Layer-one (L1) blockchains were the biggest winner of the 2021 bull market. However, one of the defining themes of the last 12 months is the adoption of Ethereum layer-two (L2) networks. With many people still holding these 2021 favourites or looking into ‘next-generation’ blockchains, I explore whether continued adoption of Ethereum L2s would be bearish for alternative blockchains.

Key Takeaways

- The market is saturated with blockchains, each fiercely competing to offer blockspace.

- For alternative L1 blockchains, a new source of competition has come through Ethereum L2s, which will likely keep growing because they are integral to Ethereum’s scaling plans.

- Despite the rise of Ethereum L2s, alternative blockchains are more than a hedge against possible Ethereum failure. They also offer different types of blockspace to fulfil certain user needs that Ethereum cannot.

- While it’s unclear how many blockchains will ‘succeed’ in the coming years, it’s probable that it won’t be several dozen (i.e. how many exist today).

Multi-Year Rise of Ethereum L2s

Ethereum L2s—networks built on top of Ethereum to help it become more accessible—have been one of the fastest-growing sectors of this bear market. Several have gone live and released significant upgrades while gaining more users, apps and developers.

It’s a trend I’ve continuously covered for members since early 2021. For a trip down memory lane, see my posts on Polygon’s rebrand (Feb. 2021), the potential for L2s to airdrop tokens (Mar. 2021), and Optimism’s $25M raise (Mar. 2021).

Widespread rollouts

Although it took much longer than initially anticipated for L2s to gain traction, they eventually did in mid-2022. Since then, there have been many mainnet launches and/or upgrades (e.g. Arbitrum One, OP Mainnet, Base, Mantle, Linea, Starknet, zkSync Era, Polygon zkEVM) and L2 token launches (e.g. ARB, OP).

The most explosive L2 launch happened last month with Coinbase’s Base, which is already a top-five L2 by total value locked (TVL) and has had more than 143,000 ETH (≈$234M) bridged to it.

Growing adoption

There is a common theme from various metrics—profit, transactions, TVL and demand are all growing and hitting near all-time highs.

Profit: L2s have been rather profitable to date, with Base’s launch contributing to record profit in August.

TVL: Value held in L2s has steadily increased, from less than $300K at the start of 2020 to $100M at the beginning of 2021 to $5B in 2022 to nearly $10B at the time of writing.

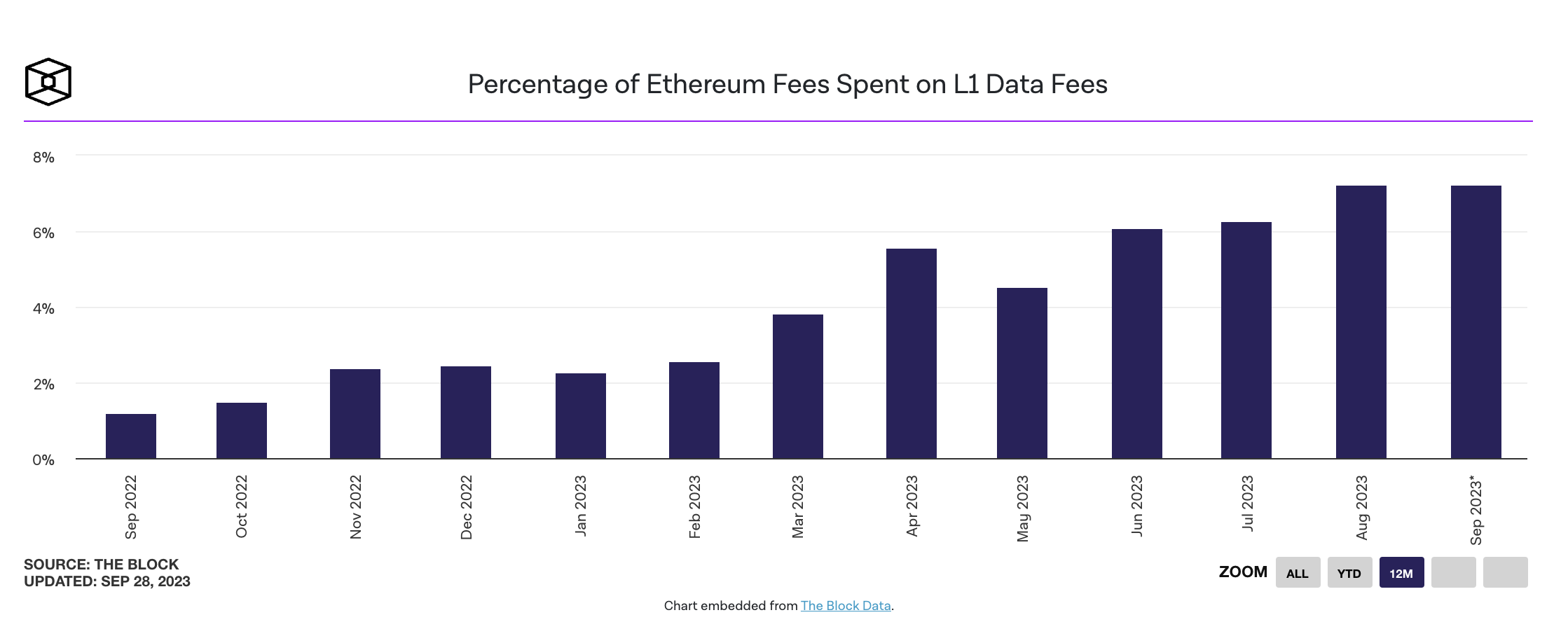

Demand for L2s on L1: The percentage of monthly gas spent posting L2 data to Ethereum climbed to 5.7%, up from 2% at the start of the year, indicating heightened demand. September has already eclipsed August’s record high—only 14 days into the month!

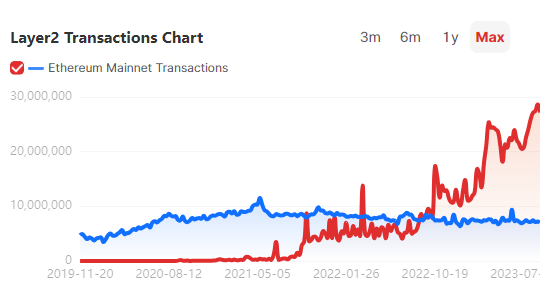

Activity: Onchain transactions on L2 have well and truly flipped L1, another sign that substantial activity is leaving L1 for L2.

Ethereum L1 vs L2 transactions since Nov. 2019 (Source: Orbiter)

One thing is clear: Demand to use Ethereum L2s is proliferating.

To read more, I covered this in more depth in our weekly newsletter!

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.