Market Analysis

Markets have felt the volatility this week, likely due to the release of US Consumer Price Index (CPI) data on Tuesday night. Inflation eased for the 7th straight month, though yearly data has delivered slightly higher than forecasted. This outcome is a mixed bag of sorts.

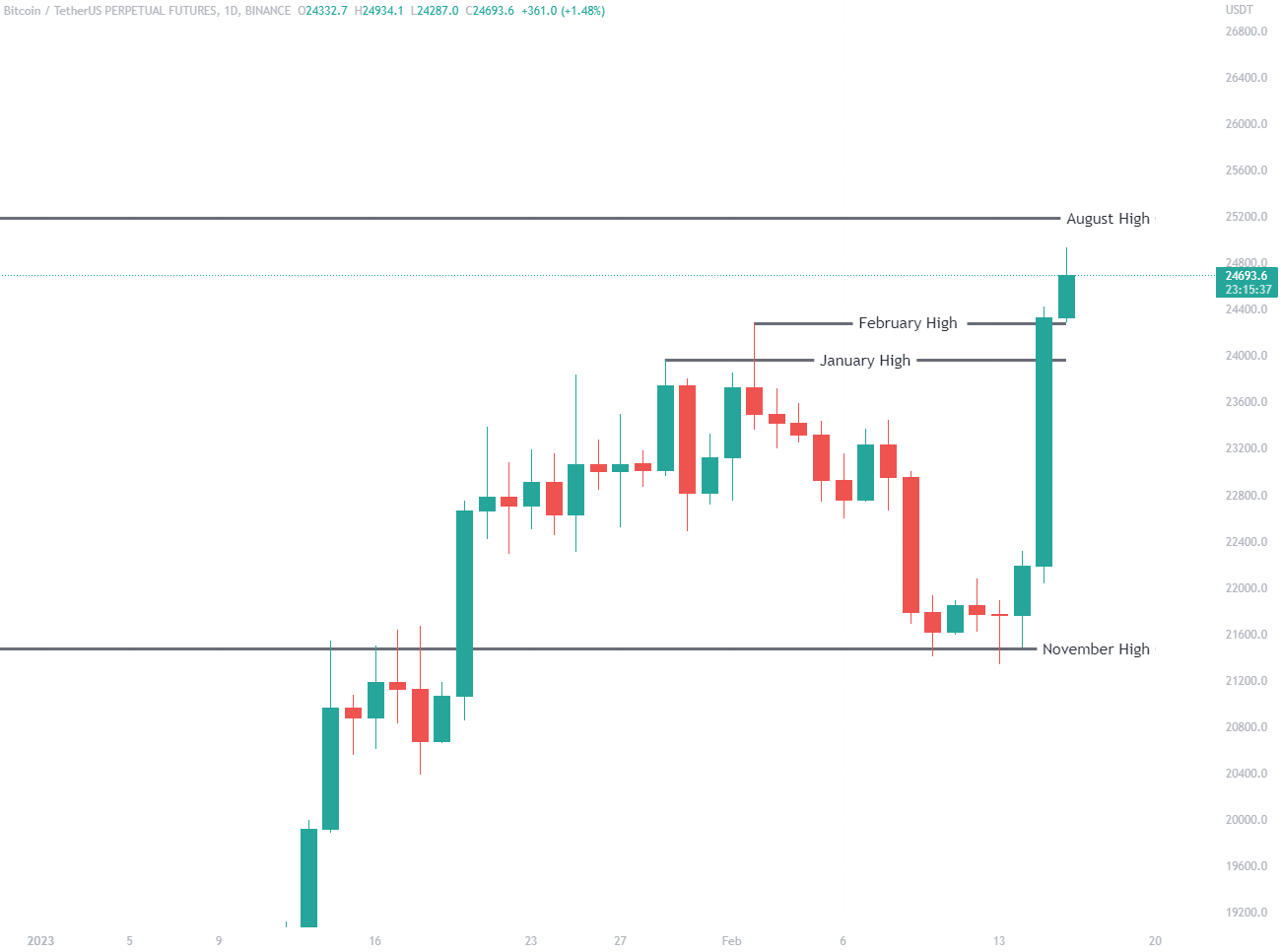

Currently, Bitcoin has broken it’s January 2023 highs in a violent move. This may likely be accelerated by short sellers in the market feeling the pain -resulting in a short squeeze. This is where stops-losses & positions for short sellers are taken out in quick succession as price moves higher.

