Key Takeaways

- XRP continues to show strength this week, as it enters the top 3 by market cap.

- Inflation data in the US lands lower than expected.

- US states continue to show support for strategic Bitcoin reserves.

An eventful week for Bitcoin, moving to $90,000 on Monday, to where it now trades at above $100,000 US. Another standout this week has been XRP, where it has broken into fresh all-time highs not seen since January 2018.

It was a significant news week, with key developments in macroeconomics and politics, which we will discuss below.

US Inflation Data

Sentiment on US rate cuts could be described best as volatile to kick off 2025. Optimism in 2024 quickly turned to cynicism in January, as analysts at Goldman Sachs warned that rising late-2024 inflation could delay rate cuts in 2025. However, lower-than-expected core consumer and producer inflation figures this week have provided positive momentum.

The leading inflation metric, Personal Consumption Expenditures (PCE), used by monetary policymakers in the US will be landing at the end of this month. This figure will directly impact the expectations of the Fed in the short term and likely influence the first US interest rate meeting for 2025 in February.

Political support for Crypto from the US

With Donald Trump’s presidential inauguration looming next week, there’s news of US states putting forward legislative frameworks to provide Bitcoin as an asset on their treasury balance sheets. The five states, at present, include Texas, Pennsylvania, Ohio, New Hampshire and North Dakota.

Donald Trump has also made it known that crypto is a national priority within his administration. Recent news of Trump purportedly receptive to the idea of including other US-based cryptocurrencies like Solana and XRP has stirred the market.

“What I think Donald Trump is going to do is signal that the United States is back and we are ready to lead in this industry,” said Kara Calvert, vice president for US policy at Coinbase Global Inc., the country’s biggest cryptocurrency exchange. “What it’s signalling to other countries is be careful, or you won’t keep up.”

Fear and greed currently reads 57 – Neutral.

Bitcoin Analysis

Using a Bollinger Band, Bitcoin is currently shifting to the higher extreme of the banding when measured on a 12-hour timeframe.

What is also notable is that market prices have so far accepted back above the December 2024 monthly low, and we are presently pushing off the November high now.

Bullish Scenario

If Bitcoin stays above the middle of the Bollinger Band (blue line), this can be seen as a sign of support from the market. This would be significant after prices reclaimed the December and November key levels in black.

Bearish Scenario

If Bitcoin fails to attract buyers at these levels, the price could drop and fall below the November highs.

