Key Takeaways

- Celestia is a modular Layer 1 that provides data availability and consensus for Layer 2s and appchains.

- It dramatically reduces data storage costs, enabling richer, high-frequency applications like Web3 games.

- Celestia is becoming a critical infrastructure for Ethereum’s scalability, though not dependent on it.

- Its biggest risk is that Ethereum may not need to scale — or could be overtaken by newer Layer 1s.

Introduction – What is Celestia

Celestia is a new type of blockchain built specifically for data availability (DA) and consensus, not for smart contract execution like Ethereum or Solana. Instead of doing everything itself, it acts as the data layer for other blockchains (like Layer 2s), helping them scale more efficiently.

In that way, Celestia is aiming to become a critical infrastructure for the blockchain ecosystem — similar to how Chainlink provides trusted off-chain data as an oracle. Most users don’t even realise Chainlink is working behind the scenes, but without it, many dapps would break.

Celestia takes a similar approach. It’s not designed to be flashy or user-facing. Instead, it focuses on powering the backend of Web3, ensuring that the data behind apps and Layer 2s is secure, decentralised and accessible, all without users ever needing to know it’s there.

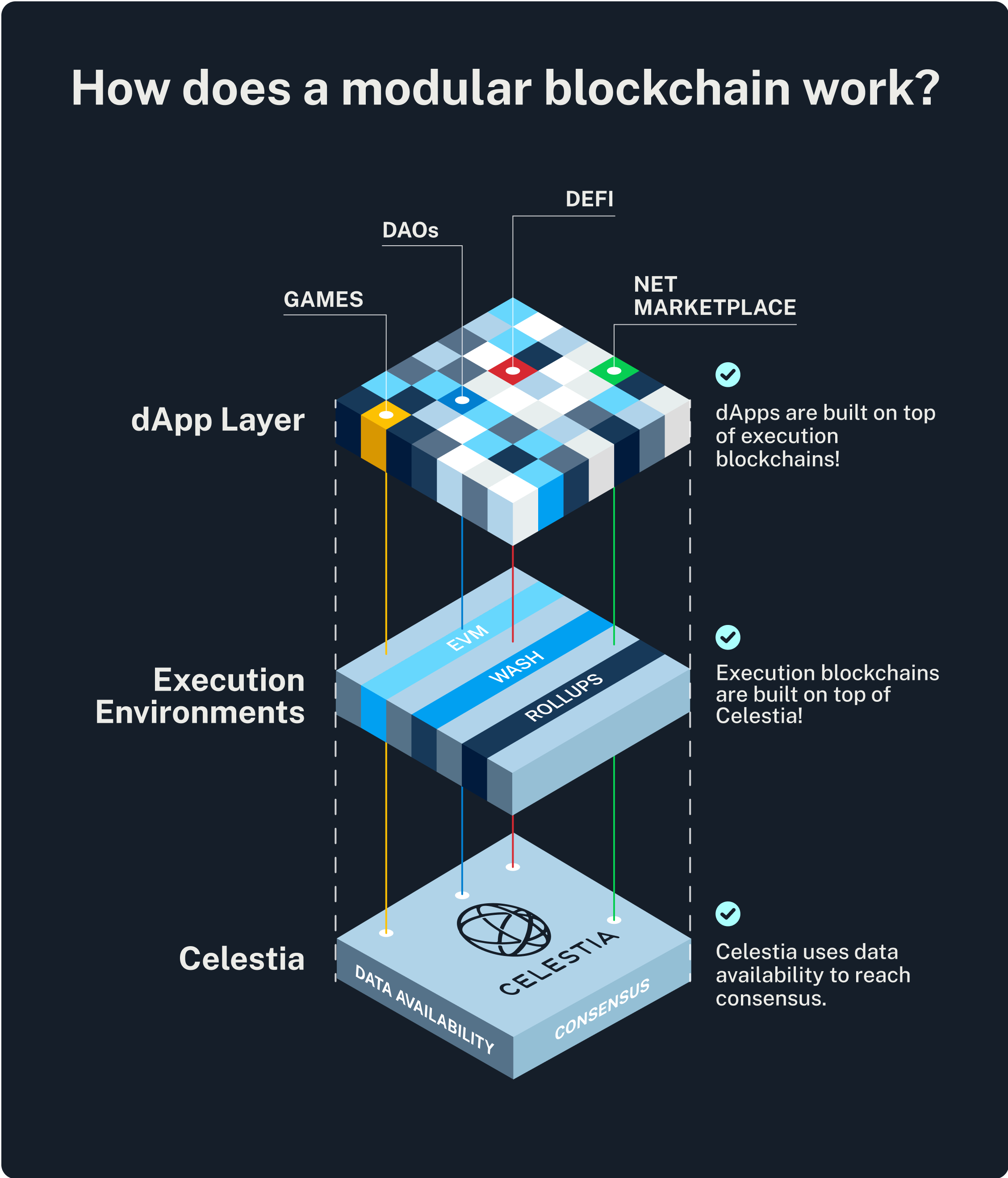

Developers use Celestia to store their chain’s transaction data in a decentralised and verifiable way. This approach is called modular blockchain architecture, and it’s quickly becoming a foundational design for scaling Web3.

