Governance tokens are blockchain tokens that allow holders to participate in the governance of a blockchain project or protocol. This is a way of distributing power and responsibility to users on a decentralized network.

This guide will discuss what governance tokens are and how they work, as well as touching on the benefits and risks of these tokens.

What is a governance token?

Governance tokens are cryptocurrency tokens created by developers to allow holders to shape the future of the project or protocol. Token holders vote on and influence decisions that will impact the future of a project. This includes proposing or actioning new proposals, integrating new features, or altering the way the governance system itself works.

Many blockchain projects use governance tokens to establish decentralized decision-making systems. Token holders present proposals, vet them, and vote on them through an on-chain governance system executed via smart contracts. This ensures decisions made via a blockchain-based governance system are executed instantly without the need for interference or control from a centralized authority or control.

Blockchain-based governance models that use governance tokens are designed to decentralize the control and development of a project or blockchain protocol. In many cases, organizations or projects that use governance tokens to control development and introduce changes are referred to as decentralized autonomous organizations (DAOs).

Some projects that adopt blockchain-based governance tokens may issue tokens specifically for use only within the governance system, while others may integrate governance functionality into the native token of the blockchain.

Did You Know?

Many decentralized finance (DeFi) projects have governance tokens that give users the opportunity to capture value through the use of the token within the DeFi protocol or ecosystem. For instance, holders of the UNI token, the native token of the Uniswap decentralized exchange, will earn a portion of the protocol’s fees as reward. This is in addition to being granted democratic voting rights.

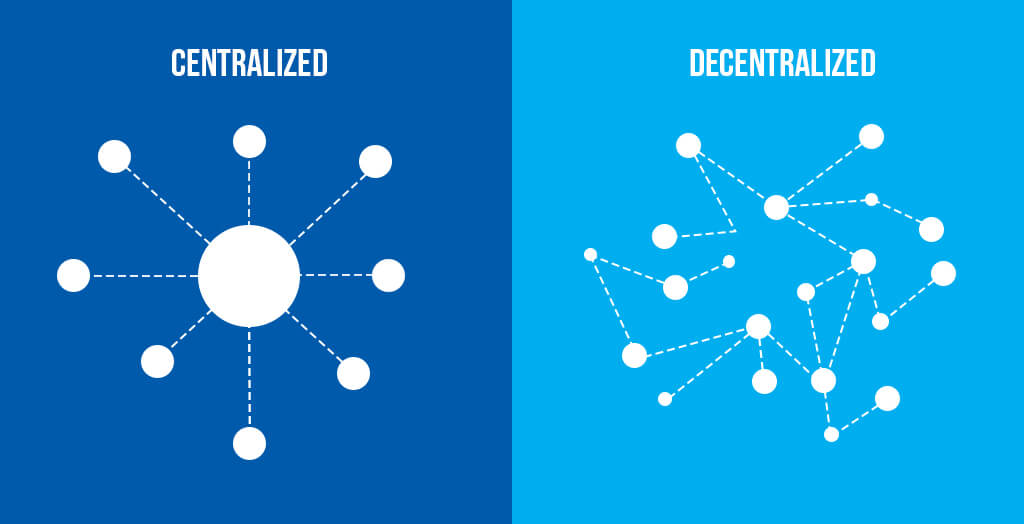

Figure 1 – Centralized network vs decentralized network

How do governance tokens work?

There are many different ways in which governance tokens can be implemented. These tokens can be considered roughly equivalent to traditional equities with regard to the claims, rights, or voting powers they grant a holder.

Holders of a governance token have the right to vote on decisions that affect the introduction of new features, disbursements from treasury funds, roadmap elements, upgrades, or blockchain maintenance.

Smart contracts and governance tokens

Governance tokens are issued on a blockchain and interact with applications or smart contracts that allow holders to make collective decisions on critical matters. In most governance token implementations, developers create smart contracts referred to as “staking contracts.” Token holders deposit governance tokens in this contract in order to vote.

Staking contracts typically allow holders to vote on dynamic parameters such as the introduction or execution of proposals or the allocation of sources. The parameters of the staking contract can be adjusted by a multi-signature smart contract.

