With April’s halving fast approaching, it’s a pivotal time to evaluate strategies. This report covers what to expect in the lead-up to the Bitcoin (BTC) halving and the potential market dynamics in the subsequent weeks and months.

Key Takeaways

- The next Bitcoin halving will happen in mid-April. Predicting exact price movements is challenging, but historical trends suggest altcoins might experience strong outperformance in the weeks and months ahead as investor confidence grows.

- Several indicators, including funding rates, the relative strength index (RSI), and memecoin performance, signal that the market is due for a short-term correction.

- Bitcoin continues to present a compelling risk-adjusted opportunity.

Bitcoin’s Pre-Halving Buy-up

Historically, BTC has surged in the months before its halving events. This time has been no different, with BTC +50% in the last month and +225% in the last year. If history repeats, some consolidation may come in the weeks ahead, followed by a strong rally in the subsequent months. Despite the recent aggressive price climb, assessing whether it’s still an opportune moment remains crucial.

To Chase or Not to Chase, That Is the Question

While investing in crypto is much less dramatic than Shakespeare’s Hamlet, the human emotions of fear and greed don’t make it any easier.

Ideally, the time to buy was when the market was fearful. In a perfect world, investments should have been more aggressive in the preceding weeks and months. However, it’s not too late to enter the market. The hardest part is figuring out whether it makes sense to buy more BTC after it has run so hard in the past several months.

With many indicators signalling that some price consolidation is overdue, it’s been hard to ignore how quickly any temporary dips in price have been scooped up by patient investors.

In previous bull markets, price corrections of 30% were common. So far in this bull market, the largest correction was around 20%, with the most recent pullback being about 15%.

At this juncture, knowing what to do next depends on your own circumstances. For those satisfied with their current portfolio allocation, holding off buying more BTC could be best. However, for those in different circumstances, such as new entrants with no BTC, adopting a heavy dollar-cost averaging (DCA) approach could be a smart move.

ETF Wave Followed by Tsunami

There’s no denying that many crypto investors have been burnt in the past by believing that “this time is different.” That said, it must be acknowledged that this bull market clearly has some distinguishing factors. (Of course, there are also lots of similarities between this bull market and previous ones.)

Institutional and retail investors now have a traditional route to access BTC, a level of accessibility never seen before. Despite BlackRock’s spot bitcoin ETF being the fastest ETF ever to reach $10 billion, most funds have yet to enter this space.

The sales force of BlackRock and other ETF issuers have only just begun selling to clients, and most institutions are still behind relative to customer demand. When combined with ETF applications from places such as Hong Kong that are yet to be launched, you can see how a tsunami of funds could keep flowing into BTC.

Unsustainable Funding Rates

The excessive funding rates observed, exceeding 100% for BTC and many altcoins, indicate an unsustainable and risky scenario for traders. Essentially, traders are willing to borrow at 100% interest rates to use leverage, which can be indicative of froth and a sign the market is nearing a temporary top.

RSI On Fire Before Latest Dump

The RSI, an essential tool for investors, recently indicated that the market might have been advancing too aggressively (Like any indicator, the RSI should not be relied upon in isolation.)

On the four-hourly and daily timeframes, the RSI rose above 80 for many cryptocurrencies before the recent sell-off, indicating overbought territory. Patient investors could wait for the RSI to reset to 50–80 before jumping heavily into positions.

