Key Takeaways

- The Genius Act defines a clear legal framework for issuing stablecoins.

- Only regulated banks and trust companies can issue stablecoins, backed by real assets held in secure, segregated accounts.

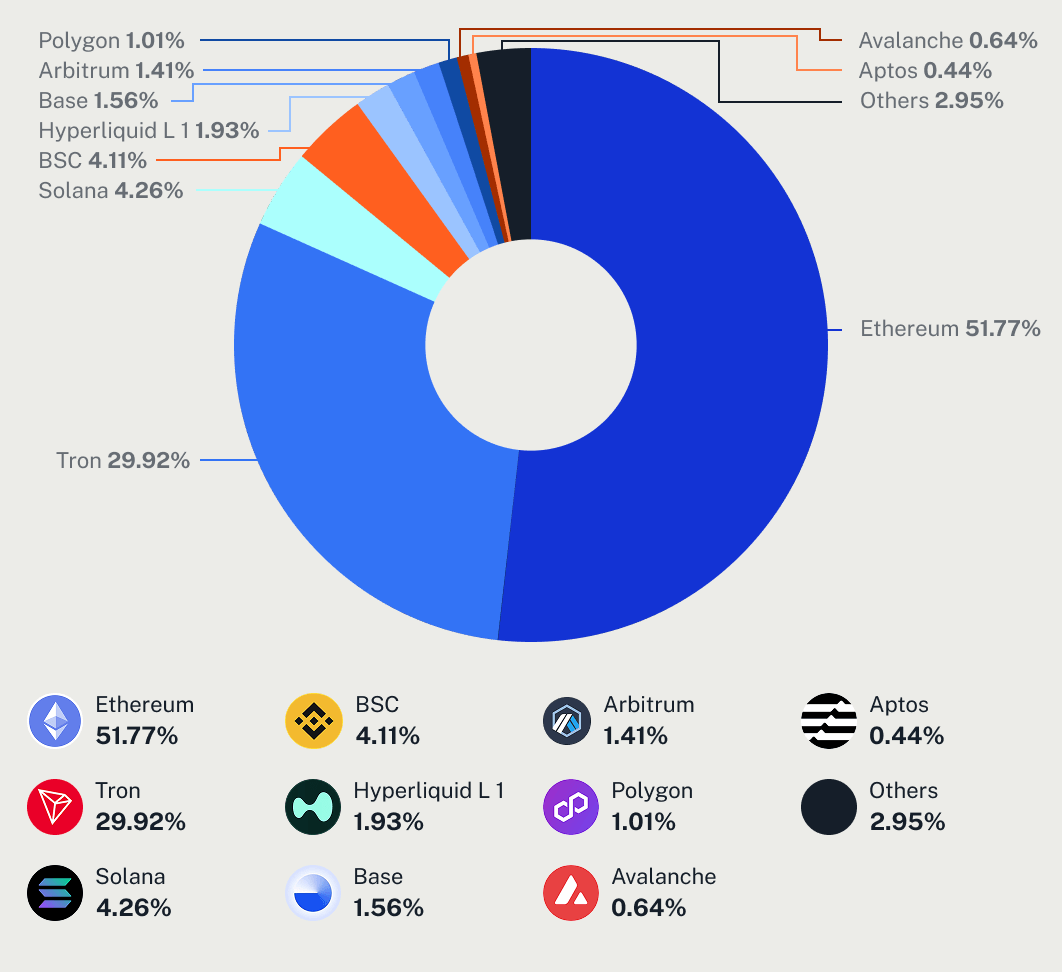

- Ethereum and TRON stand out as major winners, with Ethereum attracting large-scale decentralised finance (DeFi) development and TRON leading peer-to-peer payments.

The Genius Act: Legitimising Stablecoins

The Genius Act is U.S. legislation that defines who can legally issue stablecoins, which are often digital tokens backed by fiat currencies like the U.S. dollar. It was signed into law by President Donald Trump in mid-July to bring regulatory clarity to a fast-growing sector.

Under the law, only regulated financial institutions such as banks and licensed trust companies are permitted to issue stablecoins. These tokens must be backed one-to-one with U.S. dollars or short-term U.S. Treasuries. The money backing each stablecoin must be kept separate in approved accounts so users know their funds are protected and properly managed.

Late in July, the White House published a comprehensive report full of recommendations that are intended to make the U.S. a global leader in crypto. One of the report’s many recommendations was for the ‘faithful and expeditious implementation’ of the Genius Act by the Treasury and banking agencies.

Why The Genius Act Should Accelerate Stablecoin Growth

The Genius Act addresses three key needs in the stablecoin sector:

- Legal clarity for developers. It gives builders the confidence to create new products without worrying about retroactive penalties. Clear rules encourage innovation and responsible growth in the crypto space.

- Protection for stablecoin issuers. Issuers can now operate without the fear of legal action, provided they follow the rules. This shifts stablecoins from legal ambiguity into a recognised and regulated part of the financial system.

- Reinforcement of U.S. dollar dominance. USD-backed stablecoins already dominate stablecoin volume. By providing a legal framework, the Genius Act ensures that anyone with a smartphone can access digital dollars. This is especially powerful in countries with inflation or economic instability, giving people a more stable option. For the U.S., it extends the reach of the dollar and spreads its monetary influence.

