Key Takeaways

- Publicly traded companies in the US are holding billions of dollars of Bitcoin on their balance sheets – and this demand is growing.

- Some of these companies are starting to look beyond Bitcoin. Tom Lee from Fundstrat, for instance, is joining a new venture aiming to replicate the MicroStrategy playbook – but this time with Ethereum.

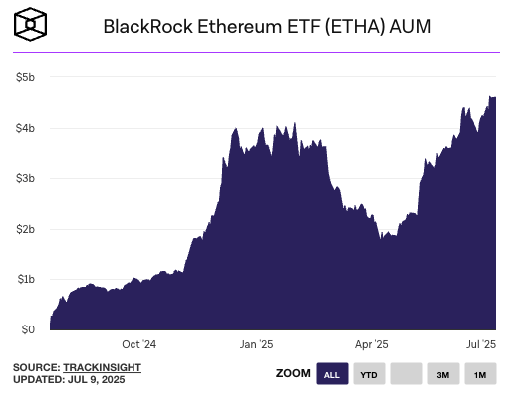

- Chart of the week: BlackRock Ethereum Exchange Traded Fund (ETF) hits new all time high in funds under management.

There is one thing you should know about crypto as we cross the halfway mark for 2025 – a new wave of corporate demand for crypto is here, and it isn’t slowing down. With Bitcoin hitting new all-time highs this week, I want to spend some time highlighting a growing demand driver for crypto, publicly listed companies.

If you’re not aware, Michael Saylor’s company Strategy (formerly MicroStrategy) has outperformed both every company in the Nasdaq 100 and even Bitcoin in the last 12 months, boasting a 208% return.

Simply put, it’s been a raging success – and we are starting to see other companies around the world follow suit.

An emerging trend

Looking at the data, US companies dominate Bitcoin holdings, representing eight of the top ten publicly traded firms with the largest reserves. Together, these companies hold an impressive $81 billion USD worth of Bitcoin at current prices.

But a shift is starting to brew, with demand beginning to move into Ethereum. SharpLink Gaming Inc. (SBET) is one of the publicly listed companies to recently adopt some form of crypto-backed strategy in their corporate treasury functions.

Recently, SharpLink successfully raised $64 million USD to deploy a staking strategy where 205k+ Ethereum is currently held. It’s reported that approximately 100 ETH have already been generated in staking activity in the last week, which would be worth approximately ~ $399,500 in Aussie dollars today.

Will we see more corporations adopt SharpLink’s staking strategy to unlock additional cashflow? Could this approach mark the beginning of renewed demand for ETH? Tom seems to think so…

All-in on ETH

Tom Lee is co-founder and Head of Research at Fundstrat, an independent financial research boutique servicing Wall Street. He’s well known most recently for being a bull in 2023 and 2024 against the consensus at the time.

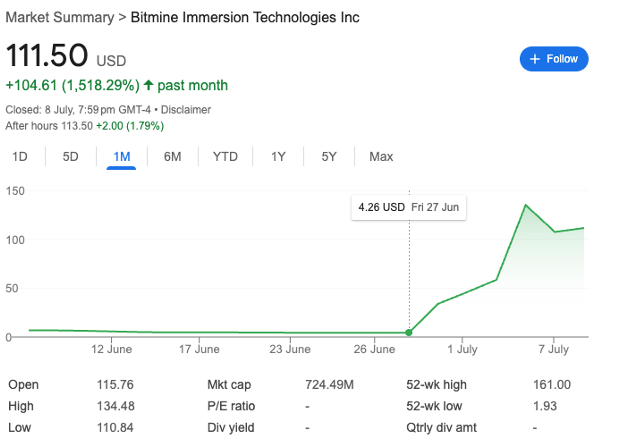

He’s now joined BitMine Immersion Technologies – a relatively small player in the mining space with an ambitious goal to become the largest publicly traded holder of Ethereum. Their strategy mirrors the playbook Michael Saylor used with MicroStrategy and Bitcoin – but this time, it’s all about ETH.

Currently a $250 million USD private placement has been announced to build up these reserves.

BitMine shares have jumped an approximate 1,500% since this news has been announced.

Both stories reflect a growing consensus that crypto isn’t going anywhere, and there are still opportunities to unearth. The recent push to formalise stablecoin regulation – many of which are likely to rely on the Ethereum network – may also be adding tailwinds to these strategic moves.

Chart of the week: BlackRock Ethereum ETF hits new all-time highs.

Things start to get interesting when we zoom in on Ethereum ETF demand in the US – we’re now seeing levels that surpassed the previous peak back in January 2025. Leading the pack is BlackRock’s product, ETHA, which currently manages $4.6 billion in assets.

Let’s take a step back and tie this back to the bigger picture. So far, US Ethereum ETFs are limited to spot exposure – but that could soon change. Amendments are already on file with regulators to allow staking within these products.

While niche players like BitMine and SharpLink have the in-house expertise and governance to stake ETH and earn yield directly, there’s a much larger group of investors still on the sidelines waiting for regulated products to offer staking natively.

What happens when those doors open?

💱 Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.