Key Takeaways

- Breaking down the Federal Open Markets Committee (FOMC) statement.

- How the projections and views of the FOMC have shifted regarding inflation and growth.

- Chart of the week: The dot plot, and the guidance on future interest rates in the US.

Throughout 2025 we’ve seen major global economies continue to ease monetary policy conditions to stimulate growth. But so far, the US has not budged at all. You might even be surprised to know that they have left interest rates unchanged since December 2024…until now.

Interest rates aren’t the only thing that move markets, but they set the price of money – and that matters a lot.

When rates are lower borrowing is cheaper, spending picks up, and growth gets a boost. That extra fuel often pushes asset prices higher, as we’ve seen in the past. When rates rise, the reverse happens. Money gets expensive, lending obligations become harder to finance and manage, spending slows and markets cool down. Just think back to 2022.

This is why understanding where we are in this current cutting cycle is important. And the good news is I’m going to spell it all out.

Let’s dig in.

What was said

Just as a key reminder, policymakers have what’s called a dual mandate. They’re responsible for keeping inflation in check while ensuring the economy is growing. This is a very delicate balancing act, so it’s important to keep that in mind when we talk about the key points Fed Chair Jerome Powell raised in his statement this week.

This year, I’ve emphasised the Feds have consistently claimed the US job market looks fine. This has been key to their decision to hold rates steady through 2025.

Well, apparently, this is not the case anymore. This was a line in the sand moment where they changed their tone.

“Labor demand has softened, and the recent pace of job creation appears to be running below the break-even rate needed to hold the unemployment rate constant,” Powell told reporters. He added, “I can no longer say” the labour market is “very solid.”

So what else has changed outside of sentiment and tone? What is the data expectation? Let’s cover that next.

How expectations shifted

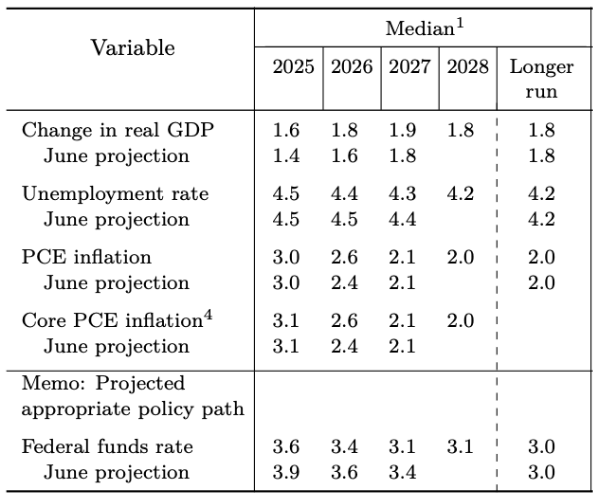

Projections are issued by the FOMC four times a year across the eight meetings that they hold annually.

Now, by looking at this data, we can glean what the policy makers think is acceptable levels of growth, employment and inflation – and importantly, what that means for future interest rates.

And this meeting gave us the latest forecasted figures, and I’m going to spell out in plain English what they mean as we steer into the end of 2025 and beyond.

Increased expectations for growth

The change in real GDP has gone from 1.4% in June projections, to now 1.6%. This also the trend we see for expectations into 2026 – steady and considered growth across the US economy.

Unemployment to remain steady

The committee expects no change from their June projections, with 4.5% expected for the rest of 2025 and a 4.4% reading in 2026. Basically, the Feds are predicting unemployment will very slowly decline over the next three years.

Inflation to rise

While the 2025 figures for PCE inflation and core PCE inflation are expected to stay steady, the committee is forecasting inflation to return in 2026, which in part may come due to their transition to a growth focus in the latest FOMC.

It’s as simple as that. Now we have an idea of what policymakers are thinking is to come, we can understand what the means for interest rates moving forward.

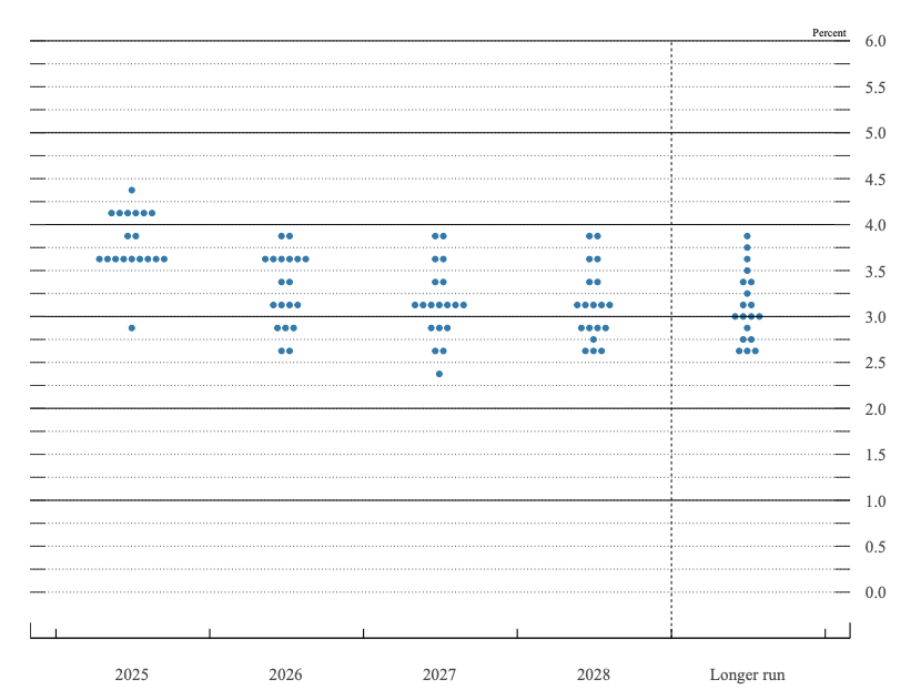

Chart of the week: The dot plot, forward guidance on interest rates.

If the data keeps moving as expected, the official roadmap points to another 1.25 percentage point drop-in interest rates in the US by December.

This chart looks busy – but all you need to look for is where the most dots are. Simple.

The cluster of dots shows the committee’s consensus, essentially where most members expect rates to end up each year. Looking further ahead, the dots trend lower, with projections suggesting rates could settle between 3.00% and 3.25% by 2027.

So…what does this all mean for the market?

Well, expectations since the Jackson Hole speech – where Jerome’s took a more dovish tone – were for a 0.25% rate cut in September. This was heavily anticipated and now delivered.

Bitcoin is up 3.49% at this time of writing since that key event, and we’ve seen some larger moves across broader altcoin markets as expectations for interest falling in September rose. (checkout Fedwatch for historical trends).

So that begs the question, is everything already priced in? Or has the market only considered the September cut, and now regains some confidence continues pushing as they expect quantitative easing to continue to end the year?

That’s what we will digest over the next few weeks, and I look forward to keeping everyone updated on how it unfolds in the next Squawk.

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.