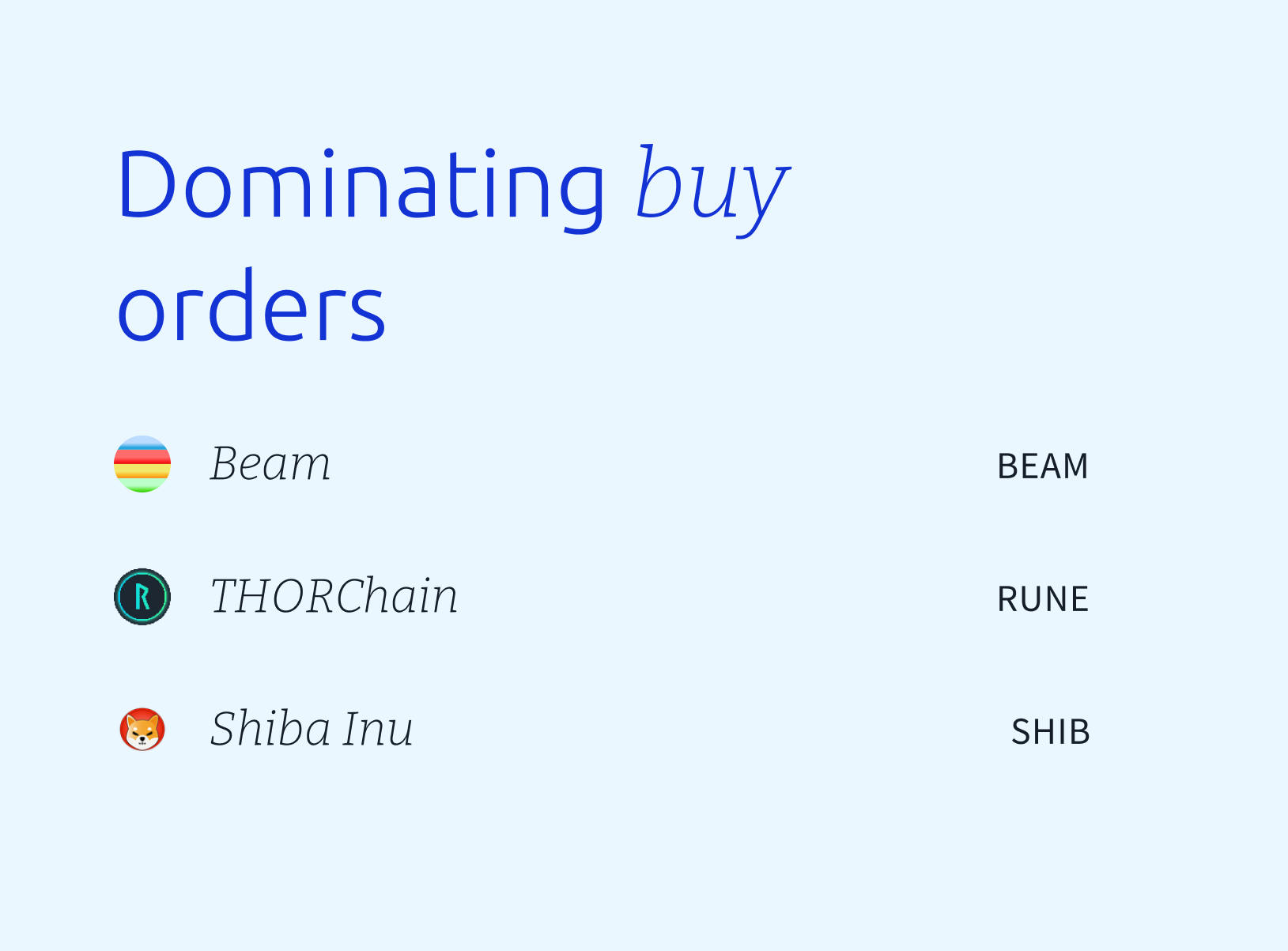

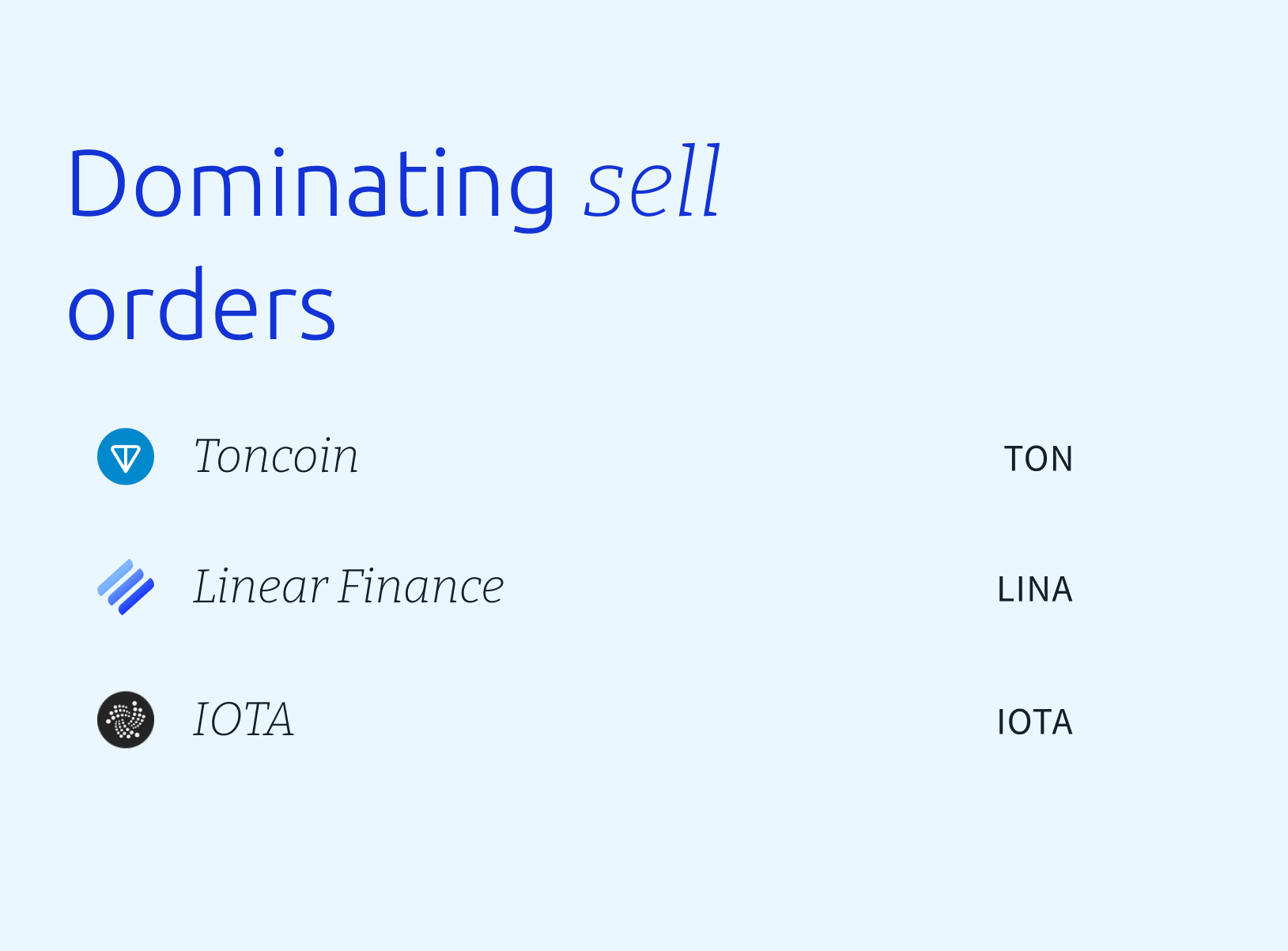

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.