Key Takeaways

- Dogecoin (DOGE) leads the meme coin market with a substantial market cap, while emerging coins like Pepe (PEPE), dogwifhat (WIF) and Brett (BRETT) operate at smaller scales, indicating potential for significant growth if they capture market attention.

- DOGE’s standalone blockchain contrasts with Ethereum, Solana, and Base ecosystems, which offer greater liquidity and decentralisation features.

- Meme coins thrive on viral trends and community enthusiasm, making social media engagement a critical factor in their success.

- An increasing number of holders often signals growing interest and potential price movements.

Market Cap Comparison

Price Data as of November 27, 2024.

The disparity between DOGE’s $54 billion valuation and Brett’s $1.46 billion highlights significant room for potential growth for smaller players. While it is unlikely that newer tokens like PEPE, WIF, or Brett will reach parity with Dogecoin’s market cap, capturing even a small percentage of DOGE’s share of memecoin market could translate into significant price appreciation. However, increasing token supplies can impact price performance in the long term.

This potential underscores the speculative appeal of lower market cap tokens in the meme coin ecosystem.

Blockchain Comparison

Dogecoin Blockchain

Advantages

Dogecoin’s standalone blockchain offers simplicity and a focused network free from congestion caused by other applications, making it a reliable and stable platform for transactions.

Challenges

Being a standalone blockchain, it is considerably harder for DOGE to leverage decentralised finance (DeFi) ecosystems or decentralised exchanges (DEXs) for trading and liquidity. This reliance on centralised exchanges (CEXs) limits its flexibility and accessibility in the broader crypto ecosystem.

Ethereum: PEPE

Advantages

PEPE leverages Ethereum’s extensive ecosystem, benefiting from its robust infrastructure and access to decentralised applications, liquidity pools, and trading platforms.

Challenges

The high gas fees on Ethereum deter smaller investors and reduce accessibility. These fees also push PEPE trading predominantly onto centralised exchanges, limiting its DeFi exposure, similar to DOGE.

Solana: WIF

Advantages

Solana’s high-speed transactions and low fees make it an attractive choice for meme coin projects like WIF, enabling rapid trading and experimentation in a cost-effective ecosystem. Solana also predominantly carries most of the meme coin adoption for this cycle, making it a hub for new and emerging meme tokens.

Challenges

The ease and popularity of meme coin creation on Solana mean a saturation of meme coins in the market, which can dilute liquidity across projects. Additionally, the high failure rate of many meme coins may lead to retail investor dismay, potentially impacting overall confidence in the ecosystem.

Base: BRETT

Advantages

As a Layer 2 solution, Base combines Ethereum’s security with fast and low-cost transactions, offering a compelling balance of efficiency and compatibility with Ethereum’s ecosystem.

Challenges

Base’s relatively new status results in lower liquidity and limited adoption compared to more established networks, reducing its current appeal for developers and users.

Social Media Attention

Meme coins thrive on community and viral trends. For example, the rise and fall of Dogecoin is well known to be connected to Elon Musk and his tendency to tweet bullishly about it.

PEPE leveraged the popularity of the cartoon meme from the early 2000s, using its nostalgic appeal to propel its brand and recognition.

