View full PDF online

Key Takeaways

- Aave (AAVE) is the largest decentralised finance (DeFi) platform by total value locked (TVL), with over $40.5 billion USD ($61.6 billion AUD) locked across multiple blockchains.

- It facilitates decentralised borrowing and lending without requiring the involvement of banks or other financial intermediaries.

- Aave’s security record and resilience during past market downturns, compared to failed centralised lenders, reinforce its role as a core pillar of DeFi.

Meme Coins Fade, Fundamentals Rise

Meme coins were one of the hottest sectors in crypto in 2024, signalling heightened speculation and a shift away from fundamentals.As explained last year, meme coins are the riskiest and most volatile type of cryptocurrency. Many have come to realise this so far in 2025, with countless meme coins plummeting in value and only a handful showing signs of resilience. The stark reality is that while a few cashed in, the majority of investors were left licking their wounds.

As the dust settles, the market is pivoting back to fundamentals. There is a renewed sense of appreciation for projects with working products, active users and revenue growth. In this return to functionality, DeFi is regaining its shine. And Aave, the DeFi protocol boasting the largest TVL in the entire blockchain space, backed by a thriving ecosystem over five years strong, is well-placed to take advantage of a return to fundamentals.

What is Aave?

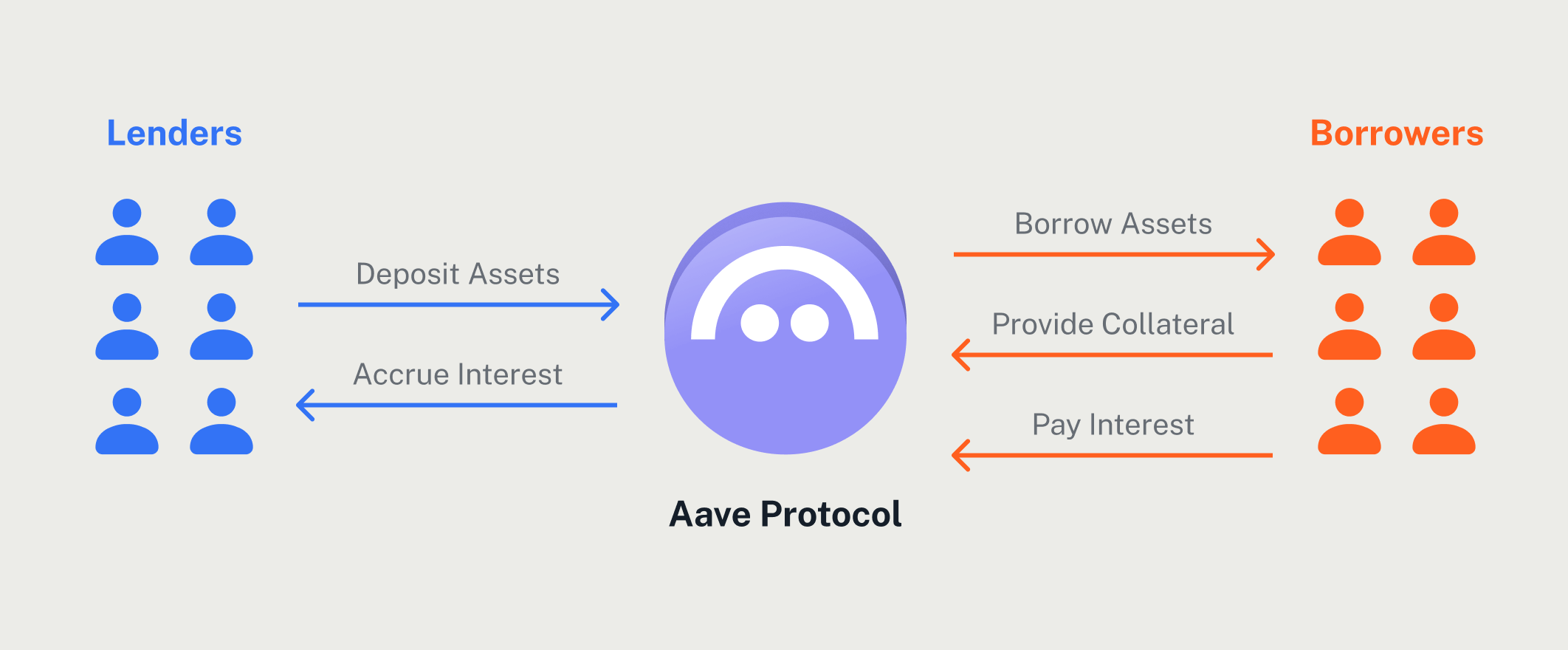

Aave stands as the original giant in decentralised borrowing and lending on Ethereum. The concept is simple: users deposit crypto as collateral – for example, deposit ETH and borrow stablecoins like USDC against it. The deposited ETH remains locked while the borrower accesses liquidity.

