Key Takeaways

- Tariff headlines take a positive turn, with the Trump administration suggesting progress between the US and China.

- Paul Atkins, a pro-crypto advocate, has been sworn in as the new Securities and Exchange Commission (SEC) Chair this week in the US.

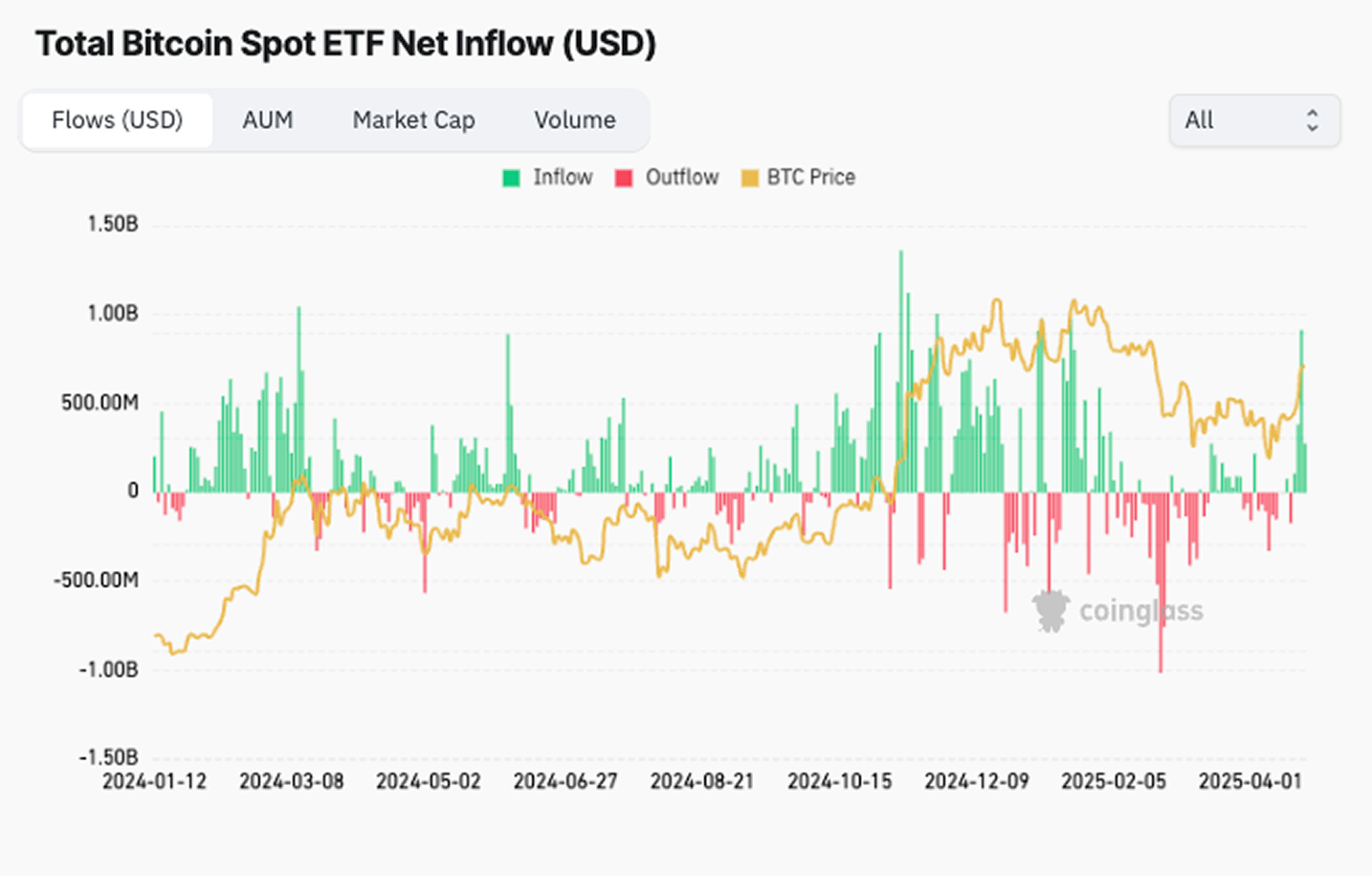

- Chart of the week – Bitcoin Exchange Traded Funds historical net flows, showing the second largest day of inflows in 2025.

Last week we discussed how headlines were a key driver for investors – both good and bad.

Improving economic fundamentals around inflation were landing on deaf ears, as the market was preoccupied with what Trump will say or do next in this evolving trade war.

We even got to the point last week where Trump threatened to fire Federal Reserve Chairman Jerome Powell. The core principle of an independent Federal Reserve is exactly that – independence!

But this week we have finally seen a circuit breaker on the, in my opinion, over-the-top negative sentiment. And the market seems to like it, so far. Bitcoin has charged back above US$90,000, a 10% gain for the week currently. On top of that, crypto ETFs (particularly Bitcoin) have seen a stellar few days of trading this week.

So let’s dive into what has shifted in the last few days and how it may have impacted investor confidence

Trade war softens

Deals are what the market is waiting to hear, and there has been some progress over the last week. US Treasury Secretary Scott Bessent laid out the idea of an opportunity brewing between the US and China overnight, labelling it a “big deal”.

“China needs to change. The country knows it needs to change. Everyone knows it needs to change. And we want to help it change because we need rebalancing too,” Scott Bessent.

While specifics remain unclear, there has been some clarity for the US auto industry overnight following a retreat by Trump. While tariffs remain in place, exceptions are being made on materials for manufactures worried the aggressive policy changes may push up car prices r and result in job losses.

But! If we’ve learnt anything from the current Trump administration, it’s to not take things at face value. There is a real chance for additional fear and doubt raised in the near future – even after this good news shift.

Pro-crypto shift

There is some more positive fundamental news coming out of the US with the appointment of Paul Atkins as SEC Chair. Atkins has a reputation for free markets, and limited government intervention.

That’s a big change from where we have been. Previous Chair of the SEC Gary Gensler was well known for an enforcement approach, during his tenure we saw little progress towards crypto legislation or regulatory clarity.

During his very first press conference Atkins stressed that “One of [his] top priorities is a firm regulatory foundation for digital assets”.

In March, the Securities and Exchange Commission began dropping several legal cases against industry heavyweights Coinbase and XRP. With the appointment of Atkins, the crypto community will be eyeing off regulatory changes that don’t involve lengthy court battles.

Chart of the week – Bitcoin Exchange Traded Funds Historical Net Flows

Positivity returning to the markets may have also aided in the return in demand of Bitcoin Exchange Traded Funds (ETFs). On the 22nd of April a total net demand of $912.7 million USD in Bitcoin was seen across all the major spot products. This is the second-largest single buying day for the year.

Is this a sign of confidence back in the market? I’m still a believer that we need to see consistency in the messaging from the US over the coming days and weeks before positive sentiment returns once and for all.

But this is a great first step.

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.