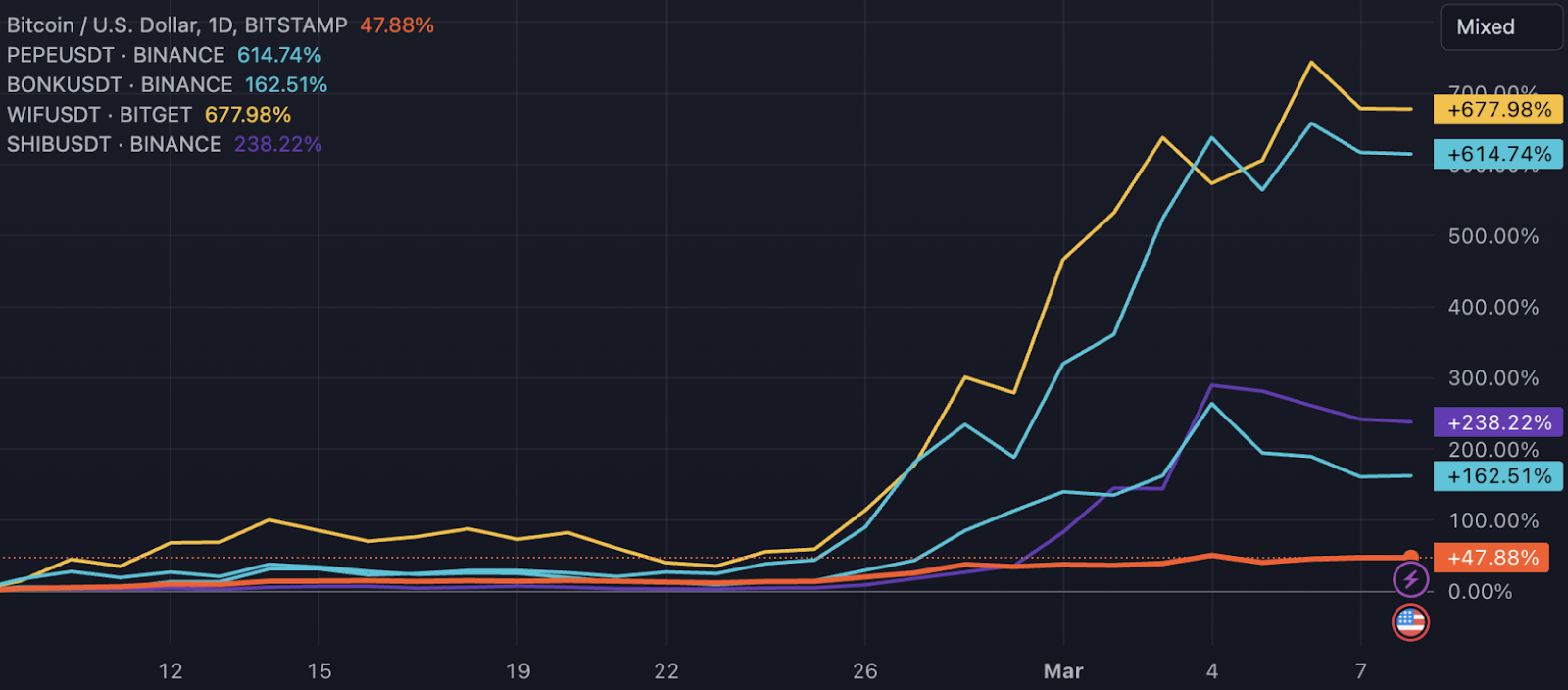

Meme-able Pump Power

Strong performance in memecoins often precedes local tops. Traders rotate between narratives before ending up in memecoins, the prices of which are largely hype-driven. These investment shifts towards highly speculative assets can also signal that the market is becoming overly excited.

From Feb. 9 through Mar. 8, the price performance of PEPE (+614%), BONK (+163%), WIF (+678%), SHIB (+238%) and BTC (+48%) (Source: TradingView)

Impending Altcoin Season

Historically, BTC outperforms altcoins up to and slightly beyond reaching new all-time highs.

However, at some stage, BTC inevitably takes a backseat as greed results in investors rotating profits into altcoins to chase profits.

Because of this dynamic, it’s reasonable to start finding suitable projects to enter, especially while many of them continue to underperform BTC. Identifying and investing in promising projects, particularly those still in accumulation phases or recovering from recent lows could be a prudent strategy in anticipation of a rotation into altcoins.