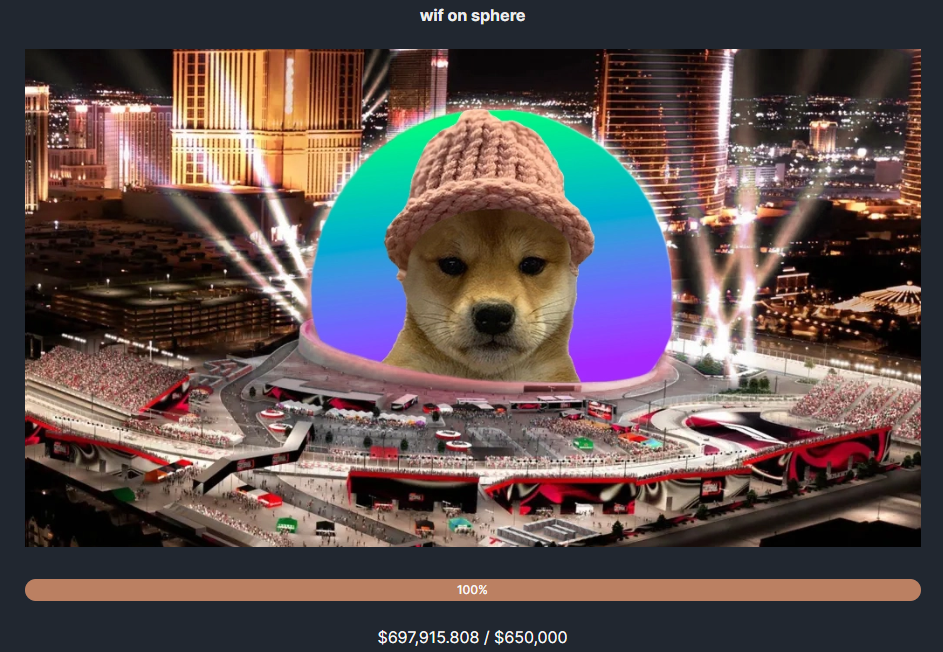

WIF gained prominence thanks to large Twitter influencers and achieved further notoriety when the community raised $700,000 (USD) to display WIF on the Las Vegas Sphere as a marketing campaign.

WIF community funding raising $700,000 USD to advertise in Las Vegas

BRETT is riding the momentum of Base’s success as the emerging Layer 2 of choice for retail users.

For meme coins to remain relevant and have price appreciation, they need to maintain attention, which is largely propelled through community engagement on social media. Generally speaking, when trending attention wains, so will the price of memecoins. Not all will gain the notoriety of Doge to sustain itself through multiple cycles.

Holder Growth Comparison

Doge has an established base with millions of holders, reflecting its longstanding position in the market. It has taken over a decade since its launch in 2013 to build this substantial community, solidifying its role as the original and most widely recognised meme coin.

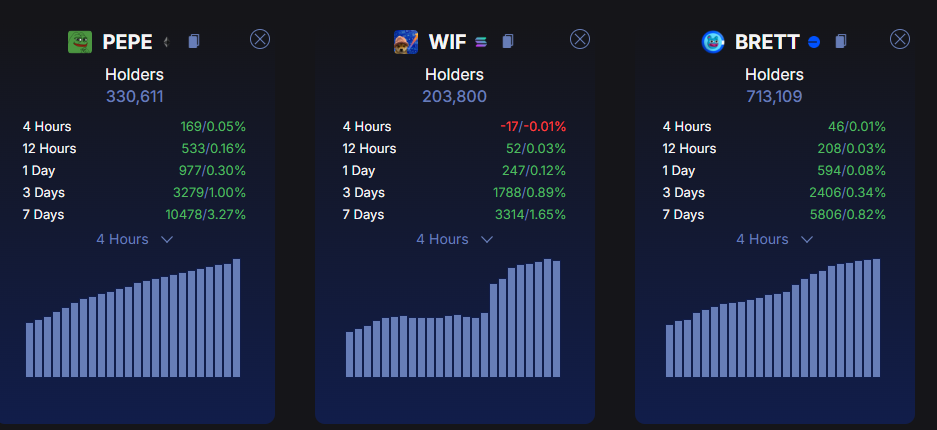

The below image shows the current holder counts for PEPE, WIF and BRETT.

Number of addresses holding PEPE, WIF and BRETT

The number of holders of these coins reflects the more recent launches of the tokens, but of significance is that Brett, which has the lowest market cap, boasts the largest holder number. Holder growth increases have sometimes been a leading indicator of price growth, highlighting the importance of tracking these metrics for emerging tokens.

Conclusion

Dogecoin’s dominance is rooted in its historical significance and high market cap. However, smaller coins like PEPE, WIF and BRETT present high-risk, high-reward opportunities, particularly for traders seeking emerging trends.

Each coin’s success will depend on the adoption of the blockchain it belongs on, capturing social media attention, and steadily increasing its holder base to build momentum. Smaller market cap coins are considered to have higher upside potential, yet carry higher risk and steep competition and greater intermittent market volatility.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.