Figure 1: Total Bitcoin liquidiations. Source Coinglass

At the time of writing, Ethereum scaling solutions like Dusk Network (DUSK) and Optimism (OP) are featuring in the top 10 gainers over the last 24 hours.

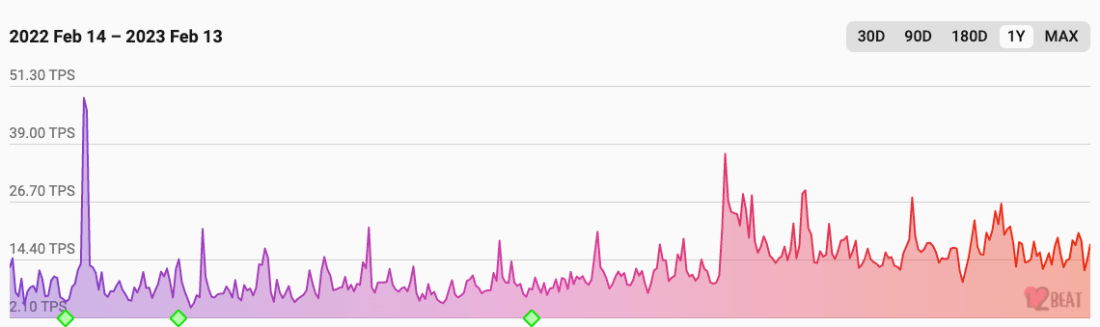

Another scaling solution, Sydney-based Immutable X (IMX) has also been a fresh regular in the top performers in recent times. Whether this trend will continue for the remainder of 2023 is yet to be seen. However, as shown by the chart below, transaction activity on layer 2 scaling solutions has been slowly increasing in the past 12 months, despite the market downturn.

Figure 2: Ethereum layer 2 transactions per second. Source L2Beat

Market outlook

A real test of strength in the market has been seen today, as Bitcoin has closed above both January and February highs. If sellers remain dominant at any point here, there is the chance to always fall lower. The next high price milestone is the August High sitting at $25,000.

Figure 3: Bitcoin price. Source TradingView

Coin watch: Polygon (MATIC)

Polygon had a huge year in 2022, earning the title of Decrypts Crypto project of the year. The layer-2 network has been hitting win after win with continued technical development and its expanding list of mainstream partnerships.

Key Partnerships

Polygon has continually made headlines over the last 12 months for their partnerships with huge global brand including the likes of:

- Starbucks

- Mercedes

- Meta

- Adobe

- Stripe

- The NFL Liverpool FC

The initiatives range from providing infrastructure to loyalty programs, NFT integrations and payment solutions.

Technical developments: Zk-rollup

Zero knowledge (Zk) tech is a hotly anticipated solution to the scalability problems on Ethereum. It provides the functionality for large batches of transactions to be verified faster. Think about many transactions are ‘rolled up’ into one large batch. This in turn reduces costs and increases the speed and capacity of a network.

Loopring (LRC) was the first Zk rollup to exist on the Ethereum blockchain and it has harnessed 2000 transactions per second (TPS). LRC is currently up over 100% since the start of the year. It will be interesting to see if these ZK projects continue to show strength or if we see a retraction.

Key calendar events: ZK Beta Mainnet

Details have recently emerged that this new tech will go live in a beta network over the coming weeks, with March 27th set as the go live date.

““Polygon zkEVM Mainnet is set to be the first fully EVM equivalent ZK rollup to reach mainnet, this represents a huge step towards scaling Ethereum and bringing Web3 to the masses,” Sandeep Nailwal, a co-founder of Polygon”

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.