Key Takeaways

- US and China to meet in Switzerland this week for first formal talks since the trade war started.

- US monetary policymakers hold interest rates, highlighting concerns that Donald Trump’s tariffs may raise economic risks.

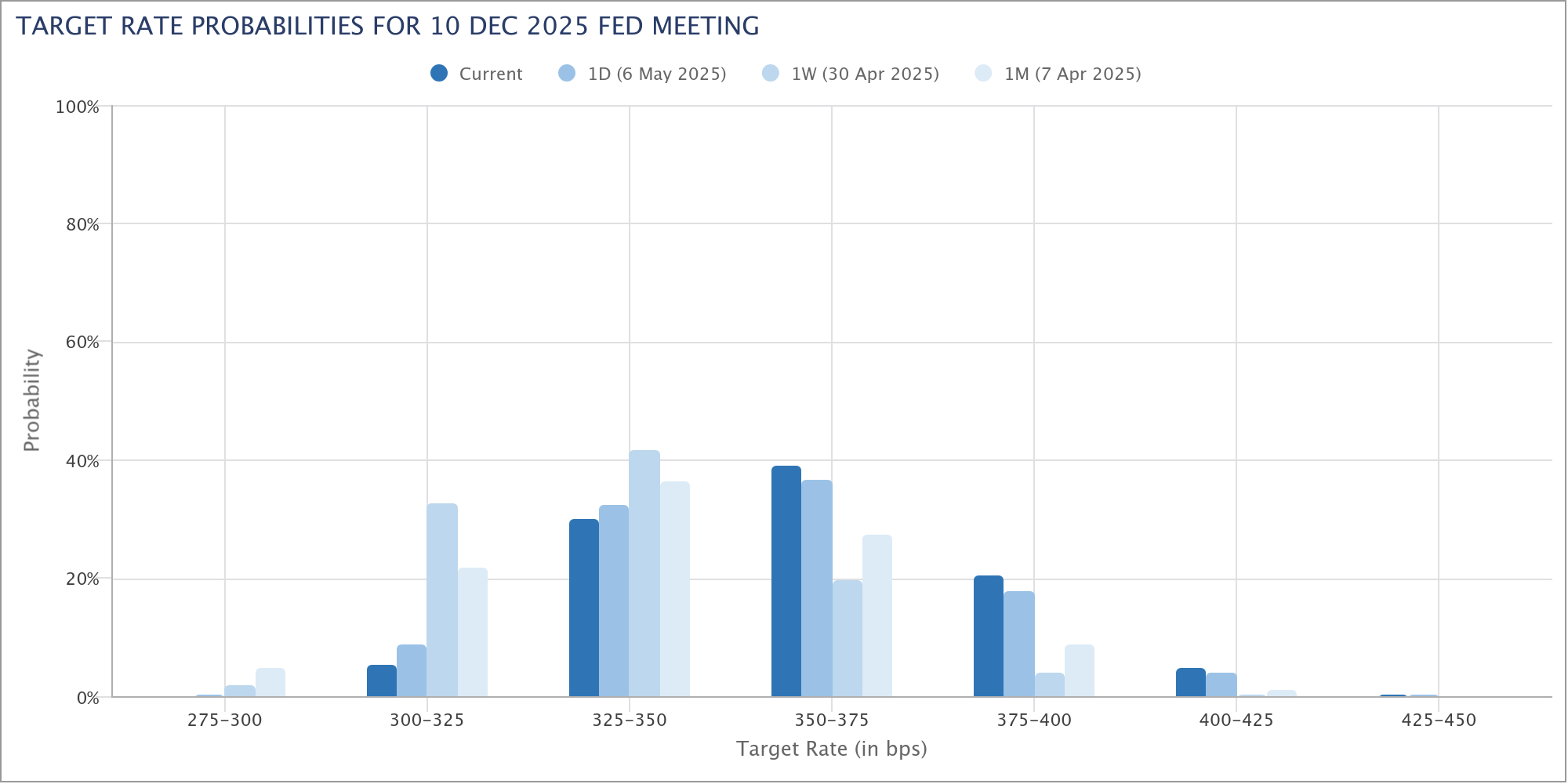

- Chart of the week: 2025 Interest Rate Expectations in the US. How the market’s expectations have evolved over the last month.

Consistency and clarity.

Those are two words I’ve mentioned in recent weeks that have been missing throughout this trade war debacle. But we might finally be able to tick off ‘consistency’, after back-to-back weeks of progress between Trump and other leaders.

Crypto has marched higher this week after another dose of de-escalation from the US and China in this trade feud. Bitcoin quickly moved to $97,000 USD on the news that US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will meet with the Chinese government this week in Switzerland.

So what gives? Will the market run every time something positive is announced on tariffs? Well if you subscribe to the idea that most businesses and the market are fearful and uncertain of what tariffs will do to the economy – the answer is likely yes.

Like any news catalysts, you should expect over time positive tariff revelations to lose their impact factor. But, right now, it’s likely what the market cares most about.

Confidence is clearly shot. It’s not hard to see why when you consider the seemingly endless noise and random tirades from Trump (like the 100% tariff on non-US movies this week…).

We know this economic uncertainty stemming from the Trump camp has been a huge reason the crypto market’s been stagnant for much of 2025.

So, any clarity and direction towards de-escalation is very welcomed from the market. But we might still be a while away from economic stability revealing the upside crypto hinted at late last year.

It’s not just the crypto market that’s spooked by tariffs, with US policy makers echoing this sentiment earlier today.

Rates on hold

The US Federal Open Markets Committee (FOMC for those of you playing along at home) have held interest rates steady for the third meeting in a row.

During question time, Fed chair Jerome Powell was quick to articulate that the economy looked to be in great shape from a data perspective but cautioned that ‘Uncertainty about the economic outlook has increased further’ with respect to the tariff regime.

Powell stated that they are in no hurry to make changes. He said the ‘right thing to do is await further clarity’. Overall, the press conference was interpreted by many journalists as a calming message during these uncertain times.

Overall, the markets were not swayed on the release in any direction in particular. You could lean that the responses were hawkish in nature – directing that the current problems the economy face are likely to get worse if tariffs remain the same. Again, another reason these deals are causing so much optimism.

We have interestingly seen some re-adjusting of market participant expectation towards interest rates, which I’ll cover next.

Chart of the week – US 2025 target interest rate probability shifts over the last month.

The Chicago Mercantile Exchange (CME) uses its own modelling on US bond markets trading behaviours to produce a probabilistic outcome of future interest rate changes. You can read more about it here.

What the below chart shows is a notable cooling in expectations on what the final interest rate will be in 2025. Expectations are shifting, the market is now expecting less interest rate drops than a month ago.

Interest rates set the price of borrowing money, which can be then used to stimulate economic growth.

The next meeting for these key interest rate decisions is 41 days away on the 18th of June. It will be interesting to note how the changes in the broader economy continue to impact the market’s perception on the future value of money, and therefore by virtue the amount of growth we could expect on the horizon.

Crypto markets have performed well during periods of economic growth, so any surprise of better-than-expected outcomes would be well received. Should we see any actual results outside what the market is expecting, likely this won’t be price into the market. Such as cuts coming faster or sooner in the year than expected, or vice versa.

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.