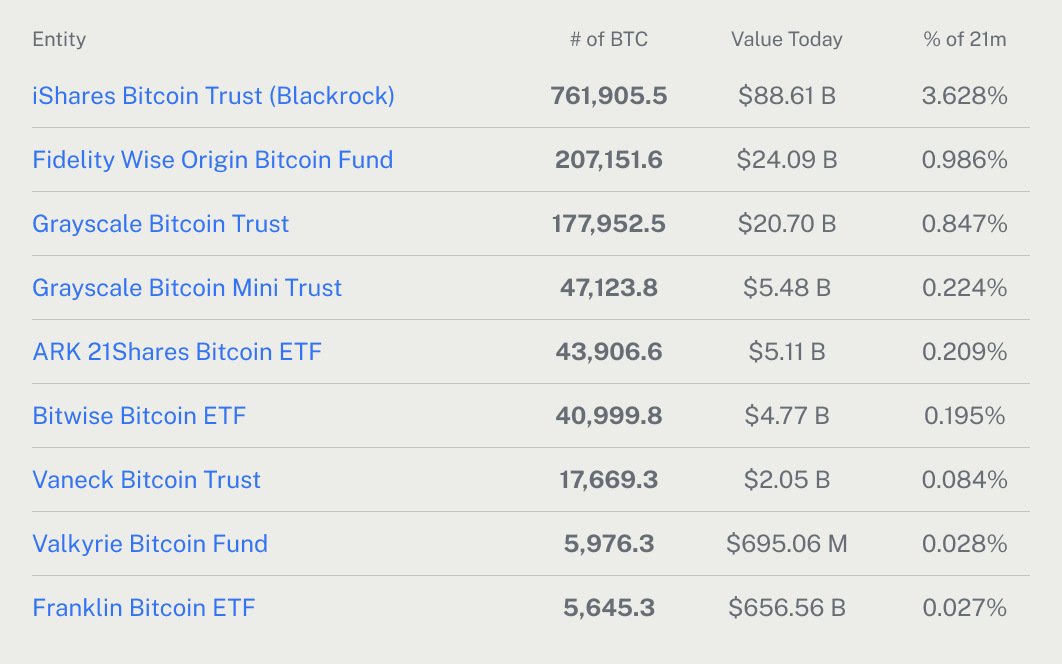

Several factors support this shift. Institutional investors are steadily acquiring crypto assets, especially Bitcoin, irrespective of halving schedules. ETFs and regulatory clarity have introduced new capital into the space well ahead of traditional cycles. Moreover, with around 95% of Bitcoin already mined, the impact of halving events on supply may be diminishing.

Many argue the four-year cycle effectively ended in 2022. That year saw a clear correlation between the stock market bear market and the crypto bear market. Both markets accumulated and corrected to the upside in 2023. This is further evidence that crypto has entered a more mainstream correlation with global macroeconomic conditions.

Today, the market appears to be guided more by macroeconomic policy than by crypto-native patterns.

The Market Catalysts

What’s been

Blockchains are now cheap and fast, a far cry from the scalability bottlenecks of 2021. With a broad range of options, from Ethereum Layer 2s to emerging Layer 1 chains, the market has access to low-cost, high-speed infrastructure. This once-critical pain point has been resolved, allowing developers and users to focus on building and adoption without congestion or prohibitive fees.

On top of this improved foundation, many of the major crypto-specific catalysts have already played out. Spot Bitcoin and Ethereum ETFs have launched, unlocking access for retail and institutional investors alike. Their approval marked a new era of regulatory maturity in key jurisdictions and reinforced crypto’s position as part of the mainstream financial system.

The U.S. Strategic Bitcoin Reserve is now in place, with the government committing to hold rather than sell its acquired Bitcoin. This move signals a significant shift in how the U.S. views digital assets, not just as speculative tools but as strategic reserves.

Institutional treasury companies are also firmly in the picture. Major players now hold meaningful positions in Bitcoin, Ethereum and Solana, reflecting a deeper integration of crypto assets into corporate financial strategy.

What’s to come

More ETFs have recently launched or are on the horizon. Solana (SOL), Dogecoin (DOGE), XRP (XRP) and Litecoin (LTC) are among the tokens speculated to be next in line for ETF approval. This would continue the trend of institutionalising crypto, making it easier for mainstream investors to gain exposure.

The treasury narrative is not completely behind us, with some companies considering expanding their holdings into XRP and other crypto assets. However, it remains to be seen how many more of these institutional treasury plays will materialise, and when the speculation begins to reach saturation. The question now is whether the treasury trade still has room to run, or if the market is nearing peak interest in this trend.

The clear implication is that crypto-specific catalysts are drying up. Most of the narratives and developments that the crypto industry once pointed to as bullish drivers have already played out. With fewer crypto-native events left on the horizon, attention is now shifting toward the global financial system as the primary source of forthcoming catalysts.

The U.S. Catalysts

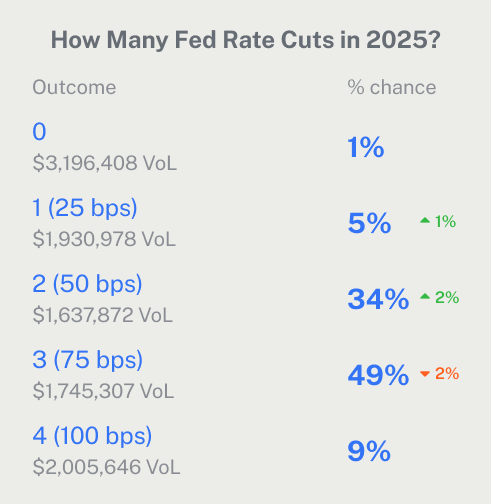

The U.S. Federal Reserve remains a key driver for markets. With the Fed now entering a rate-cutting cycle, liquidity is starting to return to the system. This shift typically acts as a bullish signal for crypto and other risk assets.

At the same time, U.S. fiscal policy under the current administration is expanding. President Trump’s ‘beautiful’ spending bill promises to increase government expenditure while maintaining tax cuts. The impact of this elevated fiscal spending will flow through to the U.S. economy over the coming months and years, likely assisting global liquidity conditions and risk assets such as crypto.

Meanwhile, campaigning for the 2026 midterm elections is currently getting underway. Historically, incumbent presidents tend to ramp up spending and introduce populist measures in an effort to hold power. These actions often result in short-term economic boosts that can positively affect asset prices, including crypto.

Is The End Near?

We are closer to the end of this cycle than the beginning. The recovery that began in 2023 marked a clear shift from the chaos of 2022. Developers returned, new ideas gained traction, and user activity began to rebound. That was the signal that the bear market had truly ended.

Since then, most of the key crypto-specific drivers have already materialised: ETFs, strategic reserves, friendlier regulation and institutional engagement. With few major surprises left in the crypto pipeline, attention has turned back to the broader financial system.

And right now, that system appears to be shifting towards monetary easing (i.e. rate cuts) and increased government spending. Historical patterns suggest these are the conditions in which crypto tends to perform well.

So while the cycle may not be over yet, the big moves may already be behind us. From here, it’s less about crypto events and more about macro trends. And at least for now, those trends look supportive.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.