Key Takeaways

- Crypto market hit hard by a number of significant industry news drops

- All eyes will be on the US Fed in the next few weeks as upcoming financial events could impact markets.

- Lido DAO (LDO) and other liquid staking protocols are worth watching in the lead up to Ethereum Shanghai upgrade

7-day market recap

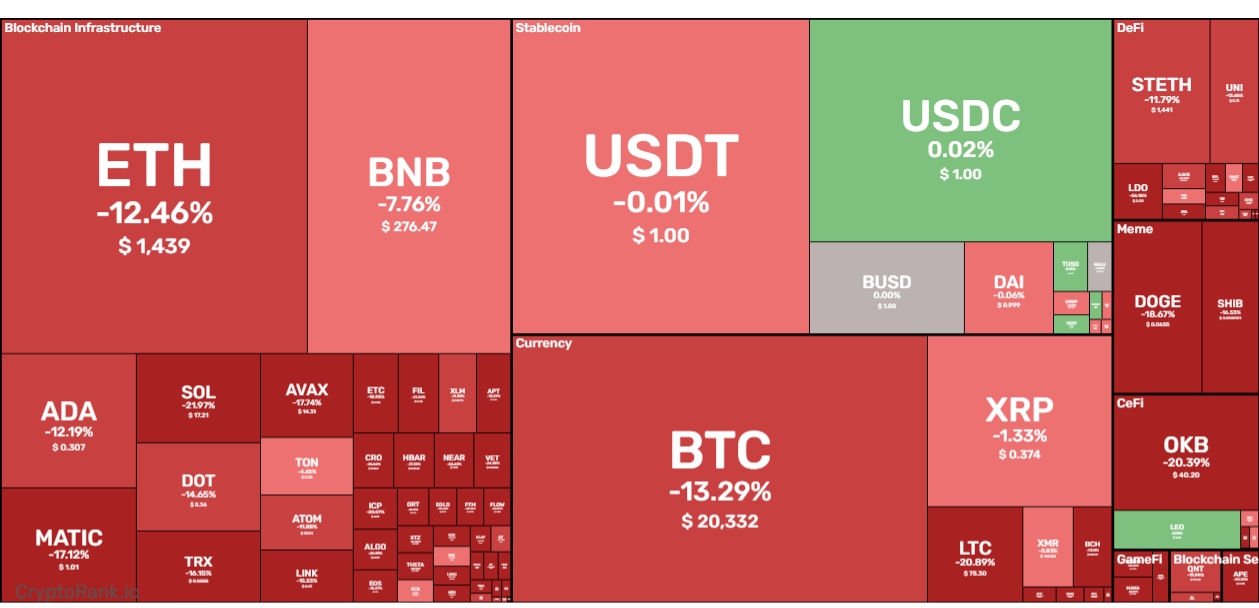

Figure 1: Performance of crypto asset last 7 days 10/03/2023 at 8:00am AEST. Crypto Ranking

