Key Takeaways

- Ethereum hit back hard last week, gaining 39%, one of its biggest seven days on record.

- This came after the Ethereum network rolled out a new upgrade, dubbed ‘Pectra’, addressing scaling and performance issues.

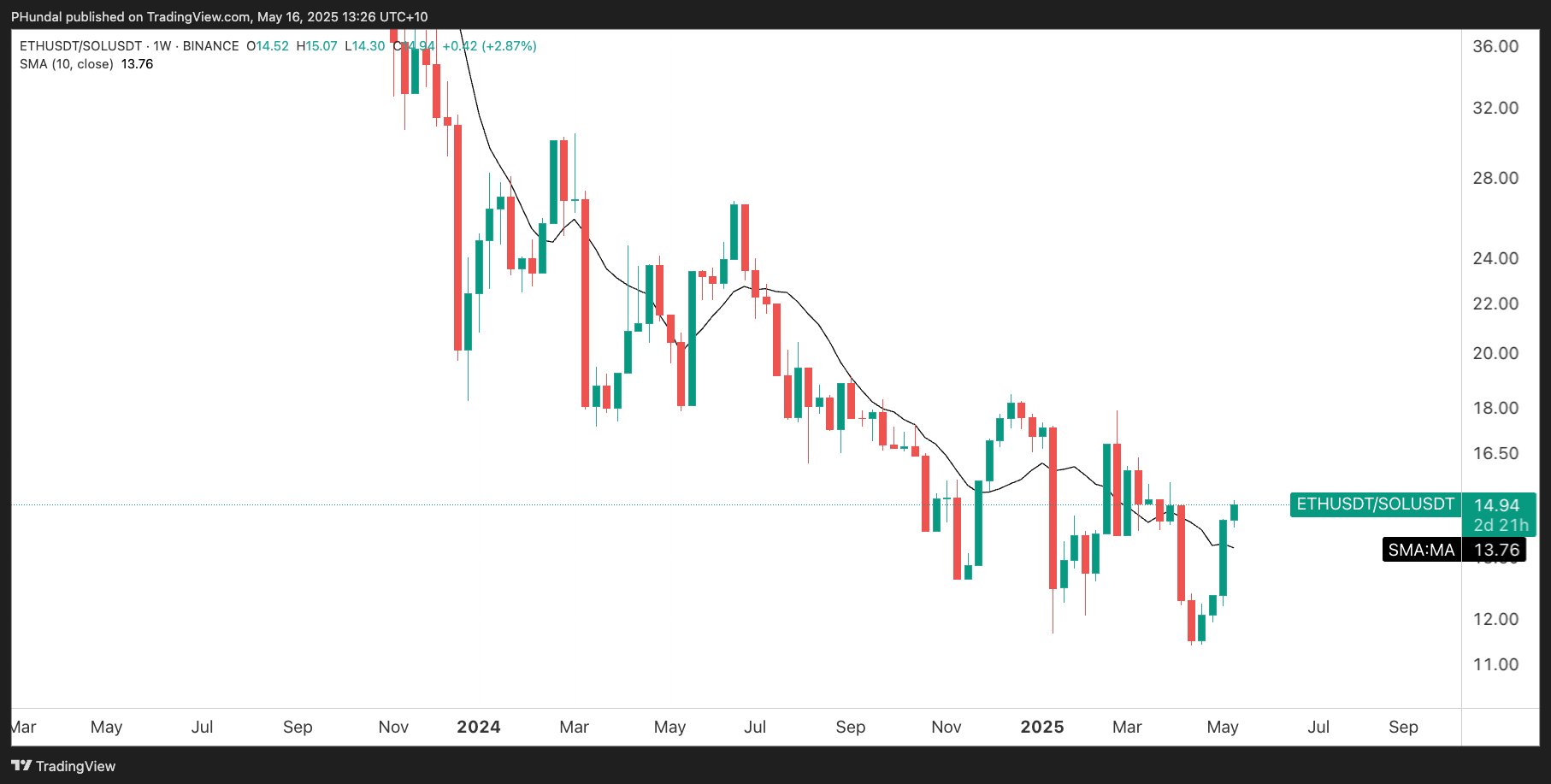

- Chart of the week: ETH vs SOL, a quick look at relative strength.

Last week was a nice change of pace.

That’s how I describe the broader market rally we saw across crypto – a change of pace. It was nice to switch the focus point after weeks of negative headlines and wavering messaging around the unpredictable trade and tariff war.

Finally something we can all enjoy!

There was one particular standout that has been very quiet in recent months – Ethereum.

Heavily criticised for underperforming over the last year compared to Solana and newer kids on the block like SUI, the project suffered leadership crises and growing scalability concerns. There was enough reason for investors to question their commitment to the project.

But maybe this latest move will provide some reassurance – ETH isn’t going anywhere.

Ethereum HODLer’s rejoice

Both seasoned and new holders of Ethereum had plenty to cheer about. A 39% weekly surge has catapulted Ethereum into one of its best seven-day performances to date – after leaving many disheartened by its weak showing compared to other L1 infrastructure tokens like Solana and Sui.

To give some perspective, in the last 365 days, according to Coingecko, Ethereum is down -14%. During this same period Solana has seen a 7% gain and – hold your hats – SUI has seen a roaring 299% gain.

The past week has breathed life back into the market’s 2nd-largest project. But is there more brewing for Ethereum? Can we start officially saying: ‘Ethereum is back?’

Well, to answer that question, we need to consider whether its latest upgrade, Pectra, is helping Ethereum close the gap on its rivals

Pectra upgrade

Adding some fuel to the optimism around Ethereum has been the launch of Pectra, the project’s latest network upgrade. This looks to make some much-needed improvements to the network in terms of performance and scalability. This is particularly relevant as competition from newer chains is heating up – both in terms of on-chain and price metrics.

A highlight of the Pectra upgrade is EIP-7702, which allows wallets to temporarily execute smart contract code. This is a major move towards improving DeFi accessibility, for example – the improvement allows you to interact with decentralised applications (dApps) without any ETH in your wallet.

Another upgrade, EIP-7691, looks to improve the throughput of Layer 2 networks such as Arbitrum and Optimism. This is a win for both users and and builders, an improvement for the technical capacity of these scaling solution networks.

Next, let’s look at the longer-term relationship of strength between Ethereum vs Solana to find out – which one’s been stronger.

Chart of the week – ETH vs SOL, a quick look at relative strength

Even with Ethereum’s week to remember, when we compare ETH and SOL’s price performance head-to-head , Solana has been the clear winner over time.

This chart measures ETH’s price performance divided by the price performance of SOL. As the chart moves up, it means Ethereum is outperforming Solana and vice versa.

Now, since the start of May, we have seen Ethereum buck the historic trend and outperform Solana considerably. We are, however, getting to an inflection point where the market will tell us something very important about these two assets.

In the coming months, the market will either chose to continue finding more strength in Solana, and we will see a rotation in this relative strength. Back to the status quo, if you will.

Or perhaps, the past week was a sign of things to come, and we see a breakout on this chart.

Can Pectra help Ethereum recapture the confidence of investors and start to trend higher relative to Solana? My opinion there is a difference between hoping and knowing, and time will tell us if this trend shifts away from Solana.

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.