Key Takeaways

- Solana’s sharp downturn in both token price and user activity is closely tied to the rise and fall of meme coin speculation.

- While key metrics like daily transactions and TVL have declined, on-chain indicators show signs of recovery and resilience.

- Compared to other Layer 1 (L1) blockchains, Solana remains ahead in active users and ecosystem traction, suggesting its presence is still significant.

Why Has Solana Been Struggling?

Solana’s image has taken a hit. The blockchain that once thrived off memecoin mania now finds itself bruised by memecoin dismay. Speculators jumped head-first into Solana-based memecoins during the peak of hype, which culminated in the price of Trump Coin surging 600% in a matter of hours. But as prices collapsed, so too did confidence.

This speculative bubble not only torched portfolios but also dented Solana’s perceived legitimacy. The dramatic drawdown in memecoin prices coincided with a sharp drop in SOL itself, fuelling talk that Solana might be another “dead chain” walking. If Solana’s niche is a memecoin chain, and memecoins are under pressure, what does that say for the ecosystem’s health?

But the full story lies deeper in the data.

What On-Chain Metrics Say

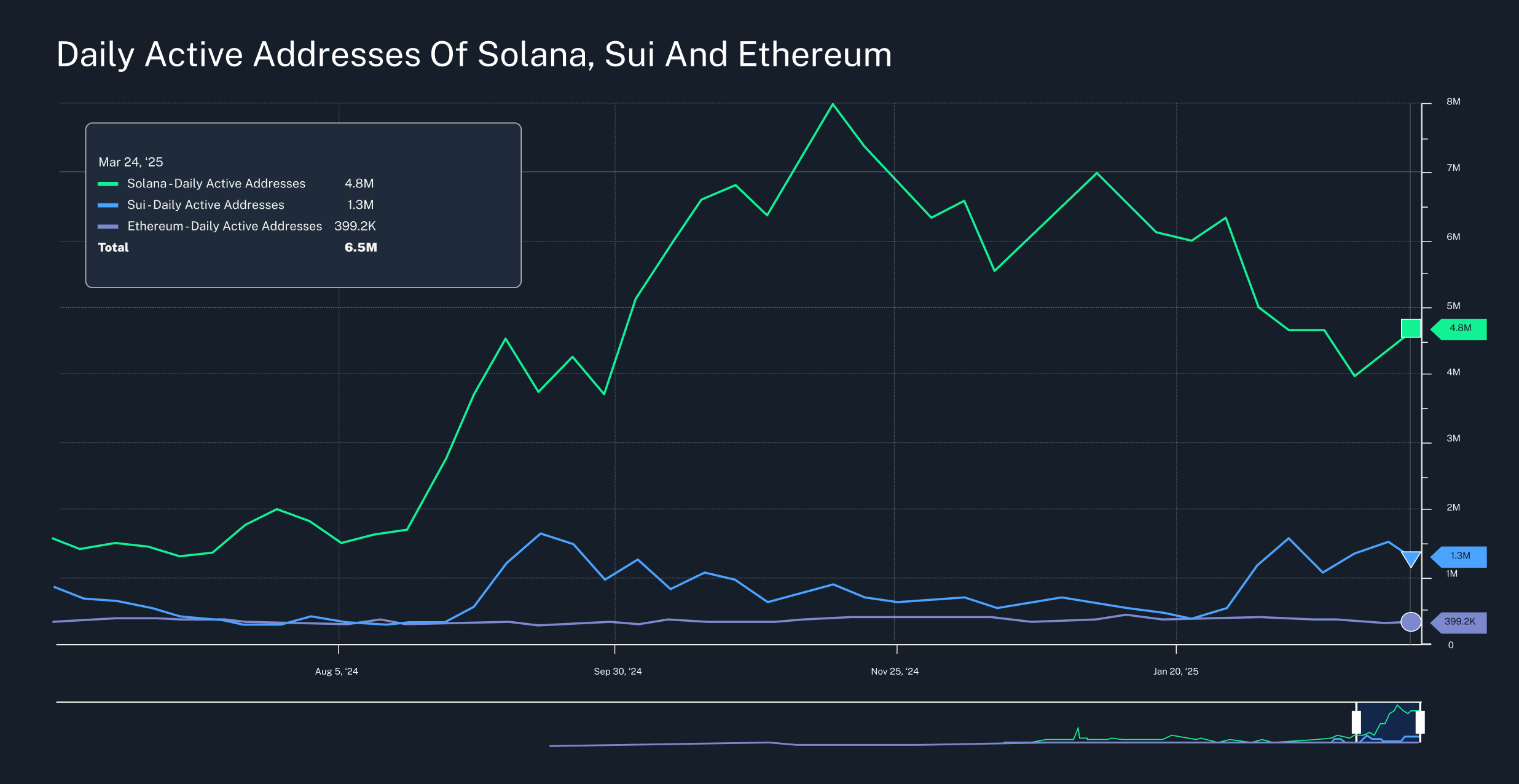

Daily Active Addresses (DAA)

DAA on Solana has fallen heavily so far in 2025, reflecting the broader pullback in market enthusiasm. This metric peaked in November 2024 with 7.5 million addresses, but has experienced a continual decline to lows of 3.9 million in early March 2025.

