The Bitcoin Halving drives behaviour, unlike other asset classes. It is unusual for supply to decrease as demand increases. As such, prices will perform well if demand remains the same while new supply is cut by half. Watch what happens when demand increases at the same time.

Key Takeaways

- The Halving will reduce Bitcoin’s issuance per block by half.

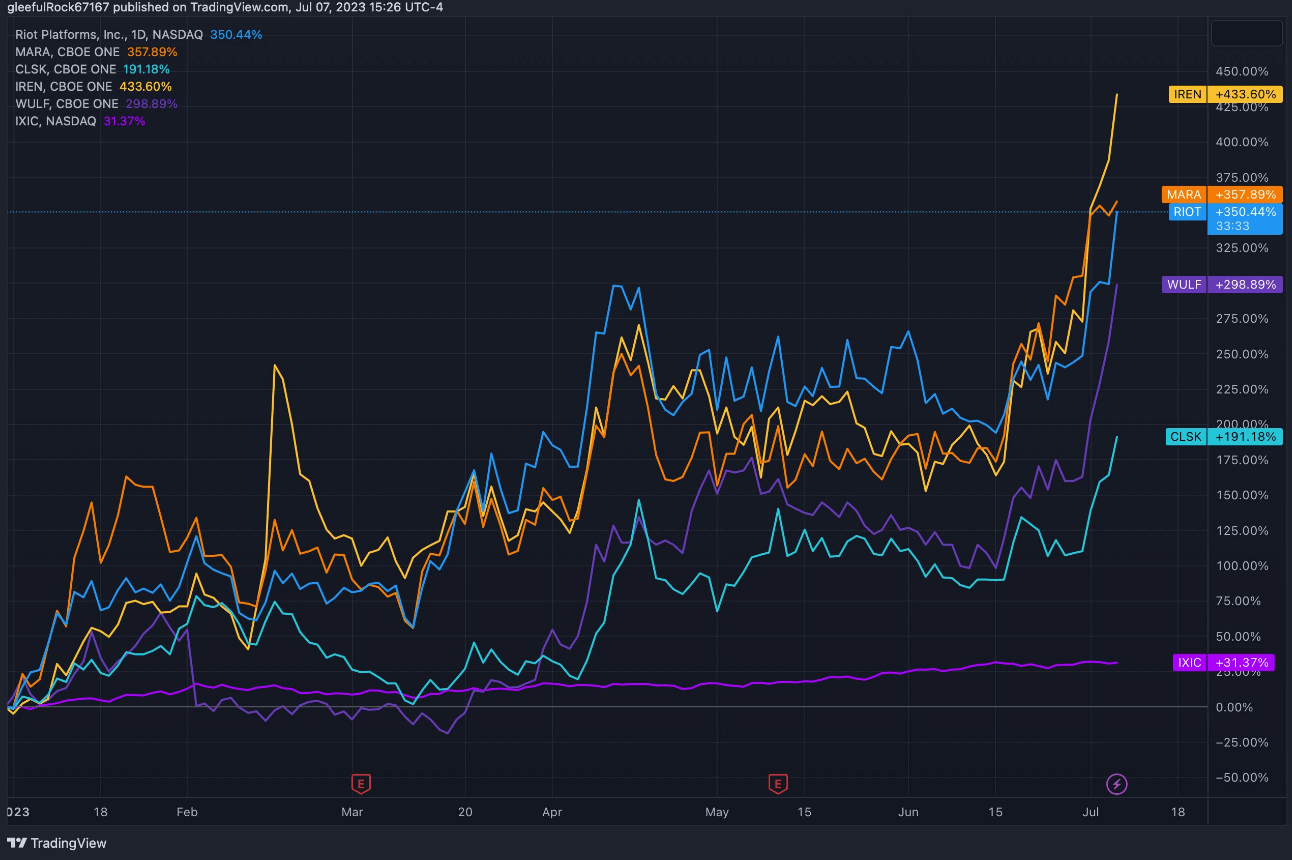

- Bitcoin miners price surges as institutional demand rises.

- Institutional FOMO is real, and their fight for ETF approval comes from forecastable profit.

- Supply and demand will push prices up, while global liquidity injections will determine how high prices will go.

