Despite the recent uptick in token prices, many crypto-assets remain with billion-dollar market caps but little to no adoption. I dive into why Cardano (ADA) remains relatively overvalued and explore various competing blockchains with high market caps relative to fundamentals.

Key Takeaways

- Cardano continues to lack meaningful adoption as metrics such as dApp usage, stablecoin supply and TVL remain far behind major L1 competitors. At a $14B market cap, it’s a tough pill to swallow.

- Honourable mentions to other competing blockchains such as XRP, Aptos (APT), Vechain (VET), Tezos (XTZ), Bitcoin Cash (BCH) and EOS (EOS).

Although the team will continue to cover undervalued cryptocurrencies throughout 2023, it’s just as important to occasionally highlight the ones who may not make it or are still highly valued despite a lack of fundamentals.

As more blockchains come to market, it’s beginning to become crowded as these chains fight for users. I’ll focus on the blockchains versus overvalued crypto applications, as many older blockchains could struggle to compete, especially as Ethereum and Ethereum-like networks look to capture back lost market share and the broader ecosystem scales.

Cardano (ADA)

Cardano launched in 2017 and has attracted significant controversy. The main issue for Cardano is it took nearly 5 years to get smart contracts onto the platform. Despite the milestone, they are yet to develop any significant transaction volume or dApp usage.

But yet, ADA remains the 8th largest cryptocurrency by market capitalisation (market cap), of nearly ~$14B. For context, this is the same market cap as companies like Snapchat, which have millions of daily users and revenue.

Trading volumes are much higher than on-chain transactions

ADA has a 24 trading volume of around $300M-$650M, but I suspect most of this is speculation from retail users rather than any meaningful use of the blockchain itself. We can see this in the transaction count, volume, and on-chain metrics, pointing to relatively little activity (explained below).

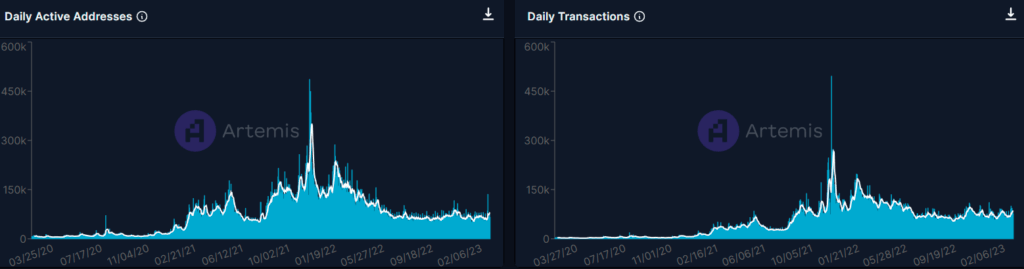

Low Transaction Count & Daily Active Users

There only remain~70K daily transactions and daily active addresses on-chain. Because transaction count can be easily faked (via fake volumes), it’s alarming such little uptake of the blockchain is happening while still accumulating a token market cap of over $14B.

Figure 1: ADA transaction count and daily active users. Source Artemis

Contract Transactions

Months after smart contracts were enabled in 2021, Cardano recorded 7,183 transactions involving a smart contract. Some 15 months later, this figure stands at ~8M.

