Key Takeaways

- Crypto market cycles tend to repeat. This current one shares many similarities with previous cycles, with Bitcoin (BTC) trading sideways for extended periods even within bull markets.

- Despite the sideways price action, onchain metrics indicate growing Bitcoin network activity, suggesting that market sentiment could shift soon.

- Past market data suggests that August and September BTC’s least favourite times of the year. However, conditions tend to improve in Q4.

The State of the Crypto Market

Bitcoin’s journey through 2024 is reminiscent of its behaviour in previous cycles. The king of crypto is currently in a lull, with its price having bounced between $55,000 and $70,000 for nearly all of the past six months. However, if history is any guide, these low-volatility periods are often followed by significant upward movements.

Comparison to Previous Cycles

Every crypto bull and bear market has its phases, and the current phase for BTC is one of consolidation. Looking back to 2016 and 2020, BTC followed a similar pattern: a surge in the first half, followed by a summer slump, and then a strong rally towards year-end. The current stagnation is not unusual; rather, it’s a hallmark of BTC’s cyclical nature. These consolidation phases test investors’ patience but have historically led to renewed momentum, especially as the market anticipates favourable conditions in Q4.

What sets this cycle apart is the introduction of the spot Bitcoin ETFs in the U.S., which is expected to provide sustained long-term holding and buying pressure. Another significant difference is the heightened political focus on BTC and cryptocurrencies. For the first time, crypto is an election topic—admittedly, a very small topic, but still, it’s progress.

While BTC is down slightly since April’s halving, history suggests that the bulk of the bull market does not happen until later (Source: checkonchain).

