Key Takeaways

- Markets flash red after US policy makers fail to reduce interest rates overnight, casting doubt in the minds of inventors.

- President Trump’s working committee delivers long-awaited report, promise to make America the ‘crypto capital of the world’.

- Chart of the week: Bitcoin’s historical price performance into the end of Q3.

If you’re wondering what just happened to crypto markets this week – you’re not alone.

After July saw weeks of double-digit gains across altcoins and Bitcoin hitting new all-time highs, the sudden pullback to close out the month has left many with a bitter aftertaste.

But let’s not lose sight of the bigger picture.

July has been a landmark month for crypto. We’ve seen a surge in corporate adoption, major progress on US crypto legislation and the release of long-awaited recommendations to President Trump from the national crypto working group – a blueprint for making the US the global hub for digital assets. More on that shortly.

But first lets dive into what happened this week that caused the sudden de-risking or selling off?

It may have a lot to do with the market’s expectations on interest rates and monetary easing.

US policy makers deliver caution

Wednesday night we saw the US Federal Open Markets Committee (FOMC) deliver the latest guidance on interest rates. The results came as expected – no change. However, it was Fed. Chair Jerome Powells remarks during the proceedings that really caught the market off-guard.

This FOMC meeting comes during an interesting period where President Trump has been heaping pressure onto Jerome Powell. The president vocalising the inaction of policy makers to reduce interest rates will have negative consequences for growth in the US.

The key call outs from me through all the noise is that the Fed committee:

- Powell is firm that the economy isn’t being held back from growth, under the current level of restrictive policy.

- Members from the committee are showing misalignment in their views.

- And are not citing or pointing to any specific data (e.g. inflation, growth targets, job data) point to either reduce rates or ease monetary policy conditions.

What will be fascinating to watch is how the market reshapes its own expectations, knowing that the Fed might not be willing to drop rates. As we’ve seen in the latest rounds of data, both jobs and growth are looking optimistic – giving no real urgency for quantitative easing.

While we wait to see how the market feels in the near term, the longer-term outlook for crypto has arguably never looked better.

Crypto report delivered to White house overnight

Since January, Trump’s assigned crypto Working Group has been tasked with bringing the President’s vision of making America the ‘crypto capital of the world’ to life. The nation intends to do this by embracing a forward-thinking, innovation-first approach to digital assets and blockchain technology.

While the report doesn’t offer a clear short-term roadmap for crypto use, it does present a comprehensive framework for long-term adoption. You can read it here.

Some key takeaways from the document recommend how to:

- Establishing Clear Legal Rights for Users and Developers

- This lays foundational legal clarity for future innovation and usage, rather than pushing for a narrow short-term implementation.

- Decentralized Finance (DeFi) Integration into Regulatory Frameworks

- This recognizes DeFi as a long-term pillar of the crypto ecosystem, laying groundwork for safe integration rather than prescribing short-term financial product rollouts.

- Stablecoin Policy and Dollar Dominance

- This positions stablecoins not as a quick-fix payment method, but as a strategic long-term tool in global financial influence.

This is all about integrating crypto technologies and solutions into the long-term strategic direction of the US. And there is a good chance this report lays the groundwork for other countries to follow suit.

So, now that we’ve had a bumper July and experienced the market tapping the brakes – what can we expect for the months ahead? That’s where seasonality data may provide some insights.

