Key Takeaways

- Trump’s election victory has already spurred optimism in the crypto sector, with expectations of a pro-Bitcoin national stance and regulatory reform aimed at encouraging digital assets.

- The anticipated removal of SEC Chair Gary Gensler signals a potential shift towards crypto-friendly regulation, reducing compliance barriers and possibly increasing institutional investment.

- Trump’s pledge to establish a strategic national Bitcoin stockpile could position the U.S. as a leader in crypto adoption, potentially impacting global adoption and Bitcoin’s valuation as a reserve asset.

What’s Already Happened

Trump’s election win has invigorated the cryptocurrency industry, setting off what appears to be a powerful bull run. After a prolonged sideways trend since March, Bitcoin has surged, reaching all-time-high prices and sending a clear signal of renewed investor confidence. The momentum is not limited to Bitcoin; most major cryptocurrencies have also broken out, surpassing key resistance levels and capturing significant attention.

This market shift reflects the growing optimism around Trump’s pro-Bitcoin stance and promises of a strategic national Bitcoin stockpile, positioning the U.S. as a potential leader in the crypto space. The post-election price action suggests that markets are rallying around expectations of favourable regulatory reforms, increased adoption, and broader institutional access. Investors appear to be betting that this political shift will accelerate crypto’s mainstream integration, further solidifying digital assets as a cornerstone of future financial systems.

