Key Takeaways

- Crypto market rebounds overnight after a sell-off at the start of this week, occurring around major US economic news releases.

- More critical US growth data to land tonight that could continue volatility surges.

- Bitcoin prices at a key technical level, why the next few days will be important

A mixed week of emotions as we witness Bitcoin move 3% to the upside on Monday, and the back the other way on Tuesday where it currently trades at $57,200 USD.

What caused this volatility? It’s hard to pinpoint exactly, but weak manufacturing data from the US, released at midnight on Tuesday, may have triggered concerns that economic growth is slowing due to efforts to control inflation.

Additionally, the upcoming interest rate meeting on September 18th is adding to the uncertainty. Jerome Powell has confirmed that a rate cut will happen, signalling a more dovish approach. The market could be reacting to both the expected easing of rates and fears of weaker growth simultaneously.

Fear and greed currently reads 34.

Jobs Data Making Waves

Overnight, we have seen a surge in volatility, which could have been partly the result of poor job openings data from the Bureau of Labor Statistics in the US. The forecast was for 8.09 million job openings for the reported month; however, the actual figure was 7.67 million.

The impact of Jobs data does not stop there this week. Non-farm employment change will be released tonight at 10:15pm AEST.

Volatility could be expected again should results land outside of the forecast.

Bitcoin Analysis

Since our last Bitcoin analysis, we can see that overnight, the Current Range lows were swept, and the daily close occurred back inside the channel. From what we know, below are two potential outcomes from these events.

Bullish Scenario

Buyers have stepped in at these range lows, and accumulated. This would next result in a push above $63,000 USD – the midpoint of this multi-month trading range.

Bearish Scenario

Sellers remain in control in the absence of buyers at these prices, and we could see a break down below $55,000 USD.

