Different people will promote various projects. Many of the top 50 altcoins are worth researching. Below are 5 strong contenders for anyone’s shortlist, in my opinion.

Key Takeaways

- Risk to reward is a central theme.

- Oracles will play a more significant role.

- The supply chain has data challenges that need a solution.

- AI is not just a fad.

- Programmability on Bitcoin could have its turn in the spotlight.

- Ecosystems can be valuable.

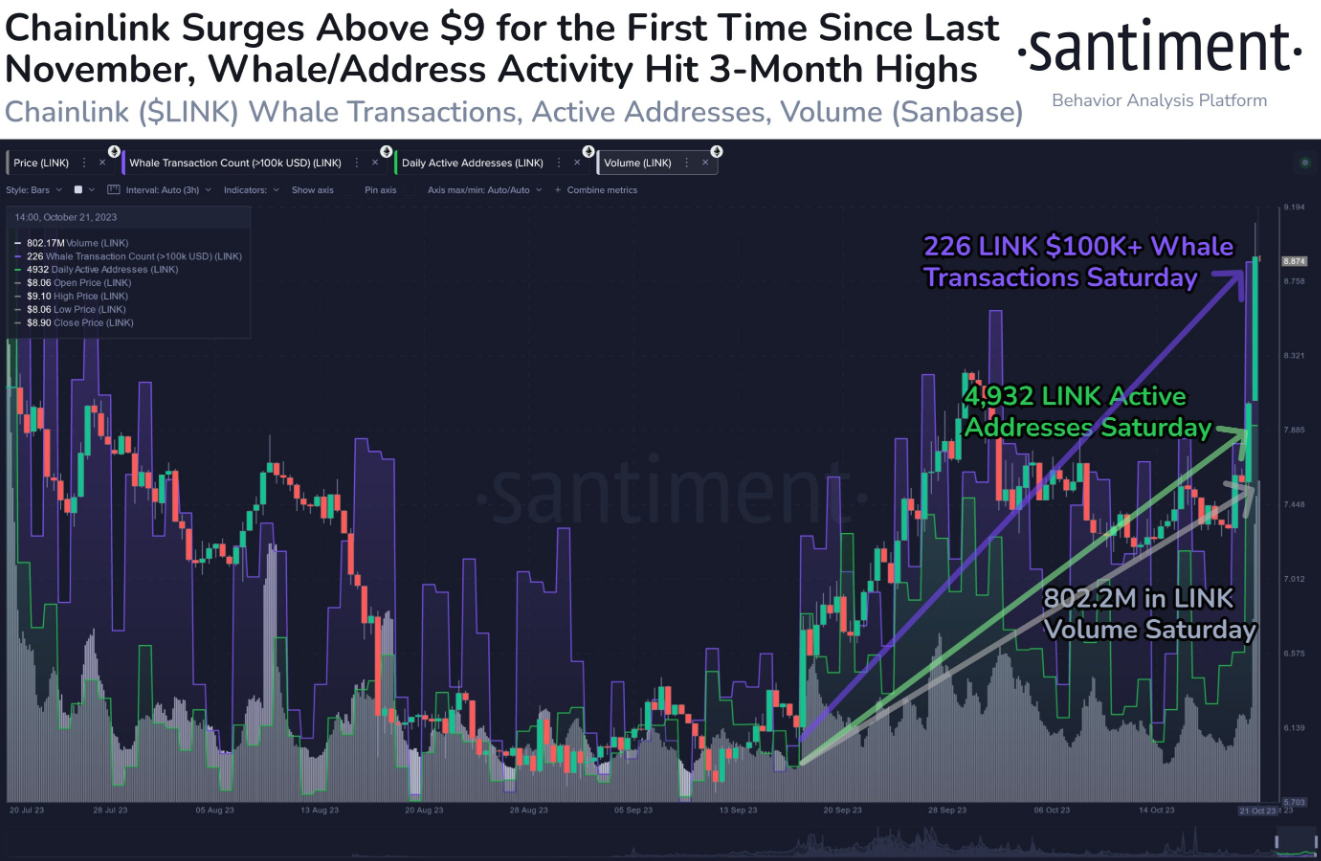

Chainlink: The Oracle For DeFi & TradFi

Consider blockchains as secure digital ledgers for online transactions, while real-world data encompasses information like weather forecasts, stock values, and sports results. Bridging the gap between these two realms is a challenge. Enter, Chainlink (LINK), an oracle network that facilitates communication between blockchain and real-world data.

Chainlink is pivotal in multiple decentralised finance (DeFi) ecosystems, providing cross-chain connectivity and dependable price information to many protocols. For instance, when trading tokens on a decentralised exchange (DEX), the platform often relies on one of Chainlink’s price oracles to accurately relay the token’s current price.

