Key Takeaways

- The GENIUS act, a landmark cryptocurrency bill to progress in the US’s stance on cryptocurrency.

- Donald Trump has said the US and China’s deal to restore their trade war truce is “done” after two days of marathon negotiations in London.

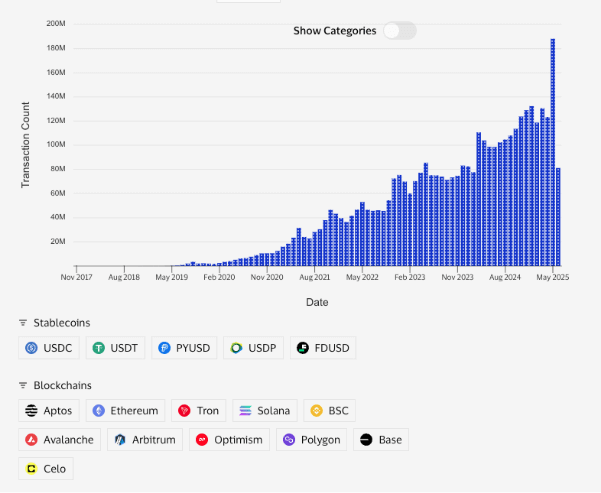

- Chart of the week: Stablecoin transaction counts growing as tracked and measured by Visa.

Bitcoin continues to tease us by almost hitting new all-time highs, in what’s been a landmark week for the crypto industry.

During Monday we saw Bitcoin head north towards $110k USD – 1.3% shy of setting a new high.

Notably, the lift this week may have been partially fuelled by a shift in major fundamentals. There has been progress in the trade tensions between the U.S. and China, while crypto legislation is poised to take a leap forward.

Time will tell whether this is enough to bring tentative investors back into the market, especially since many have likely been caught off guard more than once in 2025.

Advancing crypto regulation

The U.S. Senate has made notable progress on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

This legislation is squarely aimed at establishing a comprehensive regulatory framework for stablecoins.

On June 11, the Senate voted 68-30 to invoke cloture, this effectively limits further debate and sets the stage for a final vote as early as next week.

Here are some key provisions of the GENIUS Act:

- Full Asset Backing: Stablecoin issuers would be required to maintain 100% backing in U.S. dollars or highly liquid assets.

- Mandatory Audits: Issuers with market capitalizations exceeding $50 billion would be subject to annual audits to ensure compliance.

- Foreign Issuer Compliance: Foreign stablecoin issuers must demonstrate the capacity to comply with U.S. legal orders, including asset freezes related to criminal investigations.

it’s a real ‘pinch yourself’ moment for those who have been investing in crypto for such a long time. This isn’t just hype anymore. We’re watching the history books be written for digital assets in real time – pretty cool stuff!

But that’s not all we have to be optimistic about.

Progress in trade truce

The United States and China have reached a new trade agreement following days of negotiations in London. It’s no well-kept secret that the friction here has dealt blow after blow to investor positioning and sentiment.

Here are some key components of what we know so far:

- Tariff Adjustments: The U.S. will maintain a cumulative 55% tariff on Chinese goods, while China will impose a 10% tariff on U.S. products.

- Rare Earth Mineral Exports: China has agreed to resume exports of rare earth minerals, which are critical for U.S. automotive, electronics and defence industries.

- Educational Exchanges: The agreement includes provisions for Chinese students to have improved access to U.S. colleges and universities.

While the agreement marks a de-escalation in trade tensions, it awaits final approval from both Trump and Xi Jinping.

Here are some quotes from the two leaders on the landmark moment.

“China reaffirmed that the two sides should move toward each other, honor their words with actions, and demonstrate good faith and concrete efforts in fulfilling their commitments, jointly safeguarding the hard-won outcomes of dialogue,” Vice Premier He Lifeng was quoted saying.

“President XI and I are going to work closely together to open up China to American Trade,” Trump said. “This would be a great WIN for both countries!!!”

So, if we start to see headline risks around the trade war put to bed, could we start to see growth and investment opportunities in emerging technologies – like stablecoins?

Chart of the week – stablecoin transactions as measured by Visa

Stablecoin activity on blockchains can be noisy. That’s because blockchains support a wide range of uses, and stablecoin transactions can be triggered manually by people or automatically by bots. Not all these transactions reflect real-world payments or traditional settlement activity.

Visa’s goal is to give a clearer picture of how stablecoins are actually being used, by filtering out artificial or bot-driven activity to focus on real, meaningful transactions.

Stablecoin Transaction Count

One thing is clear: this data has been moving steadily in one direction. With the GENIUS Act gaining traction in the U.S. and a more stable environment for investors, we could see increased capital flowing into the space – along with greater adoption of blockchain-based products and infrastructure.

Circle’s well-received IPO is a strong example of this trend in action.

Very interesting times ahead!

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.