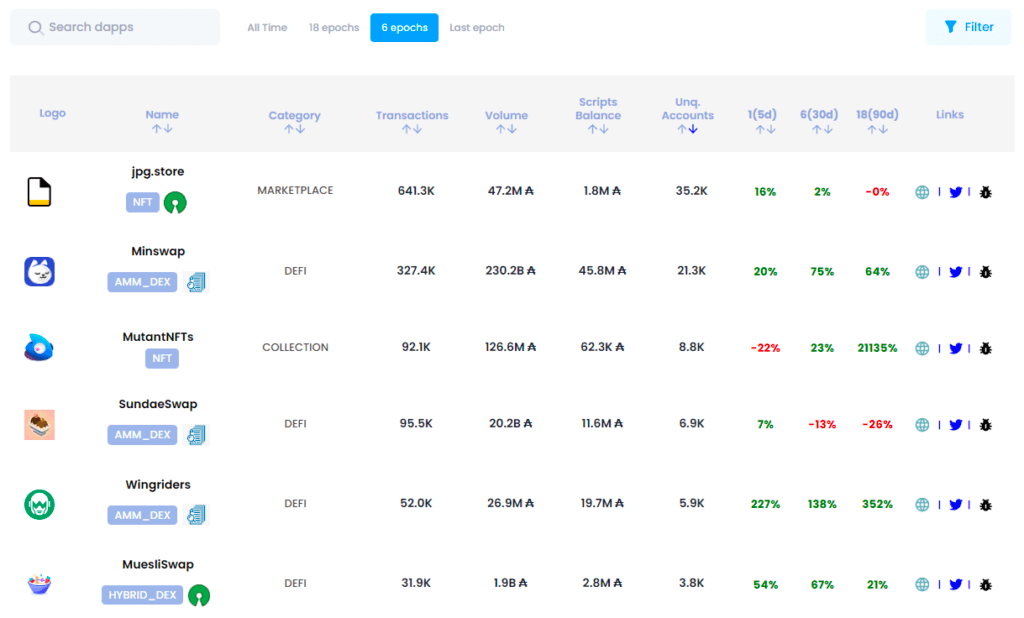

Because of the complexity of different metrics across blockchains, it’s challenging to compare contract transactions—thus the issue of making apples-to-oranges comparisons. A good gauge to signal chain and smart contract usage is unique accounts interacting with dApps.

In the last ~30 days, only 2 dApps recorded more than 10,000 unique users, pointing to a small subset of unique users of Cardano applications. *one epoch happens every ~5 days

Figure 2: Dapps on Cardano. Source DappsonCardano

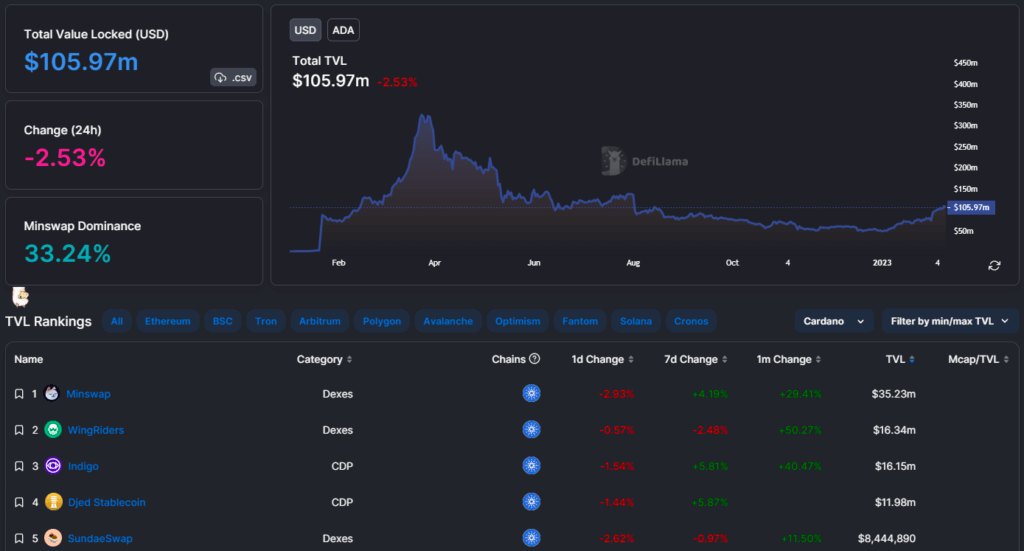

TVL

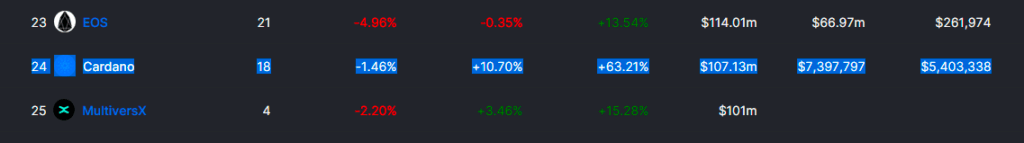

In DeFi land, it doesn’t get any better, with ~$100M of value locked in Cardano DeFi applications (this was only ~$50-$75M for most of 2022). Despite the 50% uptick (contributed due to its new stablecoin), it remains behind other leading blockchains—coming in at #24.