Closing Thoughts

The decision to buy more BTC ahead of the halving depends entirely on a person’s own circumstances. If underexposed to BTC, it could be wise to DCA, whereas someone who is happy with their current BTC position may only choose to add to their holdings during a would-be market correction of 20–30%.

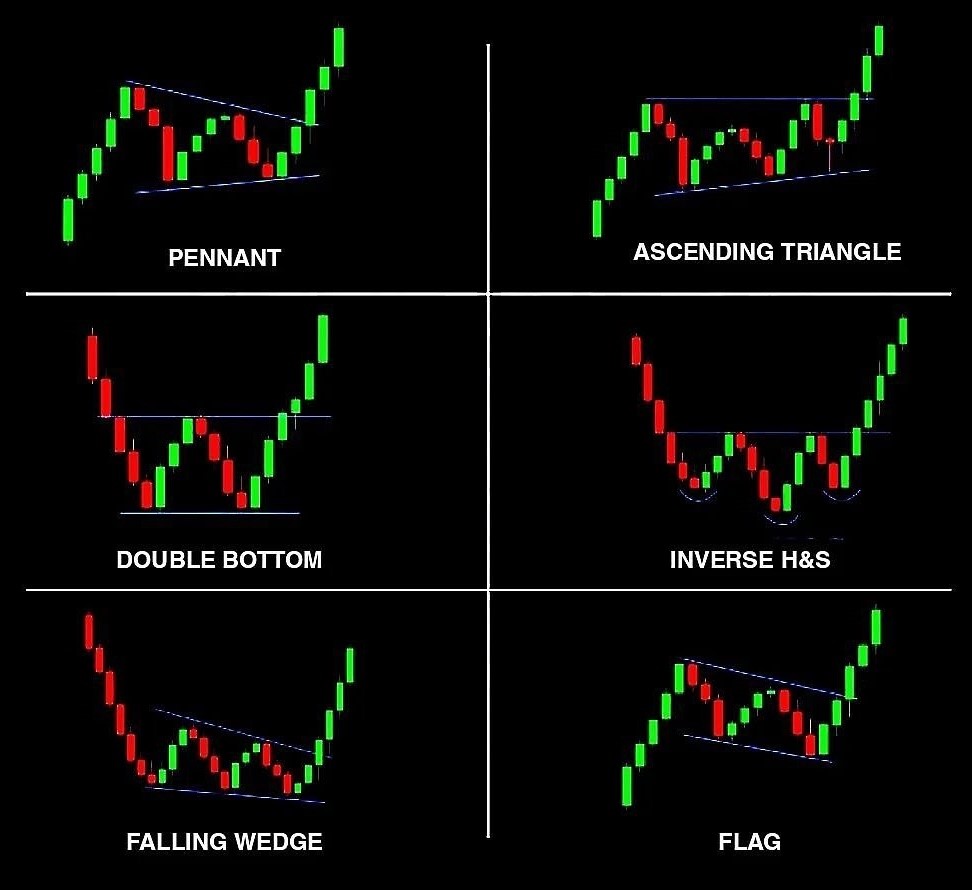

Anticipation of an altcoin season continues to grow. To get on the ‘right’ side of this narrative, it could be prudent to enter altcoins with favourable chart patterns (examples below) or altcoins that haven’t already had a major move higher.

Various bullish chart patterns (Source: X post by @mybookmojo)

As the halving approaches, consider checking in on your risk profile if you don’t own BTC. Despite the bullish outlook on altcoins, many argue that BTC is still the best risk-adjusted investment opportunity in the market.

Pullbacks may continue to be less intense, as we have already witnessed, so it’s important to be prepared for any major retracements. For example, for those wanting to buy more in the event that the market falls by 20%, they typically place a limit order at prices that are roughly 20% less than they currently are.

Finally, given this unprecedented demand for the new spot ETFs in the U.S., it’s worth acknowledging the possibility that no significant dip occurs until much later in the bull market. Indeed, some people may be left waiting a long time for the ‘perfect’ entry.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.