For the risk-averse, Aave offers a way to earn passive income. By depositing USDC or other assets, users earn yield as others borrow these assets. All transactions occur via smart contracts, meaning no banks, no KYC, no human rejection, purely decentralised, automated finance.

Aave revolutionised accessing cryptocurrency credit by removing traditional intermediaries and allowing anyone to access it from anywhere in the world.

How Aave Works

At its core, Aave runs entirely on smart contracts. Over its five-year history, its codebase has proven resilient against attacks – no small feat considering the $40 billion honeypot it represents to hackers. While no system is invulnerable, Aave’s track record inspires confidence the longer it remains uncompromised.

Security is underpinned by overcollateralisation. Borrowers must deposit more value than they wish to borrow, for instance, $10,000 in ETH to borrow $5,000 in USDC. If the value of the collateral drops and breaches a pre-set loan-to-value threshold, often around 80%, the protocol automatically liquidates the position through decentralised exchanges like Uniswap, safeguarding depositors.

Everything is managed by code, helping eliminate human error or greed – the same failings that collapsed many centralised lenders during crypto’s turbulent 2022, including high-profile examples like Celsius and BlockFi.

Protecting Depositor Money

Aave’s primary objective is to protect depositor funds. Even when centralised lenders crumbled, Aave smart contracts liquidated collateral as intended, ensuring depositors remained whole. By requiring overcollateralisation and automating the liquidation process, Aave achieves what TradFi banks often fail to: risk mitigation without human intervention.

This commitment to protecting users has helped Aave maintain trust and steadily grow its ecosystem even during broader market downturns.