Celestia is one of many parts of a modular blockchain ecosystem. Source

How It Works – Why an Arbitrum App Might Use It

Imagine you’re building a dapp on Arbitrum. Every time users interact, your Layer 2 generates a transaction history, and that data needs to be saved somewhere public so anyone can verify it.

Today, most Layer 2s post that data to Ethereum. It’s secure, but it’s also pricey.

Celestia offers a cheaper alternative. Instead of storing your receipts in a bank vault, you post them to a public, secure bulletin board — Celestia. It’s still decentralised and verifiable, just way more affordable.

Celestial X account reminding everyone that Celestia means scalability.

You also need to consider dapps are evolving far beyond simple applications like a token swap. This type of transaction might only generate a single piece of data. That’s manageable, even with higher fees.

But now, imagine a real-time game where every in-game action, move, or trade is a microtransaction. Data is constantly being created, and using Ethereum for that would quickly become unsustainable.

This is where Celestia shines. Making data available cheaper opens the door for developers to create richer, more interactive dapps – things like games, social networks, or real-time financial tools – without breaking the bank.

Why Would You Use Celestia?

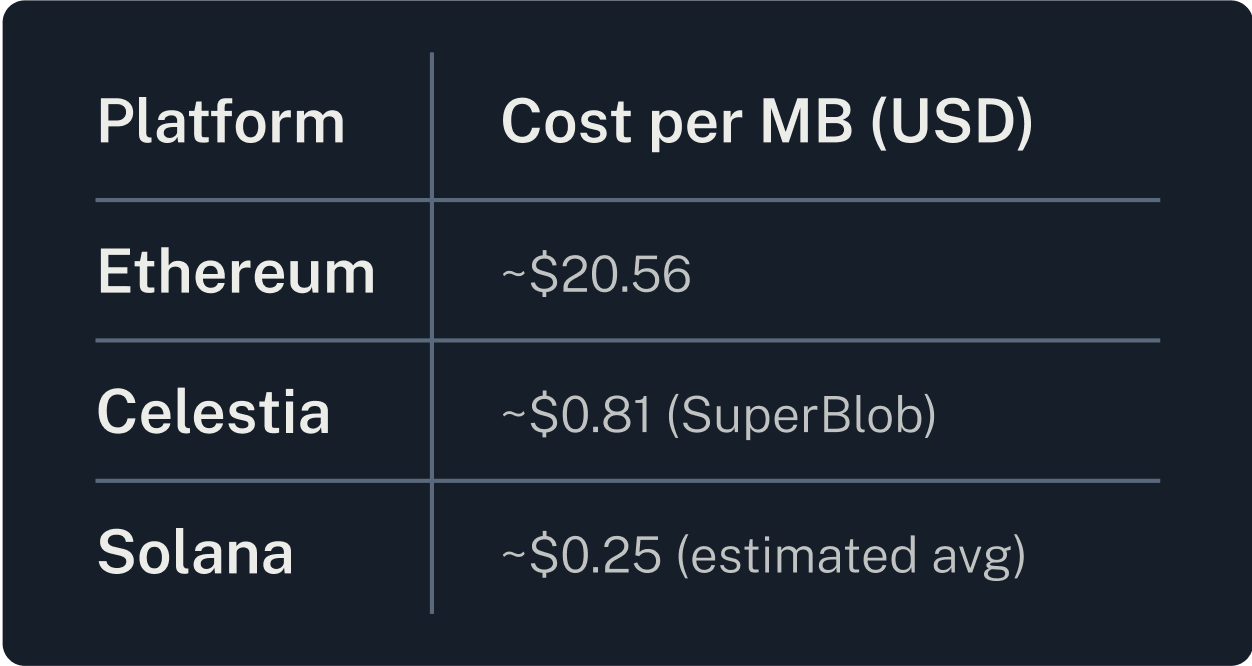

One of the biggest pain points for Layer 2s today is data costs. Here’s how Celestia compares against Ethereum and Solana:

A simple trade on a decentralised exchange (DEX) — like swapping ARB for ETH — uses only about 250 bytes of data. That’s just 0.00025 MB, which is negligible in cost. This is why occasional DeFi actions can absorb high gas fees without breaking a sweat.