Introduction to the Halving

The Halving is an important event for the Bitcoin network every four years because it reduces issuance per block by half. This event will have a unique impact on Bitcoin’s demand and supply dynamics as well as the mining industry. Bitcoin investors should be aware of the historical significance and possible impact as they prepare for the next Halving, which is scheduled to occur around April 2024. Obviously, though, nothing is guaranteed and we can’t truly predict what will occur.

Miners Earn Big Bucks

Bitcoin miners are compensated for their energy consumption through block subsidies, which consist of payments made by the network and its users. The Bitcoin code dictates that the miners’ compensation is halved every 210,000 blocks. Bitcoin’s issuance rate was high in the early years, but it has now settled into a steady average with some deviations when significant events occur. The current block issuance rate is 6.25 Bitcoin per block. This results in an inflation rate of around 1.8%.

The Halving of revenue for miners is a common concern. It comes without any reduction in production costs. It has raised concerns around the security of the Bitcoin Network if prices remain below the forecasted breakeven production cost of mid $50,000 after the Halving, less efficient miners will stop mining.

Bitcoin News– Daily News On #Bitcoin And #LightningNetwork

Supply vs Demand

Bitcoin is a scarce asset. Some see it as digital gold, and others see it as the best storage and transfer of energy. It doesn’t matter which narrative is driving the demand for Bitcoin; what matters is the adoption rate.

Adoption equates to demand, and demand will reflect price. We saw the increase in adoption during the US bank run, as everyday people scrambled to store their wealth in the orange coin. While it has been considered a more reliable asset for some citizens of countries with currencies suffering from inflation and instability, this was the first time that a major banking impact had hit the people of the largest economy in the world since the GFC.

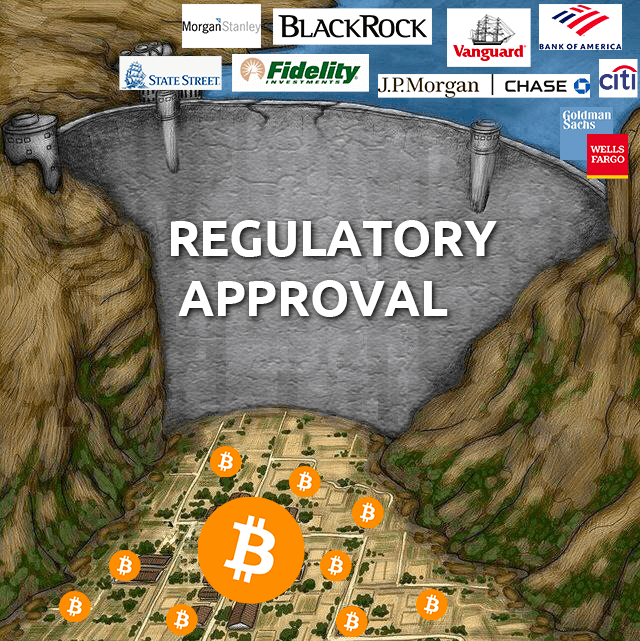

Blackrock was another major catalyst for the rebound in price. As the world’s largest and most connected fund manager, its sway is undeniable, and its track record in getting ETF approvals across many presidencies is nothing short of impressive. Larry Fink, the CEO of Blackrock, has turned 180 degrees and is now calling Bitcoin the asset that transcends any one currency. Their brand is critical, and Larry would not make public statements like this without substantial customer demand and a line of sight on how to attain ETF approval (though, we can’t know for sure).

