This week marks a historic moment for all crypto investors with the SEC approving several Bitcoin spot ETFs from global asset managers like BlackRock, Grayscale, Fidelity and 8 others. This is a landmark victory for the industry and one that will usher in the next wave of adoption.

The decision by the SEC to approve these ETFs means Bitcoin will be available through the US stock markets, improving accessibility to Bitcoin, particularly for institutions looking to invest through a regulated avenue.

What is the significance of this?

The launch of Bitcoin ETFs on US markets will enable institutional firms to access and recommend Bitcoin exposure to their clients. Currently, accessibility to cryptocurrency is a problem for wealth managers and advisors due to complexities around custody and wallet security.

Alex Thorn, head of research at Galaxy Digital, predicts that inflows to spot Bitcoin ETFs could surpass $14 billion in the first year of trading.

This also opens the door for more cryptocurrency assets to be listed as ETFs in the future as demand for asset diversification builds.

Why “Spot” Matters

In a spot ETF, the fund holds the underlying asset (in this case, Bitcoin) with a custodian for its investors. This contrasts with futures ETFs, which are cash-settled contracts that don’t require the fund to buy any Bitcoin. This means that Futures ETFs do not meaningfully impact the demand for Bitcoin in the spot market, having less impact on price.

Bitcoin enters a new era on Wall Street

In an article published by nasdaq.com, the arrival of Bitcoin ETFs on US markets represents a major step in removing barriers to adoption between institutions and cryptocurrency. As these ETFs are regulated by the SEC (Securities and Exchange Commission), it will bring greater transparency and oversight for investors when gaining exposure to Bitcoin through regulated entities that issue these ETFs.

To better understand the potential impacts of the new Spot Bitcoin ETF, BitWise and VettaFi have conducted an annual survey of 400 financial advisors in the US, the ‘2024 Benchmark Survey of Finanacial Advisor Attitudes Towards Crypto Assets’. Here are three takeaways from this survey that describe the persistent and strong demand for cryptocurrency asset exposure as a part of an investment strategy in the US.

- Demand exists from Advisors & Clients. 88% of advisors interested in purchasing bitcoin are waiting until after a spot bitcoin ETF is approved. 59% of advisors say ‘some’ or ‘all’ of their clients were investing in cryptocurrency outside their advisory relationship.

- Current access is still limited. Only 19% of advisors said they are able to buy crypto in client accounts.

- Long-term demand. 98% of advisors who currently have an allocation to crypto in client accounts plan to maintain or increase exposure in 2024.

Historically an ETF can leave lasting effects on asset classes. Casting back to 2004, Gold launched its first ETF on the New York Stock Exchange (NYSE). Since then, the price of gold has not come down.

While this isn’t a forecast of what’s to come or expect for Bitcoin, it does show that improving accessibility to an asset may have seismic effects on the long-term valuations of Bitcoin.

Figure 1: Gold Price after ETF Listing. Source Altcoin Daily

A Bitcoin ETF in the same year as the Bitcoin halving

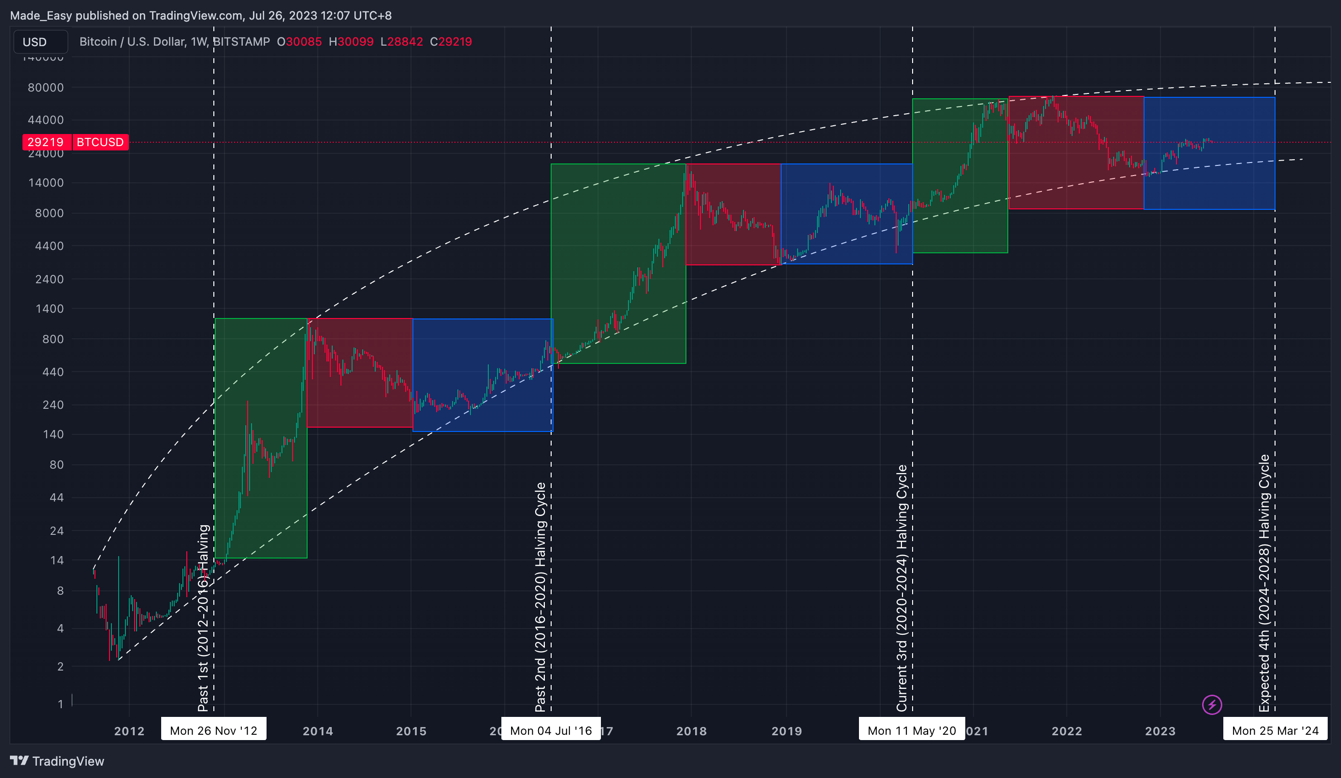

There are two large fundamental tailwinds for Bitcoin in 2024. The biggest native fundamental catalyst for Bitcoin will be occurring in April 2024. The halving event occurs every four years and reduces the number of newly created Bitcoins by 50%. This creates scarcity for Bitcoin, and what makes it a deflationary asset.

Figure 2: Bitcoin Halving Cycle. Source Seeking Alpha

Historically speaking, the halving event has been a pivotal event in prior cycles and is thought to be a major catalyst in all previous crypto bull markets.

Beyond Bitcoin – A new era of diversification?

Ark Invest CEO Cathie Wood has, in a recent interview with CNBC, described how a BTC ETF may just be the first of many cryptocurrency ETF products to be launched as investor appetite seeks further diversification into the crypto sector.

Bloomberg ETF analyst James Seyffat is quoted that spot ETFs for Ethereum are likely to roll out this year. There are currently several pending Ethereum ETF applications that have a final deadline with the SEC by May 2024.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.