The project’s overarching objective extends to linking the blockchain sector with traditional finance. This could encompass scenarios where banks seek to establish communication channels with the permissioned blockchains of other financial institutions to transfer central bank digital currencies (CBDCs), utilising Chainlink’s oracles to ensure secure and trustworthy data transmission.

Over the years, Chainlink has partnered with a long list of leading companies and organisations, including Swift. It is worthwhile researching the intricacies of the partnerships to comprehend Chainlink’s future potential.

Source: @santimentfeed

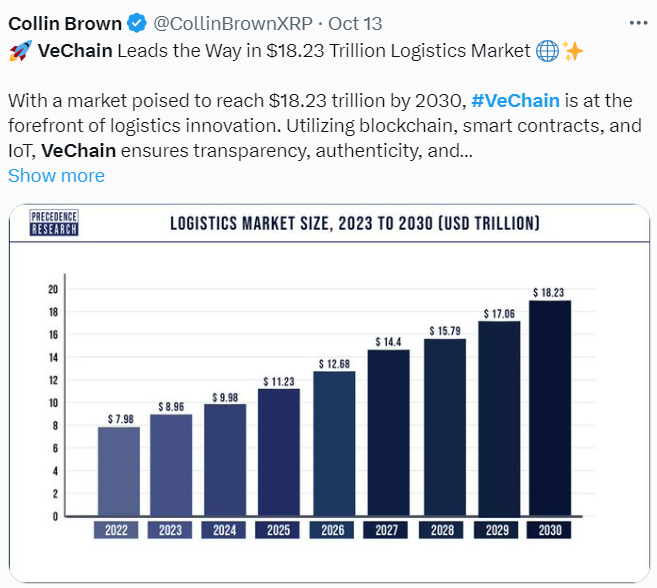

Vechain: Decentralised Data For Supply Chain

Vechain (VET) is one of the pioneering blockchains designed to cater to the specific requirements of enterprise-level clients. Its developers focus on leveraging distributed ledger technology to enhance supply chain and product lifecycle management. Notably, the platform introduces a range of innovative functionalities tailored to meet the needs of businesses striving to elevate their supply-chain protocols and operational processes.

The logistics industry has long grappled with an inherent information imbalance. Although existing systems collect extensive data, the transmission and sharing of this data are far from optimal. Compartmentalisation remains a prevailing issue, forcing the entire supply chain to depend on centralised data sources, leading to a lack of transparency and delayed data exchange.

Vechain addresses these challenges by giving businesses the ability to track an extensive array of data points. These encompass crucial factors such as product quality, authenticity, storage conditions, and transportation status. Impressively, Vechain delivers these features through a decentralised and trustless business ecosystem, effectively reducing operational overhead and enhancing accountability.

Vechain is currently working with LVMH brands to integrate its technology into the products. One such example is the utilisation of blockchain and IoT technology in Givenchy bags for authenticity verification. Vechain has also created a tamper-proof digital car maintenance book for Renault. This ensures that buyers of second-hand cars can find accurate vehicle data. Lastly, Haier has leveraged Vechain in its energy-efficient washing machines to join the carbon credit ecosystem, and its apparel will be utilising anti-counterfeiting solutions.