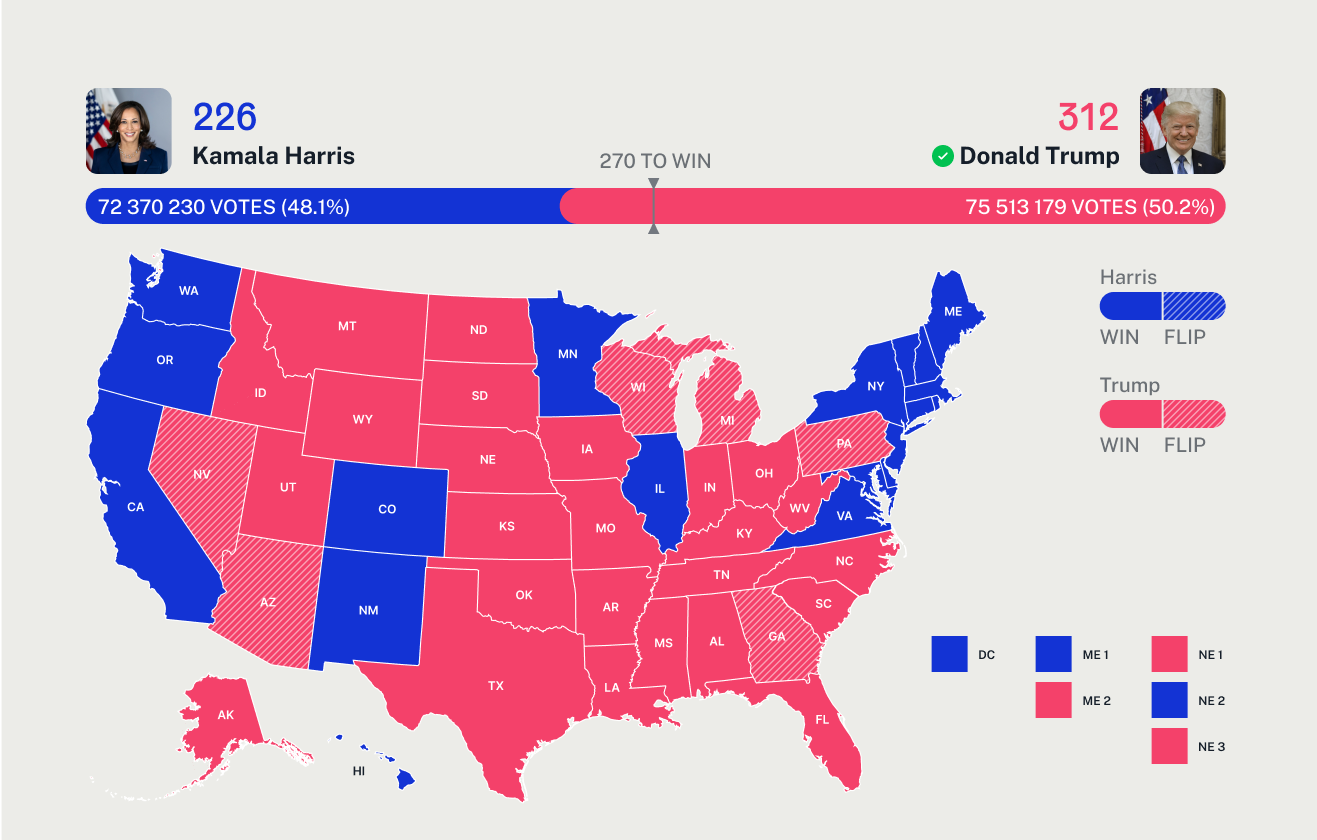

Trump Wins Election & Republicans To Control Congress

With a ‘red sweep’ (i.e. Republicans winning the majority in the Senate and House) now confirmed, Trump’s administration has significant latitude in passing crypto-friendly legislation. Two major bills, the Stablecoin Bill and a Market Structure Bill for digital assets, are expected to move forward with minimal opposition. The implications are profound:

Stablecoin Bill

This would introduce a clear framework for the issuance and regulation of stablecoins, encouraging broader adoption by creating a reliable structure for use in both retail and institutional settings.

Market Structure Bill

This bill would provide regulatory certainty by categorising and regulating digital assets, which has been lacking and has driven many crypto firms to operate outside the U.S. Clear, consistent rules could foster innovation and attract new companies to the U.S. market.

SEC Changes

Trump’s win is anticipated to bring a reshuffle at the SEC, starting with his commitment to remove Gary Gensler as chair. Gensler’s tenure has been marked by an aggressive “regulation by enforcement” approach, with the SEC launching numerous lawsuits against crypto companies and individuals. These enforcement actions have created a challenging environment for the industry, leading to uncertainty and deterring innovation in the U.S. crypto space. Many in the industry argue that Gensler’s approach has stifled growth by targeting firms without providing clear guidelines on compliance.

Trump’s proposed replacement, potentially Hester Peirce, is known for her pro-crypto stance, which may result in:

- Less aggressive enforcement actions could make the U.S. a more welcoming environment for crypto firms, allowing them to redirect resources towards growth and innovation.

- With the SEC adopting a more lenient approach, traditional financial institutions might feel more comfortable entering the crypto space, boosting market liquidity and accessibility for retail and institutional investors alike.

- Trump’s proposed advisory council would focus on regulatory reforms conducive to digital asset growth, streamlining the crafting and communication of crypto policies.

Upcoming Regulatory Changes

Trump’s administration promises a host of regulatory reforms that could redefine the U.S. crypto market:

| Reforms | Outcomes |

| Stablecoin Legislation | The Stablecoin Bill’s likely passage could reduce risks surrounding stablecoin issuance and operation, making stablecoins a reliable tool in financial transactions and reducing investors’ volatility concerns. |

| Banking Restrictions Reversal | Under Biden, efforts to allow banks to hold cryptocurrency assets faced vetoes. Trump’s support for bank custody of digital assets could represent a new milestone in crypto adoption, enabling banks to manage crypto assets for clients and spurring mainstream access to cryptocurrencies. |

| Strategic National Bitcoin Stockpile | Trump’s proposed creation of a strategic national Bitcoin stockpile is a groundbreaking step that could influence global financial strategies. This move would strengthen Bitcoin’s reputation as “digital gold” and a hedge against inflation, potentially leading other countries to follow suit.This could also cause other countries to follow, which would mean national governments would be acquiring Bitcoin |

Countries and Governments That Own Bitcoin

Conclusion

Trump’s victory has catalysed enthusiasm for the crypto-friendly U.S., with expected reforms, regulatory changes, and the potential creation of a strategic national Bitcoin stockpile. These developments could establish the U.S. as a global leader in crypto adoption, making the nation a prime destination for digital asset innovation and institutional participation. For Bitcoin and the wider cryptocurrency market, Trump’s win may mark the beginning of a new era—potentially driving Bitcoin’s value up and positioning it as a core element of national and global financial strategies.

With supportive regulatory changes and a pro-Bitcoin administration, the U.S. may help usher in a period of unprecedented growth and mainstream adoption for cryptocurrencies.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.