Key Takeaways

- Total market cap has rallied 5% so far this week.

- Ethereum ETFs are expected to launch this month, with some analysts suggesting next week.

- US Policymakers now more confident that inflation is on track to 2%.

The markets have rallied impressively this week, with Bitcoin surpassing $60,000 USD early this week and altcoins following. The total crypto market cap has increased by 11% in the last seven days to to $2.32 trillion USD.

Ethereum has gained 5.3% this week amid growing speculation that US Exchange-Traded Funds (ETFs) are nearing a launch date, with some analysts predicting July 23rd.

US Economic Data Improving

US Federal Reserve Chair Jerome Powell spoke at the Economic Club of Washington, answering various questions from the audience. Below is one of the responses he gave when questioned about the current state of inflation:

“We didn’t gain any additional confidence in the first quarter, but the three readings in the second quarter, including the one from last week, do add somewhat to confidence,” Powell said Monday.

The Fed has consistently maintained that rate cuts can only occur once the committee is confident that inflation is headed back towards its 2% target. Has the pendulum now started to turn?

Impactful data releases

Next week, key data releases in the US will start with manufacturing and services industry growth data on Wednesday. On Thursday, we will have Gross Domestic Product (GDP) data. Finally, inflation data will be released on Friday.

Fear and greed currently reads 58.

Bitcoin Analysis

Bitcoin has successfully moved below and reclaimed the May Low in the early periods of this month, where it currently trades above the monthly open of $62,772 USD.

We are also at the midpoint range of this now 127-day consolidation period. Below are two potential outcomes now that we are at the midpoint of this range.

Source – TradingView

Bullish Scenario

Bulls continue to defend any lows, holding above the monthly open. This could result in a further advance above the current range midpoint.

Bearish Scenario

Failure to hold prices above the monthly open could see a decline closer to the May low region, where prices began to rally.

