Overview of wallet types

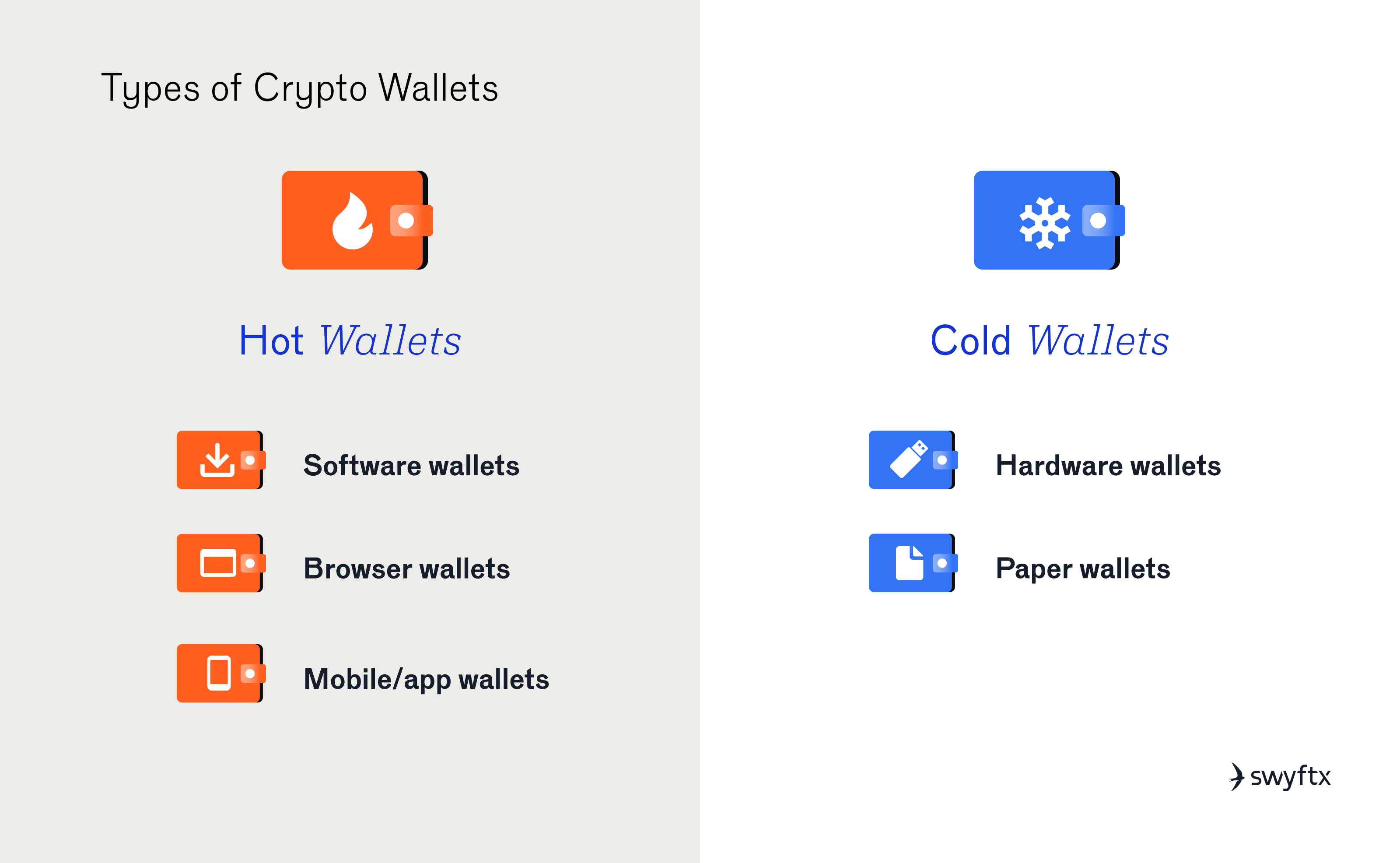

Software wallets

Software wallets have become very popular in recent years, coinciding with the explosion of decentralised finance (DeFi) ecosystems and Web3 platforms. These wallets are applications that can be installed on a desktop computer, web browser or smartphone device.

Software wallets store crypto with a simple interface that lets users quickly check their balances and send/receive digital currencies.

As crypto has grown in popularity, the functionality of software wallets has evolved. Now, users can buy and sell crypto directly from a wallet via an integrated exchange, access DeFi staking services, connect their assets to decentralised applications and much more.

