7 day market recap

Following a turbulent few weeks marked by global banking failures, we’ve seen a brief period of calm settle in over the past week.

This calmness was disrupted earlier in the week by the latest regulatory crackdown on the industry. On Tuesday morning, the market experienced a sell-off after the US Commodity Futures Trading Commission (CFTC) announced its intention to sue Binance for alleged violations of derivatives regulations.

In response to the news, BTC’s price dipped by over 4%, yet it remained within the tight range of $26,000-$29,000 USD, which has held for nearly two weeks.

While the overall market sentiment appears to be cautious, on Tuesday the CEO of MicroStrategy, Michael Saylor, announced that the company had purchased a further 6,455 BTC, worth around $150 million USD.

This takes the company’s BTC holdings to 138,955, worth roughly $3.751 billion USD.

Coinwatch: Ripple (XRP)

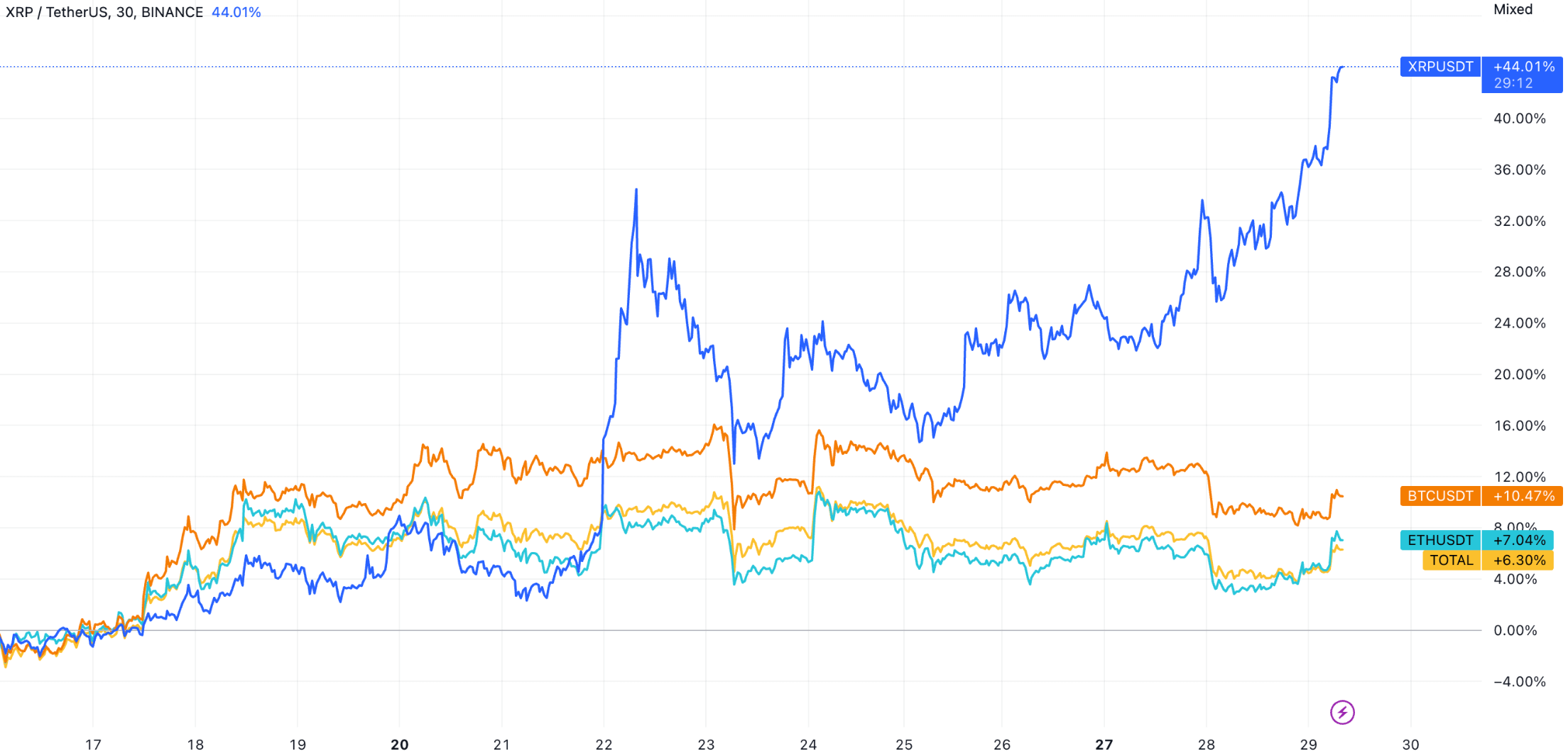

