7-day market recap

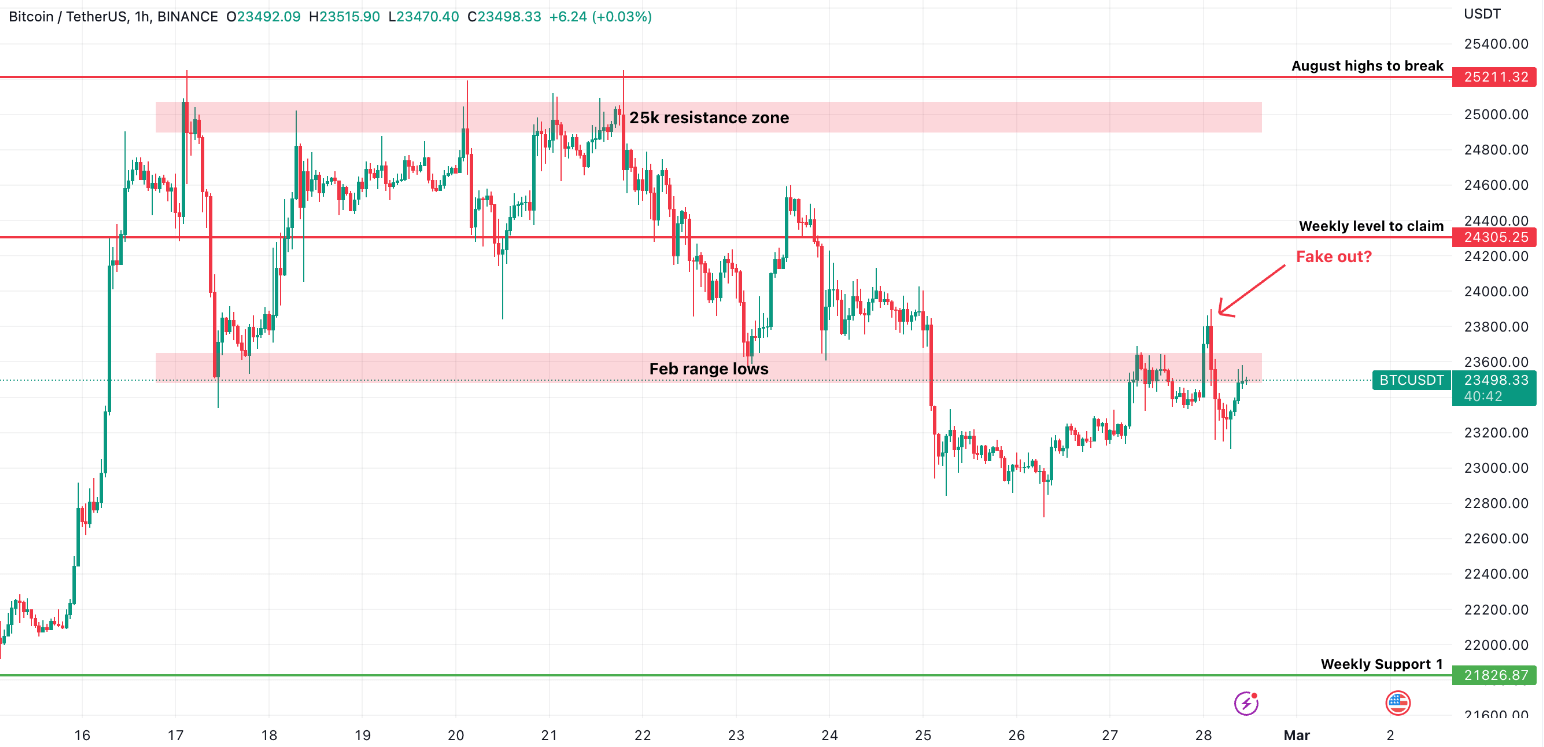

Over the past week, BTC failed to break through the resistance range around $25,000 USD after multiple attempts.

Off the back of increasing regulatory scrutiny in the US, plus growing uncertainty surrounding the next move by the US Federal Reserve, price fell as low as 10% from the highs last week.