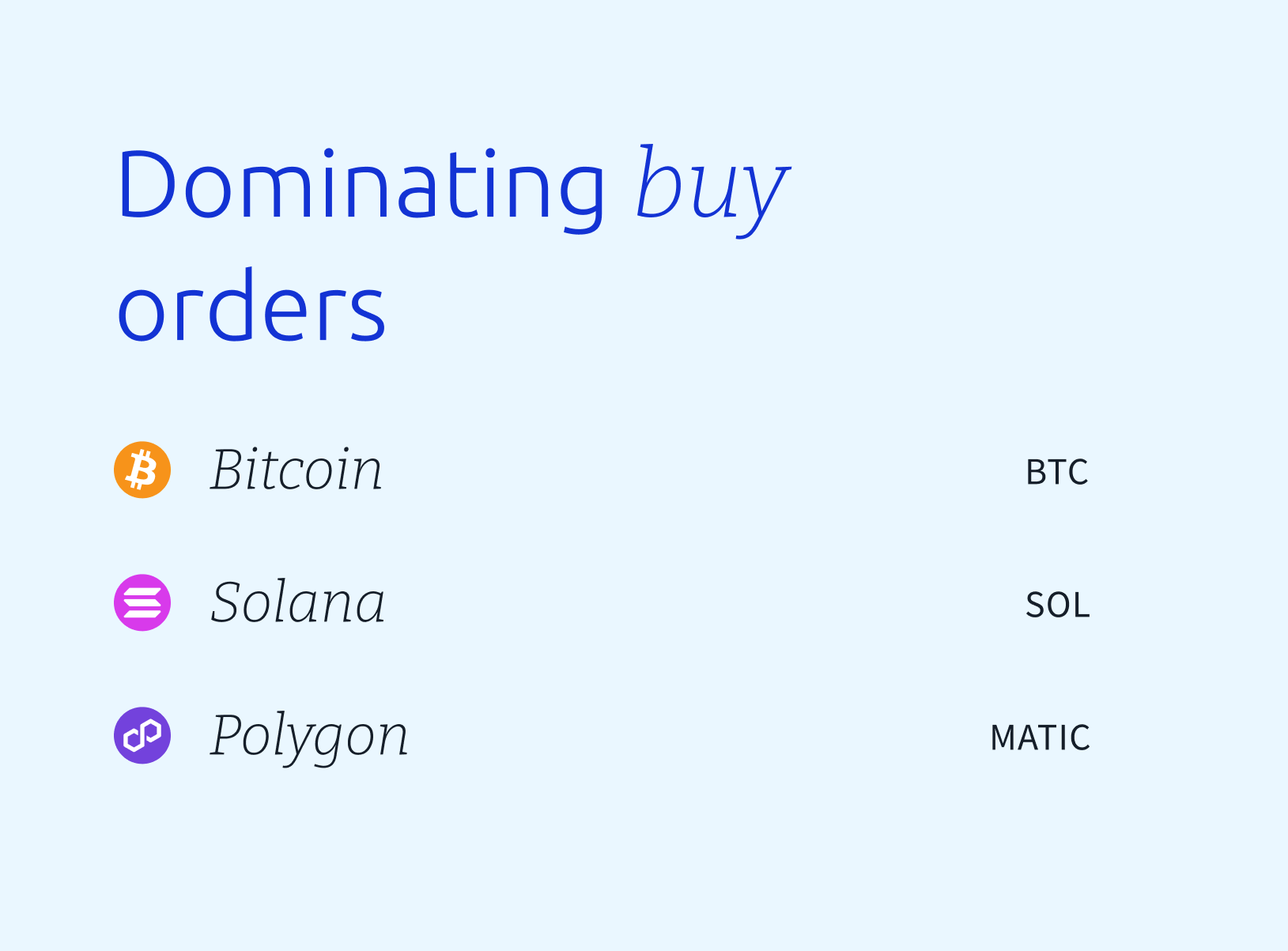

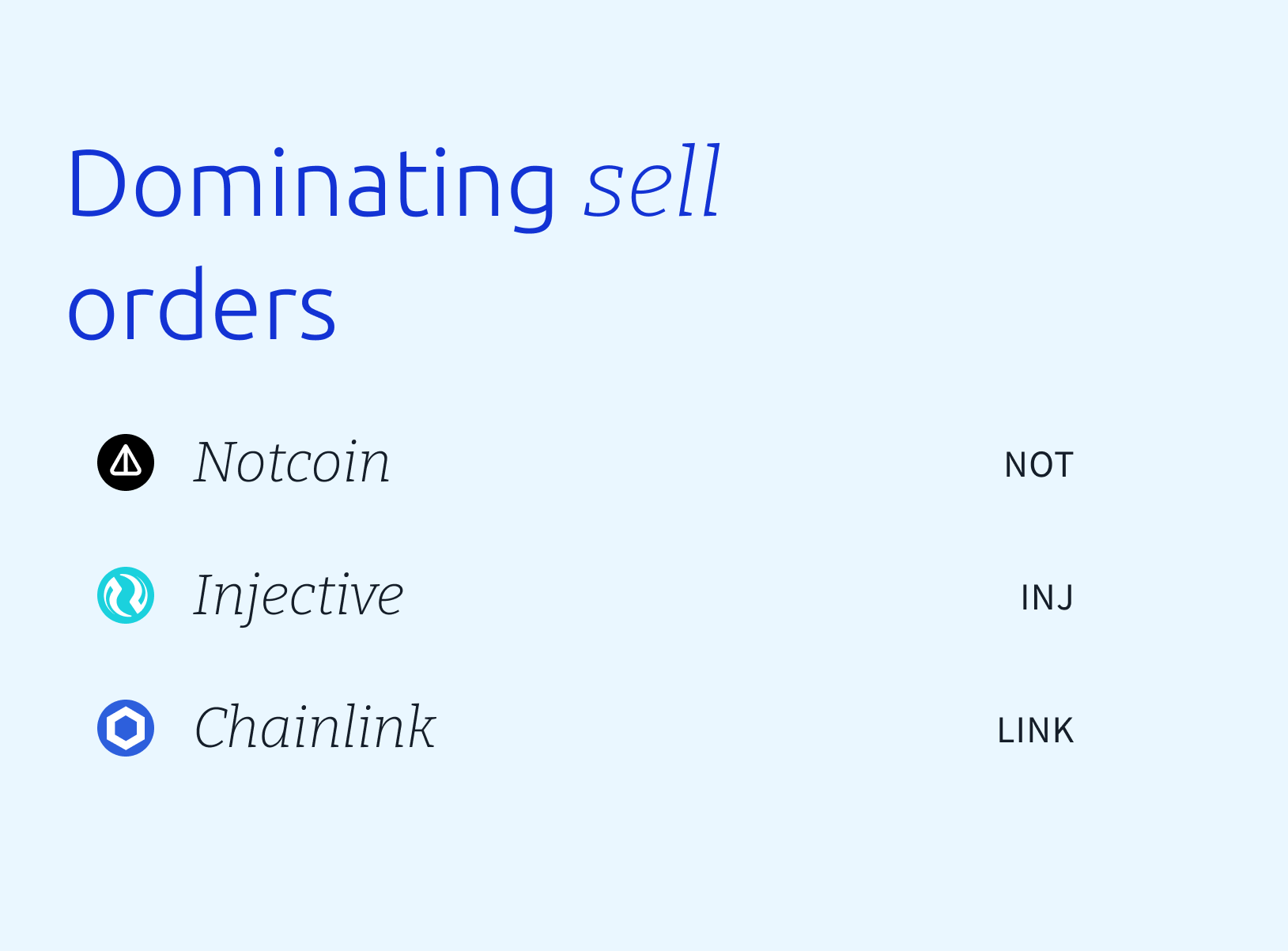

Swyftx Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

📣 Upcoming Announcements

Wednesday 24/07/24

- 11:45 pm AEST – US Flash Manufacturing PMI

- A leading indicator for economic health in manufacturing. Where metrics like CPI often lag, PMI is reported from businesses quicker to react to underlying market conditions. This indicator describes industry expansion when above 50.

- Expected: TBD

- Previous: 51.6

- 11:45 pm AEST – US Flash Services PMI

- A leading indicator for economic health for services. Where metrics like CPI often lag, PMI is reported from businesses quicker to react to underlying market conditions. This indicator describes industry expansion when above 50.

- Expected: TBD

- Previous: 55.3

Thursday 25/07/24

- 10:30pm AEST – US Advanced GDP q/q

- The broadest measure of economic activity and the primary gauge of the economy’s health

- Expected: TBD

- Previous: 1.4%

Friday 30/08/24

- 10:30pm AEST – US Core Personal Consumption Expenditure (PCE) Price Index

- The Federal Reserve’s primary inflation measure. Measurement of price of goods and services directly consumed by individuals. Gives important insights into consumer spending.

- Expected: TBD

- Previous: 0.1%

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.