Figure 3: TVL all chains. Source DeFillama

Figure 4: Cardano TVL. Source DeFillama

Stablecoins on the network

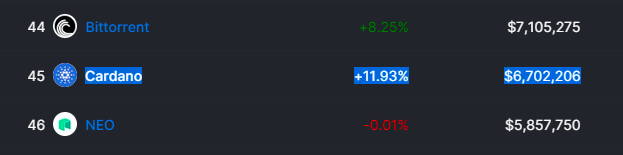

Stablecoins are a great indicator of adoption. A vibrant ecosystem should have demand for stablecoins, as users actively trade in and out of cryptocurrencies or save in stables. Of the $136B of stablecoin market cap, only $6.7M lives on Cardano or ~0.04%—ranking it #45.

Cardano plans to launch an algorithmic stablecoin called Djed. All previous algorithmic stablecoins have failed, so I’m quite cautious about this new stablecoin.

Figure 5: Stablecoins By Chains. Source DeFilama

Is anyone building on Cardano?

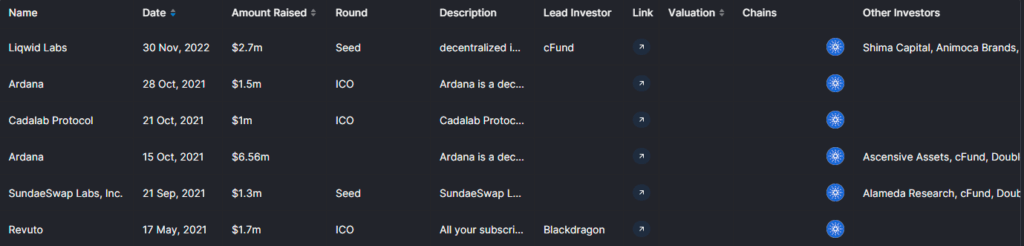

There were billions raised throughout 2021. Looking back, there were only a few seed raises from firms building on Cardano.

From 2021 to date, according to DeFilamma’s raises database, only 6 projects raised funds to deploy on Cardano, with 50% being ICOs. The total amount raised was ~$14M.