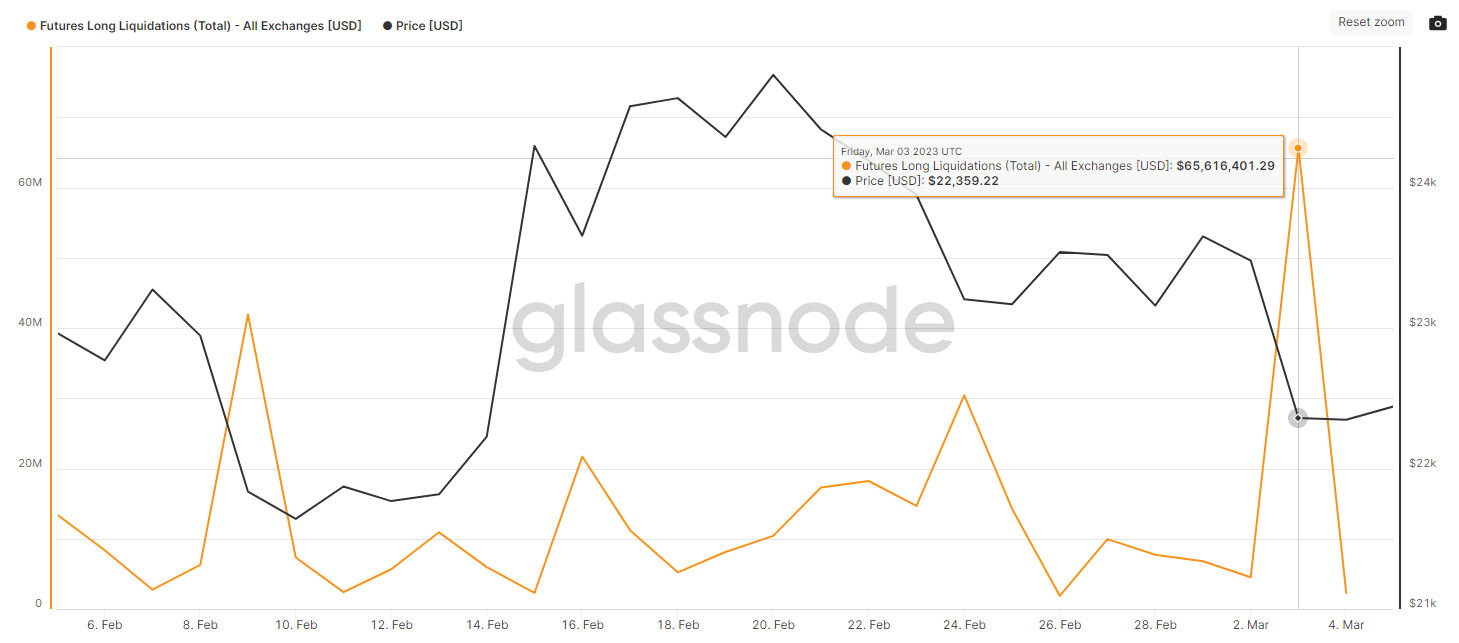

After a fairly uneventful few weeks, the markets took a swipe last Friday, creating one of the largest liquidations in recent times, with USD $65m worth of long positions liquidated. This all comes at timely point in the macro finance calendar, as major news drops begin.

Figure 2: Bitcoin liquidations. Source Glassnode

US Federal Reserve Chair Jerome Powell delivered his semi-annual testimony to the Senate Banking Committee in the middle of the week, reporting on the state of the US economy.

During the unscripted Q&A session, Powell commented that the latest economic data has been stronger than expected, suggesting that interest rates may be heading higher than previously anticipated. He also noted that if data supports a faster tightening, the Fed would be prepared to increase the pace of rate hikes.

Later in the week, Bitcoin saw a drop of -9.71% in price for the week, potentially influenced by news such as President Biden proposing a 30% tax on electricity used for mining Bitcoin and KuCoin being sued by the New York Attorney General for failing to register Ethereum as a security.

Market outlook

Upcoming economic events include the release of unemployment numbers, CPI, and the US Treasury FOMC interest rate meeting, which may affect market movements.

