Key Takeaways

- The trade war takes a stunning twist as US court blocks Trump’s sweeping tariffs citing overreach.

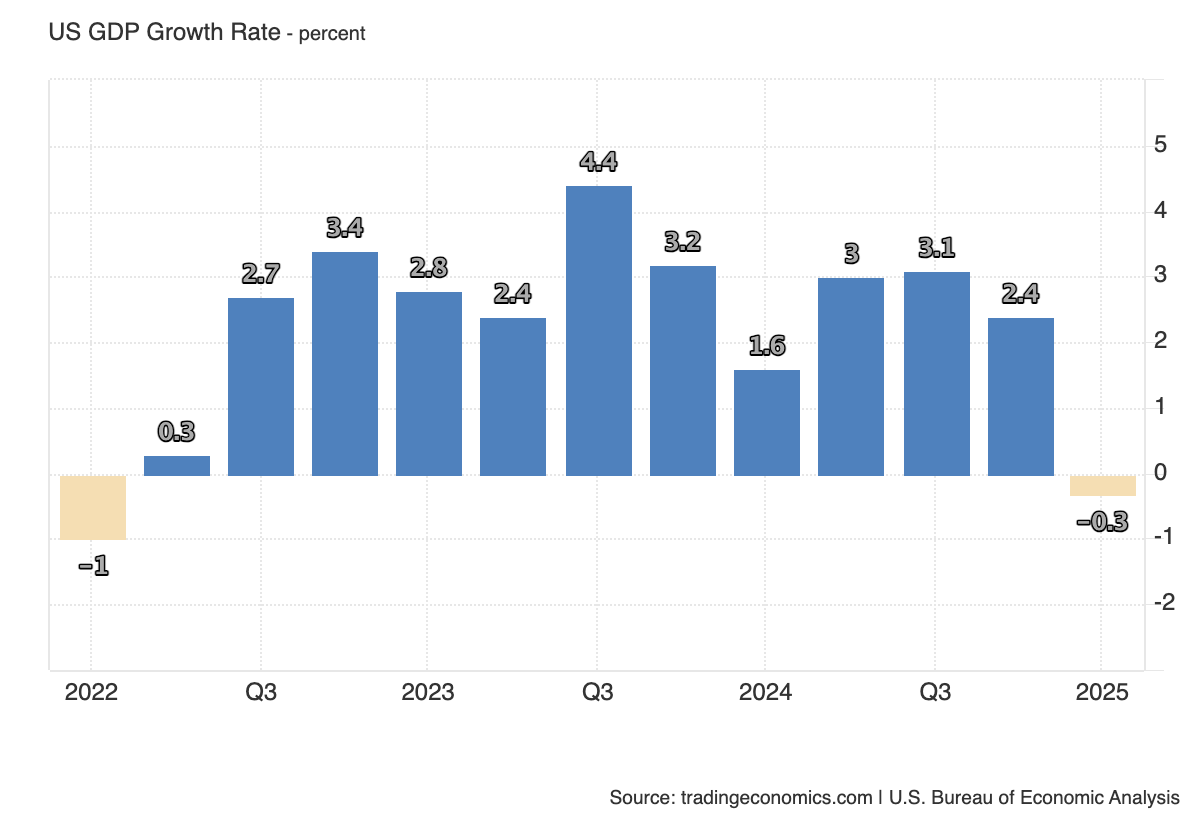

- Preliminary gross domestic product (GDP) reading to land from the U.S. This is an important one as last quarter’s results hinted at an economic slowdown.

- Chart of the week: A look at Global GDP as measured by the International Monetary Fund (IMF).

Just when you thought the story around tariffs couldn’t possibly have more twists and turns, what if I told you they are all null and void?

Because that’s exactly what a U.S. trade court ruled early this morning.

The Court of International Trade said the U.S. Constitution gives Congress exclusive authority to regulate commerce with other countries – and that is not overridden by the president’s powers to safeguard the U.S. economy.

‘The court does not pass upon the wisdom or likely effectiveness of the President’s use of tariffs as leverage. That use is impermissible not because it is unwise or ineffective, but because [federal law] does not allow it,’ a three-judge panel said in the decision.

So could this spark the biggest unwinding in sentiment since the tariffs came into play? Well, one could start to imagine that, if there isn’t a fight back from the White House on this ruling, we’re…back to where we started? What a time to be alive. Maybe now we start to see the positive fundamental tailwinds that have been blowing for Bitcoin start to hit home for investors. A recent one that comes to mind is the Texas Bitcoin Reserve.

Now imagine if we got another surprise this week!

Growth surprise incoming?

Last month, the U.S. closed its first quarter of 2025 with a negative gross domestic product (GDP) figure of -0.3%.

Now, for perspective, we haven’t witnessed a negative quarterly growth print in since the inflation crisis kicked off back in 2022.

The concern here is that if the largest consumers on the planet are seeing a pullback in growth, the global economy may also experience a slowdown.

If you prefer a more fear-driven analysis, then some might choose to describe a slowdown as a recession.

Tonight at 10:30pm AEST, preliminary GDP data from the U.S will be released, and the expectation is that growth figures will continue to sour with -0.3% forecasted.

But, don’t lose hope. There is data that challenges the idea that it’s all doom and gloom. I go over this in more detail in a post that I encourage you read.

The key point is that jobs are continuing to grow in the U.S., which manifested in non-farm job numbers landing higher than forecasted last month. Growing labour is often a telling sign of a growing economy, and not what you would typically see heading into a recession.

Data models which look to forecast GDP using the data available this quarter so far, like GDPNow, are pointing to a 2.1% growth figure – a polar opposite of the -0.3% forecast from the US Bureau of Economic Analysis.

So, is this a case that market might be getting ahead of itself in expecting the worst? Set your alarms and we’ll get the next piece of the puzzle tonight 10:30pm AEST.

Chart of the week – Global GDP data is flashing growth mode

While we’re talking growth, let’s look at how the rest of the globe is performing.

The annual percentage change in real GDP (which is inflation adjusted growth) across major economies show that things are looking better than they did a year ago.

So maybe things aren’t all as bad as you might hear. The trend globally in the last 12 months has been in favour of growth, even in the macroeconomic shock we have witnessed at the start of this year.

We are seeing solid data land above market expectations on job growth well after the tariff’s had started, and recent data is supportive that we shouldn’t be overly concerned of a recession in the very near future.

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.