Figure 6: Raises. Source DeFillama

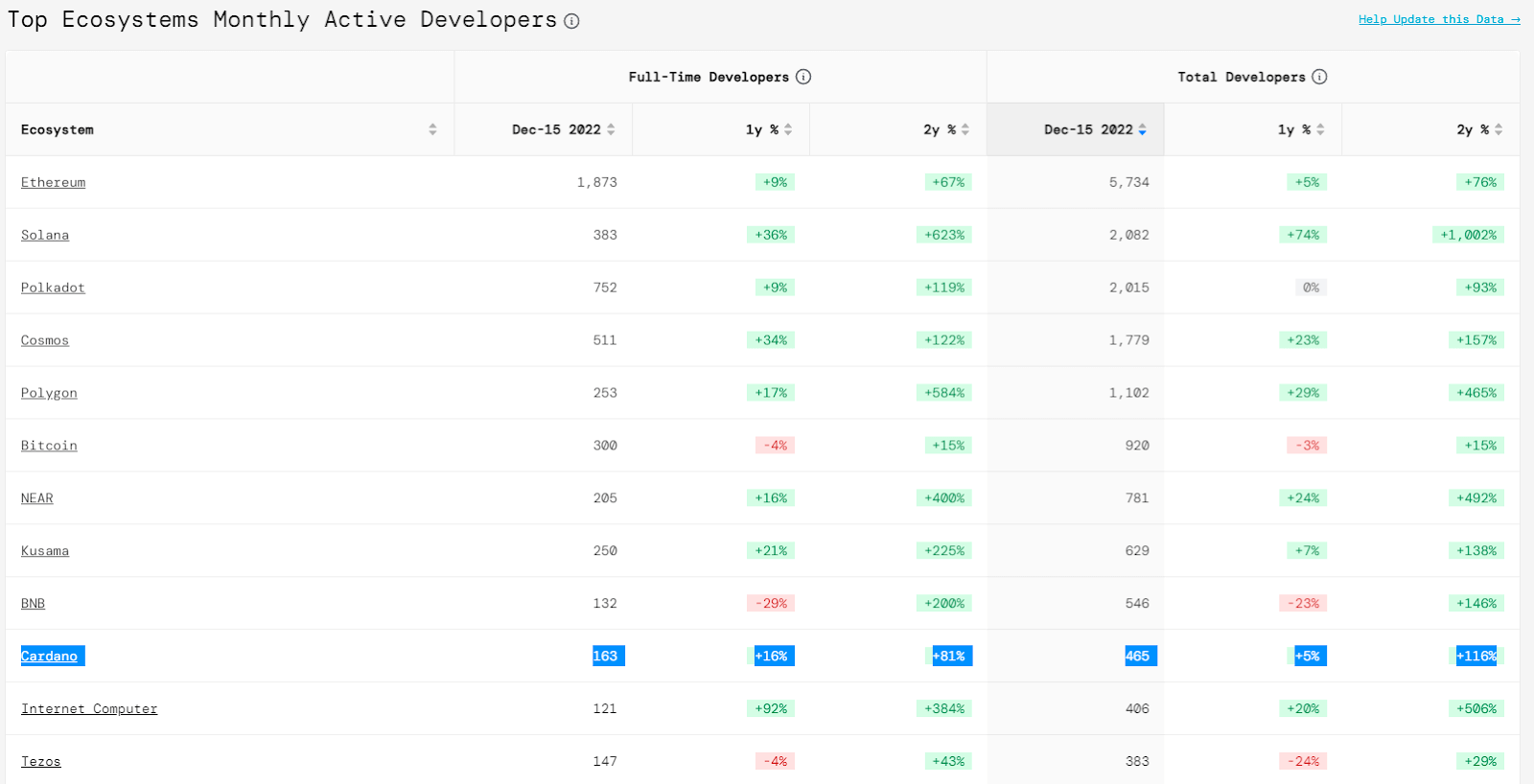

Total developers also lag behind other major protocols, Ethereum, Cosmos, Solana, Bitcoin, Polygon, Kusama, Near and BNB Chain.

Figure 7: 2022 Electric Capital Developer Report. Source Developer Report

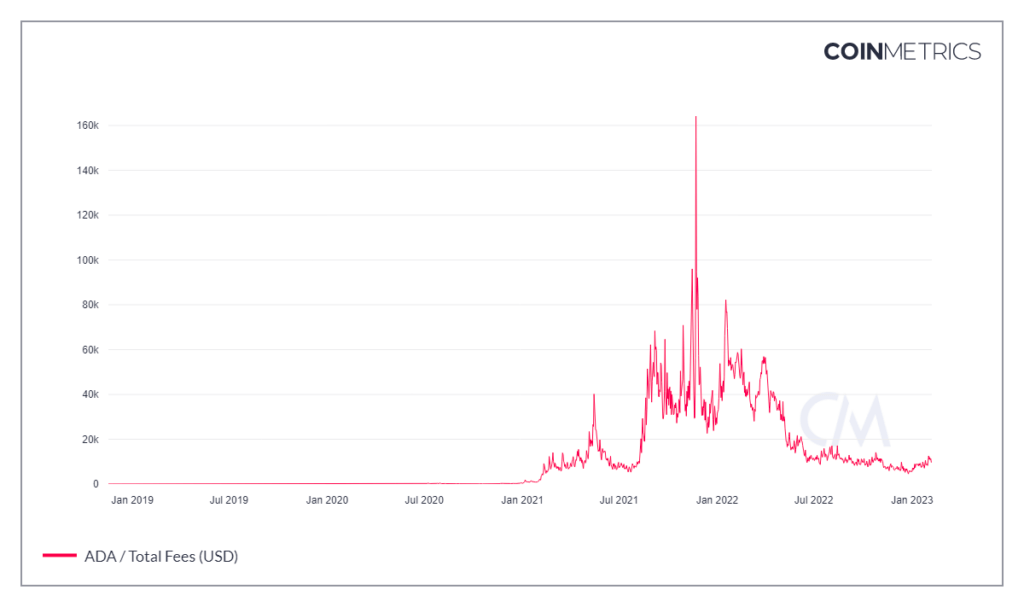

Is anyone paying to use Cardano?

Yes, but very small. Cardano is earning ~8–10K a day in fees. This is much lower than networks like Ethereum, BNB Chain, Solana, Optimism, Avalanche or Arbitrum. But more than Ethereum Classic ($89), Stellar ($235), EOS ($359), Ripple ($455) and Near ($1,445).

For a cryptocurrency with a $14B market cap, fees generated of sub-$10K indicates little interest in paying to use the network to secure data, send transactions or deploy apps.