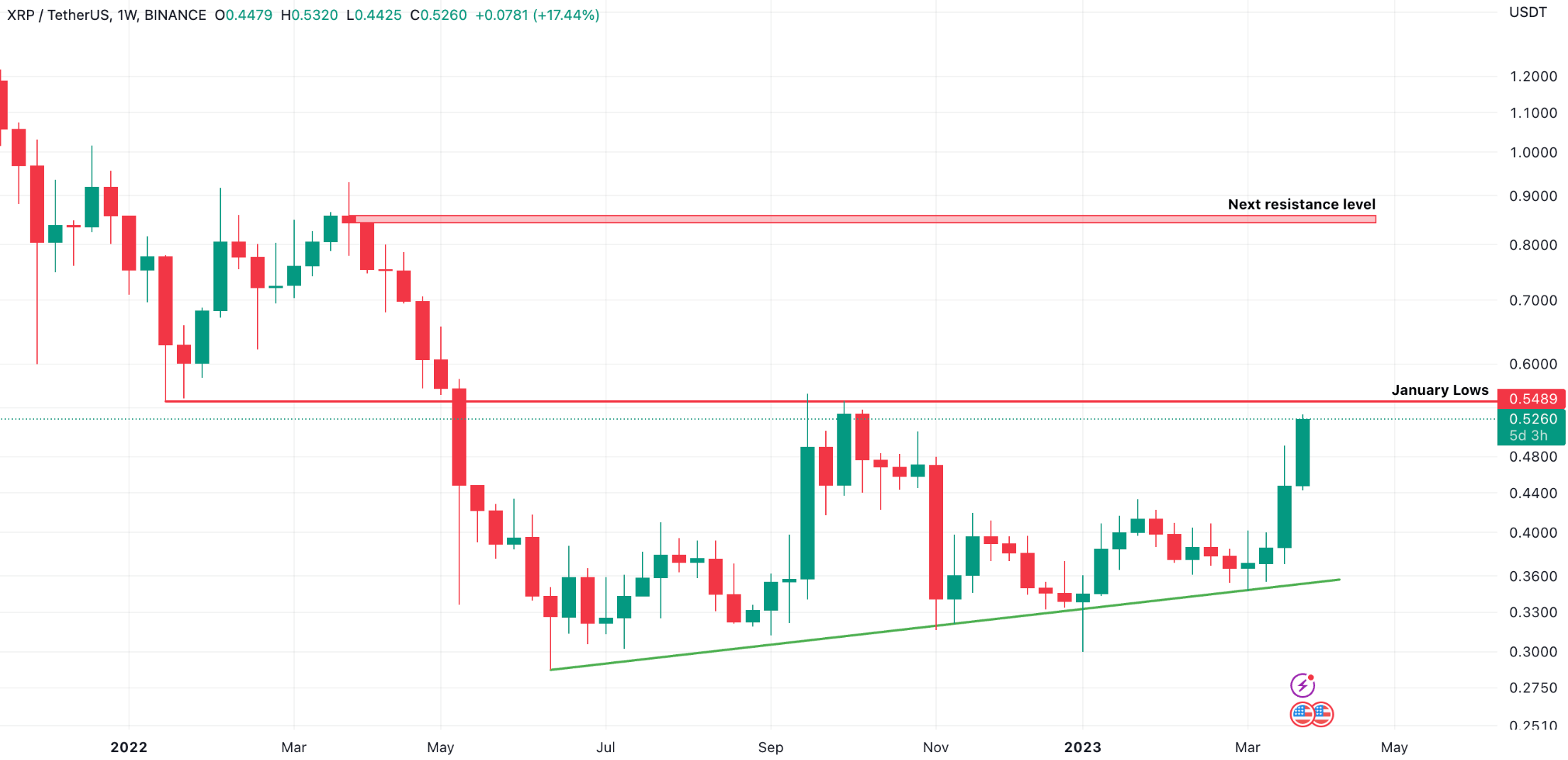

Ripple (XRP) has had a strong run recently, with its price surging to a 5-month high and increasing over 40% in just two weeks, significantly outpacing both BTC and ETH.

As rumours swirl about the potential impending conclusion of the lawsuit between the SEC and Ripple , many commentators believe that Ripple is well-positioned for victory.

The legal battle began in 2020 when the SEC accused Ripple of selling unregistered securities. Ripple’s goal is to prove that XRP isn’t a security, and the result of this case could have ‘ripples’ across the entire crypto ecosystem.

Additionally, Santiment data reveals a 1% increase in wallets holding between 10 million and 100 million XRP in February, suggesting that some whales or large investors have been accumulating more holdings.

As the court case may reach a conclusion shortly, XRP is one to keep an eye on.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.