Key Takeaways

- Monthly and quarterly closes at the end of this week.

- US Policymakers solidify the reality of interest rate cuts.

- US GDP and Inflation data to impact markets over the next two days.

After a breakout on Friday last week, we now find Bitcoin trading just above last week’s open price of $58,480 USD.

Why the breakout?

This move may have been influenced by a key announcement out of the US, with the Federal Reserve Chair, Jerome Powell, publicising for the first time publicly that rate cuts are coming.

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” Jerome Powell, Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming.

Bitcoin specifically moved 5.2% between the time of the announcement and the daily close at 10 am AEST on Saturday.

Macro events left for the week

The latest US Gross Domestic Product (GDP) figures will be released tonight at 10:30 pm AEST. Current expectations are for 2.8%, a repeat of last month’s figure.

Friday at 10:30pm AEST will bring the latest leading metric for inflation in the US: Personal Consumption Expenditures (PCE). This metric describes the change in the price of goods and services purchased by consumers. The forecast is for 0.2%, again a mirror of last month’s figure.

As Jerome Powell stated, the pace of rate cuts will depend on incoming data, which is why these data results are impactful.

Fear and greed currently reads 45.

Bitcoin Analysis

After the explosive move towards the back end of last week, Bitcoin has now retraced the move entirely.

Bullish Scenario

Back at the previous lows, where the breakout began last week, we could see some support from the bulls here to potentiate the next swing higher back towards $64,000 USD.

Bearish Scenario

With Bitcoin now trading back inside the current range identified above, we could see sellers continue to add pressure and move prices to the lows of $56,000 USD.