In summary

Although a limited number of people are building and using Cardano, total usage is minimal. There’s:

- High exchange volumes but low network total transactions.

- Low unique accounts using dApps.

- Minimal fees generated.

- Low TVL and minimal stablecoin supply.

- Little investment and struggling developer attention.

Although Cardano plans to increase capacity through its scalability upgrade “Hyda” sometime in 2023 or 2024, it could remain moot, as there’s no point in building a bigger railway if there are no users to ride it.

All signs point to an overvalued blockchain with little users, a clear purpose or any key reason it should be in the top 10, with a token market cap of $14B.

Honourable Mentions

Looking at alternative layer-1 blockchains (rather than apps), I see many still commending high market caps in an increasingly competitive market. Six that remain in the top 50 I remain sceptical of include:

XRP (XRP) | Market Cap $20B: XRP has not left the top 10 market cap since 2014. Much hinges on its upcoming SEC case verdict—a win could move it higher, a loss send it lower, or a settlement could be neutral. Unlike others on this list, Ripple’s Ripplenet and XRP Ledger (XRPL) have actual users, businesses and adoption. It aims to provide products in 3 key areas: (i) lowering remittance costs for cross-border payments, (ii) providing CBDC (central-bank digital currency) solutions, and (iii) providing cryptocurrency liquidity.

Although XRP remains moderately overvalued, in my opinion, due to several factors:

- Intense competition from existing payment networks, banks and other centralised networks.

- Investment in XRP does not equal investment in Ripple.

- Unclear long-term value in CBDCs for XRP.

- XRP is not needed for all Ripple products.

- Unclear the actual value of a quasi-payment network that is not decentralised but distributed.

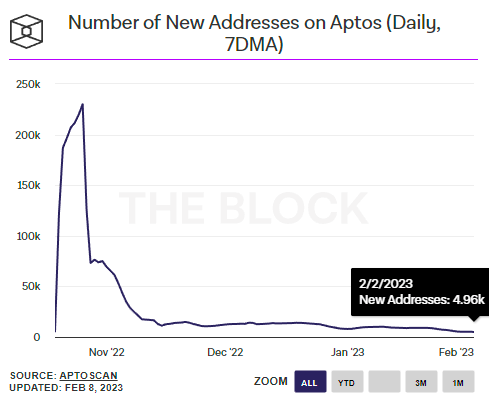

Aptos (APT) | Market Cap $2.6B: Surged 400% last month. The price increase could’ve been driven by NFT demand, but at ~$2.6B, I can’t help but think it may not be deserving of this market cap given the stage of development and adoption. After all, <5,000 new addresses are created daily and trending down since launch. Collective Shift dive into APT in our latest altcoin report.

Figure 9: New Addresses on Aptos. Source The block

VeChain (VET) | Market Cap $1.9B: VET has been controversial since its launch in 2019. From misleading announcements to a $100M sponsorship with the UFC, VET has not gained any meaningful adoption, with only ~2M known addresses and ~20K contracts. I’m shocked VET remains a top 50 asset with a market cap of nearly $2B.

EOS (EOS) | Market Cap $1.2B: The creators of the “Ethereum killer” and year-long ICO in 2018 raised ~$4B. EOS remains with little activity or projects building on it but still commands a large market cap in the billions and is a top 50 asset. Block.one, who raised the funds, has since used the funds to launch its cryptocurrency exchange “Bullish”, and the community are attempting to claw back the money. I’d be very cautious thinking this can make a return.

Tezos (XTZ) | Market Cap $1.1B: Another 2017 chain that failed to deliver any meaningful adoption outside some high-profile partnerships. Developers are still upgrading the chain with 4 upgrades in 2022, but with only 2M funded accounts in 5 years (many likely abandoned or lost), Tezos should continue its slide outside the top 100.

Bitcoin Cash (BCH) | Market Cap $2.5B: The last Bitcoin fork to remain in the top 50. These Bitcoin forks remain large in market cap mainly because of the lost cryptocurrency and airdropped coins. Exchanges are finally starting to delist others (e.g. Bitcoin SV) and remain a powerful reminder of a critical point in Bitcoins history.

These were just a couple of blockchains that took stood out to me. There are other cryptocurrencies, blockchains and apps in the top 50, and even 100, that I strongly feel are not legitimate and in no way should command market caps upwards of $500M, such as Radix, NEO, Klaytn or IOTA.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.