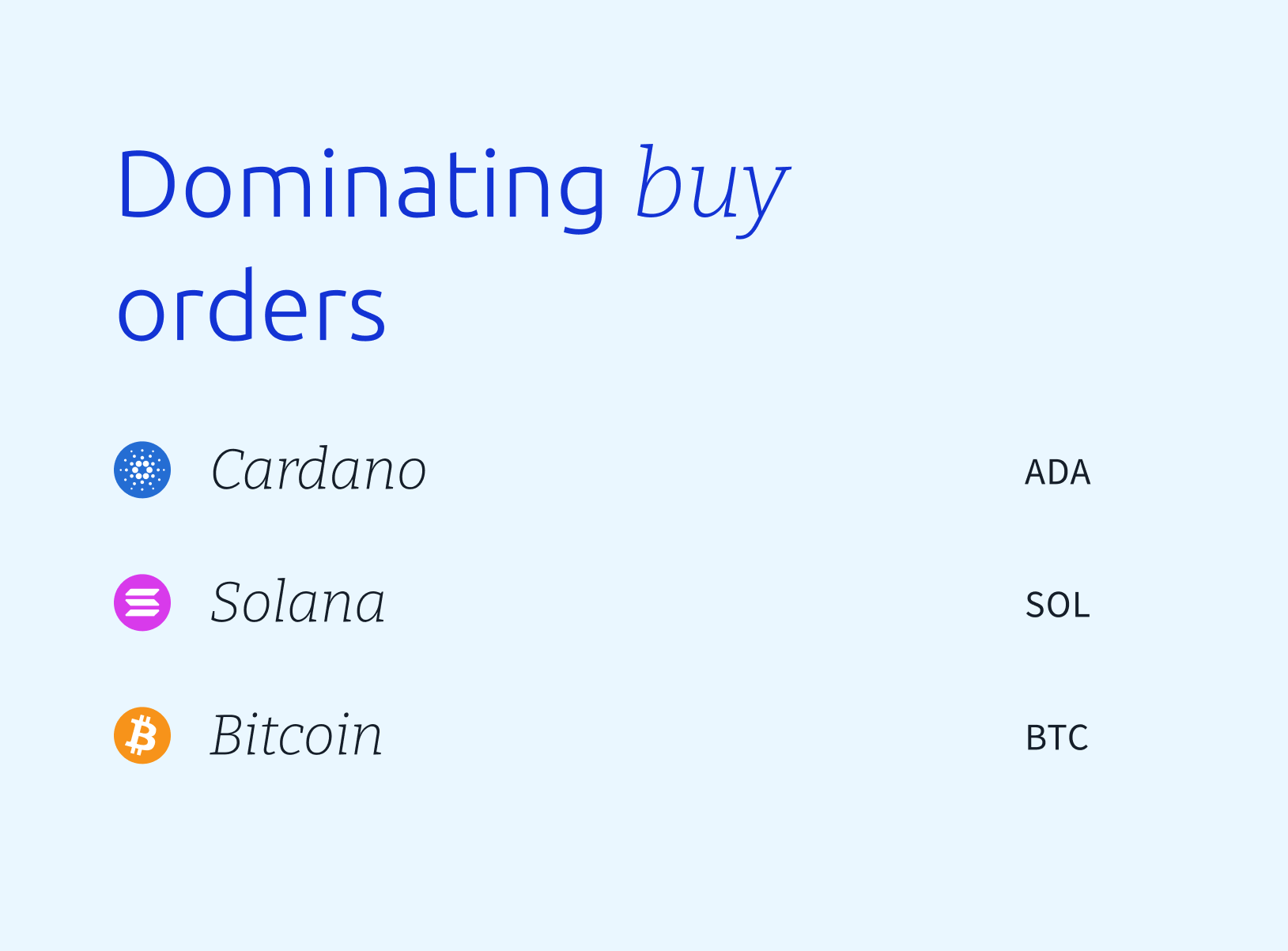

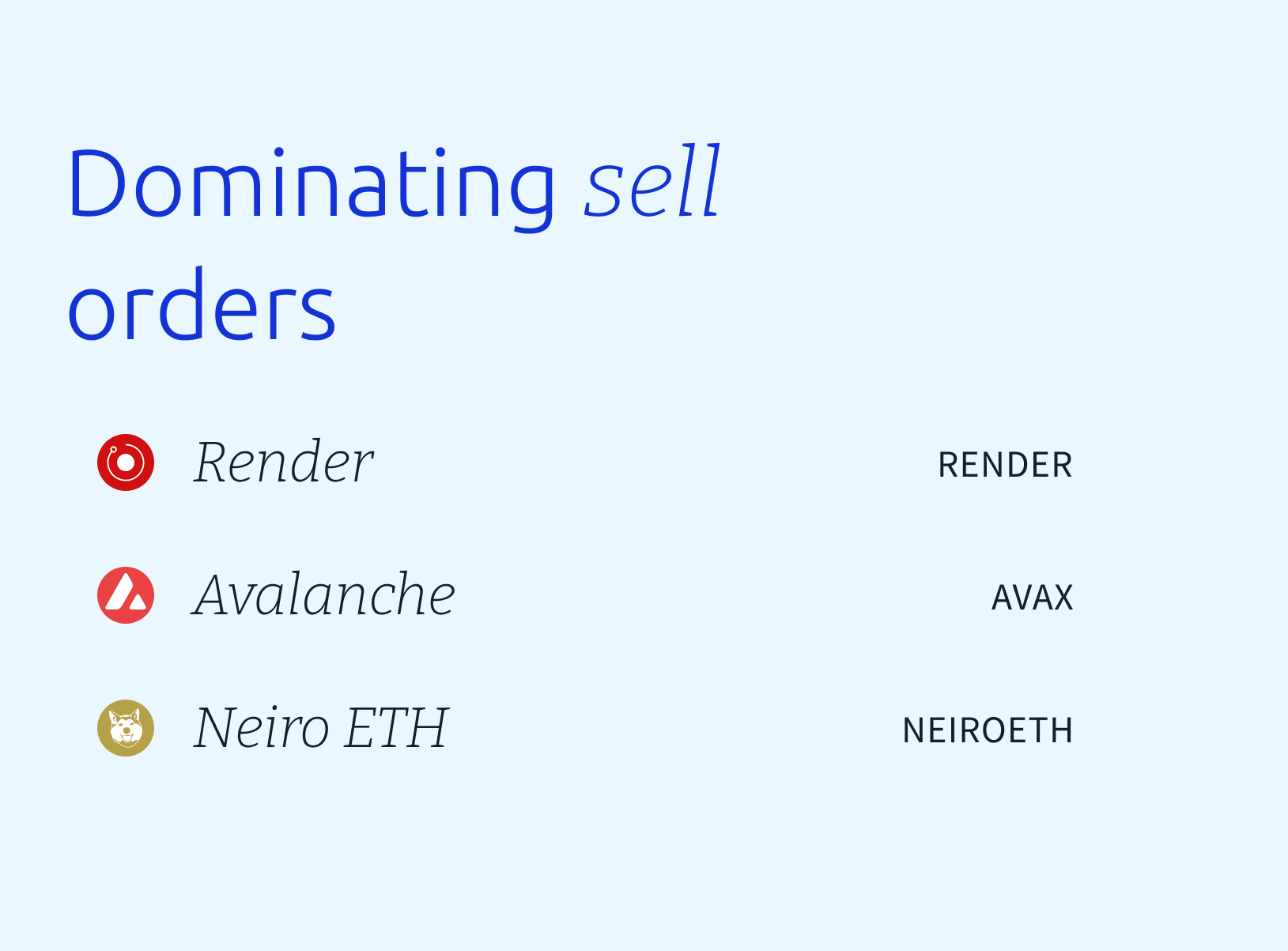

💱 Flows

The buy-to-sell ratio for unique Swyftx orders is nominally >$20,000 AUD (rolling data over the last 7 days, captured at 09:00 am AEST).

📣 Upcoming Announcements

Thursday 5/9/24

- 10:15pm AEST – ADP Non-Farm Employment Change

- Job creation is an important leading indicator of consumer activity and spending. This leads to overall economic growth and activity.

- Expected: 144k

- Previous: 122k

- Job creation is an important leading indicator of consumer activity and spending. This leads to overall economic growth and activity.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.