However, this metric has recently stabilised and even started to climb again. In raw numbers, Solana still leads most other Layer (L1) blockchains by a country mile. For example, Ethereum and Sui have 1.3 million and 400,000 DAAs, respectively.

This suggests that while many users left during the downturn, a committed base remains. And in blockchain, maintaining user stickiness is key – especially during market drawbacks. The ongoing recovery implies Solana’s core community and dApp developers haven’t abandoned ship, which may hold it in good stead going forward.

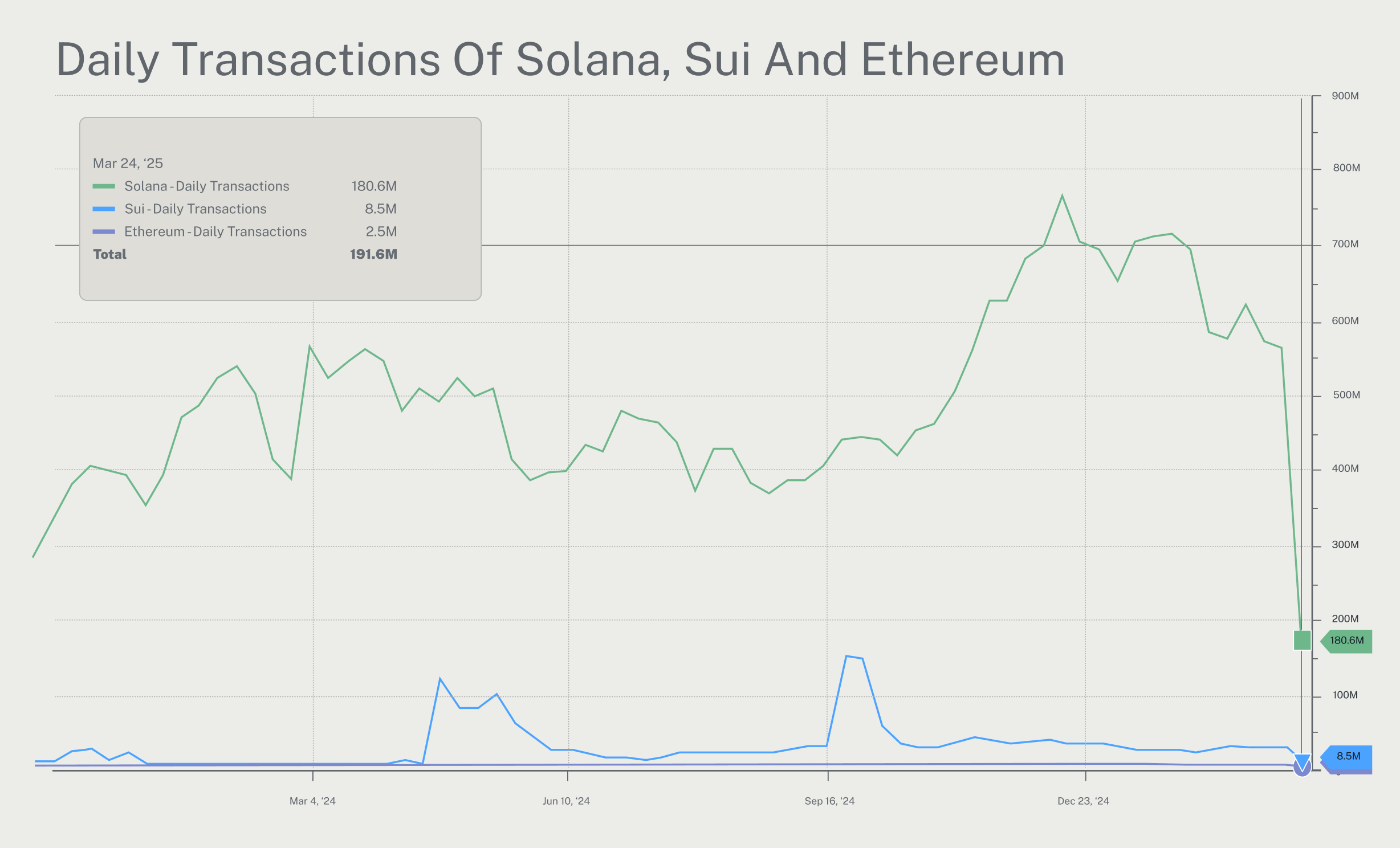

Daily transactions

Over the past month, there has been a significant decline in the number of daily transactions on the Solana blockchain. Activity has plummeted, underscoring how deeply memecoin trading was embedded in Solana’s usage. With much of that speculative flow gone, the chain is currently seeing far less movement.

This sharp contraction in on-chain activity highlights Solana’s challenge. To regain momentum, it needs new use cases and sustained user demand beyond the froth of meme culture. Until then, the data will likely reflect a quieter chain.