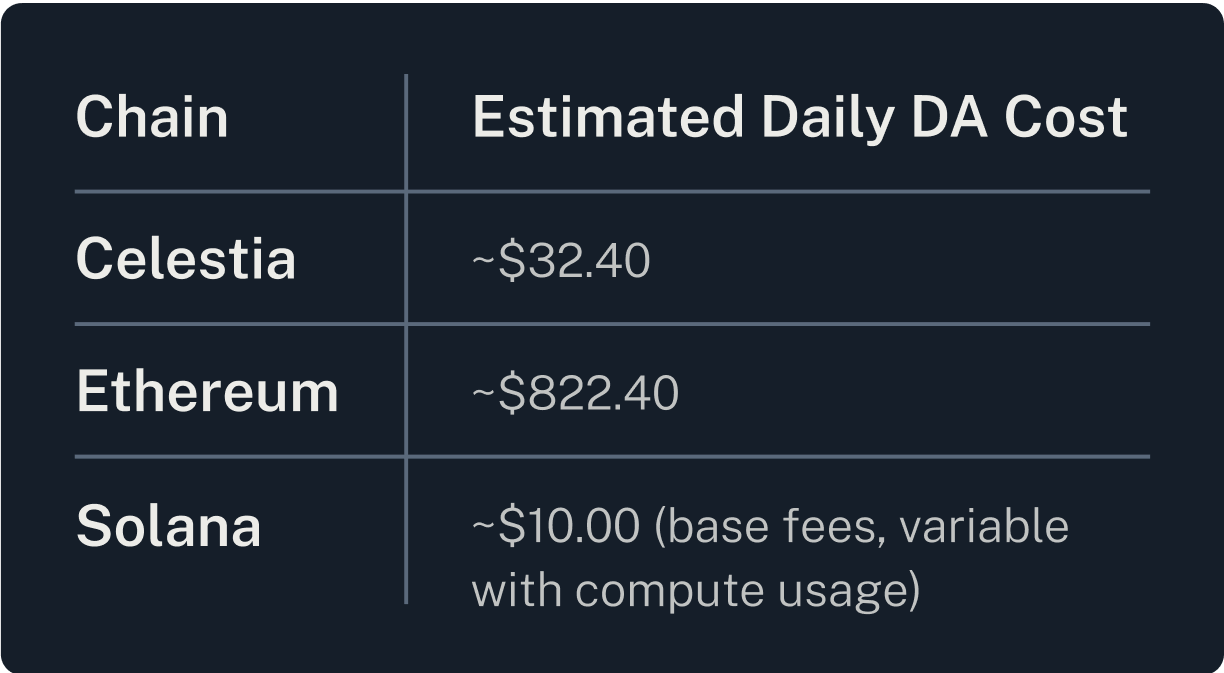

But now consider a more demanding use case — a microtransaction-heavy Web3 game:

Let’s say there are 1,000 players, and each one performs 100 actions per day. If each action produces about 400 bytes of data, it adds up to 40 MB of data per day.

Now, here’s what that would cost to store on each chain:

This level of activity becomes prohibitively expensive on Ethereum — but using Celestia reduces costs by over 95%, while offering more predictable economics than Solana.

These lower fees could even be absorbed by the project, enabling a “fee-free” experience for the user — a major advantage for user adoption and retention.

So Do We Still Need Ethereum?

Yes, but it depends on the setup.

Even if a Layer 2 uses Celestia to store its data, it might still send a final “summary” of what happened back to Ethereum. This is kind of like telling a trusted referee the final score of the game – so everyone knows it’s official and can’t be changed.

Ethereum is still seen as the most trusted chain, so posting those final results there helps make sure no one can cheat or rewrite history, even if the game was played somewhere else.

However, some Layer 2s skip Ethereum entirely. They use Celestia for both data and consensus and rely on their own built-in systems to check that everything is correct.

This typically means a less decentralised setup. This model is more flexible and can be significantly cheaper, but it also shifts trust away from Ethereum.

Why New Gen Blockchains Don’t Need It

High-performance L1s like Solana, Sui, Aptos, Sei, and Berachain are monolithic blockchains. They’re built to handle execution, consensus, and data availability all in one system.

That means they don’t need Celestia because they already scale natively without splitting roles. Their tech stacks are optimised for performance, with built-in DA, so there’s little incentive to offload that role to an external layer like Celestia.

However, monolithic blockchains come with limitations. As demand grows and usage increases, these chains can become congested as all apps are competing for the same blockspace. This can drive up fees and create performance bottlenecks.

These are bottlenecks that don’t exist yet but may in the future.

In contrast, Ethereum Layer 2s and modular appchains are built specifically to split these roles and that’s where Celestia becomes essential.

Conclusion

Celestia is fast becoming one of the most critical back-end solutions for scalable Web3 infrastructure. It doesn’t host smart contracts or tokens – instead, it focuses on one crucial task: storing blockchain data securely and cheaply.

For Layer 2s and appchains trying to escape the high cost of Ethereum, Celestia offers an alternative that doesn’t compromise on decentralisation or transparency. As the crypto ecosystem moves towards more modular systems, Celestia is well-positioned to be the backbone of blockchain data availability – particularly for builders who want to scale without limits.

Celestia is critical infrastructure for the Ethereum ecosystem (and potentially other L1s). However, its biggest risk is whether Ethereum will need to scale — or if it will be overrun by the new generation of Layer 1s.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.