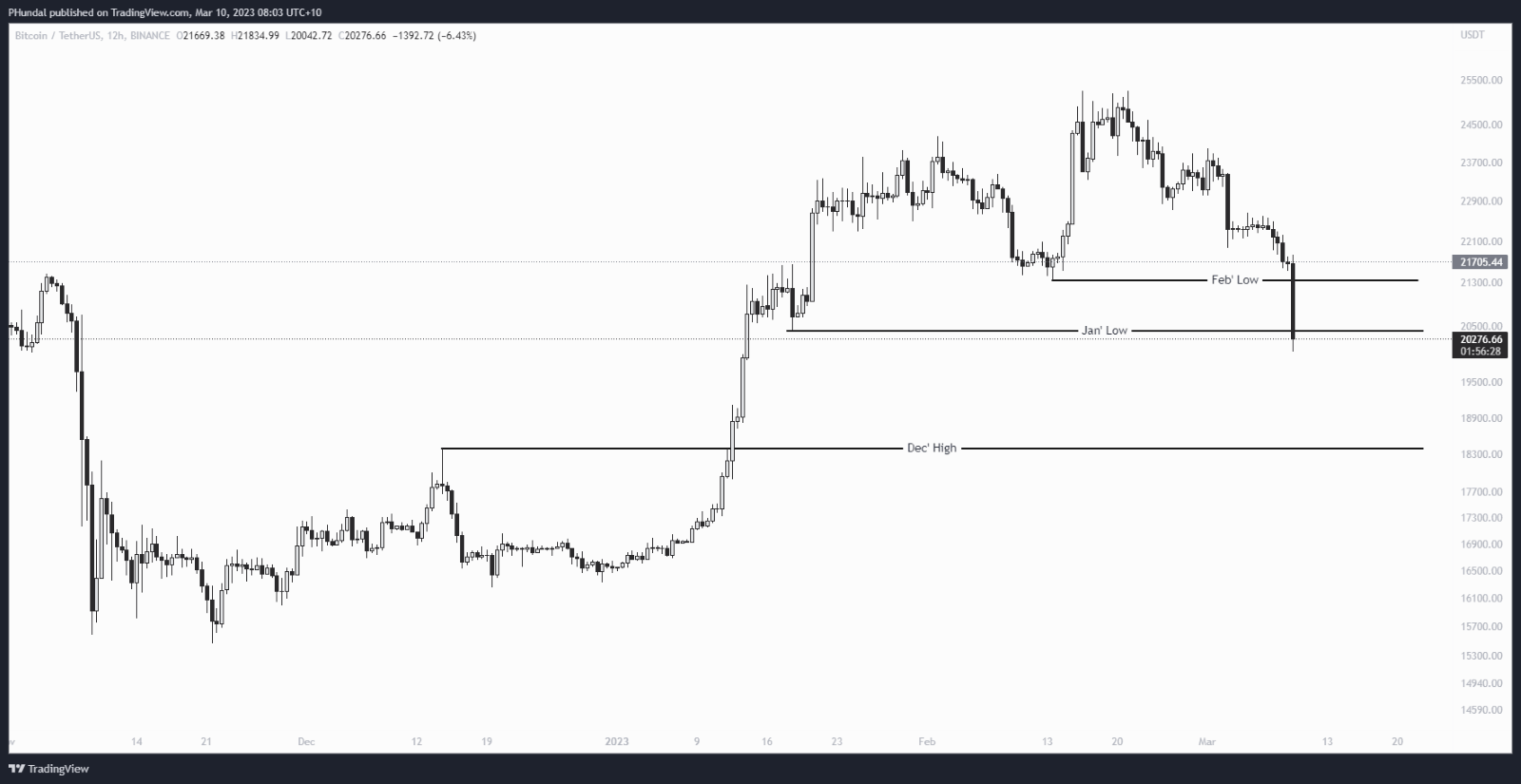

Let’s look at Bitcoin and map out some monthly price levels.

Figure 3: Bitcoin price levels. Source TradingView

There are potential scenarios for both bullish and bearish outcomes that could occur in the market, as always. Currently, the price has fallen below last month’s low and has reached the January 2023 low.

A bullish outcome could result in this level holding, with the price closing above the ~USD $20,500 range on the upcoming weekly close.

However, if the January low is lost, the next key monthly data point is the December high at USD $18,400. It’s important to note that there are possibilities for any outcome in between these scenarios as well.

Coin Watch – LidoDAO (LDO)

Adoption of Ethereum liquid staking has soared over the last 12 months and the amount of staked ETH continues to rise despite falling asset prices.

In order to stake Ethereum directly, you need a minimum of 32 ETH, which in today’s prices is just shy of $50,000 USD. For most investors this is not viable, so they turn to liquid staking protocols which allow users to stake any amount of Ethereum.

Lido DAO (LDO) is currently the biggest Ethereum liquid staking protocol with over 29% of all staked ETH. Lido gives users the ability to earn a yield by staking any amount of their ETH, without having to endure any of the lockup periods.

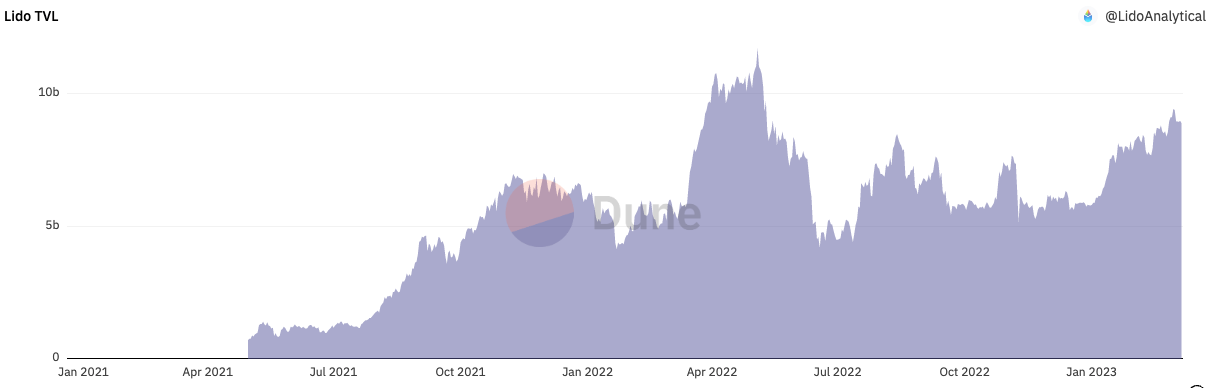

Total Value Locked (TVL) is a metric to represent the number of assets that are currently being staked in a protocol. Lido’s TVL has been steadily increasing over the last year and is now sitting above $8b.

Figure 4: Lido DAO Total Value Locked (TVL). Source Dune.

Ethereum Shanghai upgrade

Ethereum’s Shanghai upgrade, slated for April 2023, will enable Ethereum stakers to withdraw their assets for the first time since the Beacon chain launched. It is expected that staking could become more attractive once stakers can withdraw their assets whenever they like and liquid staking protocols like Lido may be in a position to benefit from this potential popularity, though it is still unknown as to how these protocols could be affected.

Upcoming release – Lido V2

Lido V2 is a proposal that will help to further decentralise the Lido protocol. In the past, Lido has been the target of criticism as a centralisation risk to Ethereum given the protocol controls 25-45% of all staked ETH.

The launch of V2 is expected to ease these concerns as it will allow a more diversified set validators to join Lido.

Lido alternatives

Rocket Pool (RPL), another leading liquid staking protocol based in Brisbane, currently accounts for about 2% of all staked ETH. Compared to Lido DAO, Rocket Pool currently prioritises decentralisation and offers higher staking returns.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.