Celestia just launched with a new take on what a blockchain is. Find out why everyone is talking about it, why it could meet a growing need in the crypto economy and why it should remain atop your watch list.

Key Takeaways

- Celestia is a new take on blockchains, known as a ‘modular approach’.

- It launched in an experimental capacity with 100 validators and limited features.

- Its value is proving data availability (publishing)—a growing issue for applications and blockchains.

- Celestia aims to be a critical low-cost infrastructure to help guarantee data assurances for blockchains or ‘rollups’ to operate.

- Despite the positives, questions remain in the short term about its large launch valuation.

Celestia’s Launch & Fundamentals

The long-awaited Celestia blockchain officially launched on mainnet in an experimental capacity. Rollups and other modular blockchains can now use Celestia as a data-availability layer.

This initial version of Celestia is far from feature-complete. Moving forward, the community will decide on which features and improvements to add to Celestia. In the launch announcement, the core team shared potential ways to improve Celestia.

Celestia Explained: A New Type of Blockchain

Celestia is a blockchain but designed differently. It takes a modular approach to build a scalable data availability layer to service data-hungry blockchains.

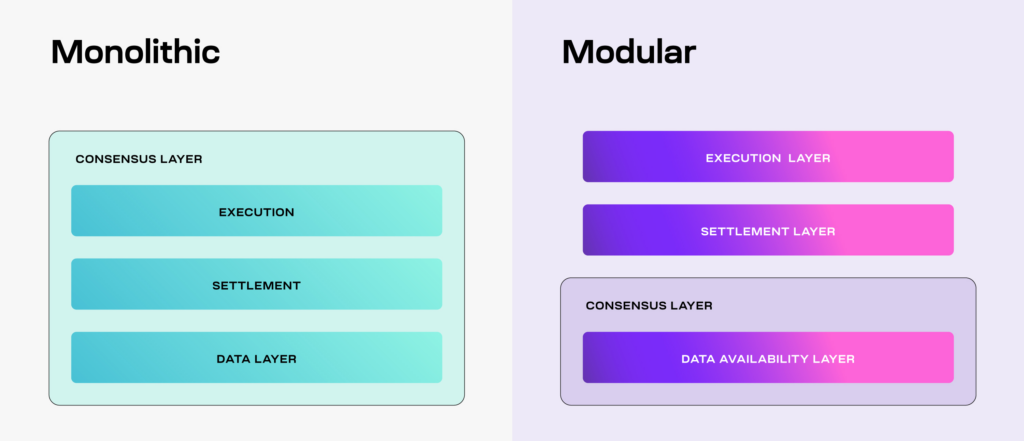

Rather than having one blockchain do everything or perform all roles (called ‘monolithic’, such as Solana), Celestia offers a different solution by splitting up core functions (called ‘modular’).

Instead of handling all the duties of a blockchain, such as Solana’s approach, Celestia only handles a select few, outsourcing the rest.

- Example: Ethereum outsources most of its user activity to ‘L2s’ so users can have faster transactions and cheaper fees.

Monolithic vs. modular blockchains (Source: Celestia docs)

What does it provide?

Celestia provides data availability (DA) as a service to other blockchains or apps. You can also think of this data publishing.

Its job is to ensure the data is (or was) there and verify that data (the transaction details) have been published to the world.

To do this job, Celestia uses something called ‘data availability sampling (DAS)’ to ensure data is available without doing a bunch of extra work. Simply, it takes a sample of some data to know that the rest is valid. It’s like taking a small piece of pie and being able to reconstruct the pie’s size and the ingredients in it.

Celestia: Solving The Growing Need For Data Availability

The need for data availability is fast-growing.

As blockchains grow, so too does its data history. Over time, it gets more expensive to verify and hold this data. Celestia ensures that anyone can inspect and verify a blockchain’s data.

The growing problem = new networks called ‘rollups’ must house vast amounts of data.

Demand is growing fast for the service that Celestia offers—that is, the provision of cheap and accessible data-publishing guarantees.

The biggest potential users of Celestia’s data availability network are Ethereum L2s and rollups. These scaling solutions have exploded in usage, with a trend to outsource activity to these other layers. Making it an opportune time for Celestia to capitalise on this fast-growing and essential need for data-publishing guarantees.

Likewise, any blockchain looking to use a “modular” approach and outsource data availability are potential users.

Going deeper: Why Ethereum’s next upgrade likely won’t threaten Celestia

Celestia’s Ecosystem Is Growing

Celestia has already developed a vibrant ecosystem, with developers and projects choosing to build with its technology.

For example, multiple projects, such as OP Stack or Arbitrum Orbit, have supported Celestia, while a handful of projects, such as Eclipse, have committed to using Celestia for data availability.

Celestia ecosystem as of Jul. 20, 2023 (Source: Celestia.org)

History & Team

Celestia remains one to watch due to the team’s history.