Aave’s Metrics

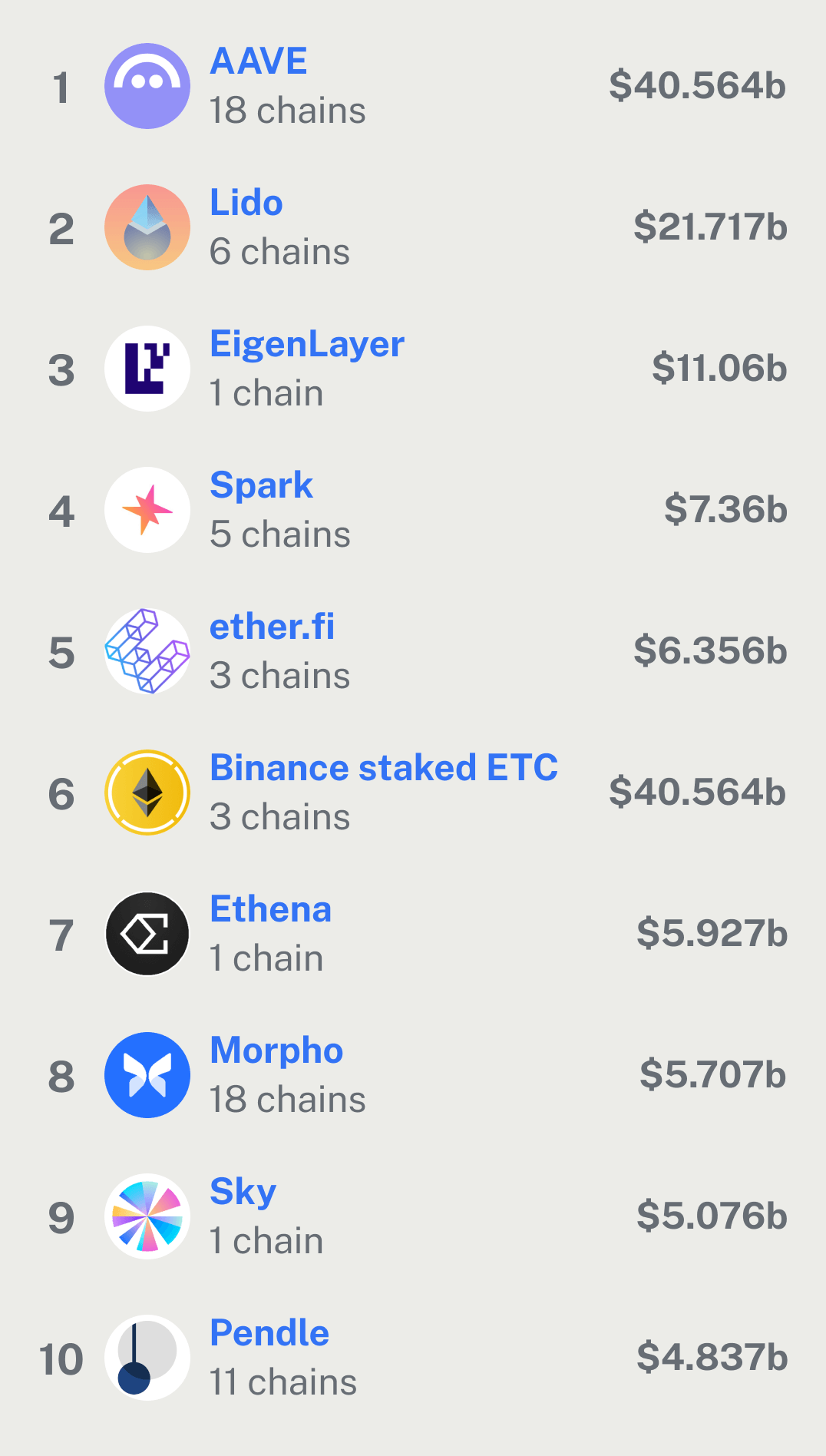

Aave is DeFi’s king by TVL. The protocol currently secures over $40.5 billion USD ($61.6 billion AUD), more than double that of the second-largest DeFi protocol, Lido, which sits at $20 billion USD ($30.4 billion AUD).

On Ethereum, Aave represents almost half of all DeFi TVL, a staggering statistic highlighting its dominance. It is not just an Ethereum Layer 1 play either. Aave has expanded across 17 Layer 2s within the Ethereum Virtual Machine (EVM) ecosystem, proving its adaptability and reach across the broader blockchain landscape.

Lending and Borrowing Metrics

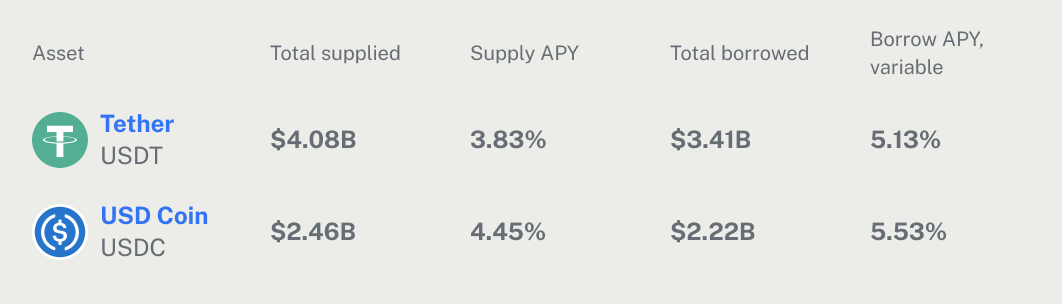

Aave remains highly competitive when compared to traditional finance (TradFi). In times of market calm, stablecoin deposits yield around 5%, while borrowing rates sit near 6%. For depositors, this beats the returns from most traditional bank savings accounts. For borrowers, it offers unique flexibility, a decentralised platform where you can borrow against your crypto assets without selling them.

In a sideways market, these yields offer stable, predictable returns, appealing to both retail and institutional investors seeking alternatives to TradFi products.

However, unlike TradFi, which offers stable yields for very long periods of time, Aave yields and borrowing amounts tend to spike significantly. As crypto prices surge, the euphoria and greed of the market can lead to many people taking on large amounts of leverage. This is great for depositors as yields can spike above 10% annualised, but risky for borrowers as their interest rates can reach 15%, putting many at risk of liquidation.

Conclusion

As the market moves back to fundamentals, Aave stands out. It has working products, active users and real revenue. Aave continues to deliver what decentralised finance was built for: open, trusted access to credit without intermediaries.

In a space still finding its footing after the hype, Aave remains one of the few protocols built to last.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.