7-Day Market Recap

It’s been another wild week in the markets. We saw the global banking crisis continue, BTC rallying over $28,000 USD and another US FOMC interest rate update.

After the fall of Silicon Valley Bank (SVB), Silvergate and Signature Bank, the next to go was Credit Suisse. With the global investment bank having their own liquidity crisis, UBS have come in and snapped them up for a little over $3 billion USD.

This, along with speculation about easing of US interest rate hikes, seemed to add fuel to the BTC fire, with price continuing to show strength and rallying to almost $29,000 USD earlier this week. The strength in BTC was most evident by the rise in BTC Dominance (BTC.D), increasing to levels not seen since June 2022.

Most recently, on early Thursday morning we saw the latest US FOMC meeting results, with the US Fed hiking rates again by 25bps. Although markets had forecasted this hike, some hawkish words from Fed Chair Jerome Powell sent the markets falling.

Powell said in his press conference that they “don’t see rate cuts this year” and that “process of getting inflation down has a long way to go, it will be bumpy.”

Market outlook

While the banking crisis appears to be stabilising, it’s hard to know what is around the corner after the past few weeks.

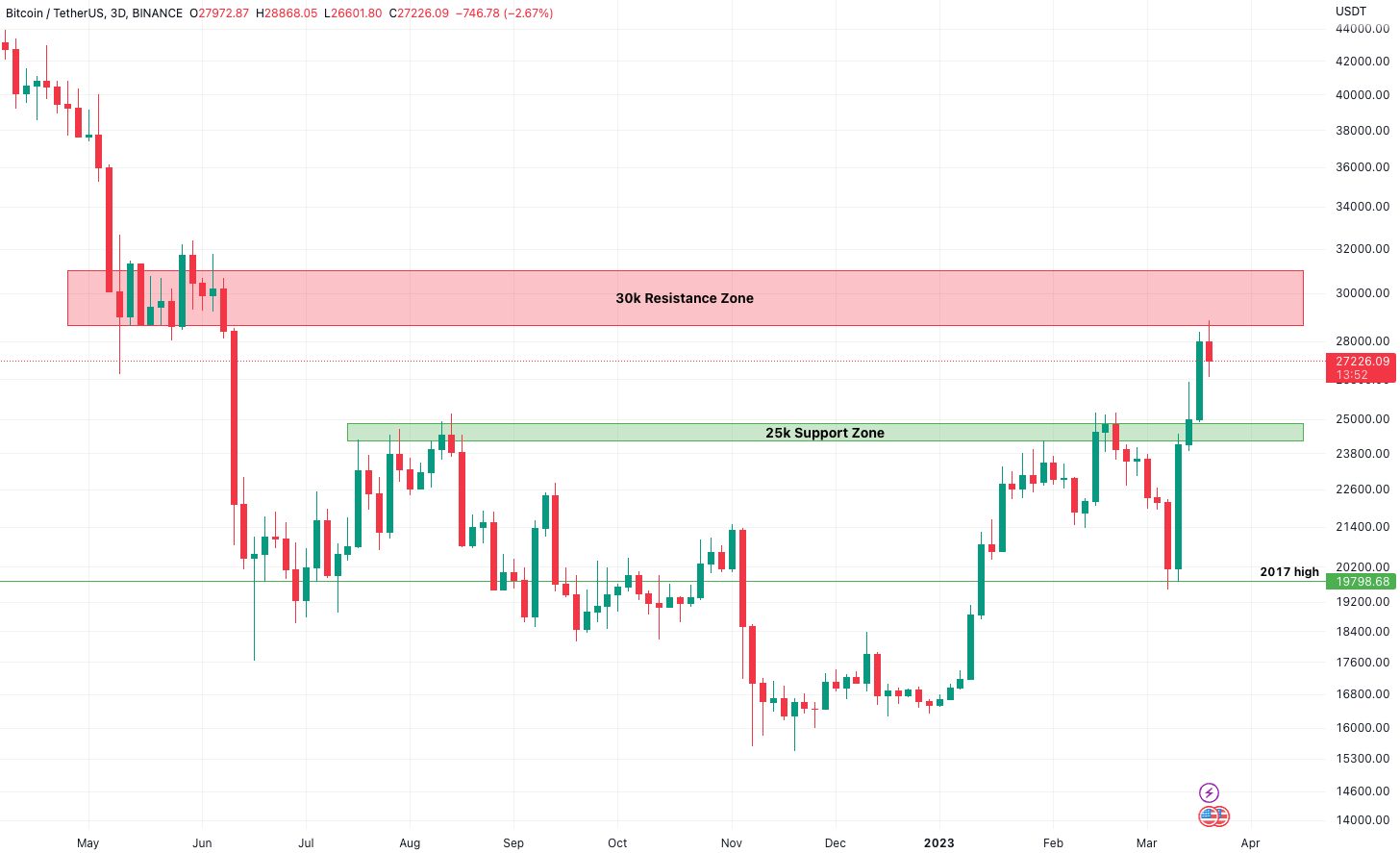

Looking at the charts, after a clear breakout above the $25,000 USD resistance range we’ve now seen price move strongly up to the next major resistance level around $29,000-$30,000 USD.

With price rejecting this level and falling off after the FOMC meeting, we’ll be looking for any upcoming catalysts that might help regain strength or we may see a further fall. With most of the planned market moving macro news already done for the month, we could see some calmness across the markets for the next week.

BTC Dominance is worth monitoring over the next week. While BTC.D showed strength during the banking issues, a fall could possibly see funds rotate from BTC into altcoins.

Coinwatch: Arbitrum (ARB)

Ethereum, for a long time, has faced challenges related to its scalability. Specifically, Ethereum can’t handle a lot of transactions at once, and that’s led to higher transaction fees (gas fees) that make it pricier to use.

With more and more people using Ethereum apps, figuring out how to solve these issues has become a big deal for the community.

Layer 2 solutions offer a promising resolution to Ethereum’s scalability concerns. Notably, Arbitrum has emerged as the largest Ethereum Layer 2 solution, with a Total Value Locked (TVL) exceeding $3.5 billion USD. Recently, they have announced plans to launch their own token.

Arbitrum uses optimistic rollups, which is a technology that processes transactions faster and cheaper by doing most of the work off-chain, while still leveraging the security of the Ethereum blockchain.

ARB Token & Airdrop

One week ago, the Arbitrum Foundation announced the launch of the ARB token which sent the crypto community into a frenzy. ARB is the governance token that grants holders the right to vote within the Arbitrum DAO.

Being one of the most highly anticipated token releases this year, the project also announced that over 600,000 wallets were eligible for an airdrop.

Speculators are already trying to determine the initial price of ARB, with many looking at its main competitor, Optimism (OP), to try and gauge a price.

To briefly compare the pair, Optimism currently has just over $2billion TVL with a Fully Diluted Valuation of $10.85 billion USD. This TVL is eclipsed by Arbitrum’s $3.5 billion TVL, so it will be interesting to see how this launch plays out.

Swyftx has just listed ARB for trading.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.