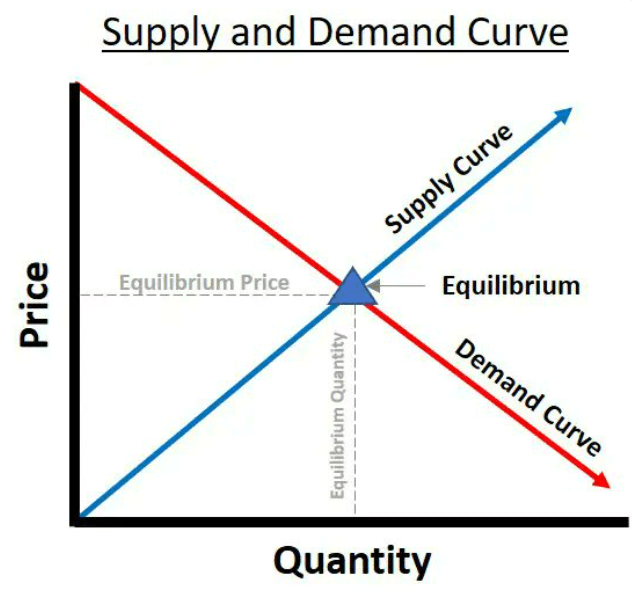

The market has front-run the news, and prices have increased. Similarly, the market is front-running the Bitcoin Halving. Whether it’s individuals or institutions, they know that the block rewards will be cut in half so that the supply will reduce. If demand stayed the same, prices would have to increase. However, if demand were to grow simultaneously with a reduction in supply, prices would move substantially to a point where early investors are willing to part with their coins. Markets are efficient so equilibrium will be found, but extremes will happen to the up and downsides.

Institutional FOMO

While many of us are keeping a close eye on the Bitcoin price, institutions have quietly entered large positions in stocks that provide Bitcoin exposure. According to Cointelegraph, the average of the top 9 Bitcoin mining stocks has increased 257.14% year-to-date. Cipher Mining had risen by over 500%.

Humans run institutions, and they know about the impending Halving. They also understand supply and demand dynamics. Without an ETF, the simplest way for them to gain exposure to the asset is through Bitcoin-related companies.

Similarly, Blackrock, Fidelity and Vanguard Group each own a substantial portion of Microstrategy. The company is the closest proxy they have to an ETF, so their ownership of the stock shows they are looking to gain exposure to Bitcoin.

While the current stock acquisition does not directly impact the price of Bitcoin, it is a precursor to what may happen after the approval of an ETF. Institutions have an incredible amount of interest. Otherwise, they would not fight for approval because of the SEC headwinds. This, of course, is a positive sign for Bitcoin’s future demand.

Record amounts of Bitcoin taken off exchanges

Another critical aspect of supply is that the amount of Bitcoin on exchanges has hit a low that has not been seen since 2018. Consequently, the amount of liquid supply is low. If there is a surge in demand, the imbalance of supply and demand will result in a surge in price.

Institutions may require OTC arrangements directly with miners to attain as much Bitcoin as possible. Regardless of how institutions acquire the coins, it will be a further reduction in supply until they believe the price is high enough to sell. This will ultimately lead to the next crypto winter but don’t worry about that for now.

Putting it All Together

Bitcoin’s Halving is an important known event. It drives behaviour in those that understand its scarcity. Comparatively, Bitcoin and crypto’s market cap is small by global standards, so the upside potential is still immense for early participants. Increasing the market cap of Bitcoin by $1 Trillion, and you could double the return of investors. Doing the same for gold will return 10%, and doing it for property would barely register a move.

In traditional economics, when the demand for something increases, so too does the supply. When prices reached a certain point, fracking was invented to produce more oil. When gold prices surged to new highs, investments flew into mining exploration. As luxury goods like Gucci increased in demand, so too were the number of stores globally, despite its perception as a scarce luxury good. In contrast, Bitcoin is decreasing in supply as demand is increasing. Because existing holders understand the power of the Halving, they are also hoarding the scarce asset.

Consequently, the shortage of supply drives demand. Institutions are starting to come into Bitcoin and crypto, and it is likely to be on a much bigger scale than the last cycle because they understand the value of provable scarcity. As an institution’s desire for profits grows, so will its direct and indirect advertising for the asset class. This will drive towards global adoption, which drives the price appreciation loop.