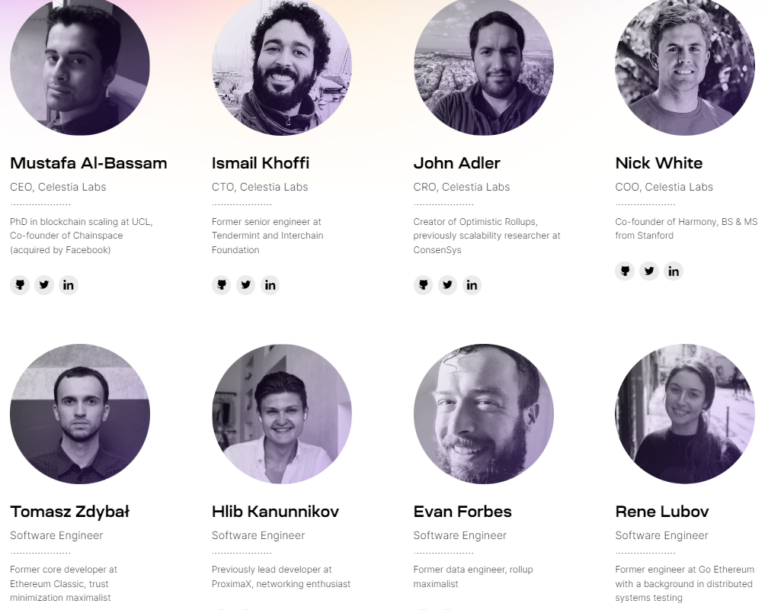

Celestia isn’t new and has been developing since the idea was put forth in 2019. The first iteration of what is now Celestia appeared in an academic paper in 2019 by Mustafa Al-Bassam. John Adler (creator of Optimistic Rollups) and Ismail Khoffi partnered as co-founders with Al-Bassam.

Celestia Labs (formerly LazyLedger Labs) is building out Celestia. It raised a $1.5M seed round in Mar. 2021, followed by a joint Series A and B round worth $55M in October 2022.

Celestia boasts a strong team and advisors from established backgrounds in web2 companies or web3 native blockchains from Tendermint, Interchain Foundation, Cosmos and Harmony.

Eight members of the team at Celestia Labs (Source: Celestia.org)

TIA Tokenomics

Details about the TIA token were announced earlier this month. I briefly share my pros and cons below. For a more in-depth analysis of TIA, click below to visit our new TIA asset page.

What?

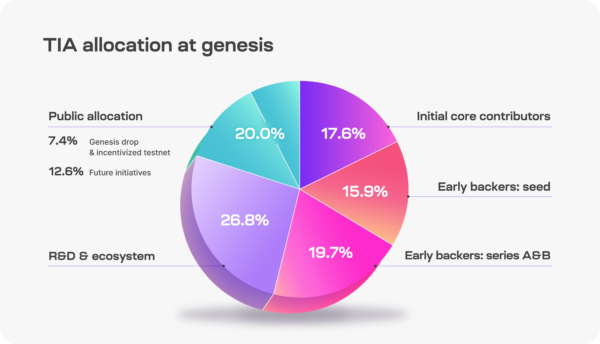

- Total supply: 1 billion TIA.

- Inflation schedule: 8% in the first year, decreasing 10% per year until reaching an inflation floor of 1.5% per year.

The good: TIA has real utility and productive power.

- With Celestia being a PoS blockchain, TIA is essential to delegating stake and maintaining security.

- TIA has governance power to help decentralisation and impact real decisions, such as network parameters or what to do with the community pool.

- TIA is used to pay for transaction fees.

- TIA can be used to bootstrap other Cosmos-based chains.

The bad: TIA launched with a massive ~$2.4B fully diluted validation (FDV), with only 14% of tokens released into the market. Likewise, over 50% of the token went towards early investors and contributors.

As per market intelligence firm Messari, to justify the valuation, Celestia will need to capture 2x the rollup adoption of Ethereum.

One has to question whether this high value at launch is very high in the short term, given Celestia has yet to capture many projects using its services.

Competitors

Celestia is not the only one to have recognised the fast-growing market need for data availability. Its closest competitors are EigenDA and Avail, which have yet to launch.

EigenDA is a data-availability network targeted at L2 networks on Ethereum. It is being built by EigenLabs—the team behind the restaking protocol, EigenLayer—and is expected to launch on testnet by year-end.

Avail is another data-availability network that has been developing for a long time. The project spun out of Polygon Labs earlier this year and launched on testnet in June. Details about an incentivised testnet should be shared this month, according to an Oct. 3 blog post.

Celestia has a first-mover advantage. Its mainnet has launched, while EigenDA is yet to launch a testnet, and Avail remains in the very early stages of its testnet.

Ethereum also has plans to launch its own Celestia-style DA solution in the coming years (referred to as Danksharding), although this remains multiple years away.

Risks

Celestia’s main risks and challenges are threefold.

- Hefty valuation at launch: As explained, Celestia will need to capture a significant market share to justify its high launch FDV.

- Failing to guarantee correct data publishing: If this happens, confidence will reduce, and the project will likely fail.

- Long-term viability: If Ethereum successfully ships its own Celestia-style DA solution in the coming years, it’s unclear where Celestia fits in and whether other blockchains will recreate their own DA layer. If this happens, it will represent an existential threat to Celestia.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.