With all the fear and doubt that has been circulating through the crypto markets in recent weeks, there is now key news that could shake the industry again completely – but potentially for the better.

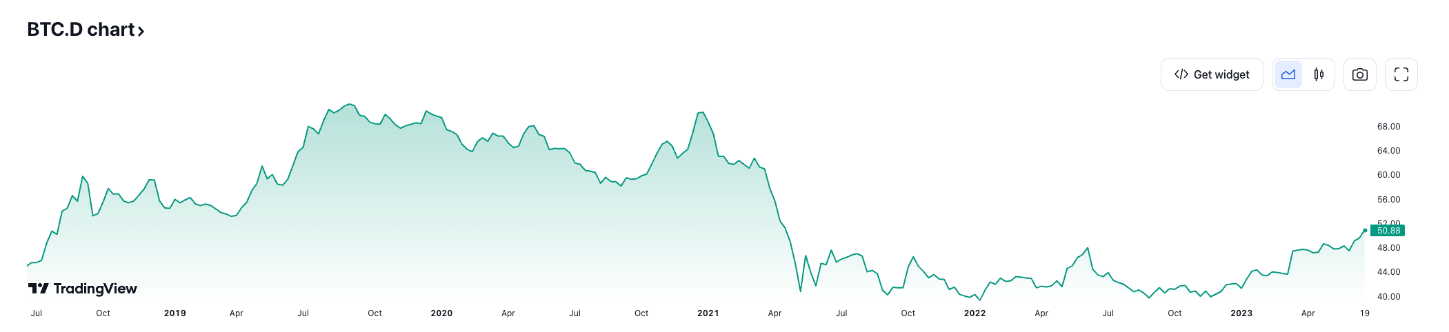

Figure 1: Bitcoin dominance chart.

We’ve seen a surge in the price of Bitcoin in recent time. Notably, Bitcoin’s market cap is outpacing the rest of crypto market.

This week, Bitcoin’s dominance (i.e. BTC’s percentage of the entire crypto market cap) broke 50% for the first time in 2 years. Blackrock’s recent ETF application could have played a major role in this.

Blackrock Bitcoin ETF

Blackrock is the largest investment manager in the world with over $9.5 trillion assets under management. Here in Australia, you may have seen their iShares ETF products.

Amongst all the chaos of the SEC filing lawsuits against exchanges and cryptocurrencies in the US, Blackrock has now officially filed for a spot Bitcoin ETF, with Coinbase as the custodian.

Blackrock has an almost perfect record of ETF applications with the SEC having approved 575 and only rejecting 1.

This is a landmark moment for the industry. To date, there has never been an approved spot ETF for Bitcoin. We are still yet to see if this is more than just a good news story. Confirmation of the ETF approval will be seen in the coming months.

For more details: BlackRock’s Proposed Bitcoin ETF & Why Investors Need To Know About It

Why a spot Bitcoin ETF matters

To provide context to this potential event, when the first ever Gold ETF Gold Bullion Securities ($GBS) was launched in March 2003, it opened the doors to new investors. Although it should be noted that Gold and Bitcoin are not comparable, a Bitcoin spot ETF could similarly open the doors to new previously deterred investors.

Figure 2: Price of Gold following release of first gold ETF.

Custody and counter-party risk still to date is a large limiting factor for investing in Bitcoin. Especially after the FTX incident. An ETF would break down these barriers. Allowing transparent and secure trading of a product representing the spot digital asset through a traditional avenue like the stock market.

EDX Markets – a new Tradfi-backed crypto exchange

A new player is entering the crypto exchange realm, but what sets them apart is their backing from prominent players in traditional finance. Fidelity Digital Assets, Charles Schwab, and Citadel Securities will soon leave their imprint on the crypto space.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.