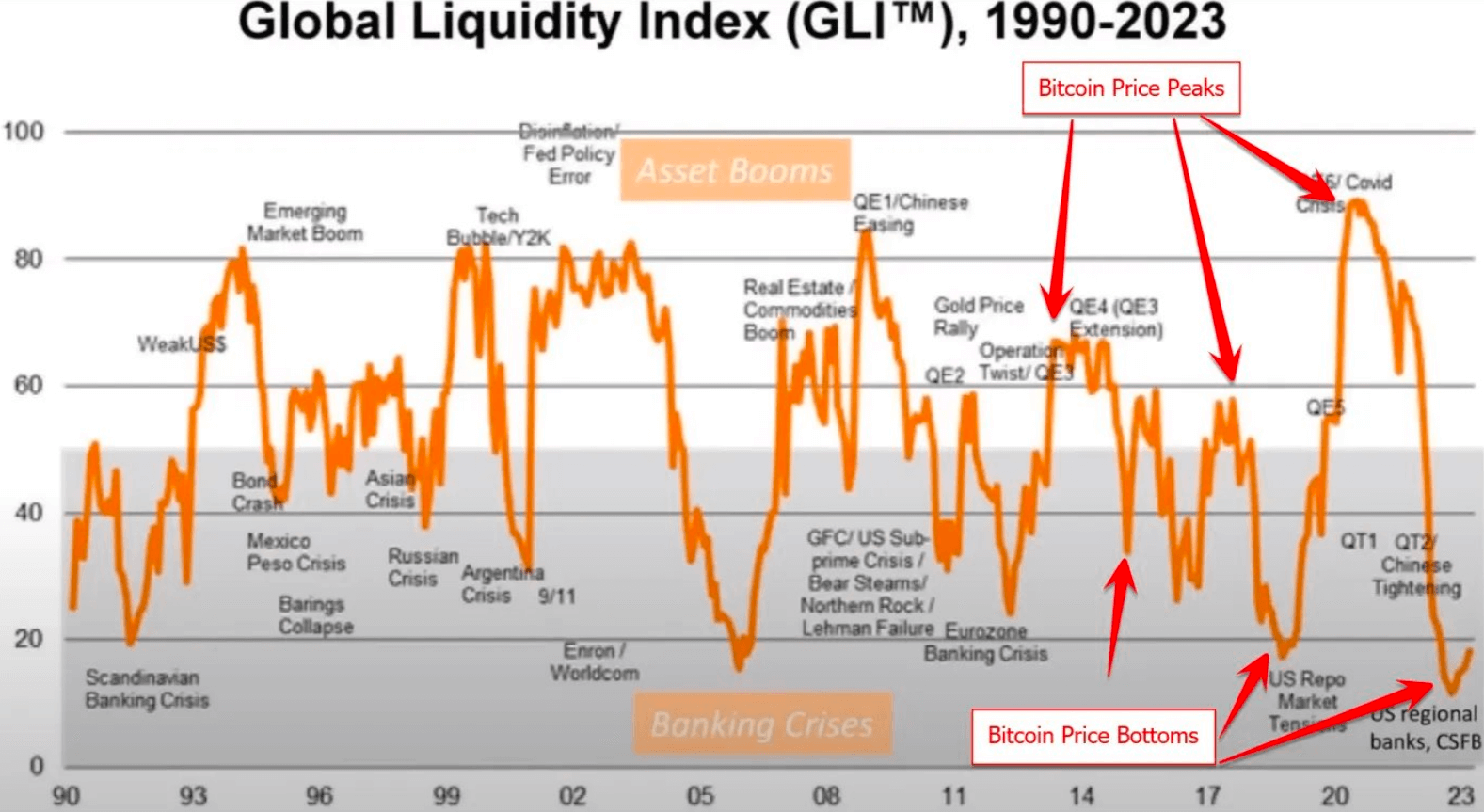

Individuals and institutional adoption will likely continue to increase through this cycle, causing demand to reach all-time highs. However, the unknown factor is the amount of global liquidity injection. This will determine the intensity of demand and, ultimately, the price of Bitcoin.

Think of an allocator of funds or the financial controller in a family. If global liquidity increases slowly, they allocate 2% of their portfolio, which equates to $2,000. If liquidity increases the size of the pie, making 2% equate to $2,500, then that’s an extra 25% of funds that would flow into the asset class. In the bullish case, the increase in the size of the pie may lead to a higher percentage allocated to crypto because, in absolute dollar terms, they have allocated enough to other assets, and the remainder can enter Bitcoin and crypto.

Adoption cycles are primarily driven by 3 things 1. Global liquidity 2. Network growth 3. The Halving supply shock narrative- @theweb3sharma

Recap

The Halving is a valuable component of Bitcoin that drives value and speculation. Supply and demand dynamics will drive the prices up over the long run. However, global liquidity injections will determine the move’s intensity.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.