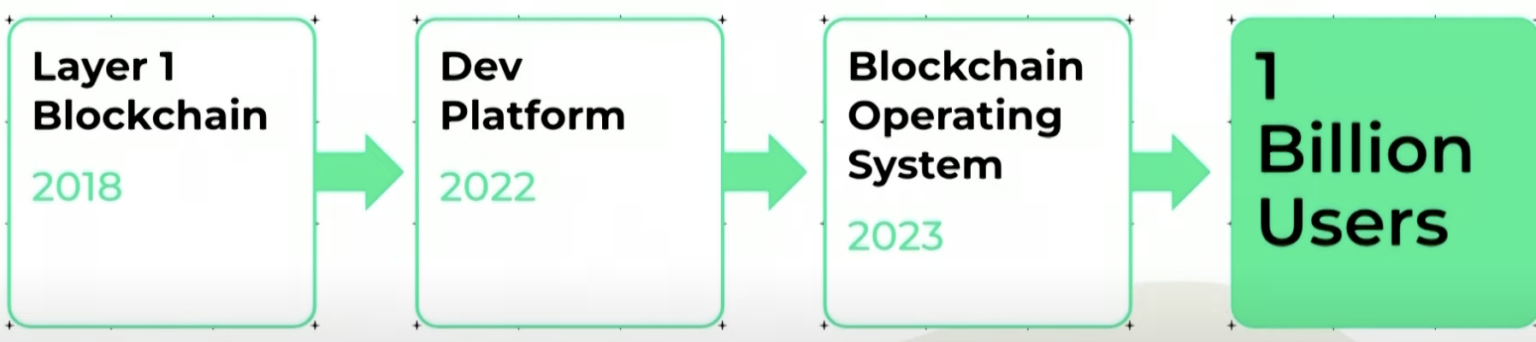

NEAR Protocol: AI Origins

NEAR Protocol (NEAR) is a layer-one blockchain designed to facilitate swift and effortless development, deployment, and scalability of apps with minimal operational overhead. In stark contrast to other blockchain platforms, NEAR Protocol prioritises a user-friendly experience through its wallets and software development kits (SDKs).

One hallmark of NEAR is its implementation of human-readable account names, a departure from the intricate cryptographic wallet addresses used by most blockchains. This user-centric approach can help ease user and developer friction, fostering a more accessible blockchain environment.

A less recognised aspect of NEAR Protocol is that its co-founder, Illia Polosukhin, was one of Google’s researchers who co-authored an AI paper that formed the foundation for ChatGPT. The project actually started as NEAR.ai before rebranding to NEAR Protocol in August 2018.

Polosukhin’s initial direction for the project was AI until he realised the collection, pricing and sharing of data remained a major obstacle to the evolution of AI. This led to the transition towards blockchain and smart contracts to solve the data challenge in machine learning. Consequently, the project’s potential to truly tap into the AI space is better than most other layer-one blockchains.

Furthermore, the project is backed by reputable and accomplished venture capital firms such as Dragonfly Capital, Pantera Capital and Coinbase Ventures. Importantly, this fact alone does not guarantee the success of NEAR. However, these particular firms have a better-than-average track record in betting on strong founders.

For anyone wanting to follow NEAR Protocol closer, the upcoming NEARCON 2023 (Nov. 7–10) should be the source of various project updates. The project’s X account will be sharing any noteworthy news during the event.

Evolution of NEAR Protocol in pursuit of its goal to attract a billion users (Source: Presentation by Polosukhin on Jul. 16, 2023)

Stacks: Programmability For Bitcoin

Stacks (STX) is an innovative protocol that enhances Bitcoin’s capabilities. This secondary layer expands upon and extends Bitcoin’s inherent functionality and scalability while maintaining the integrity of its fundamental code. Within the Stacks ecosystem, developers can craft dapps, smart contracts, and digital assets, all while harnessing the robust security and decentralisation attributes synonymous with Bitcoin.

The primary advantage of Stacks lies in its ability to empower developers to craft dapps and smart contracts that inherit all of Bitcoin’s capabilities. Developers can harness elements like Bitcoin’s liquidity to significantly enhance the overall user experience.

Stacks essentially makes it possible for Bitcoin to support DeFi, NFTs, gaming, and perhaps other use cases that have yet to be discovered. There are a large number of apps that have either been built on or are currently being built on Stack. While some argue that it detracts from the pureness of Bitcoin, others believe that innovation will drive greater adoption of Bitcoin.

This layer-two solution illustrates its capacity to improve Bitcoin’s scalablity while upholding the core tenets of security and decentralisation.

Paul Veradittakit (Managing Partner, Pantera Capital) from a recent issue of his newsletter (Sep. 21, 2023)

Injective: Far More Than a Typical DEX

Injective (INJ) is a blockchain protocol designed for DeFi apps such as DEXes and lending protocols. Among the DeFi community, Injective is often known for its extensive cross-chain trading capabilities, allowing users to trade various asset types (e.g. cryptocurrencies, derivatives).

Injective is an advanced DEX with features that expand far beyond typical token-swapping. The project is focused on derivatives trading, which is powered by decentralised order books that preserve a traditional exchange system without sacrificing security or speed.

By functioning via a sidechain powered by the Cosmos SDK, Injective can offer scalable L2-fueled scalability on Ethereum. The project’s transactions are reportedly near instant and charge incredibly low fees, especially compared to centralised exchanges.

There are currently more than 100 projects in Injective’s ecosystem. This should continue growing, given that the project announced a $150M ecosystem fund at the start of 2023.

Lastly, the tokenomics of the INJ token are attractive, and its investors have deep pockets, including Binance, Pantera Capital, and Jump Crypto. As such, it is a project that should be on your radar.

Screenshot from the homepage of the Injective website (Source: Injective)

Recap

The top 50 altcoins contain some fundamentally strong projects. The 5 above show a balance between risk and reward. There is no need to jump all in, especially after price rallies. Having them on your shortlist could pay off in the longer term.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.