However, it’s important to note that software wallets store private keys on their host device, your laptop or smartphone. This can leave your assets vulnerable to online threats such as hacking.

Exchange wallets

If you’re buying cryptocurrency with fiat (such AUD), you will typically need to use an exchange wallet. When you buy crypto from a trading platform like Swyftx, they often automatically store purchased assets on your behalf. You don’t control your private keys, and instead, you manage your assets from what is known as an exchange, or custodial wallet.

Exchange wallets are convenient because their holdings can easily be accessed via your trading account. This means you can trade or send crypto via a familiar username/password process. Another great benefit of using this type of wallet is that you can recover your account through a process you’re used to too—no seed phrase needed. Since custodial platforms are operated by centralized entities, they typically offer customer support options too.

While exchange wallets are secure and easy to use, non-custodial wallets offer more control of your private keys and provide greater flexibility when interacting with dapps, thus experienced crypto users tend to use both types.

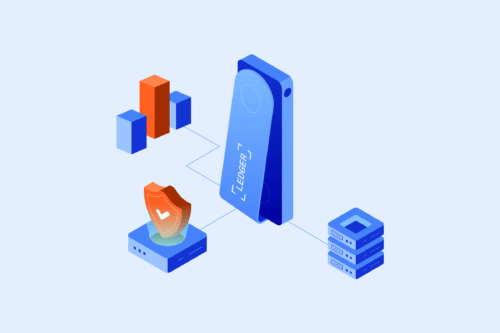

Hardware wallets

Hardware wallets are considered the most secure form of non-custodial crypto storage. Unlike other popular digital wallets, hardware wallets are physical devices that store your private keys in an environment isolated from your internet-connected device.

Because they store private keys offline, hardware wallets are much more difficult to hack: they don’t expose your keys to the internet’s threats such as malware and spyware. As they are physical device, hardware wallets cost money and can have a more challenging user experience than other wallet types.

Paper wallets

Paper wallets are non-custodial wallets that store your private keys offline on paper. Usually, they come in the form of a printed QR code. You can either generate them yourself at home or receive them from crypto ATMs for depositing fiat.

However, because they are easily damaged and offer a less-than-optimal user experience, those looking for offline storage typically opt for a hardware wallet instead. Recovery of paper wallets also poses a problem, which many unfortunate investors discovered through losses during Bitcoin’s developmental years.

Custodial vs. non-custodial wallets

A custodial wallet means someone else is in charge of storing your private keys. This can be a convenient solution for many, especially those new to investing in digital currencies. Usually, a crypto exchange will manage keys on your behalf, however, spot crypto ETFs and other investment managers may also offer this service.

Then to protect their funds, most custodians will use a mix of software and hardware wallets.

On the other hand, using a non-custodial wallet means that your private keys are entirely your responsibility. This is a popular choice for more experienced investors who prefer to retain complete control over their assets. Non-custodial wallets usually come in the form of an application (software wallet) or a physical device (hardware wallet).

Custodial wallet providers offer a familiar user experience and the benefit of convenience, especially for new users and when buying crypto with fiat currencies. However, protecting your assets in a custodial wallet also means trusting the wallet provider, so you should always check the exchange you use is credible.

Non-custodial wallets offer you true ownership of your assets, guaranteeing the only person who can access them is you. However, protecting your assets in a non-custodial wallet means you must actively protect your funds—there’s no one to call if you mistakenly send your assets to the wrong address or your seed phrase is compromised.

Hardware wallet vs. software wallet

Choosing between a hardware and software wallet can prevent some hurdles for first-time investors. Each come with a set of benefits and disadvantages.

Software wallets like Metamask or Phantom are a fairly convenient option, especially for users interested in accessing DeFi services such as staking or yield farming. As these “hot” wallets are typically compatible with multiple dApps, they offer opportunities to connect your wallet and begin traversing the Web3 world.

Hardware Wallets: the ultimate protection

If you’re a dragon who plans to sit on your pile of gold (Bitcoin) for the foreseeable future, cold storage is likely your best bet.

Unlike software (hot) wallets, hardware wallets store your private keys offline. This keeps your accounts safe from potential malware on your internet-connected device. While hardware wallets require another device, such as a laptop or smartphone, to send transactions to the blockchain; they remain completely isolated from its internet connection. The hardware wallet allows you to sign the transaction offline and then sends the signed transaction to your laptop or smartphone for distribution to the blockchain.

Since the transaction is already signed, there’s no way for malware on your smartphone or laptop to tamper with it. The transaction is safe to send to the blockchain via the internet.

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read