Key Takeaways

- Last week’s inflation data landed about as clear as mud. Consumer inflation cooled while wholesale inflation ticked higher, leaving markets spinning.

- All eyes now turn to Jackson Hole, the last major stop before September’s FOMC. With Powell set to speak, the market may be hanging on every word to gauge what comes next.

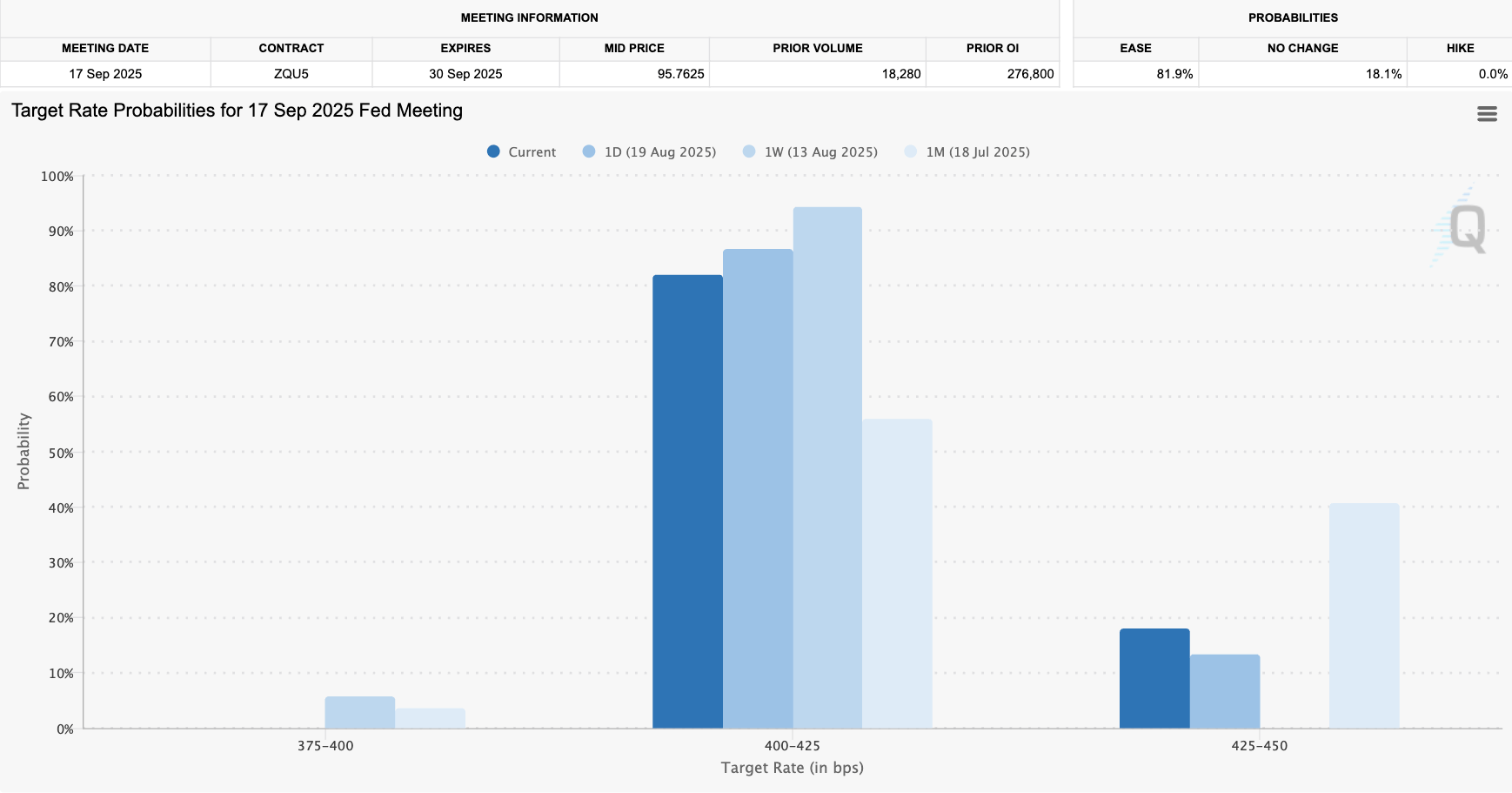

- Chart of the week: Changing Views on the Fed’s Final 2025 Interest Rate over the last month.

Last week’s inflation data has dealt a severe case of whiplash to the market. We’ve been flagging this as a key moment for weeks. (Check out the last two videos as a refresher).

To bring you up to speed: Consumer inflation cooled, wholesale inflation heated up, and crypto markets have chopped around trying to make sense of it all.

That’s the problem with data like this. It gives both the bulls and the bears something to shout about. Cooling CPI fuels the rate-cut narrative. Hotter PPI reminds us inflation might not be dead just yet. And in between, prices just twist and turn.

It seems the markets won’t climb out of this uncertainty by themselves – but maybe Jackson Hole could give them a foothold.

Every year, leading economists and monetary policymakers descend on Wyoming. The mountain views are picture perfect, but it will be Fed Chair Powell’s message to the markets that really set the scenery for the weeks ahead.

Now, you might not remember this, but at Jackson Hole in 2024, Powell surprised the market by laying out the pathway for rate cuts. That was a big departure from the hawkish stance he’d held through 2022 and 2023, when it was all about fighting inflation at any cost. At that event, he acknowledged progress on inflation – and just weeks later, on September 18th, we saw the first Fed rate cut in years.

So, what are the outcomes we should be watching for?

The playbook

If Powell leans dovish (acknowledging disinflation and giving the market a wink that cuts are on the table), risk assets will love it. Crypto could rip, ETH probably keeps outpacing BTC and alts might finally catch a proper bid.

If he sticks to the hawkish script (inflation still sticky, cuts not guaranteed), it’s a cold shower moment. Expect a reset, with BTC dominance firming up as traders de-risk.

The key takeaway is this: The market currently has an 75% expectations of a rate cut at the next FOMC meeting on September 17th. Although the odds are very slowly moving out in the past week, most are still convinced quantitative easing is coming.

Jackson Hole is where that conviction gets put to the test.

Now let’s dive into understanding how these expectations have evolved in recent times also adds some additional context.

Chart of the week: Changing Views on the Fed’s Final 2025 Interest Rate

Interest rates are the price of money. The market’s expectations about where rates are going can send ripples through the global economy. Even Bitcoin can’t escape this macro influence, as we saw in 2022 when rates increased globally and Bitcoin failed to move higher. It’s not the only reason why, but it’s part of the story.

Which is why understanding how the market is expecting interest rates to play out for 2025 will help forecast where the rest of the year may be heading.

The below graphic shows how the market’s expectations on what the Fed will do in the September meeting has changed in the last month. For reference, the Fed targets interest rates within ranges, not absolute percentages. The current target range is 425-450, meaning 4.25% to 4.50%.

A month ago, the market saw no change. A week ago, it was certain on cuts. Today? It’s betting on at least a 0.25% ease, with less conviction than just seven days ago.

And to make matters even more complicated, Polymarket odds – while still heavily leaning pro-cut – are moving closer to parity than they’ve been throughout August.

Those kinds of swings show just how unsure the market is right now for what comes next. It needs more data for direction.

I don’t blame if you feel this chop is exhausting. But Jackson Hole might finally give us the signal that breaks the deadlock.

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.