Many blockchain-based governance models implement a time delay in the voting process that allows stakeholders within the decision-making process to withdraw the assets they have committed to a project if they disagree with the outcome of a decision and prevent malicious actors to alter parameters without community consent.

Key Takeaway

There are several ways in which you can participate in governance. A common way for holders to vote on the future of the project or protocol is to deposit tokens into a smart contract. Other governance systems allow token holders to vote through their web wallet.

Why are governance tokens important?

Governance tokens are an extension of the core tenet of blockchain technology — decentralization. Digital assets and the blockchain networks they operate on are driven by the fundamental goal of decentralizing and democratising the storage and transfer of value within peer-to-peer ecosystems.

Governance tokens decentralize the decision-making process of a blockchain project or protocol, enforcing community decisions by code. A blockchain protocol that implements these tokens ensures that future development of the protocol can only be made by stakeholders that are invested in it.

Blockchain network participants that hold governance tokens may also receive additional benefits that incentivise participation in the decentralized governance process. A protocol that charges fees to users, for example, may distribute a portion of collected fees to governance token holders in a process analogous to dividends with equities.

Benefits and risks of governance tokens

Benefits

Governance tokens may provide blockchain protocols and network participants with a number of advantages. In addition to providing immutable governance rights enforced by code, governance tokens present unique collaboration opportunities.

By decentralizing and democratising the governance process, governance tokens allow community members to openly collaborate, solve problems, and present new features in a transparent, efficient manner.

Token-based governance also allows stakeholders in a project to respond to malicious attacks on a blockchain network quickly and effectively. A blockchain that experiences a large-scale attack, for example, may present a vote to revert the chain to a block prior to the attack.

Risks

Governance tokens hold the potential to completely decentralize a blockchain protocol or project but are not without risks or obstacles.

Decentralized autonomous organizations (DAOs) take the concept of blockchain-based governance to the logical conclusion of an entirely code-based organizational structure. The DAO model eliminates the need for centralized decision-making, relying only on smart contracts and governance tokens to execute decisions made by token holders.

The major risk of this, however, is the security and strength of a DAO are only as robust as the code that drives it.

In addition to smart contract security risks, governance tokens are subject to similar risks that affect Proof of Stake blockchains. Individuals that control an extremely large amount of governance tokens have greater voting power, which could potentially overpower stakeholders with fewer tokens unless a protocol incorporates a weighted voting mechanism.

Did You Know?

In 2016, the first ever DAO created on Ethereum was hacked which resulted in the loss of $60 million USD worth of ETH. This functions as an example of the potential risks of governance-by-code.

Examples of governance tokens

There are a number of blockchain protocols that currently implement governance tokens in various applications. These projects include:

- Maker: The Maker (MKR) token allows token holders to make decentralized decisions on the policy of the Dai stablecoin, introduce new collateral types, or alter the way the Maker governance model works. You can purchase the MKR governance token with Swyftx

- Uniswap: The Uniswap (UNI) governance token allows token holders to participate in managing the Uniswap treasury or create and vote on proposals. UNI can also be committed to a liquidity pool which can provide holders with a potion of trading fees. Buy UNI to participate in governance.

- Compound: Compound, a decentralized marketplace for crypto investor has its own governance token, Compound (COMP). Users who buy COMP and hold it are able to submit or vote on proposals or delegate voting power to other COMP holders.

- PancakeSwap: PancakeSwap, one of the biggest decentralized exchanges, is governed by its community. Any CAKE holder can participate in governance of the decentralized exchange project by voting on existing proposals or creating their own proposal. You can invest in CAKE through Swyftx.

Interesting Fact

Governance tokens and utility tokens are two different types of crypto tokens. A utility token is a digital asset that have some sort of utility, typically on the their native blockchain network. They differ to governance tokens as they feature no governance power.

Wrap up

Governance tokens represent a code-enforced, immutable, and wholly transparent share of voting power within the governance system of a blockchain protocol. In some ways, governance tokens bear similarities to equity in traditional financial ecosystems — a governance token may give users voting rights and can dictate the disbursement of treasury funds.

Unlike equity, however, governance tokens are completely transparent and create outcomes enforced by smart contracts and code. By tokenizing stakeholder voting power, governance tokens and blockchain-based governance systems function as the framework upon which future DAOs will operate.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.