💱 Flows

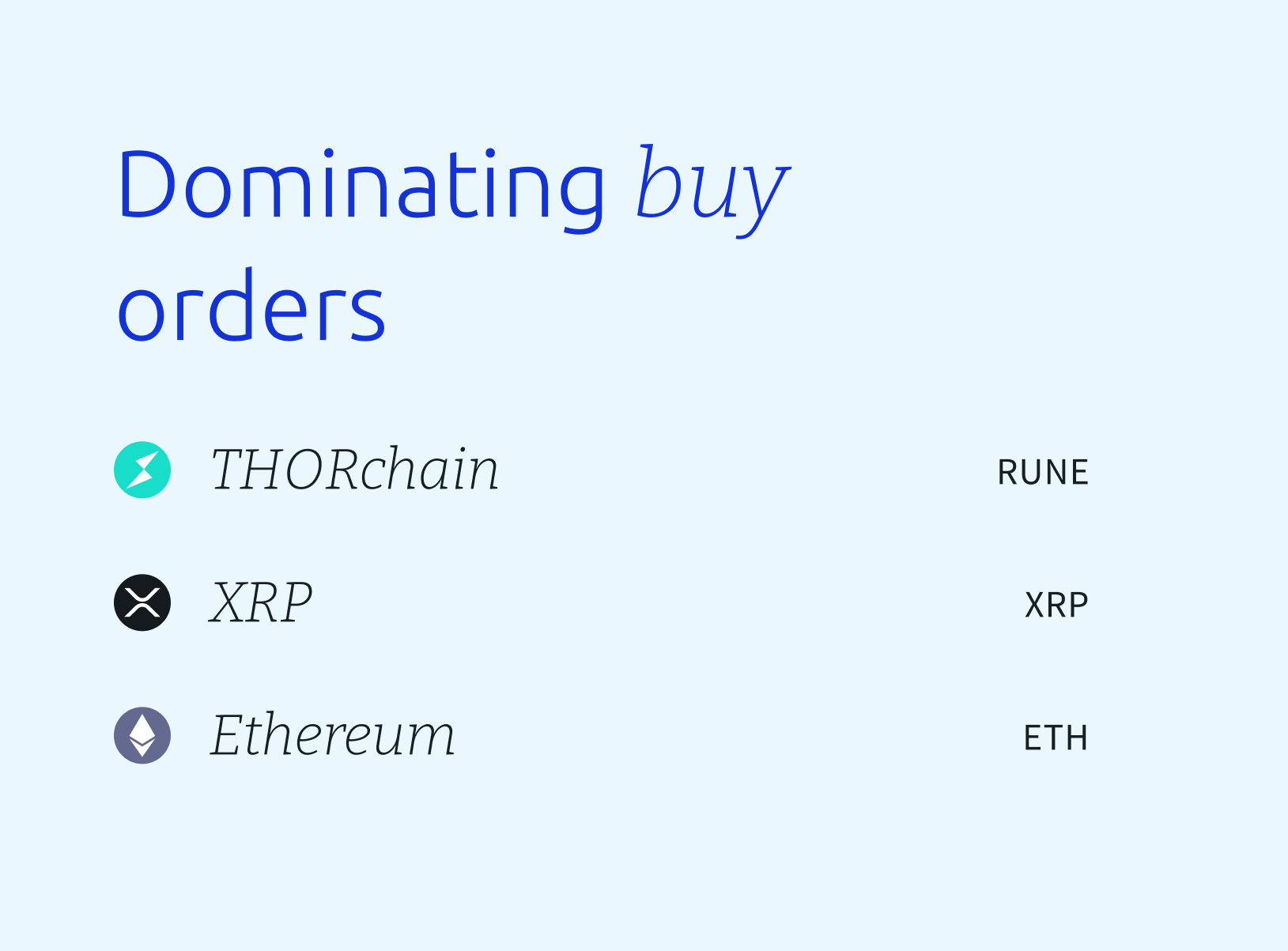

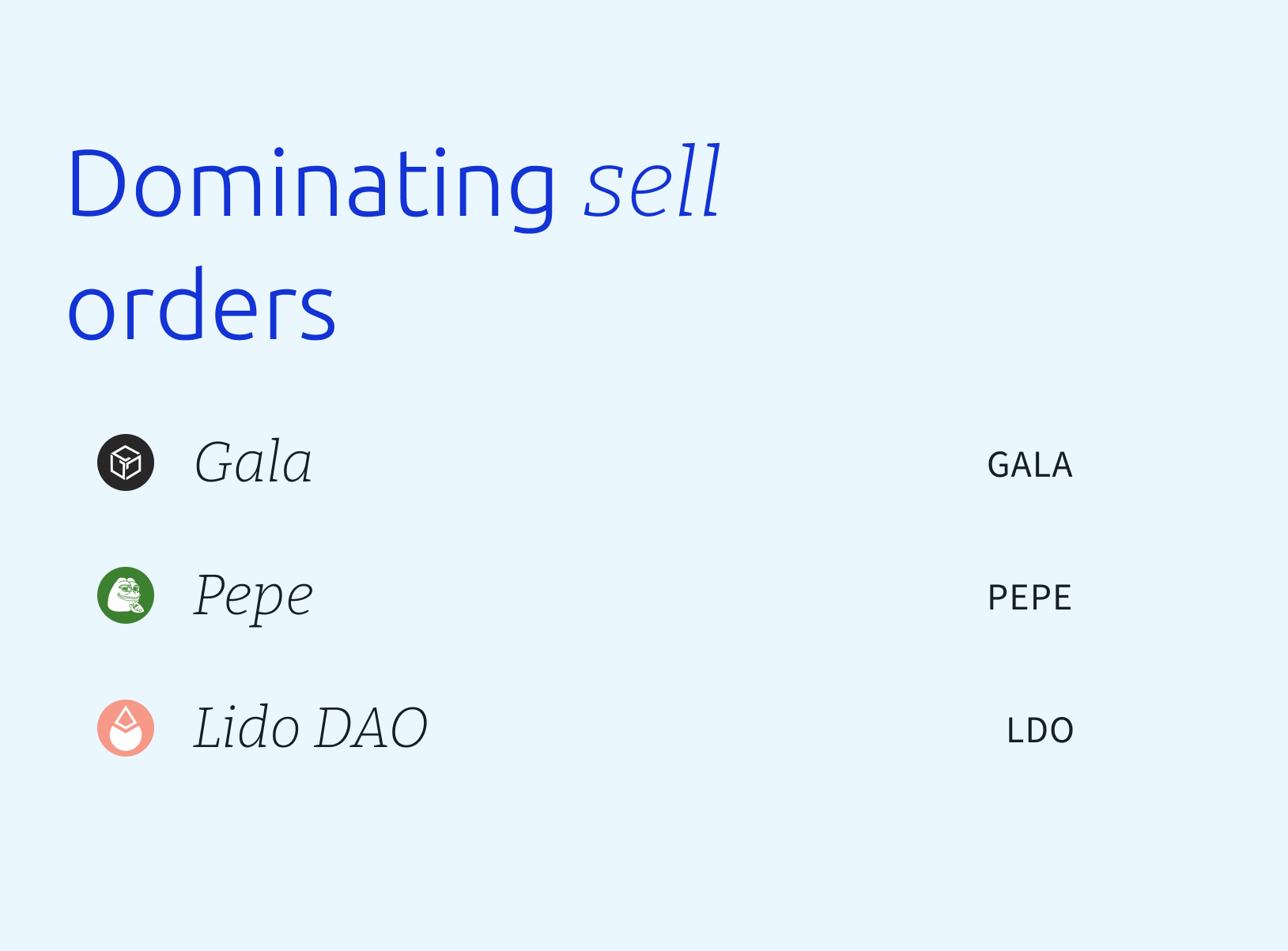

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

📣 Upcoming Announcements

Thursday 29/08/24

- 10:30pm AEST – US Preliminary GDP q/q

- The broadest measure of economic activity and the primary gauge of the economy’s health

- Expected: 2.8%

- Previous: 2.8%

- The broadest measure of economic activity and the primary gauge of the economy’s health

Friday 30/08/24

- 10:30pm AEST – US Core Personal Consumption Expenditure (PCE) Price Index

- The Federal Reserve’s primary inflation measure. Measurement of price of goods and services directly consumed by individuals. Gives important insights into consumer spending.

- Expected: 0.2%

- Previous: 0.2%

- The Federal Reserve’s primary inflation measure. Measurement of price of goods and services directly consumed by individuals. Gives important insights into consumer spending.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.