Who Benefits?

The Blockchains

Ethereum, the leading blockchain for all things decentralised finance (DeFi), among other use cases, is arguably the most well-positioned to benefit from the Genius Act. Companies and institutions will naturally gravitate toward the most established layer-one (L1) blockchains to compliantly build on top of it.

TRON, on the other hand, is favoured for its fast, low-cost transactions. It has become the leading chain for peer-to-peer payments, with stablecoins on TRON predominantly used as a payments network, particularly in regions where access to traditional banking is limited or costly.

Stablecoin Supply By Blockchain

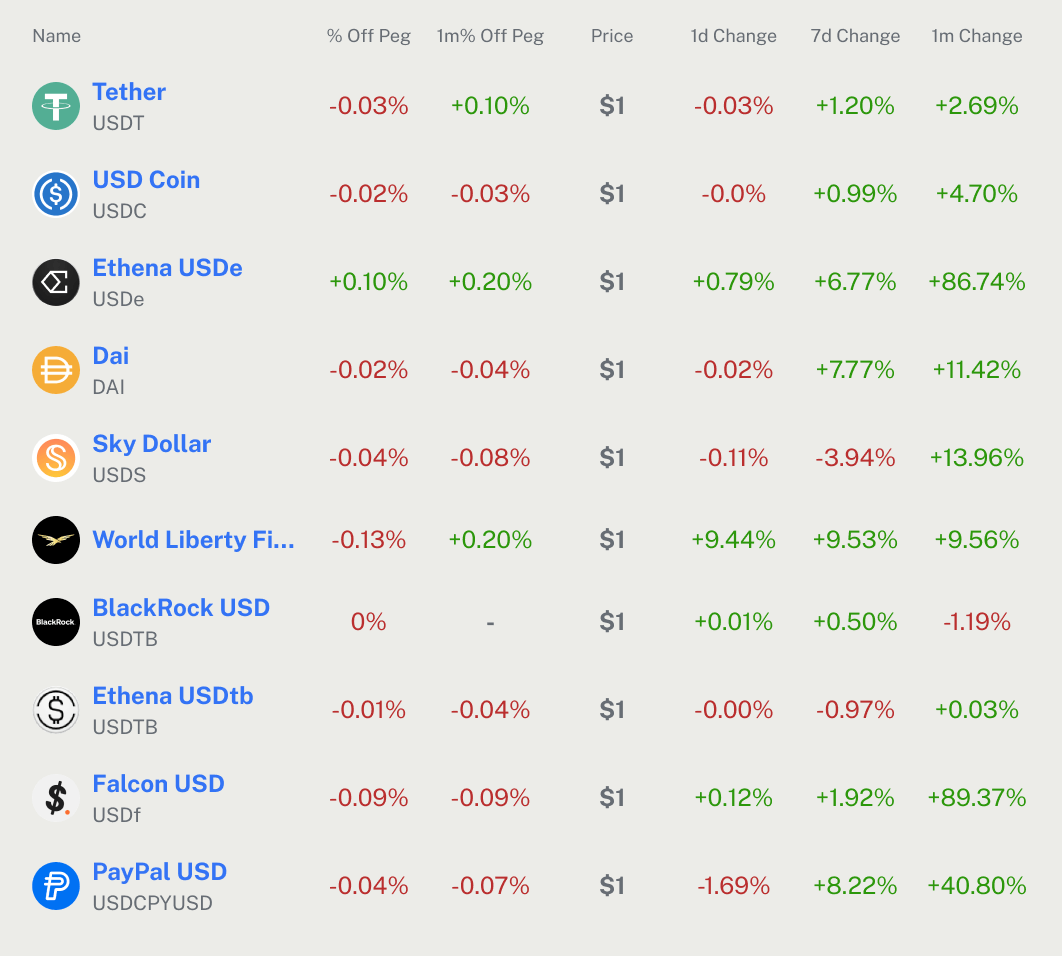

The Stablecoin Issuers

Stablecoin creators may also benefit from the new rules. Take Tether (USDT), for example. It issues tokens pegged to the U.S. dollar and holds reserves in U.S. Treasuries. The yield on these assets generates billions in revenue annually.

Banks in the U.S. would undoubtedly know about Tether’s success, and now, with a clear legal framework, they have the greenlight to replicate this business model.

This creates a major financial incentive for regulated banks and trust companies. Those approved to issue stablecoins can effectively operate like mini central banks, minting digital USD and earning yield on the reserves.

The rules also open a clear pathway for new participants to enter the market, potentially improving decentralisation among stablecoins and incentivising innovation to keep up with competitors.

Top Ten Stablecoin Market Cap

Conclusion

The Genius Act brings stablecoins out of legal limbo and into the regulated mainstream. It defines who can issue them, how they must be backed, and where the reserves are held, all of which increase user trust and institutional interest.

For developers and blockchain platforms, this opens the door to innovation without fear of regulatory backlash. Ethereum is positioned to attract large-scale applications, while TRON continues to double down on stablecoin payments and related use cases.

This legislation doesn’t just legitimise stablecoins, it provides the regulatory clarity needed for stablecoin adoption to enter the next growth phase.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.