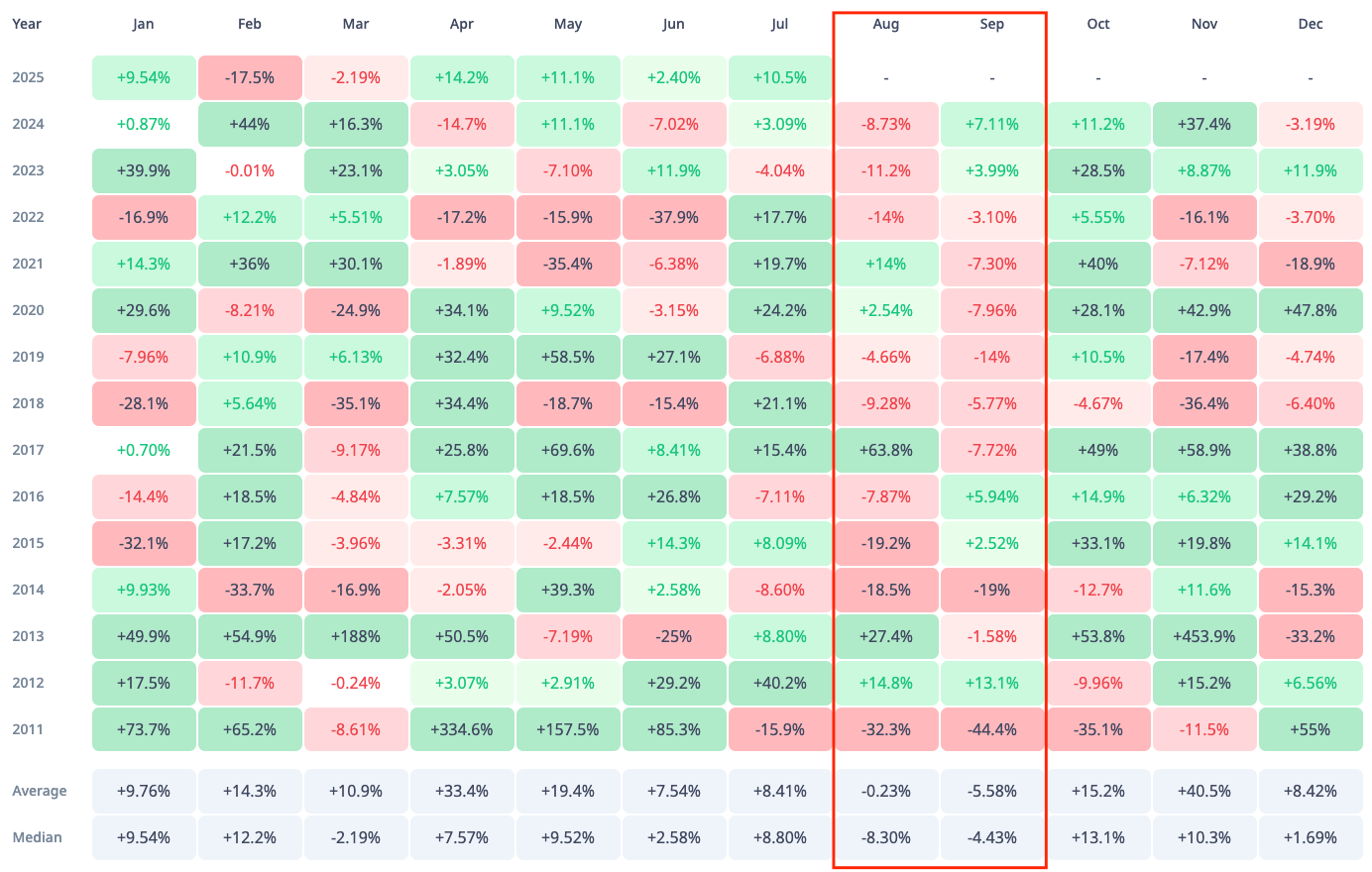

Chart of the week: Bitcoin’s Historical Price Performance into the end of Q3.

Seasonality describes the historical trends Bitcoin has shown us over the course of the calendar year. Unfortunately, it doesn’t favour the bulls heading into the back end of the third quarter. Average returns for Bitcoin during these periods are -0.2% in August and -5.5% in September respectively.

While this doesn’t predict future performance, it does show that historically the wind isn’t blowing in the sails of investors over this period.

When we strip it all back – it’s encouraging to see crypto asserting itself more confidently on the global stage. There’s growing consensus among policymakers that this ecosystem holds real value.

For many of us who’ve backed this space early, this moment reflects the vision we’ve believed in all along. And even if we do experience a quieter phase – the long-term blueprint for the industry remains unchanged.

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.