What is Arbitrum (ARB)?

Arbitrum (ARB) is a layer 2 scaling solution (L2) that aims to enhance scalability and reduce transaction costs on the Ethereum network. It offers developers and users a high-throughput, low-cost solution for decentralised applications (dApps) and smart contracts. By leveraging Optimistic Rollups, Arbitrum achieves faster transaction confirmation times while maintaining the security and decentralisation of Ethereum.

Why We’re Watching

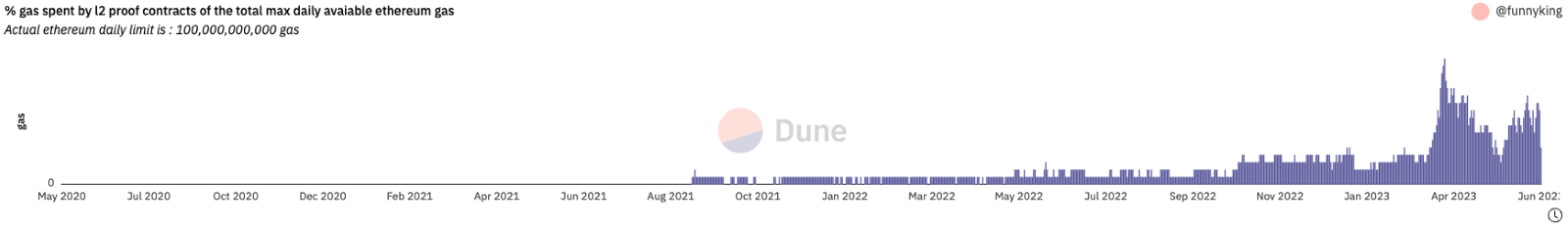

As a whole, layer 2 usage has been on the rise in the last 12 months. As shown by the chart below, the amount of Ethereum gas used by L2’s has seen significant increases since the start of 2023.

Figure 1: % gas spent by layer 2 proof contracts of the total max daily available Ethereum gas. Source Dune

As it stands, Arbitrum is currently leading the pack as the most widely used Ethereum layer 2 network.

The following numbers have been taken from L2beat, an Ethereum layer 2-focused analytics website and Dune, a blockchain analytics website.

- Total Value Locked (TVL) on Arbitrum reached an all-time high of $7 billion in mid April.

- Arbitrum accounts for ~65% of the TVL across all Layer 2 solutions.

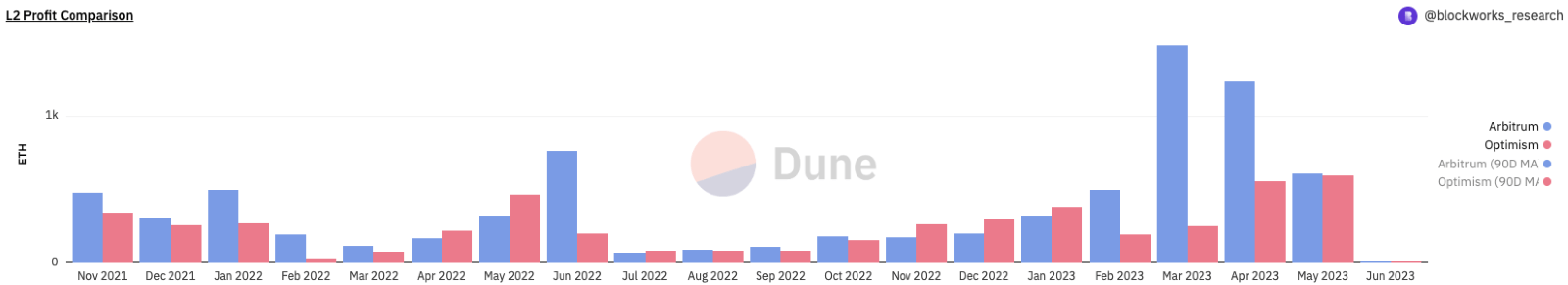

- Year to date, Arbitrum has generated more profit from transaction fees than any other Layer 2 solution.

- Arbitrum boasts the highest stablecoin supply among Layer 2 solutions, with 1.83 billion stablecoins. This surpasses prominent layer-one blockchains like Solana (1.54 billion) and Avalanche (1.42 billion), as reported by Artemis.

- Arbitrum has facilitated over ~26m transactions in the last 30 days, which is only just shy of Ethereum mainnet transactions at ~32m.

- ~137,000 active wallets today (on day of writing)

Arbitrum’s biggest competitor – Optimism (OP)

At the time of writing, Optimism (OP) is Arbitrum’s biggest competitor in the L2 space. They made headlines recently following Coinbase’s announcement to launch their own layer 2 scaling solution, that utilises Optimism’s tech stack.

Below, we’ve provided some activity statistics that can be used to compare against Arbitrium’s above:

- Accounts for 19% of all Layer 2 TVL

- Has facilitated ~8m transactions in the last 30 days

- ~51,000 active wallets today (on day of writing)

Figure 2: L2 profit comparison – Arbitrum vs Optimism. Source Dune

For context, the market cap of ARB at the time of writing is ~$2b, whereas the market cap of OP is ~$965m.

Questions marks surrounding layer 2 tokens

Despite the growing popularity and usage of layer 2 networks, some question marks remain around the use case of their native tokens and whether they accrue value. As these networks continue to mature, these use cases have become clearer.

It is obviously important to mention that as layer 1 networks seek to reduce their fees (such as Ethereum’s planned next update), this could mean that layer 2’s may not prosper into the future.

However, these layer 2’s can incentivise users through airdrops and loyalty rewards and can be used for fee payments – though most L2’s use ETH for fees.

These L2 tokens also attract developers by providing grants for ecosystem development. Governance is another crucial aspect, enabling decentralised decision-making over funds and chain upgrades through community and token holder voting.

Overall, L2 tokens serve as incentives, governance tools, and potential fee mechanisms in the evolving Layer 2 ecosystem.

The tweet below shows some of the tokenomics of ARB.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.