But notably, even with the heights of 800 million daily transactions shrinking to 180 million, Solana remains leagues ahead of its rivals. Through March, Ethereum and Sui have 2.5 million and 8.5 million daily transactions, respectively, demonstrating that even after this dramatic fall, Solana is still used significantly more than other comparable Layer 1s.

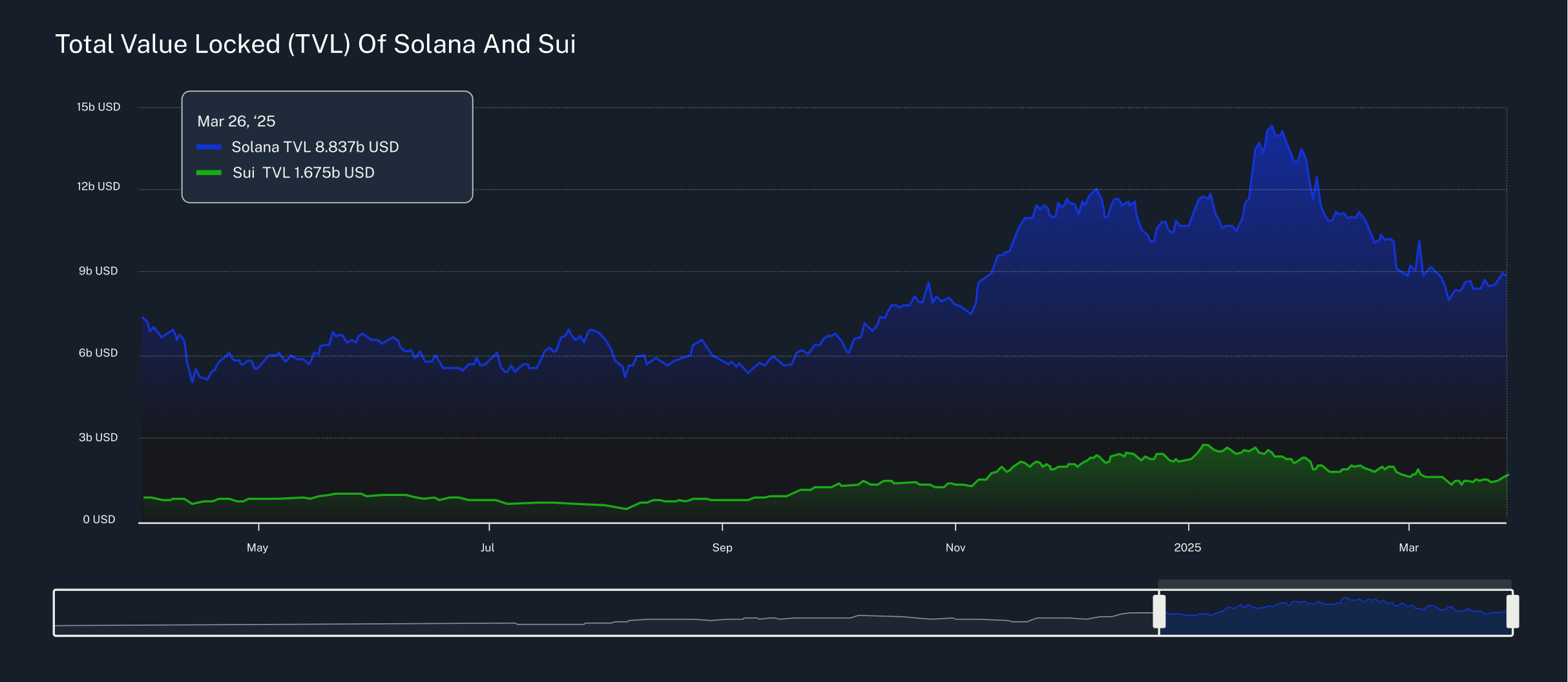

Total Value Locked (TVL)

Solana’s TVL has also fallen but appears to be levelling out. Compared to daily transactions, TVL arguably says more about the degree to which a blockchain is trusted (i.e. are users willing to keep their valuable cryptocurrencies tied up in a smart contract on this blockchain?).

In that respect, Solana’s TVL of $14 billion ($8.8 billion USD) remains a standout second place, though is well behind Ethereum’s TVL of $111 billion ($70 billion USD) and firmly ahead of Sui’s $2.5 billion ($1.6 billion USD).

Sui and other newer L1s have grown fast, but Solana still commands a notable lead in this area. The chain’s consistent TVL, even in a downturn, speaks to the stickiness of its DeFi protocols and the confidence of long-term capital.

Conclusion

Solana has taken a hit, no doubt. The crash in memecoin sentiment and price action has dragged usage down across multiple metrics. But when you dig into the data, the narrative that Solana is “dead” doesn’t hold. Developers still want to build on Solana – as that is where the users are.

It continues to outpace competitors in user engagement and DeFi capital. Its tech stack, community, and network effects give it resilience. As blockchain adoption moves forward, these fundamentals should help Solana remain a top-tier player, even if the memecoin frenzy never returns.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.