Figure 1. Source TradingView

BTC is now struggling to reclaim the range lows that previously acted as support several times over the past month. BTC appears to be waiting for a new catalyst that will provide enough volatility and momentum to push price in one clear direction.

At the time of writing, Stacks (STX) is up 54% in the past 7 days. The hype around the recent release of Bitcoin ordinals, which allows NFTs to be inputted into the Bitcoin blockchain, seems to be the catalyst for this.

Stacks is a layer that allows people to create smart contracts and build decentralised applications on Bitcoin and appears to be the way for Investors to capitalise on this newfound Bitcoin utility.

Market Outlook

Looking forward, during the second half of this week we have some important US economic activity data due to be released.

With the US struggling to fight inflation, there are growing fears that the next interest rate hike in the US will be 50bps. All economic data leading up to the next FOMC meeting in mid-March is going to be critical for the US Federal Reserve to help make their decision. Volatility is to be expected.

The CME FedWatch Tool provides the probabilities of upcoming rate hikes, and currently has a 24.7% chance of a 50bps hike in March. I’ll be watching to see if any economic data later this week changes that percentage.

With BTC trending sideways for most of February, a sign of strength could be if BTC can break through the lower timeframe resistance level (‘Feb range lows’ in chart above) and continue north towards the weekly level of $24,300 USD. Failure to break and reclaim the current level could see prices fall back to weekly support of $21,800.

Coin watch: Optimism (OP)

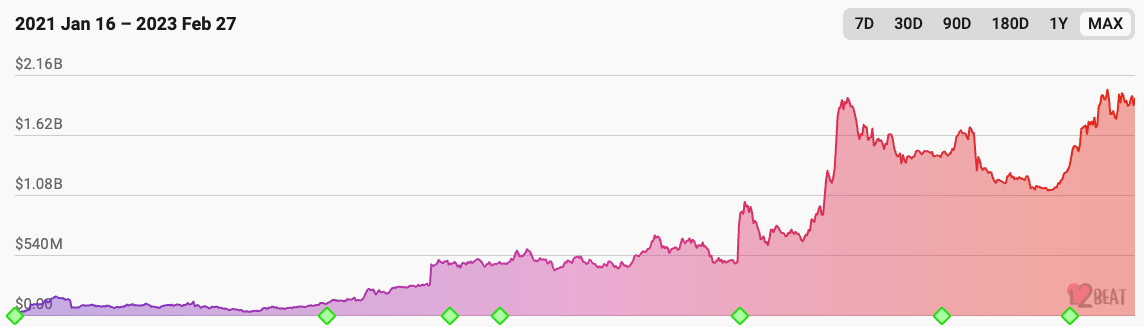

Optimism (OP) has been on a roll this year, with a staggering 215% increase YTD. It is currently the second biggest Ethereum layer 2 (L2) scaling solution with almost $2b USD Total Value Locked (TVL).

Figure 2: Optimism Total Value Locked (TVL). Source L2 Beat

Optimism has recently been in the headlines for its recent development involving Coinbase, and also is scheduled to undergo a “major” technical upgrade in March.

Coinbase partnership

Optimism has teamed up with Coinbase for their new Layer 2 solution, BASE.

Coinbase will be deploying BASE on the OP Stack which is responsible for powering Optimism. With BASE, developers will have access to a secure, low-cost, and developer-friendly Ethereum L2 that will allow anyone to build decentralised apps.

Jesse Pollack, Coinbase’s Senior Director of Engineering, believes that “in collaboration with Optimism [OP] and building the OP Stack, we’re going to make it so Base and other chains running on the OP stack are incredibly low cost, decentralized and secure.”

With access to the 100 million-plus users in the Coinbase ecosystem and more than 100 billion in assets, developers will have an unprecedented opportunity to build decentralised apps that can scale to meet the demands of mainstream users.

Technical upgrade

Optimism is also preparing for its upcoming Bedrock upgrade in March, which will significantly enhance its transfer speed, lower fees, and improve compatibility with the Ethereum Virtual Machine (EVM). In its proposal, the Optimism Foundation stated that the Bedrock upgrade is a ‘major step towards a multi-chain future’.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.