Onchain Activity: A Silver Lining

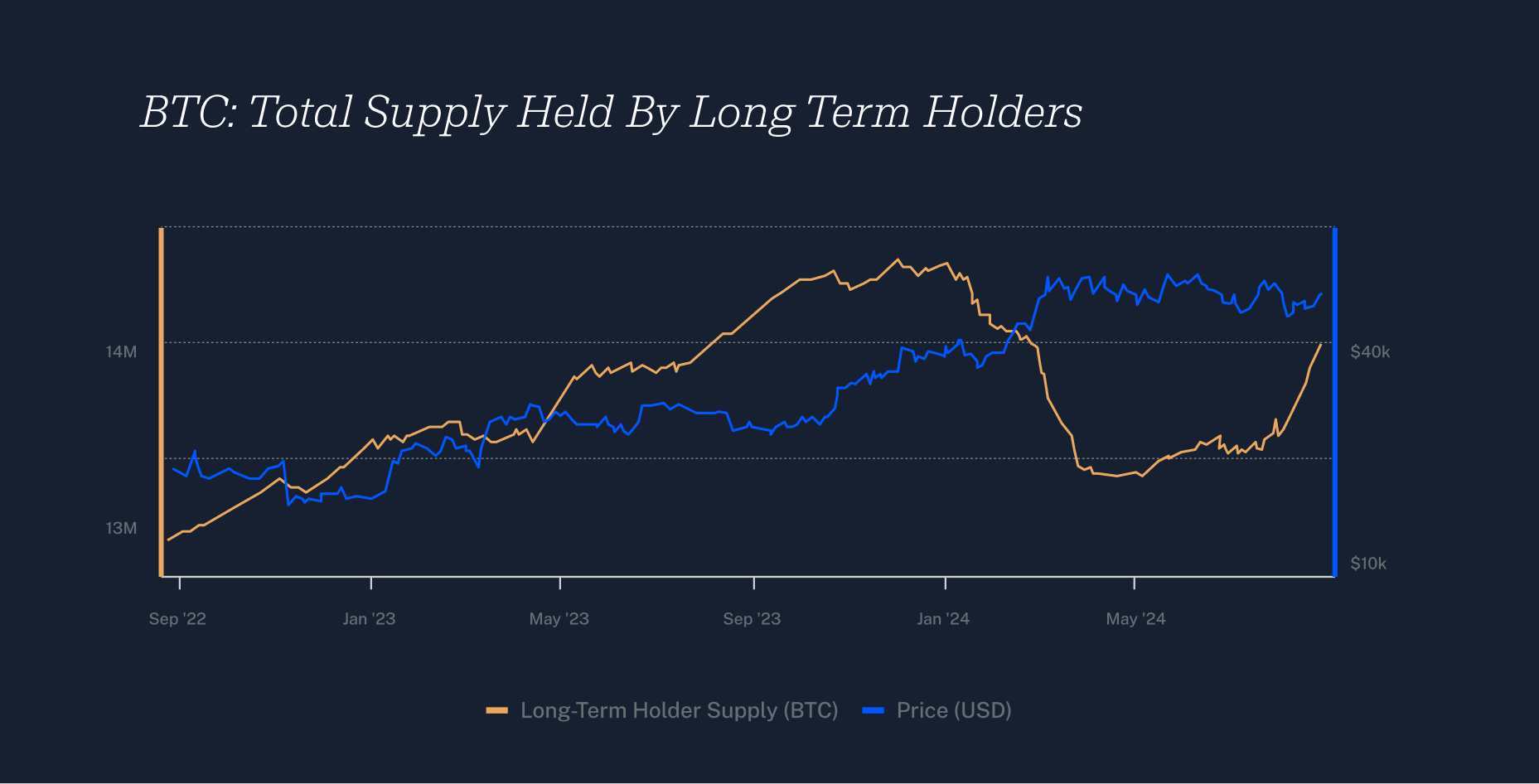

Despite the stagnant price action, BTC’s onchain metrics suggest that activity is brewing beneath the surface. Metrics such as transaction volumes, the number of active addresses, and the amount of BTC held by long-term holders (HODLers) have remained robust. This indicates that while speculative interest might have waned, the underlying network activity continues to build, setting the stage for a potential price breakout as market conditions improve.

Source (Glassnode)

Crypto Doesn’t Like This Time of the Year

We are in a seasonally terrible period for crypto. You can’t ignore the data.

BTC really doesn’t like August and September. Taking the median average of monthly returns since 2013, August (-7.8%) and September (-5.6%) are literally the worst and second-worst months for BTC, as per Coinglass. Using the mean average, August (+1.5%) is the third-worst and September (-4.8%) is the worst.

Bitcoin monthly performance 2013-2024 (Source: CoinGlass)

Macro Factors Falling In Place

It’s impossible to discuss the state of the crypto market without acknowledging the macroeconomic and political backdrop. Historically, BTC and other risk assets have been impacted by macro factors such as interest rates and global liquidity.

Over the coming months, the below factors will likely affect the trajectory of the crypto market.

- Starting in September, the U.S. central bank is expected to cut rates for the first time since 2020. As per CME FedWatch, there is a 44% chance that rates will be 100 basis points lower by year-end.

- Global liquidity—a term used to determine how much money is available in the global economy—has started to trend higher in recent months, according to multiple measurements.

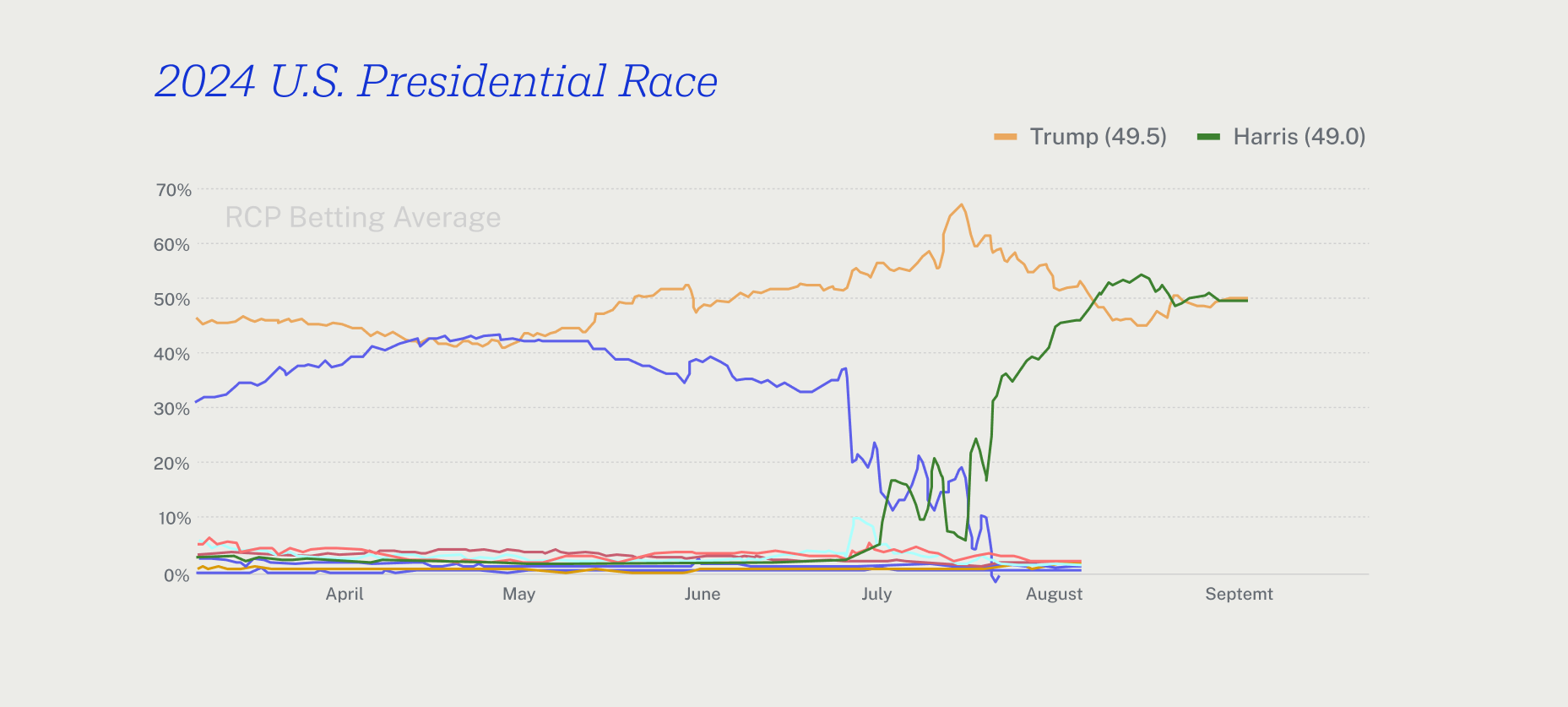

- The outcome of November’s U.S. election. A victory for Trump would likely be perceived as favourable for crypto, and vice versa if Harris wins.

The election race has tightened considerably in recent weeks (Source: RealClearPolitics).

When Will Altcoins Run?

Altcoins often mirror BTC’s performance but with greater volatility. In past cycles, altcoins have typically lagged behind BTC during its initial breakout phases, only to surge later as capital flows from BTC into higher-risk assets.

Historically, altcoins perform best near the end of a bull market (Source: Pantera)

Given the current market structure, it’s likely that altcoins will see significant gains once BTC establishes a clear uptrend, particularly as a historically strong period of the year draws closer. Historically, Q4 has been a strong period for the entire crypto market, with BTC often leading the charge and altcoins closely following.

What is different in this cycle is the sheer number of altcoins compared to previous cycles. In earlier cycles, BTC’s price lift would generally raise all altcoin prices. However, this cycle may be different, with not enough money to spread across the entire ecosystem, so only select altcoins may rally.

Conclusion

The current state of the crypto market may seem frustrating, especially with BTC stuck in a range and most altcoins struggling. However, these phases are a regular part of the market cycle. As Q4 approaches, the setup for BTC—and by extension, the broader crypto market—looks promising.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.